Is Interest On Home Equity Loans Still Tax Deductible Since you re already at the cap you cannot deduct any interest on a home equity loan Prior to the TCJA you could deduct up to 1 million in home mortgage debt plus 100 000 in home

While the TCJA does limit homeowners ability to deduct interest on a home equity loans or a home equity line of credit HELOC a loophole allows you to claim a deduction in certain Joint filers who took out a home equity loan after Dec 15 2017 can deduct interest on up to 750 000 worth of qualified loans 375 000 if single or married filing

Is Interest On Home Equity Loans Still Tax Deductible

Is Interest On Home Equity Loans Still Tax Deductible

https://i.ytimg.com/vi/luCQbERebtQ/maxresdefault.jpg

Can I Deduct Interest On A Home Equity Loan YouTube

https://i.ytimg.com/vi/LKaeTsJSQxI/maxresdefault.jpg

How Does A Home Equity Line Of Credit or A HELOC Work YouTube

https://i.ytimg.com/vi/SGTclQMCYdc/maxresdefault.jpg

Is it possible to get a tax deduction on your home equity loan in 2024 and 2025 The answer is you can still deduct home equity loan interest Interest on home equity loans When you borrow against your home s equity the interest you pay every year is tax deductible up to a government imposed limit as long as the borrowed money goes toward improving your

Due to recent tax law changes the interest on a home equity loan can be tax deductible including interest paid on your second home In this article we ll cover everything you should know about claiming a home equity loan tax deduction Home equity loan interest can be tax deductible as long as the loan is used to buy build or improve the home The TCJA also lowered the total mortgage loan amounts that you can

More picture related to Is Interest On Home Equity Loans Still Tax Deductible

Is Interest On Home Equity Borrowing Tax Deductible YouTube

https://i.ytimg.com/vi/tgyf7e4FfdI/maxresdefault.jpg

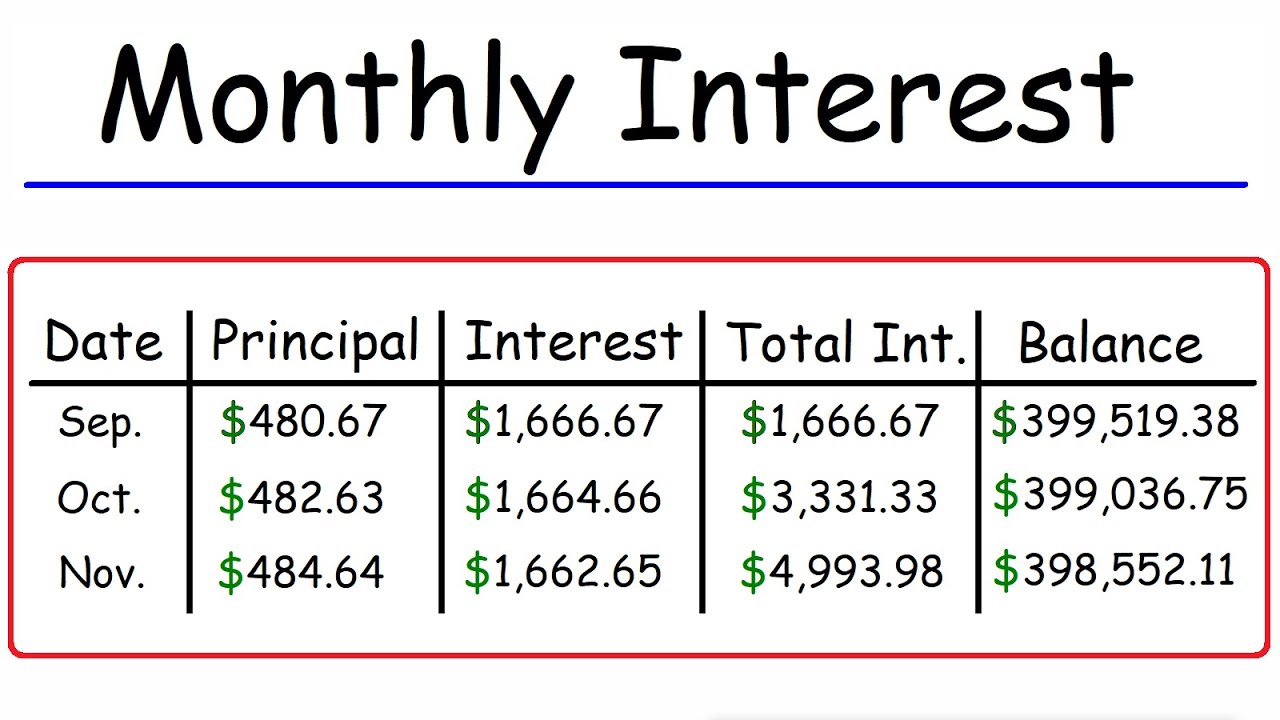

How To Calculate The Monthly Interest And Principal On A Mortgage Loan

https://i.ytimg.com/vi/FN9poyqaIBw/maxresdefault.jpg

How To Apply For Home Equity Line Of Credit Choose Adjustable HELOC

https://i.ytimg.com/vi/0_1hQu5VAcg/maxres2.jpg

The short answer is yes the interest you pay on home equity loans can be tax deductible But it depends on how you use your loan The interest on home equity loans may be deducted for tax purposes only if the proceeds were used to buy build or substantially improve your home This rule started to

According to the IRS home equity loan interest can be tax deductible as long as you use the funds to buy build or substantially improve your home However you won t Under these rules you could potentially deduct home equity loan interest up to the maximum limits if you They re taking out an 80 10 10 loan to avoid mortgage insurance

HOME EQUITY LOANS Woodmen Federal Credit Union

https://woodmenfcu.org/wp-content/uploads/2020/01/5pct_home-equity-loan-1.jpg

Home Equity Loan Calculator Wells Fargo 29

https://www.dupaco.com/wp-content/uploads/2019/06/HELOC-HomeEquity-chart.png

https://www.forbes.com › advisor › home-equity › are...

Since you re already at the cap you cannot deduct any interest on a home equity loan Prior to the TCJA you could deduct up to 1 million in home mortgage debt plus 100 000 in home

https://www.investopedia.com › taxes › tax-loophole...

While the TCJA does limit homeowners ability to deduct interest on a home equity loans or a home equity line of credit HELOC a loophole allows you to claim a deduction in certain

Is Interest On Home Equity Loans Tax Deductible

HOME EQUITY LOANS Woodmen Federal Credit Union

Home Equity Loans Rates POPA Federal Credit Union California

Credit Equity Home Line Rate BURSAHAGA COM

Home Equity Loans

Home Equity Main Line Real Estate Blog

Home Equity Main Line Real Estate Blog

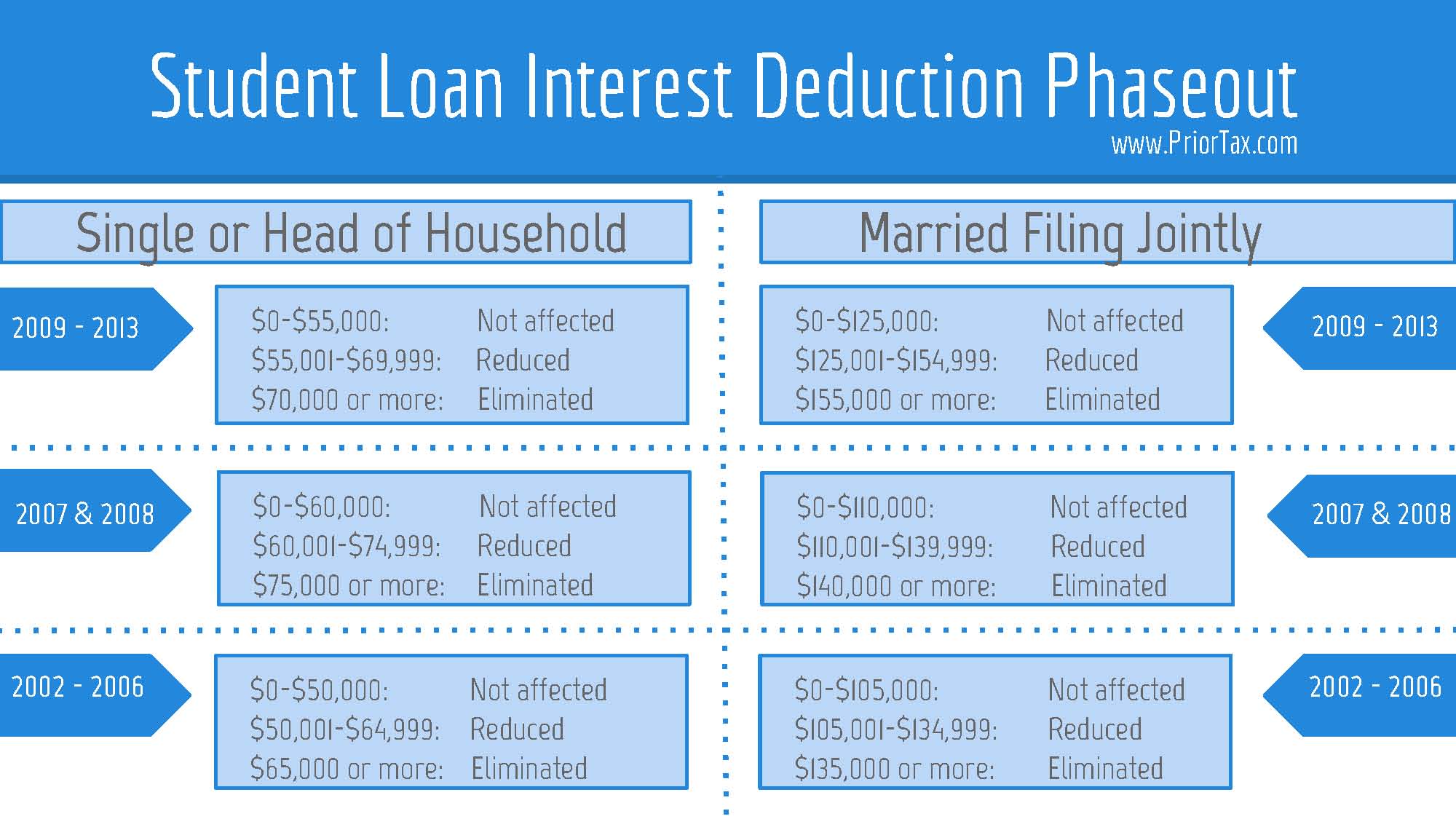

Is Student Loan Interest Tax Deductible RapidTax

Property Loan

3 Things To Watch Out For When Getting A Home Equity Loan Online

Is Interest On Home Equity Loans Still Tax Deductible - Can I deduct interest on a home equity loan or a HELOC In most cases you can deduct your interest How much you can deduct depends on the date of the loan the amount of the loan