Non Qualified Retirement Plans A non qualified plan is a type of retirement plan that does not meet the requirements established by the Employee Retirement Income Security Act ERISA and the

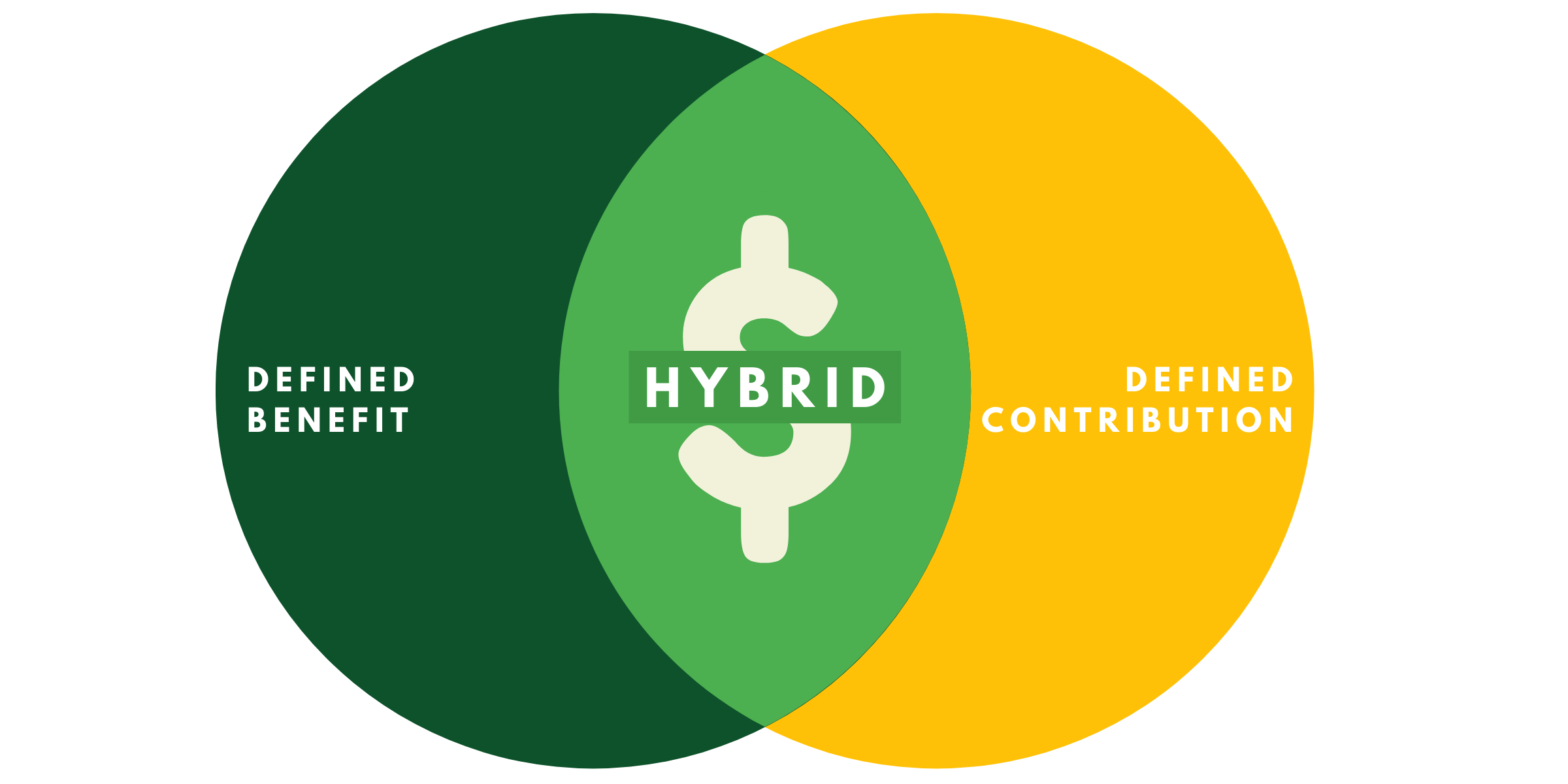

A non qualified plan is a type of tax deferred employer sponsored retirement plan that falls outside of Employee Retirement Income Security Act ERISA guidelines Nonqualified retirement plans enable highly compensated employees HCEs to save more money for retirement than they could in a qualified plan Qualified plans are subject

Non Qualified Retirement Plans

Non Qualified Retirement Plans

https://www.moneyhacker.org/wp-content/uploads/2020/05/Money-Hacker-Retirement1.png

The Ultimate Guide To Qualified Versus Non Qualified Retirement Plans

https://www.moneyhacker.org/wp-content/uploads/2020/05/Money-Hacker-Retirement2.png

The Ultimate Guide To Qualified Versus Non Qualified Retirement Plans

https://www.moneyhacker.org/wp-content/uploads/2020/02/savings-finances-economy-and-home-budget-PHZWZZQ-scaled-e1580426614305.jpg

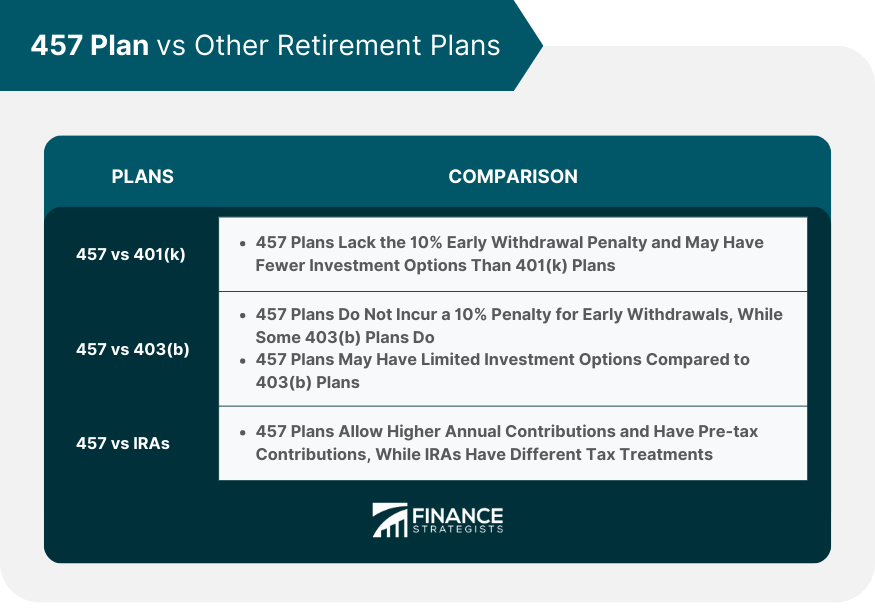

On the other hand nonqualified retirement plans such as deferred compensation plans and supplemental executive retirement plans SERPs provide employers with greater Non qualified retirement plans offer the advantages of long term savings flexibility and tax deferral Non qualified retirement plans can be grouped into four general categories

A Non qualified Plan also called a non qualified retirement plan or non qualified benefit plan is an employer sponsored retirement plan that does not fall under the purview of Explore the features types and tax implications of non qualified plans and their impact on retirement planning for both employers and employees Non qualified plans offer a

More picture related to Non Qualified Retirement Plans

The Ultimate Guide To Qualified Versus Non Qualified Retirement Plans

https://www.moneyhacker.org/wp-content/uploads/2020/05/Money-Hacker-Retirement3.png

The Ultimate Guide To Qualified Versus Non Qualified Retirement Plans

https://www.moneyhacker.org/wp-content/uploads/2020/05/Money-Hacker-Retirement4.png

Types Non Qualified Retirement Plans In Powerpoint And Google Slides Cpb

https://www.slideteam.net/media/catalog/product/cache/1280x720/t/y/types_non_qualified_retirement_plans_in_powerpoint_and_google_slides_cpb_slide01.jpg

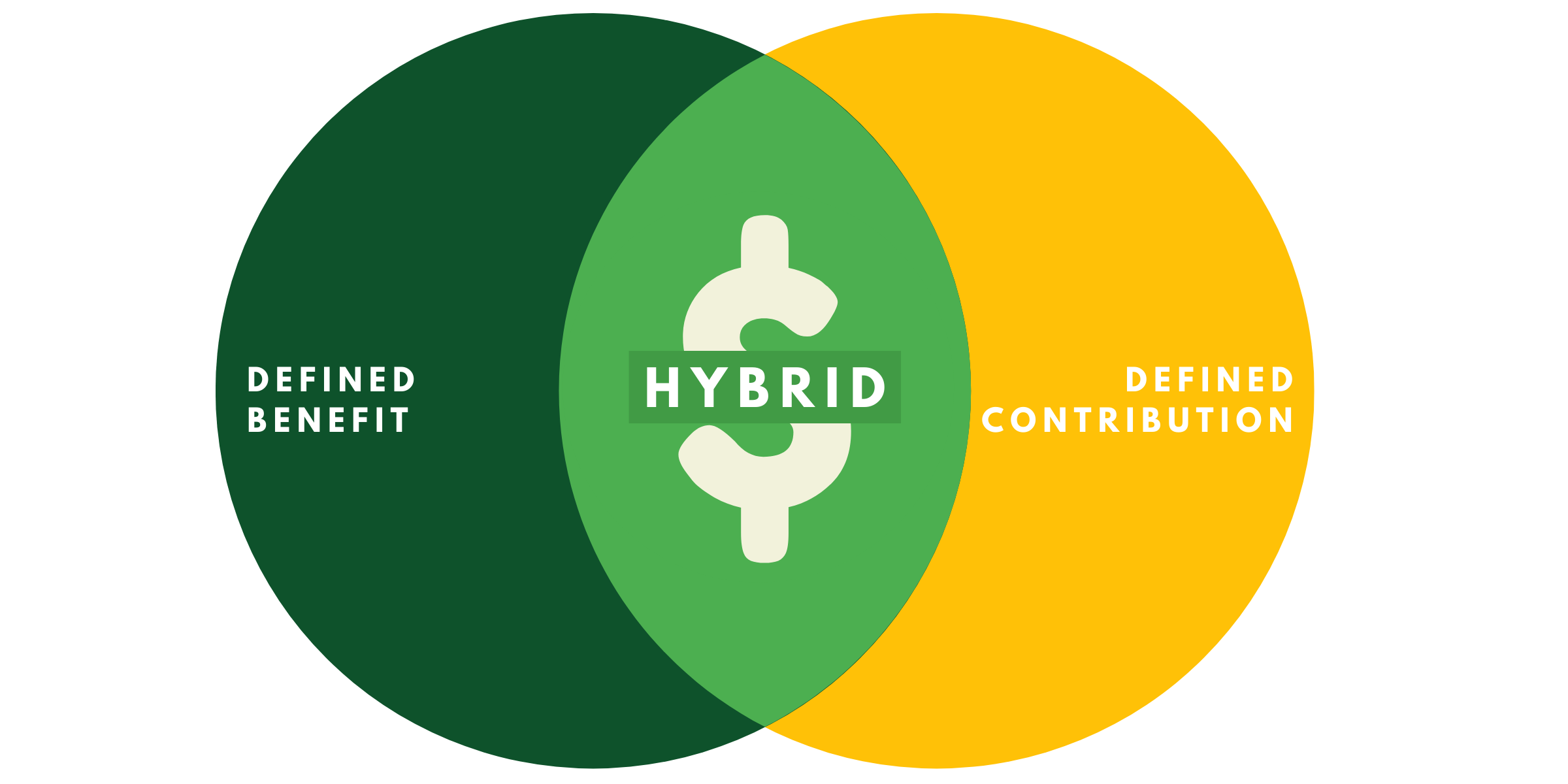

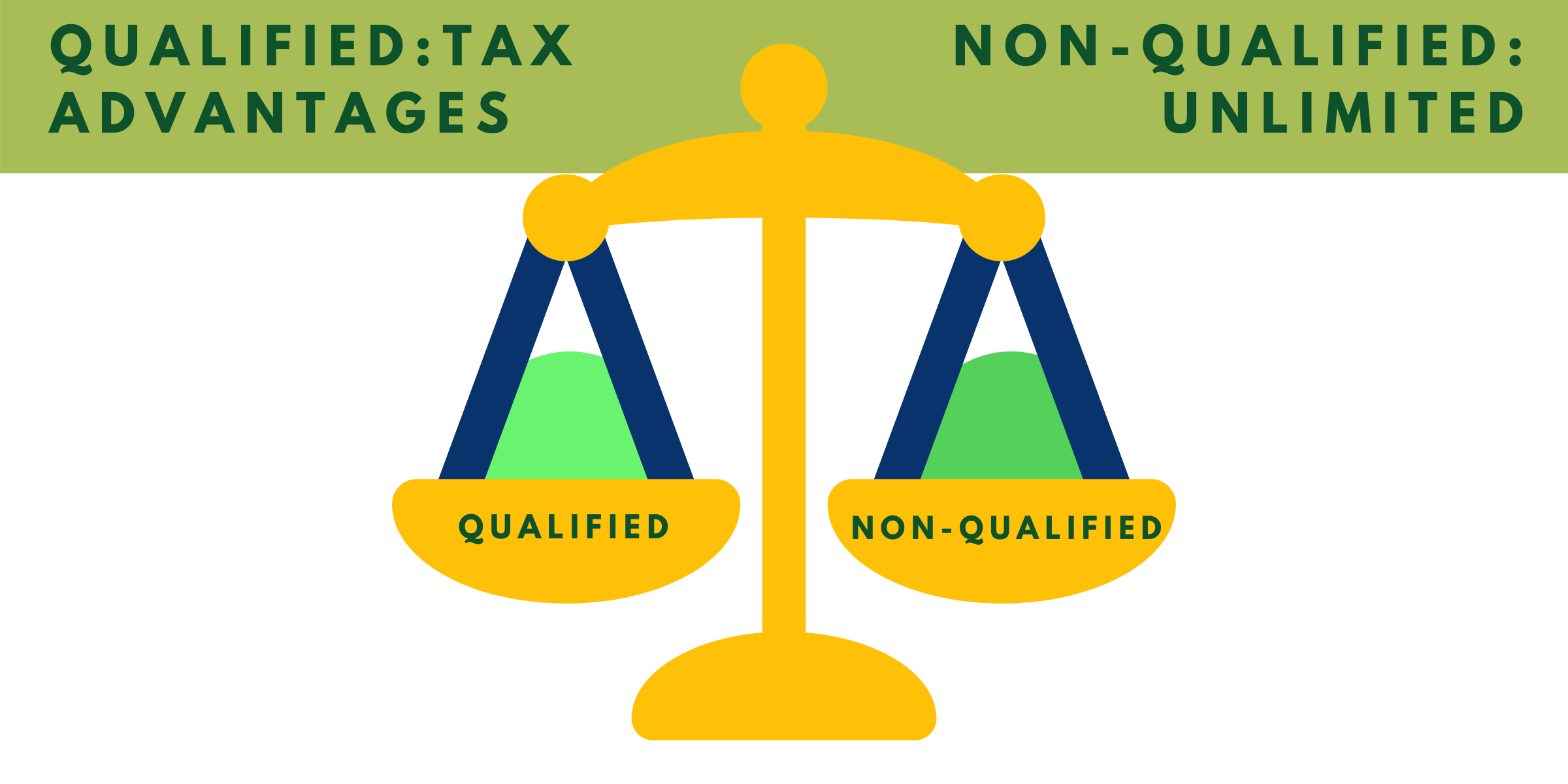

Retirement accounts can broadly be classified into a qualified or a non qualified retirement plan Both these types can offer you great benefits and at the same time come with Explore the essential differences between qualified and nonqualified retirement plans focusing on sponsorship contributions taxes and legal aspects Understanding the

[desc-10] [desc-11]

Qualified Vs Non Qualified Retirement Plans What Is The Difference

https://www.retirementplanning.net/blog/wp-content/uploads/2023/09/Qualified-Vs-Non-Qualified-660x400.jpg

37 Qualified Retirement Plans Non Qualified Retirement Plans

https://i.ytimg.com/vi/bwYZHvJ62sQ/maxresdefault.jpg

https://www.financestrategists.com › retirement...

A non qualified plan is a type of retirement plan that does not meet the requirements established by the Employee Retirement Income Security Act ERISA and the

https://www.investopedia.com › terms › non-qualified-plan.asp

A non qualified plan is a type of tax deferred employer sponsored retirement plan that falls outside of Employee Retirement Income Security Act ERISA guidelines

Unlock Your Business Potential Exploring Non Qualified Retirement Plans

Qualified Vs Non Qualified Retirement Plans What Is The Difference

Difference Between Qualified And Non Qualified Plans YouTube

Qualified Retirement Plans

Incoterms Explained Definition Examples Rules Pros Cons 57 OFF

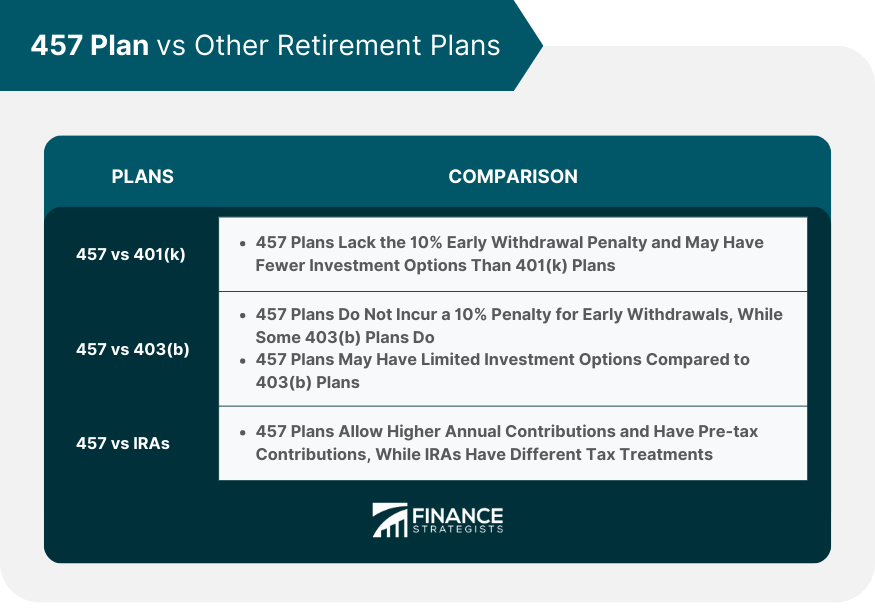

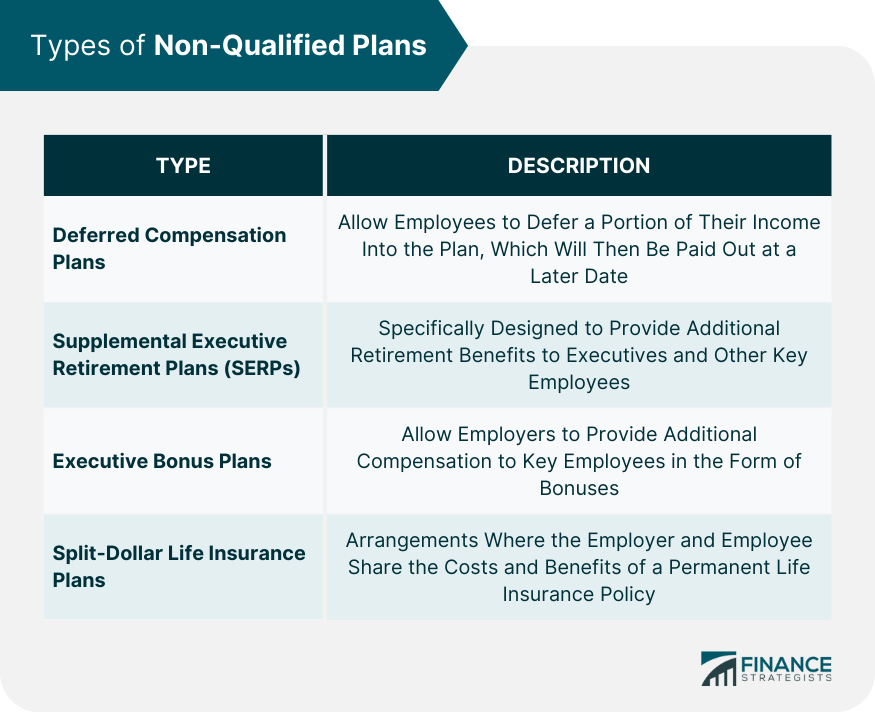

457 b Plan Definition How It Works Pros And Cons 44 OFF

457 b Plan Definition How It Works Pros And Cons 44 OFF

WellsColeman Changes Affecting Qualified Retirement Plans

Few Allowed Share To Get Into General Judge Methods Other Are Juridical

Cozen O Connor Brehm Lynn

Non Qualified Retirement Plans - [desc-13]