Is Tax Assessment The Same As Market Value When you are on your Sign In Partner s website ensure it is your information that is entered and not that of somebody else If you register with someone else s banking credentials by mistake and link your SIN to them the other person will have access to your tax information

Tax on RESP excess contributions An excess contribution occurs at the end of a month when the total of all contributions made by all subscribers to all RESPs for a beneficiary is more than the lifetime limit for that beneficiary We do not include payments made to an RESP under the Canada Education Savings Program CESP or any designated provincial education savings The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income tax rates apply in addition to federal income tax rates

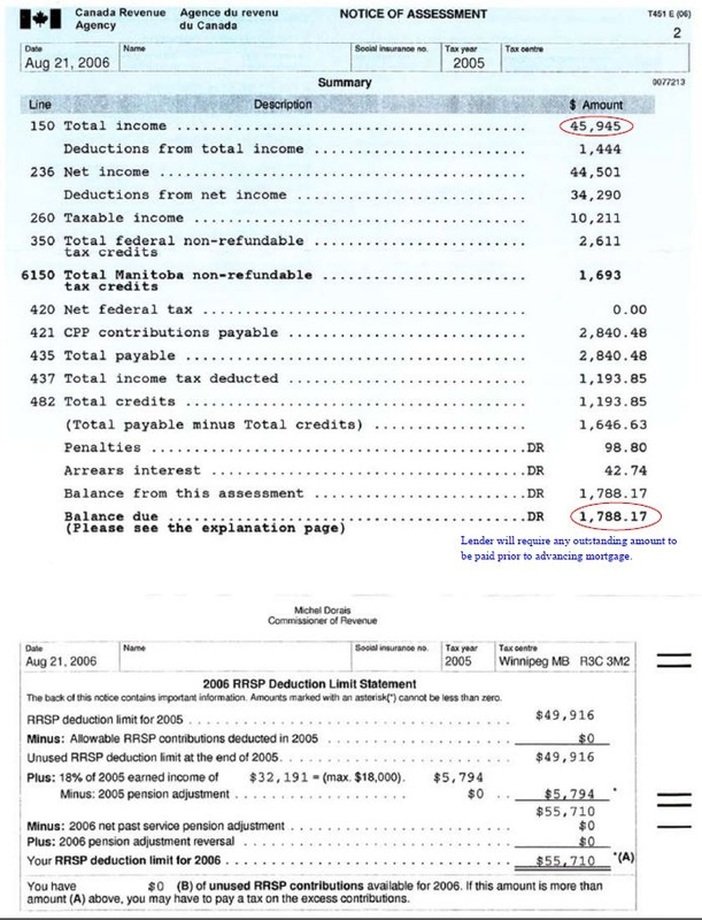

Is Tax Assessment The Same As Market Value

Is Tax Assessment The Same As Market Value

https://irp-cdn.multiscreensite.com/9b168ae4/dms3rep/multi/Notice-of-Assessment.jpg

Are Beetroots The Same As Beets Purchase Cheap Www metaltecnica pe

https://www.alphafoodie.com/wp-content/uploads/2022/08/Beetroot-Juice-square.jpeg

Craiyon Free Online Ai Image Generator From Text On Craiyon

https://pics.craiyon.com/2023-09-29/8136e3e8bd2441e4aa01d5eb6118a484.webp

A first home savings account FHSA is a registered plan allowing you as a prospective first time home buyer to save for your first home tax free up to certain limits If you get your tax refund by direct deposit you would also get your CCR by direct deposit For more information and ways to enroll for direct deposit go to Direct deposit Canada Revenue Agency

If you receive federal benefits including some provincial territorial benefits you will receive payment on these dates If you set up direct deposit payments will be deposited in your account on these dates The Payroll Deductions Online Calculator PDOC calculates Canada Pension Plan CPP Employment Insurance EI and tax deductions based on the information you provide

More picture related to Is Tax Assessment The Same As Market Value

Creative Username Ideas On Craiyon

https://pics.craiyon.com/2023-09-29/b920568a6537411088b7aa32d06880a7.webp

Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=10159381993357404

BIR60 Workstem

https://www.workstem.com/wp-content/uploads/2022/10/pasted_image_01-min-2.png

GST HST rates by province GST HST calculators Sales tax calculator Use this calculator to find out the amount of tax that applies to sales in Canada Enter the amount charged for a purchase before all applicable sales taxes including the Goods and Services Tax Harmonized Sales Tax GST HST and any Provincial Sales Tax PST are applied Determine the tax treatment of payments other than regular employment income EI premium rates and maximums For each year the CRA provides the Maximum insurable earnings Rate you use to calculate the amount of EI premiums to deduct from your employees remuneration On this page Federal EI premium rates and maximums Quebec EI premium rates and

[desc-10] [desc-11]

And As We Let Our Own Light Shine We Unconsciously Give Other People

https://64.media.tumblr.com/8ead1d78663a1caac9122026cb9ca8b1/tumblr_ozgxd1N9zZ1r67vv9o1_1280.jpg

Individual Income Tax Rates 2023 In Singapore Image To U

https://i0.wp.com/justonelap.com/wp-content/uploads/2023/06/Tax-rates-2024-1.jpg?w=1526&ssl=1

https://www.canada.ca › en › revenue-agency › services › e-services › cr…

When you are on your Sign In Partner s website ensure it is your information that is entered and not that of somebody else If you register with someone else s banking credentials by mistake and link your SIN to them the other person will have access to your tax information

https://www.canada.ca › en › revenue-agency › services › tax › individual…

Tax on RESP excess contributions An excess contribution occurs at the end of a month when the total of all contributions made by all subscribers to all RESPs for a beneficiary is more than the lifetime limit for that beneficiary We do not include payments made to an RESP under the Canada Education Savings Program CESP or any designated provincial education savings

Add Modern Elegance To Your Home Decor With Our Versatile Concrete Tray

And As We Let Our Own Light Shine We Unconsciously Give Other People

What Happened To Those 15 000 000 Biden Voters What Happened To

Three Horn Circus Inkipedia The Splatoon Wiki

We re Not The Same Why Helly Doesn t Want To Help The Outies In

How To Install Minecraft NeoForged

How To Install Minecraft NeoForged

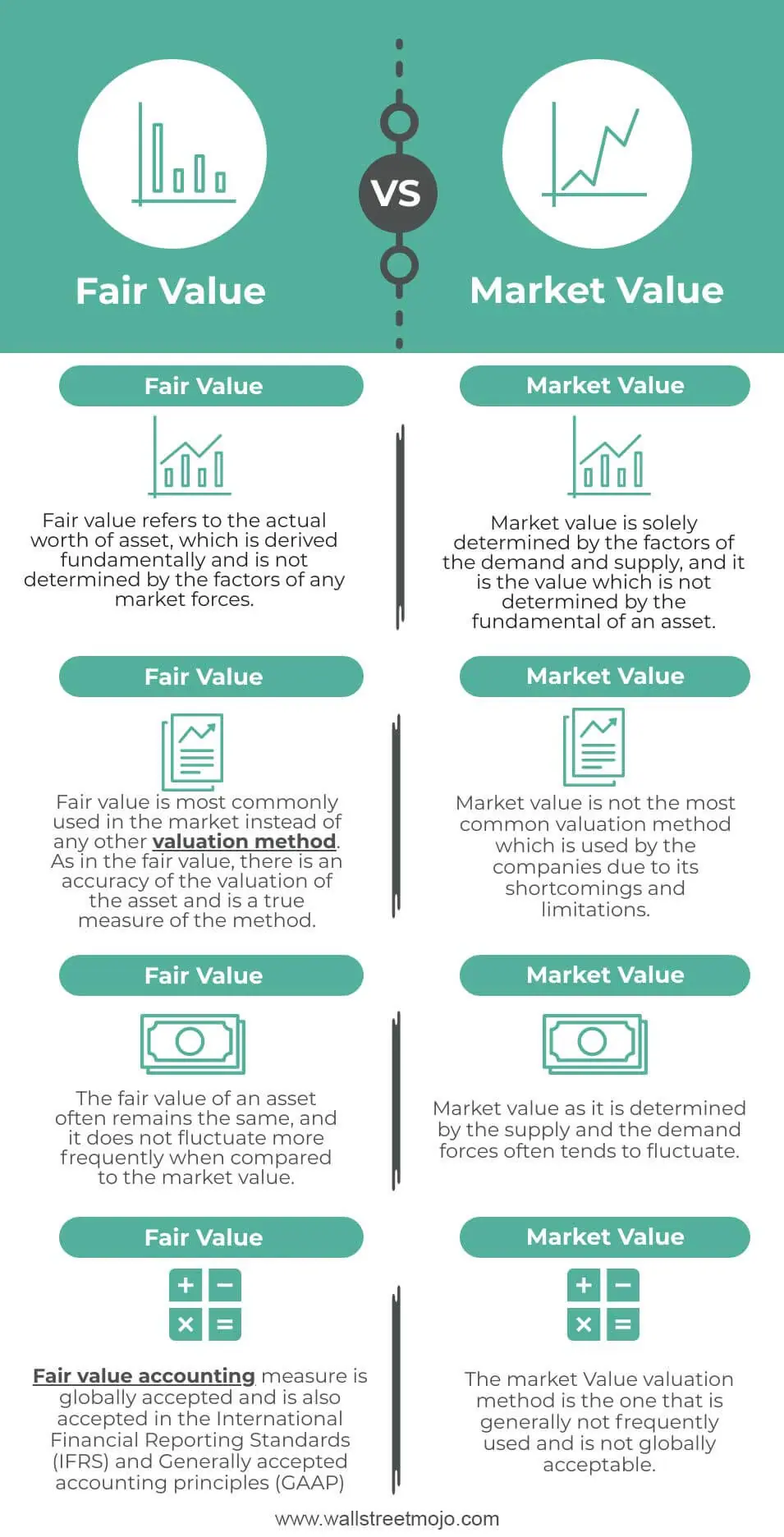

Fair Value Vs Market Value Top 4 Key Differences

1 Bluest GAMER Sets Out To Become VICTORY INCARNATE In Battle Royal

Fair Value Vs Market Value Top 8 Differences With Infographics

Is Tax Assessment The Same As Market Value - A first home savings account FHSA is a registered plan allowing you as a prospective first time home buyer to save for your first home tax free up to certain limits