Is A Roth Ira Considered Qualified If you re withdrawing from a Roth IRA you should understand the tax differences between qualified and non qualified distributions Learn more

A Roth IRA is not a qualified retirement plan but there are similar tax advantages for those planning for retirement What type of account is a Roth IRA considered A Roth IRA A qualified distribution from a Roth IRA is tax free and penalty free provided that the five year aging requirement has been satisfied and one of the following conditions is met

Is A Roth Ira Considered Qualified

Is A Roth Ira Considered Qualified

http://odsonfinance.com/wp-content/uploads/2019/04/How-to-do-a-Backdoor-Roth-IRA.png

2025 Income Limits Documentation System In India Pippa Henderson

https://www.carboncollective.co/hs-fs/hubfs/2021_and_2022_Roth_IRA_Income_Limits.png?width=1686&name=2021_and_2022_Roth_IRA_Income_Limits.png

Ira Results 2025 Glory Kamilah

https://www.carboncollective.co/hs-fs/hubfs/Roth_IRA_Distributions.png?width=3840&name=Roth_IRA_Distributions.png

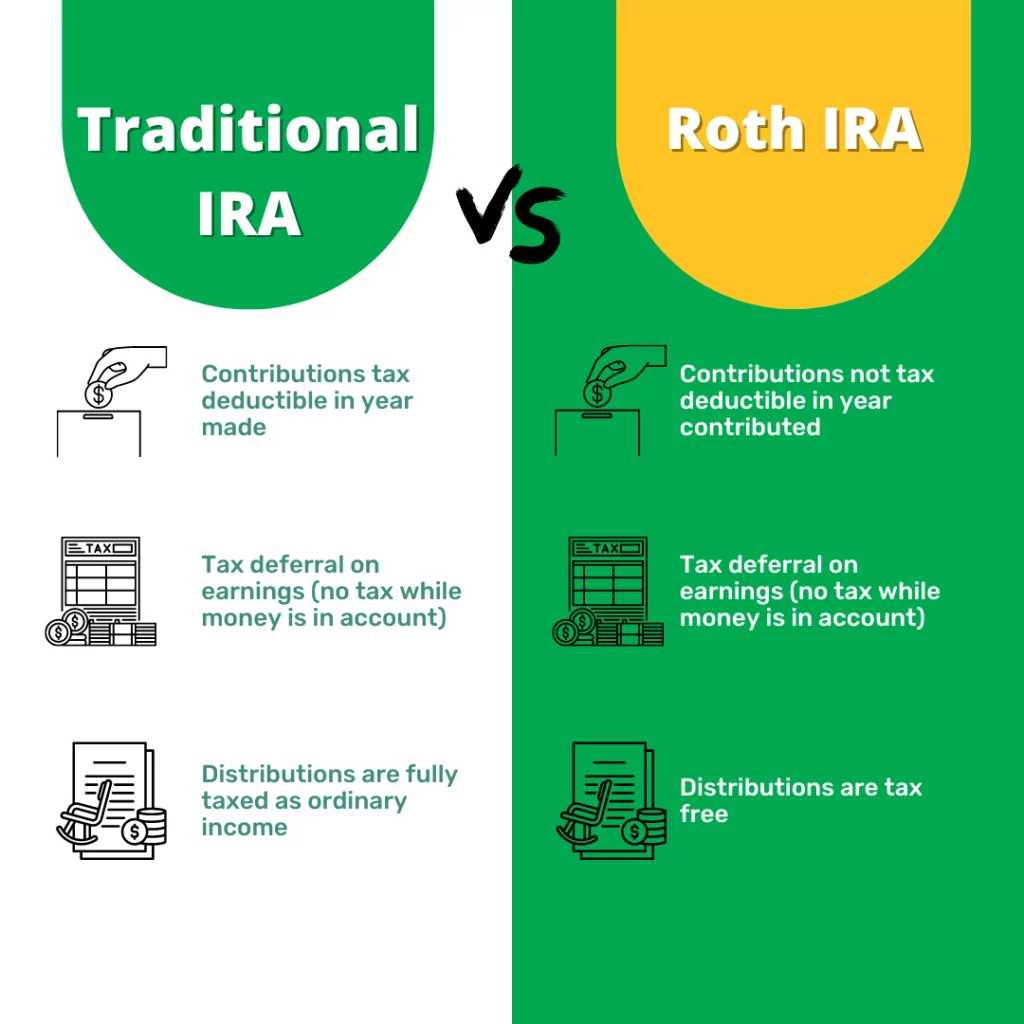

Because an individual retirement account IRA is not offered by employers a traditional or Roth IRA is not considered a qualified plan A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA You cannot deduct contributions to a Roth IRA If you satisfy the

A Roth IRA is a type of retirement account that can be established by any person with earned income Unlike a traditional IRA Roth IRA contributions are not tax deductible However the Qualified Roth IRA distributions are tax free and penalty free while non qualified distributions are not As such it s a good idea to know what constitutes a qualified distribution because those

More picture related to Is A Roth Ira Considered Qualified

Roth Income Limits 2025 Agi Zena Angelia

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-12-2022-Roth-IRA-Income-Limits.png

Roth Ira Portfolio Example Choosing Your Gold IRA

https://community.personalfinanceclub.com/uploads/default/original/1X/709b237a8f80dd8a67ef49366bfd2bb0f88870bb.jpeg

Income Limit For Roth Ira Contribution 2025 Shae Carmine

https://yourfinancialpharmacist.com/wp-content/uploads/2019/03/presentation2.png

A Roth IRA is not a qualified retirement plan but there are similar tax advantages for those planning for retirement Distributions from a Roth IRA are categorized as either qualified or non qualified each with distinct tax implications Understanding the factors that determine the qualification of

For earnings in a Roth IRA to be tax free a distribution must be qualified Find out the differences between qualified and nonqualified Roth IRA distributions A qualified distribution is a tax free withdrawal from specific types of retirement accounts such as Roth IRAs or Roth 401 k s To be considered qualified a distribution must

Traditional IRAs Vs Roth IRAs 1st National Bank

https://www.bankwith1st.com/wp-content/uploads/2022/12/Traditional-IRAs-vs-Roth-IRAs-Comparison-1024x1024.png

Roth IRA Tax Free Wealth And Income In Retirement

https://www.annuityexpertadvice.com/wp-content/uploads/What-to-know-about-Roth-IRAs-1.png

https://smartasset.com › retirement › roth-ir…

If you re withdrawing from a Roth IRA you should understand the tax differences between qualified and non qualified distributions Learn more

https://financeband.com › is-a-roth-ira-considered-a-qualified-account

A Roth IRA is not a qualified retirement plan but there are similar tax advantages for those planning for retirement What type of account is a Roth IRA considered A Roth IRA

Roth Ira Vs Traditional Ira Choosing Your Gold IRA

Traditional IRAs Vs Roth IRAs 1st National Bank

What Is The Difference Between An IRA A 401k IWA Blog

SEP IRA Vs Roth IRA Which Is Right For You 2023

:max_bytes(150000):strip_icc()/rothira_final-9ddd537c67fd44ecb14dbdeba58a6ace.jpg)

Individual Retirement Account IRA What It Is Types

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth IRA What s The Difference

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth IRA What s The Difference

401 K Vs Roth 401 K Which Is Best For You The Motley Fool Free

SEP IRA Vs Roth IRA Definition How To Set Up Major Differences

Can I Convert A Qualified Annuity To A Roth Ira Choosing Your Gold IRA

Is A Roth Ira Considered Qualified - Qualified Roth IRA distributions are tax free and penalty free while non qualified distributions are not As such it s a good idea to know what constitutes a qualified distribution because those