Is A Sep Ira A Non Qualified Plan A SEP plan allows employers to contribute to traditional IRAs SEP IRAs set up for employees A business of any size even self employed can establish a SEP Choose a

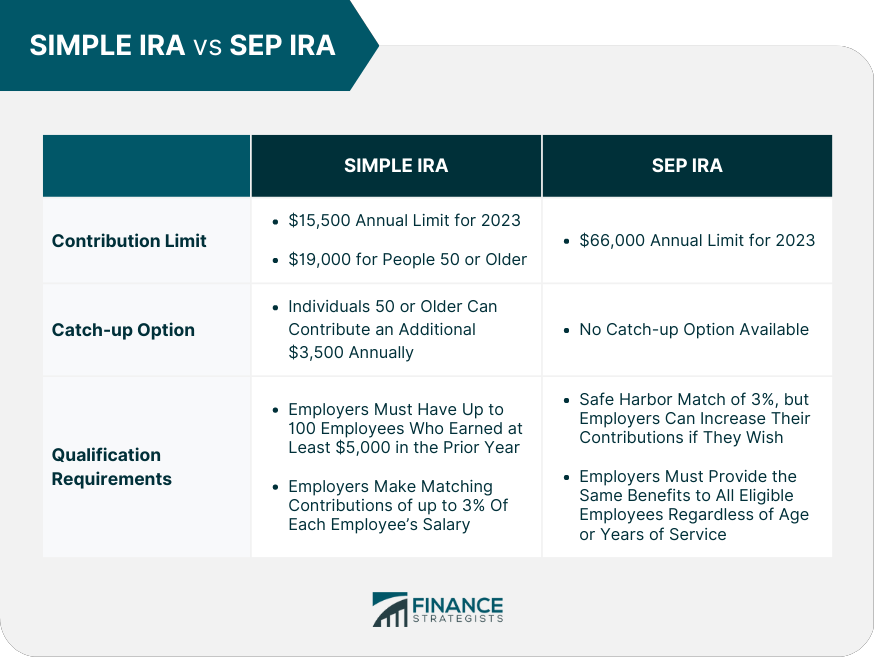

If the SEP IRA permits non SEP contributions you can make regular IRA contributions including IRA catch up contributions if you are age 50 and older to your SEP IRA up to the maximum By its definition a traditional IRA is not a qualified retirement plan as it is not offered by employers unlike 401 k s SEP and SIMPLE IRAs

Is A Sep Ira A Non Qualified Plan

Is A Sep Ira A Non Qualified Plan

https://www.kitces.com/wp-content/uploads/2015/08/Backdoor-Roth-Contributions-Form-1040-Updated.png

Retirement Comparison Chart

https://www.moneylend.net/wp-content/uploads/retirement_compare.jpg

2025 Max Ira Contribution Khodadad Ruby

https://www.marinerwealthadvisors.com/wp-content/uploads/2019/11/401k-Advantages-Over-SEP-and-Simple-IRAs-1024x533.png

Since only employer contributions are allowed for SEP IRAs an employer must choose a 401 k plan to allow participants to make salary Internal Revenue Code Section 457 retirement plans for state and municipal employees and 403b programs for nonprofit organizations are nonqualified plans They

A SEP IRA is a retirement plan option for small business owners and qualified employees It has higher contribution and income limits than other retirement plans A qualified retirement plan can allow a participant to borrow from his or her account assuming the plan permits it but a SEP cannot allow this In this respect a SEP is like an

More picture related to Is A Sep Ira A Non Qualified Plan

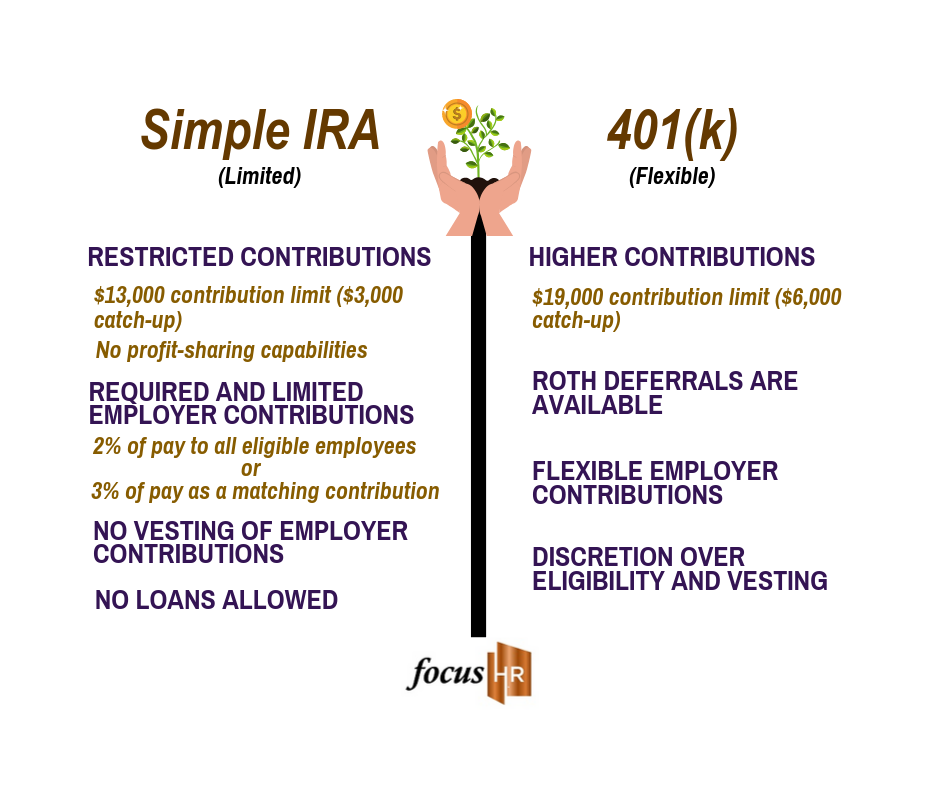

Fidelity Simple Ira Contribution Limits 2025 Frank M Cooper

https://focushr.net/wp-content/uploads/2019/09/Simple-IRA.png

Sep Ira Contribution Limits 2025 Due Date Marya Leanora

https://www.carboncollective.co/hs-fs/hubfs/A_Side_by_Side_Comparison_of_SEP_and_Simple_IRA.png?width=3588&name=A_Side_by_Side_Comparison_of_SEP_and_Simple_IRA.png

Ira Contribution Limits 2025 Table Of Contents Annie Nicolina

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-12-2022-Roth-IRA-Income-Limits.png

1 Is a 401 k Plan Qualified or Nonqualified A 401 k plan is considered a qualified retirement plan If your company offers employees a 401 k you may get a tax break by contributing a percentage on your SEP Plans SEP plans offer a flexible option for self employed individuals and small business owners In 2024 contributions are limited to the lesser of 25 of compensation

SEP IRAs are set up for at a minimum each eligible employee A SEP IRA may have to be set up for a leased employee but does not need to be set up for excludable Non qualified retirement plans offer the advantages of long term savings flexibility and tax deferral Non qualified retirement plans can be grouped into four general categories

2025 401k Max Contribution Limit Aurora Cooper

https://www.investors.com/wp-content/uploads/2019/12/wFAP-contribution-122719.jpg

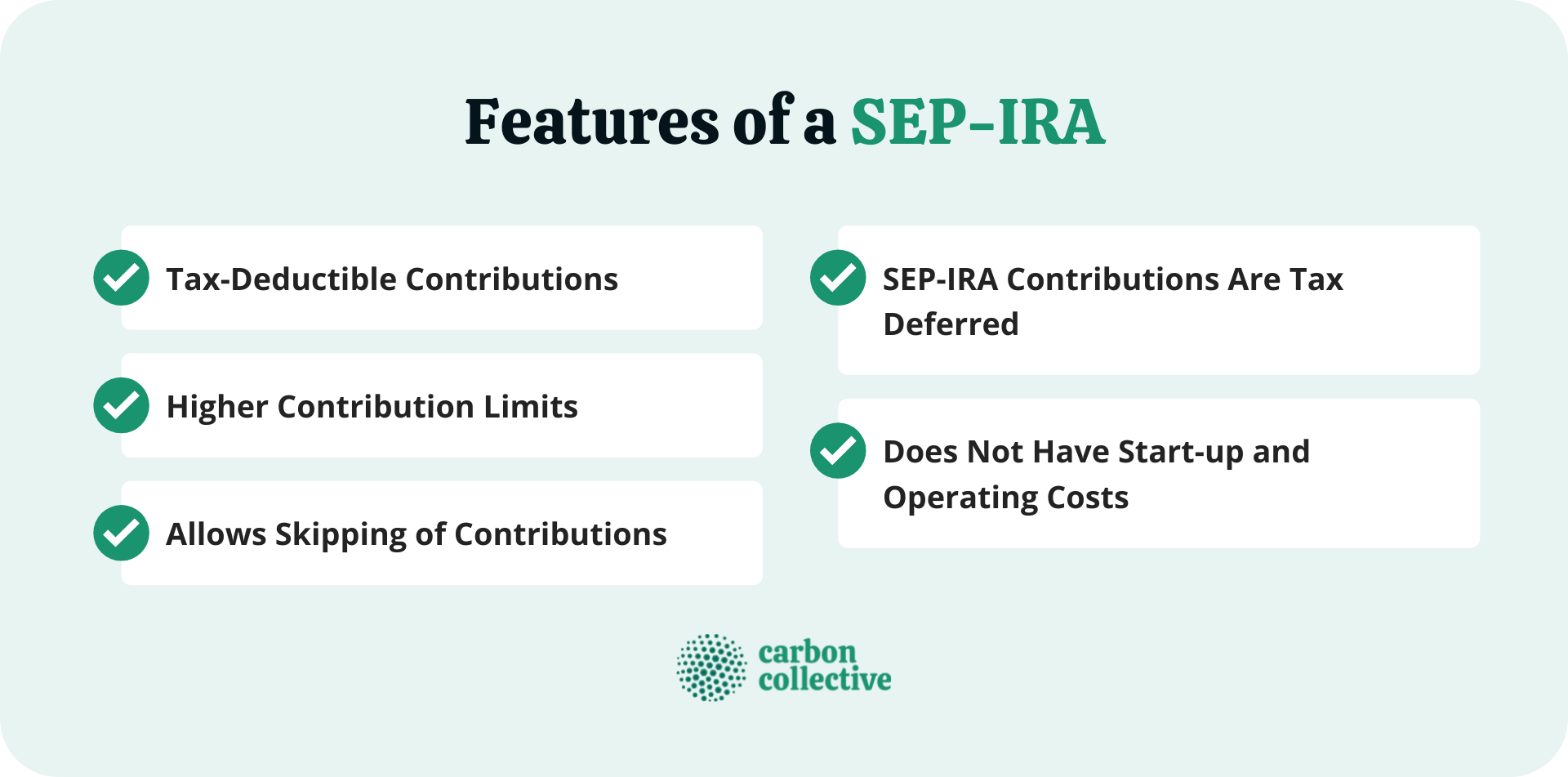

SEP IRA Definition Features Contribution Limits Rules

https://www.carboncollective.co/hs-fs/hubfs/Features_of_a_SEP-IRA.png?width=1920&name=Features_of_a_SEP-IRA.png

https://www.irs.gov › retirement-plans › plan-sponsor › ...

A SEP plan allows employers to contribute to traditional IRAs SEP IRAs set up for employees A business of any size even self employed can establish a SEP Choose a

https://www.irs.gov › retirement-plans › retirement...

If the SEP IRA permits non SEP contributions you can make regular IRA contributions including IRA catch up contributions if you are age 50 and older to your SEP IRA up to the maximum

Limit Qualified Ira Amount Tax Year 2024 Susie Corette

2025 401k Max Contribution Limit Aurora Cooper

Sep Ira Max Contribution 2025 Dakota Sun

Sep Ira Max Contribution 2025 Dakota Sun

:max_bytes(150000):strip_icc()/sep.asp-final-a70730c1f5034f9780d458bee74059b1.jpg)

Sep Ira For 2024 Jaine Gwenore

Roth Ira Contribution Limits 2025 For Spouse Benefit Magnolia Grace

Roth Ira Contribution Limits 2025 For Spouse Benefit Magnolia Grace

Open Enrollment Retirement Savings 401k Or IRA

SEP IRA Vs Roth IRA Which Is Right For You 2023

Sep Ira Contribution Limits 2024 Over 50 Melba Carlota

Is A Sep Ira A Non Qualified Plan - Since only employer contributions are allowed for SEP IRAs an employer must choose a 401 k plan to allow participants to make salary