Is Interest Paid On Home Equity Line Of Credit Tax Deductible For tax years before 2018 and after 2025 for home equity loans or lines of credit secured by your main home or second home interest you pay on the borrowed funds may be deductible

You can only deduct the portion of the loan or line of credit you used to buy build or substantially improve the home that is used to secure the loan or line of credit This Interest paid on a home equity loan or a home equity line of credit HELOC can still be tax deductible Don t take out a home equity loan or a HELOC just for the tax deduction

Is Interest Paid On Home Equity Line Of Credit Tax Deductible

Is Interest Paid On Home Equity Line Of Credit Tax Deductible

https://i.ytimg.com/vi/uRPfcoHs3ZQ/maxresdefault.jpg

Home Equity Loan Full Guide How It Works YouTube

https://i.ytimg.com/vi/zD567J7RrvY/maxresdefault.jpg

How To Calculate Home Equity Loan BC YouTube

https://i.ytimg.com/vi/g8s7k_FCn-k/maxresdefault.jpg

Home Equity Lines of Credit HELOCs offer homeowners a flexible financing option but understanding the tax implications is essential Recent changes in tax laws have With HELOCs a tax deduction means you can reduce your taxable income by the amount of interest paid on the line of credit Typically the interest on a home equity line of credit is tax deductible if you use the funds

As of 2023 interest on HELOCs is deductible only on debt up to 750 000 or 375 000 if married filing separately This limit is inclusive of any other mortgages the homeowner might have The deductibility of HELOC The IRS allows you to deduct the interest paid on a home equity loan or HELOC if the funds are used to pay for qualified home improvement expenses if it meets the requirements outlined in IRS publications 936 and

More picture related to Is Interest Paid On Home Equity Line Of Credit Tax Deductible

Home Equity Line Of Credit To Pay Off Credit Card Debt A Critical

https://i.ytimg.com/vi/YwhevdNxi38/maxresdefault.jpg

How Does A Home Equity Line Of Credit or A HELOC Work YouTube

https://i.ytimg.com/vi/SGTclQMCYdc/maxresdefault.jpg

Home Equity Line Of Credit Variable Interest Rates YouTube

https://i.ytimg.com/vi/NQTVEpdctcM/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGEgYShhMA8=&rs=AOn4CLDfZGl0fstlNnLfwT-WyIZ-_AECIg

Home equity loans and HELOCs make it possible to borrow against the equity you have in a property without changing your primary mortgage Interest on these loans may be tax deductible if Before the tax year 2018 home equity loans or lines of credit secured by your main or second home and the interest you pay on those borrowed funds may be deductible

If you use the proceeds from a home equity loan or HELOC for home improvements the interest you pay on the loan is generally tax deductible To deduct this What are the tax benefits of having a HELOC The Tax Cuts and Jobs Act of 2017 allows homeowners to deduct the interest paid on a home equity line of credit if the borrowed funds

Home Equity Line Of Credit Or Refinance Cash Out YouTube

https://i.ytimg.com/vi/DxMCBqUrADQ/maxresdefault.jpg

How Does A Home Equity Line Of Credit Affect Medicaid Eligibility Of A

https://i.ytimg.com/vi/SPUCAHKYLdM/maxresdefault.jpg

https://www.irs.gov › faqs › itemized-deductions...

For tax years before 2018 and after 2025 for home equity loans or lines of credit secured by your main home or second home interest you pay on the borrowed funds may be deductible

https://ttlc.intuit.com › ... › deduct-interest-home-equity-loan-heloc

You can only deduct the portion of the loan or line of credit you used to buy build or substantially improve the home that is used to secure the loan or line of credit This

How I Retired Using A Home Equity Line Of Credit YouTube

Home Equity Line Of Credit Or Refinance Cash Out YouTube

How To Apply For Home Equity Line Of Credit Choose Adjustable HELOC

When Is A Home Equity Line Of Credit A Good Idea YouTube

3 Ways To Take Advantage Of Home Equity Achieva Life Home Equity

Home Equity Cover Letter Velvet Jobs

Home Equity Cover Letter Velvet Jobs

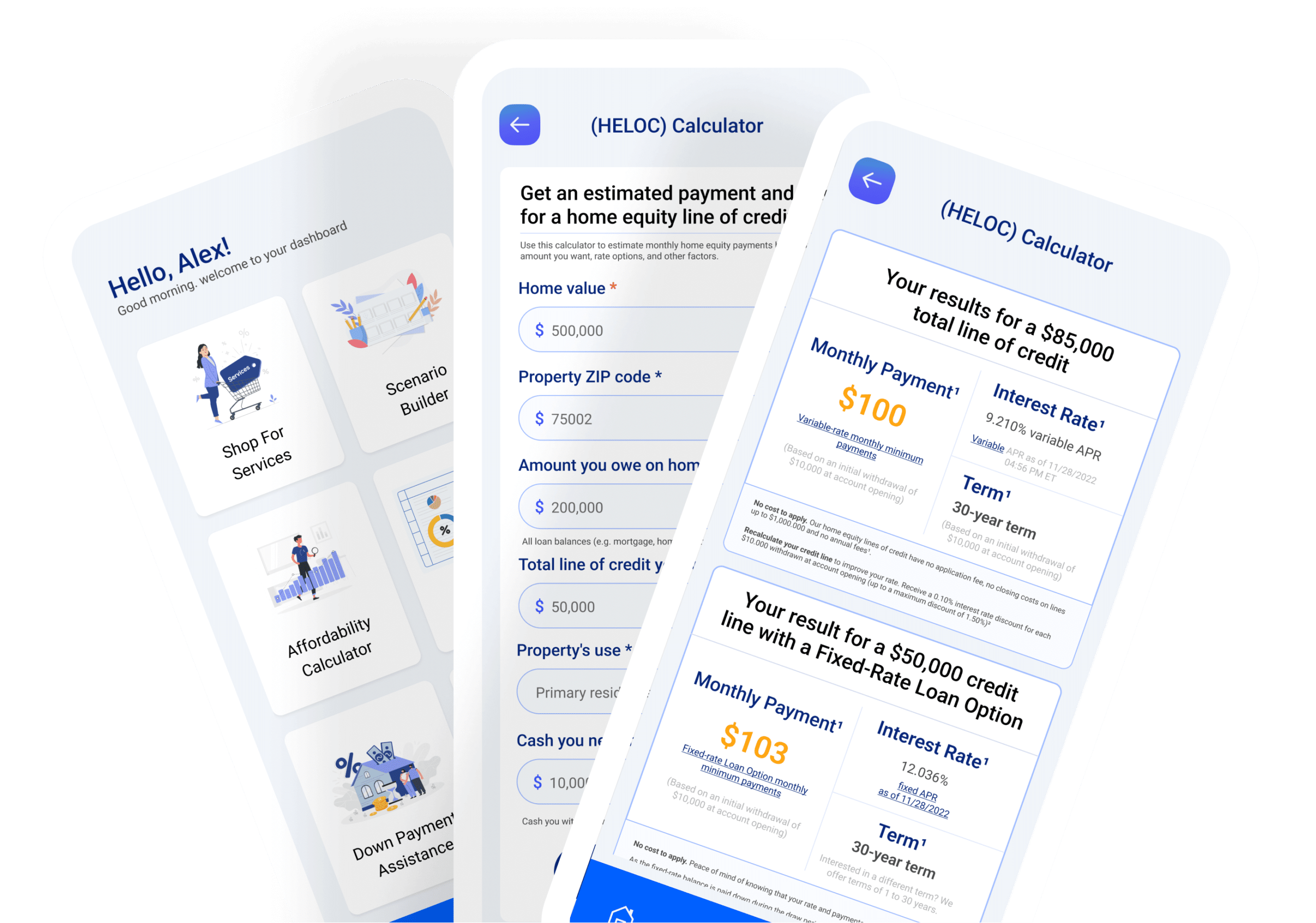

Tools For An Engaging Easy User Journey With Confer

Seeking Home Equity Infographic Home Equity Home Equity Line Equity

Home Equity Line Of Credit Peoples State Bank

Is Interest Paid On Home Equity Line Of Credit Tax Deductible - The IRS allows you to deduct the interest paid on a home equity loan or HELOC if the funds are used to pay for qualified home improvement expenses if it meets the requirements outlined in IRS publications 936 and