Tax Credits For Energy Efficient Home Improvements 2022 2025 federal income tax rates These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been applied There are

Tax free savings accounts registered savings plans pooled pension plans and plan administration Excise and specialty taxes Duties customs charges tax on underused The Canada Revenue Agency is inviting individuals to use the SimpleFile by Phone service again this year You may also be invited to try out a new digital option as part of a pilot as we work

Tax Credits For Energy Efficient Home Improvements 2022

Tax Credits For Energy Efficient Home Improvements 2022

https://i.ytimg.com/vi/jPnkaZv4M1g/maxresdefault.jpg

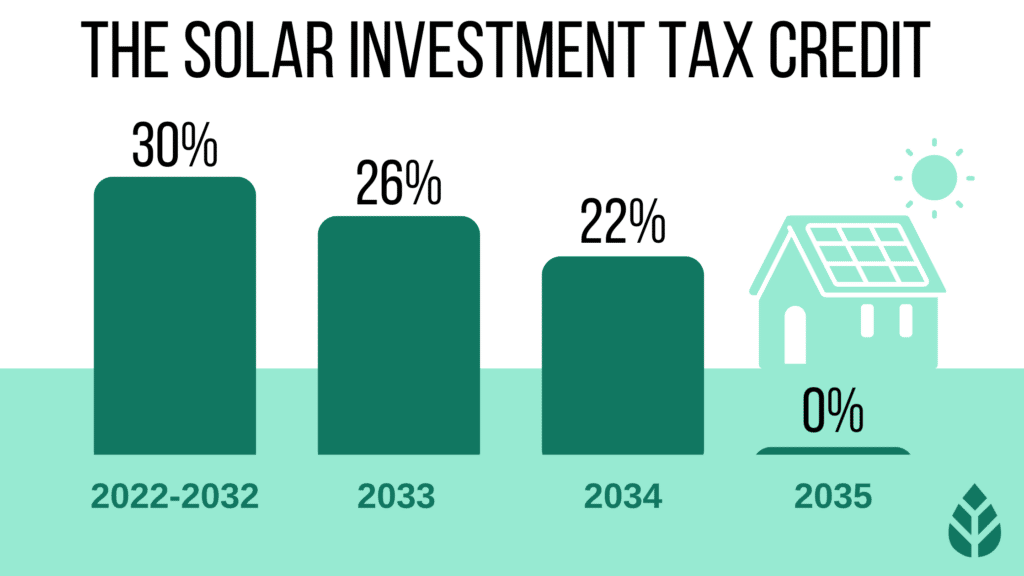

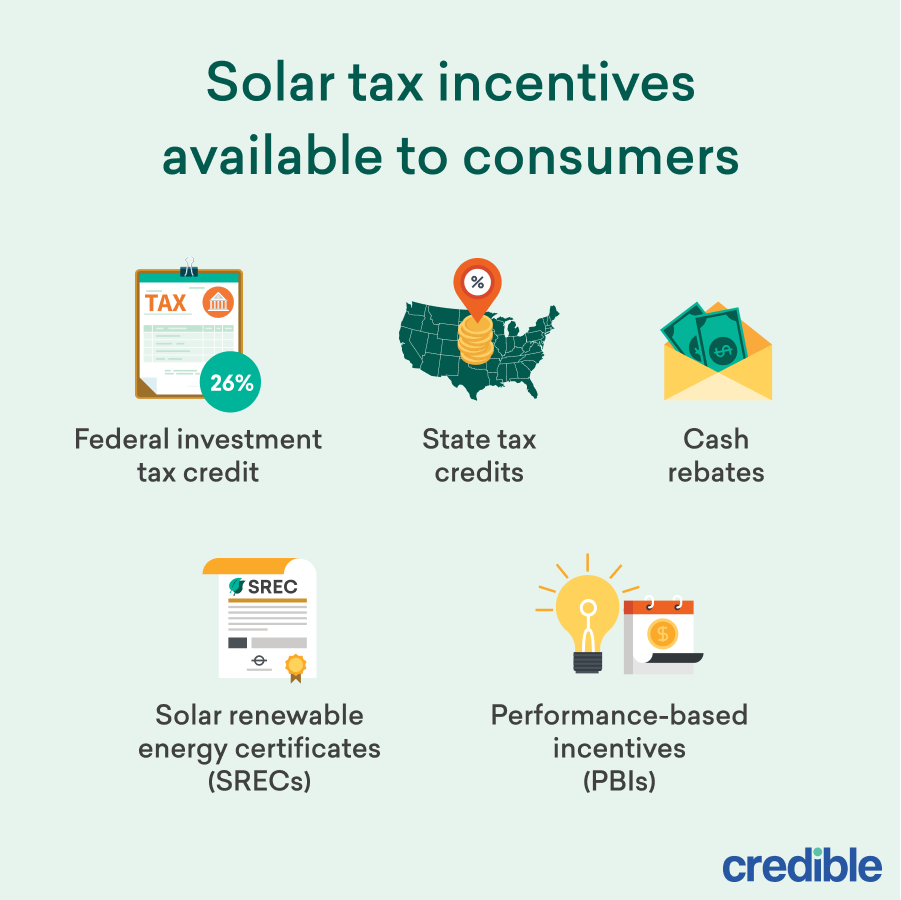

Government Solar Incentives 2024 Ola Lauryn

https://www.credible.com/blog/wp-content/uploads/2021/07/Solar-tax-incentives-available-to-consumers-infographic.png

Tax Credits 2024 Hvac Kyle Shandy

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white.png

The bulk of tax relief will go to those with incomes in the two lowest tax brackets i e those with taxable income under 114 750 in 2025 including nearly half to those in the The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

Tax filing assistance from a CRA agent Complete and file your taxes over the phone with a CRA agent The CRA will send an invitation to those eligible through mail or My Account Who can Since this date falls on a Sunday the CRA will consider your income tax and benefit return filed on time if it is received on or before June 16 2025 The CRA provides free

More picture related to Tax Credits For Energy Efficient Home Improvements 2022

Government Solar Incentives 2024 Suzie Cherianne

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2-1024x576.png

5695 Form 2025 Mariam Skye

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/03/irs_form_5695_part_ii_top-1024x814.png

Energy Efficient Tax Credits 2025 George Clementina

https://www.energy.gov/sites/default/files/2022-10/Summary-ITC-and-PTC-Values-Table.png

April 30 2025 Deadline for most individuals to file their tax return and pay any taxes owed June 15 2025 Deadline to file your tax return if you or your spouse or common law partner are The first R550 000 of your retirement lump sum is tax free as of 1 March 2024 Any previous withdrawals or retirement lump sums you ve taken will reduce your tax free amount The

[desc-10] [desc-11]

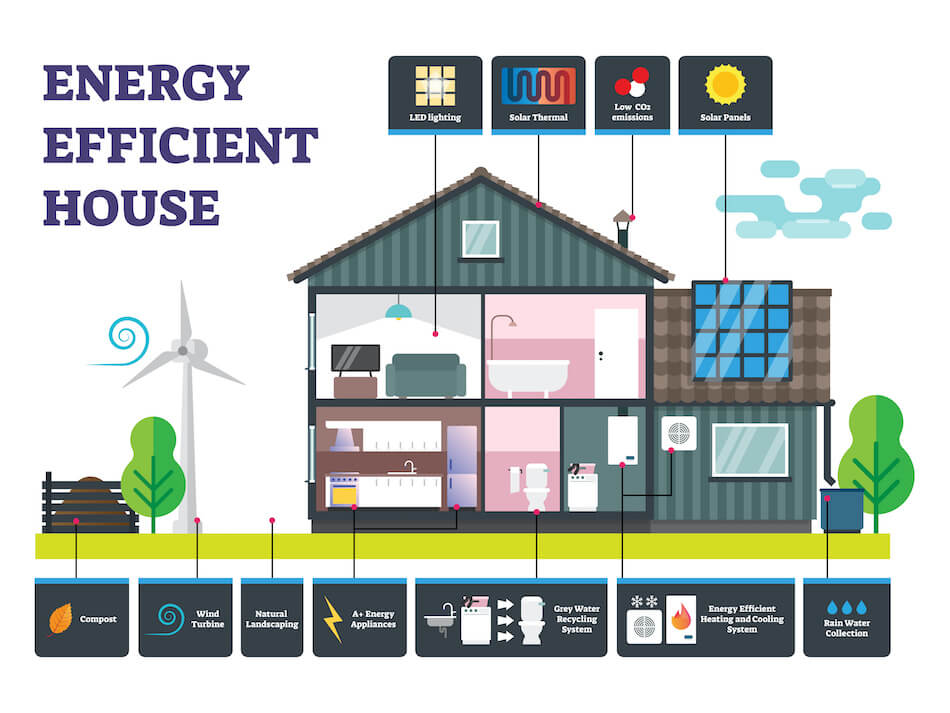

What Is An Energy Efficient House Image To U

https://genstone.com/wp-content/uploads/2018/10/How-to-Make-Your-Home-More-Energy-Efficient-Infographic.jpg

Tax Credits 2024 List Uk Carena Stephani

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

https://www.canada.ca › en › revenue-agency › services › tax › individual…

2025 federal income tax rates These rates apply to your taxable income Your taxable income is your income after various deductions credits and exemptions have been applied There are

https://www.canada.ca › en › services › taxes

Tax free savings accounts registered savings plans pooled pension plans and plan administration Excise and specialty taxes Duties customs charges tax on underused

.png)

Inflation Reduction Act Energy Cost Savings

What Is An Energy Efficient House Image To U

Residential Energy Efficient Property Credit Limit Worksheet

7 Great High ROI Energy Efficient Home Improvements Rexmont

Residential Energy Tax Credits Changes In 2023 EveryCRSReport

2024 Tax Credits For Windows And Doors Crissy Noelyn

2024 Tax Credits For Windows And Doors Crissy Noelyn

IRS Form 5695 Residential Energy Credits Forms Docs 2023

Extended Tax Credits For Energy Efficient Windows Efficient Windows

Home Energy Improvements Lead To Real Savings Infographic Solar

Tax Credits For Energy Efficient Home Improvements 2022 - [desc-14]