Rmd 10 Year Rule Inherited Ira A required minimum distribution RMD is the amount of money that must be withdrawn annually from certain employer sponsored retirement plans like 401 k s and certain

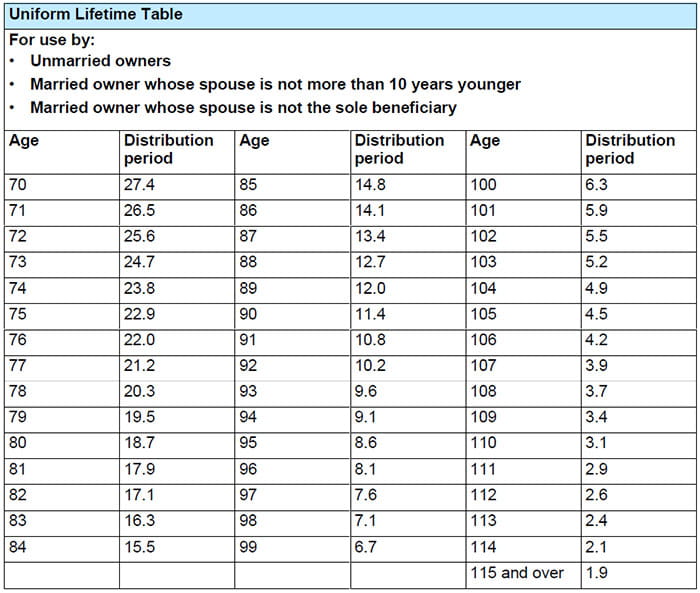

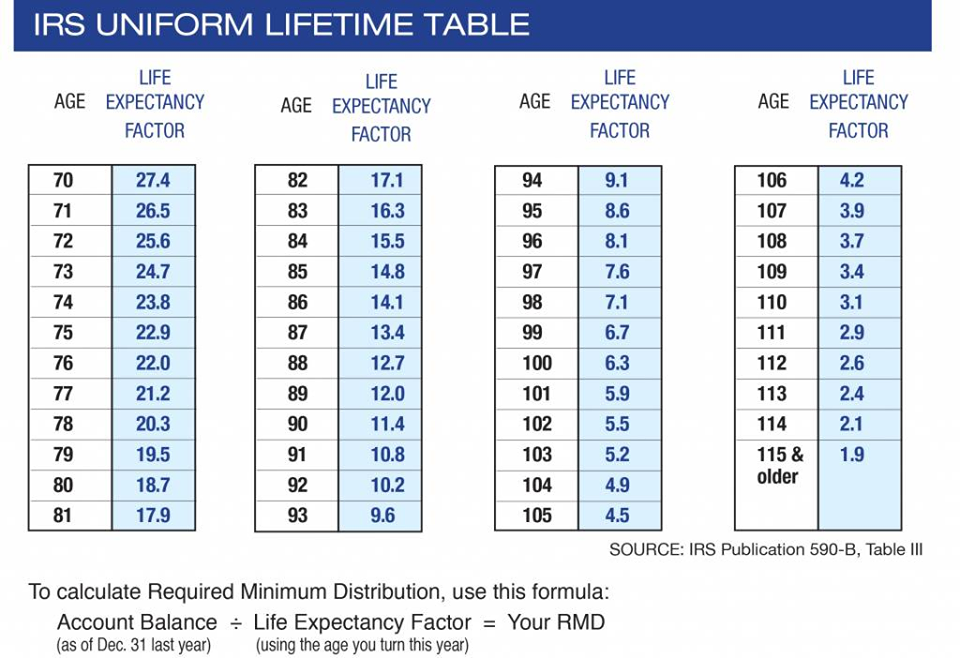

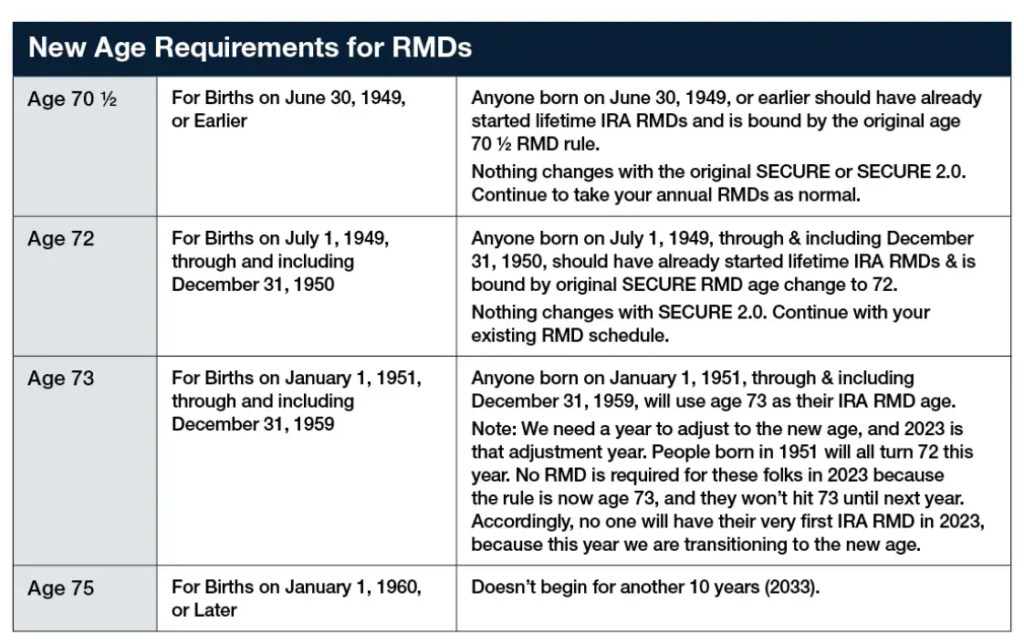

A required minimum distribution or RMD is the amount of money that the IRS requires you to withdraw annually from certain retirement plans the year after you turn 73 What is an RMD A required minimum distribution RMD is the amount the government requires you to withdraw each year from certain retirement accounts such as a 401 k or IRA once

Rmd 10 Year Rule Inherited Ira

Rmd 10 Year Rule Inherited Ira

https://i.ytimg.com/vi/074pHMj7ntk/maxresdefault.jpg

The SECURE Act s 10 Year Rule Is Actually An 11 Year Rule

https://i.ytimg.com/vi/5eu-DsDAU_k/maxresdefault.jpg

Beneficiary Ira Mandatory Distribution Table Elcho Table

https://www.aaii.com/images/journal/12099-figure-2.gif

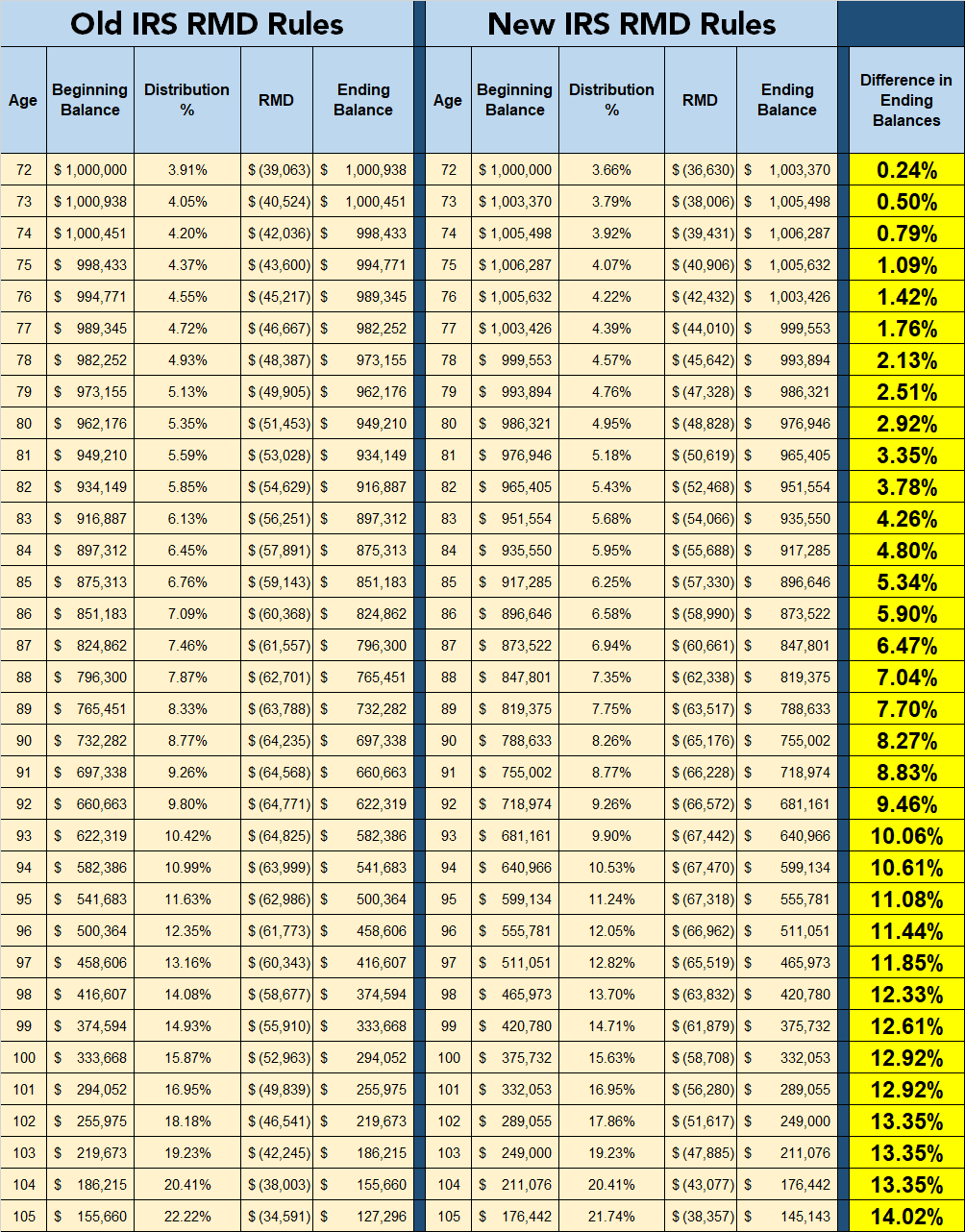

An RMD is the amount of money that you must withdraw from nearly all types of tax deferred retirement accounts each year once you hit a certain age As the name implies an RMD is the minimum amount to be withdrawn from retirement accounts that have been funded with pre tax dollars If you need or want to

RMD rules dictate the minimum amount you must withdraw from your account every year beginning at age 73 depending on your age on Jan 1 2023 A required minimum distribution RMD is the minimum amount you must withdraw from your individual retirement account IRA or 401 k plan upon reaching a certain age The age used

More picture related to Rmd 10 Year Rule Inherited Ira

Rmd Tables For Inherited Ira Elcho Table

https://levelfa.com/wp-content/uploads/2020/12/RMD-Rule-Changes.png

Aarp Rmd Calculator 2025 Fawne Christal

https://www.raymondjames.com/-/media/rj/advisor-sites/sites/n/e/nevadafamilywealth/images/rmd-chart.jpg

Aarp Rmd Calculator 2025 Fawne Christal

https://alquilercastilloshinchables.info/wp-content/uploads/2020/05/RMD-Table-Required-Minimum-Distribution.jpg

Rheumatic and musculoskeletal diseases RMDs are chronic systemic diseases that commonly affect the joints but can affect any organ of the body There are more than 200 The relative mean difference is defined in terms of the mean difference as follows mathrm RMD frac mathrm MD bar x where bar x is the sample mean

[desc-10] [desc-11]

Aarp Rmd Calculator 2025 Fawne Christal

http://staging-rodgersassociates.kinsta.cloud/wp-content/uploads/uniform-lifetime-table.jpg

What Is A Donee Beneficiary

https://www.kitces.com/wp-content/uploads/2020/07/Graphic-2-Successor-Beneficiaries-Inherit-Assets-From-The-Beneficiaries-Of-Original-Account-Owners.png

https://www.investopedia.com › terms › required...

A required minimum distribution RMD is the amount of money that must be withdrawn annually from certain employer sponsored retirement plans like 401 k s and certain

https://www.bankrate.com › retirement › required...

A required minimum distribution or RMD is the amount of money that the IRS requires you to withdraw annually from certain retirement plans the year after you turn 73

Rmd Calculator 2025 Aarp Medicare Otis G Hawkins

Aarp Rmd Calculator 2025 Fawne Christal

Rmd Table 2025 Pdf Free Windy Lilian

Rmd Table 2025 Pdf Free Windy Lilian

Rmd Tax Factors For 2025 Carey Maurita

Current Life Expectancy 2025 Lok Abdul Reyna

Current Life Expectancy 2025 Lok Abdul Reyna

Rmd Calculator 2025 Table Pdf Nadir Wren

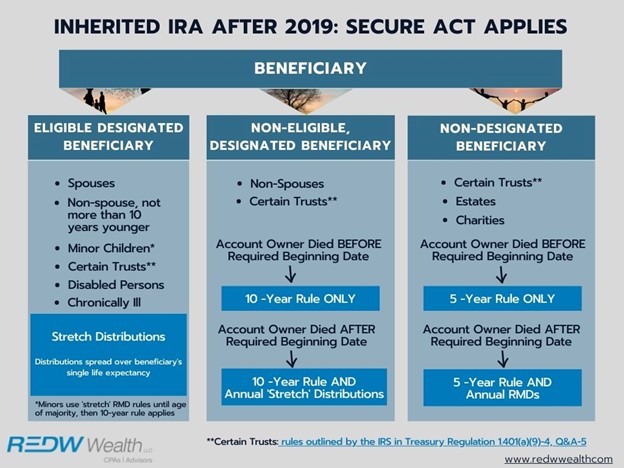

Inherited IRA Required Distributions REDW Financial Advisors CPAs

Aarp Rmd Calculator 2025 Table Reta Rosemarie

Rmd 10 Year Rule Inherited Ira - [desc-12]