Tax Plan House The House Build Back Better tax plan reduces economic output by reducing the after tax return to investment opportunities for firms and the incentive to work through higher tax rates on labor income About 25 percent of the plan s economic impact is due to increasing the tax burden on corporations which is the most economically costly way to

Published January 20 2021 President Biden s Build Back Better social spending and tax bill is slowly working its way through Congress It was recently passed by the House of Representatives Published Sept 13 2021 Updated Sept 15 2021 WASHINGTON House Democrats on Monday presented a plan to pay for their expansive social policy and climate change package by raising taxes by

Tax Plan House

Tax Plan House

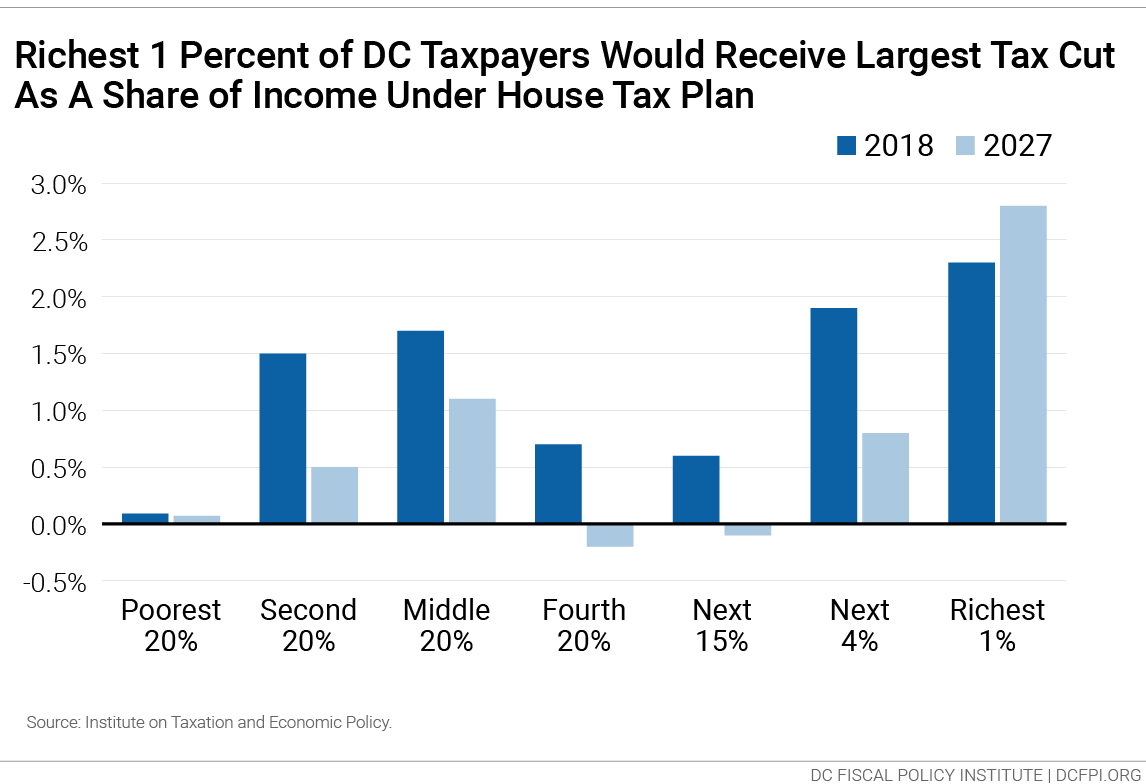

https://www.dcfpi.org/wp-content/uploads/2017/11/house-tax-plan-1.png

The Good And The Bad In The House Tax Plan

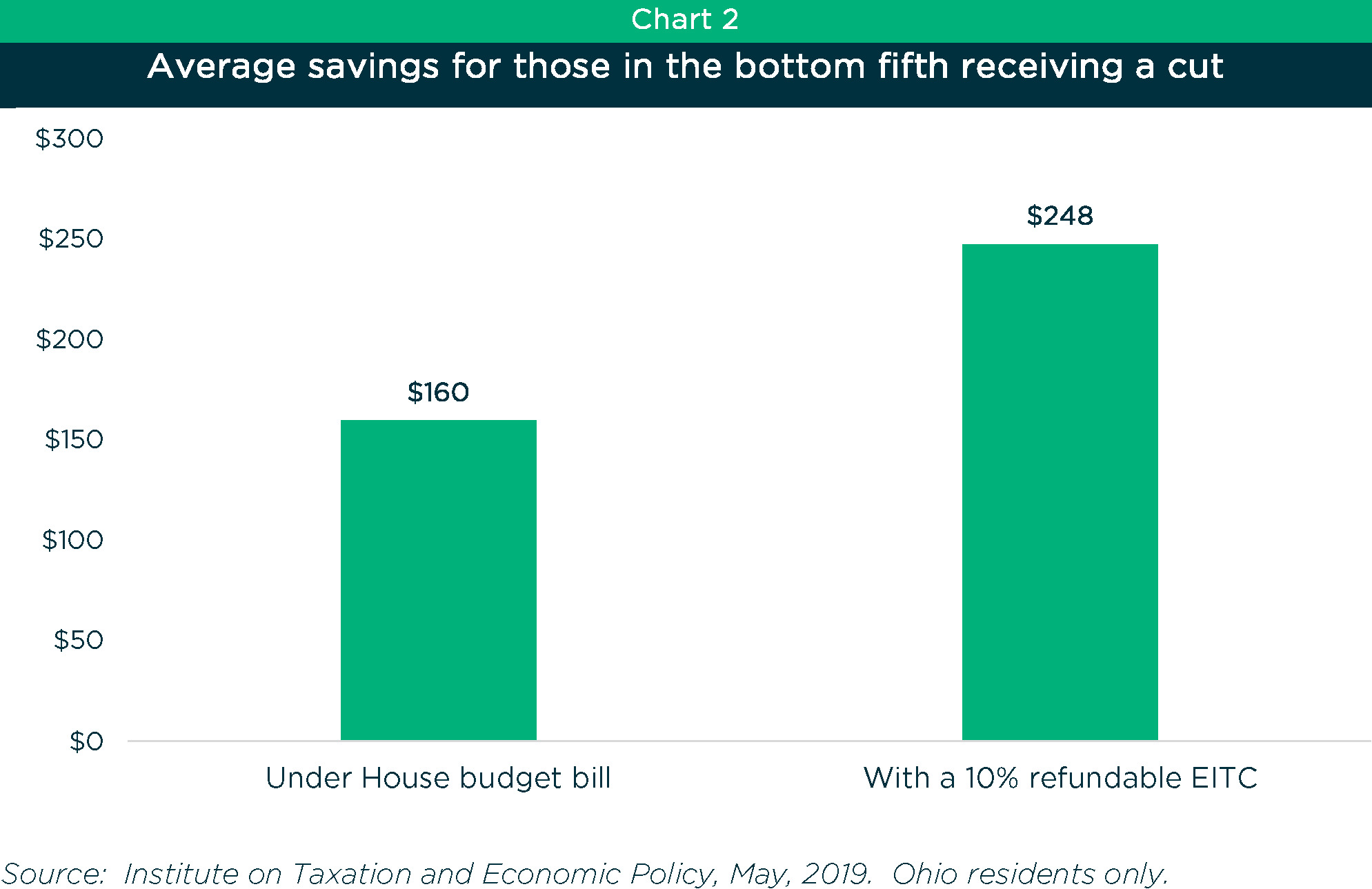

https://www.policymattersohio.org/files/research/chart2itephousetax2019.jpg

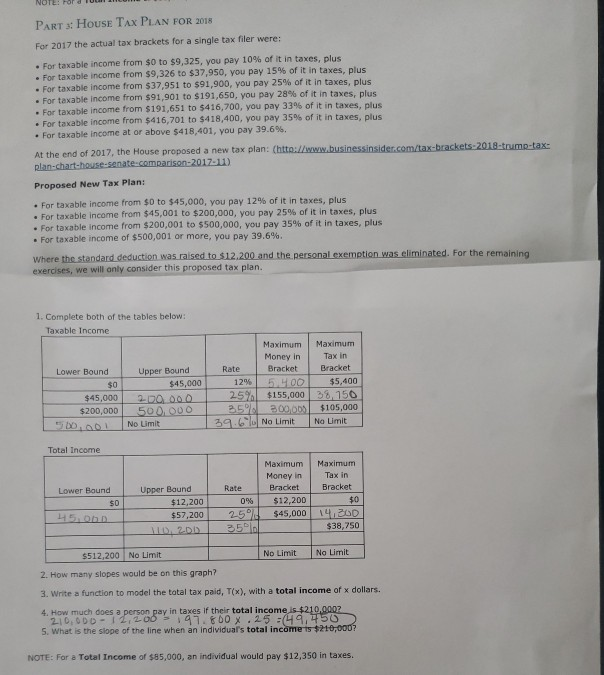

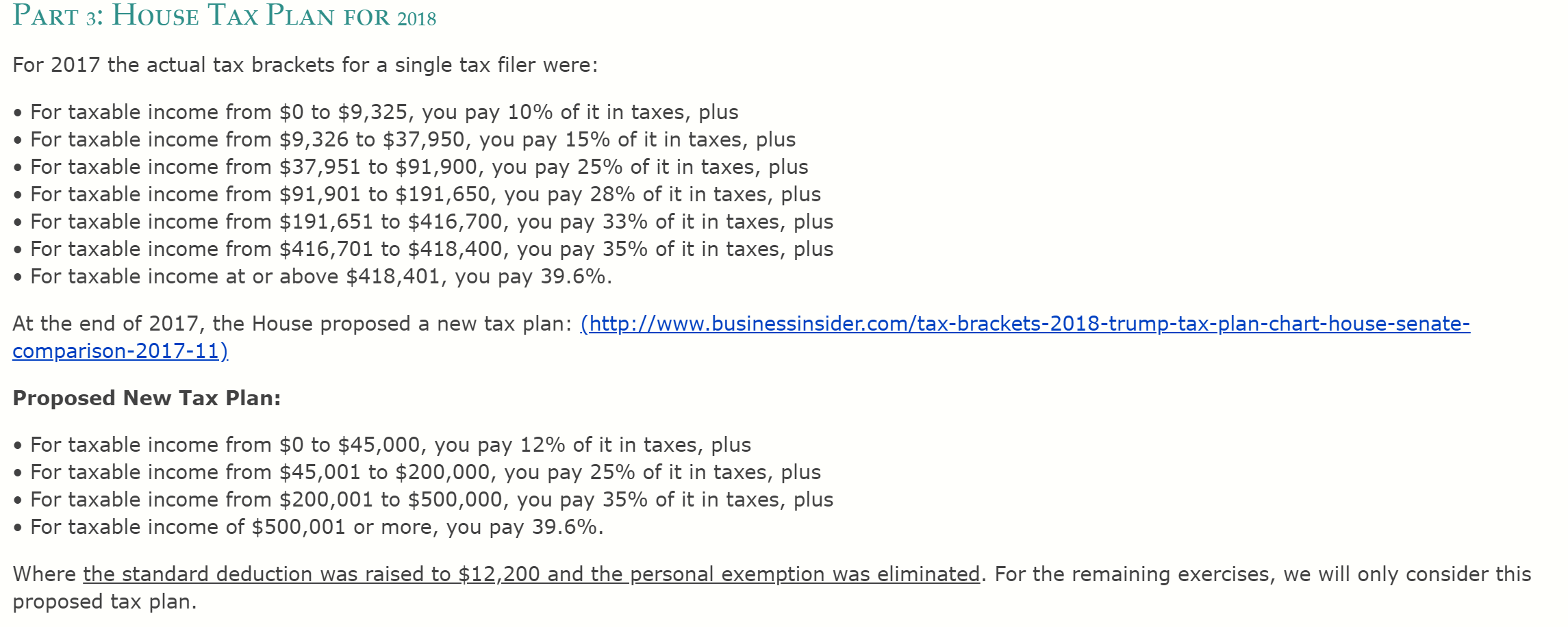

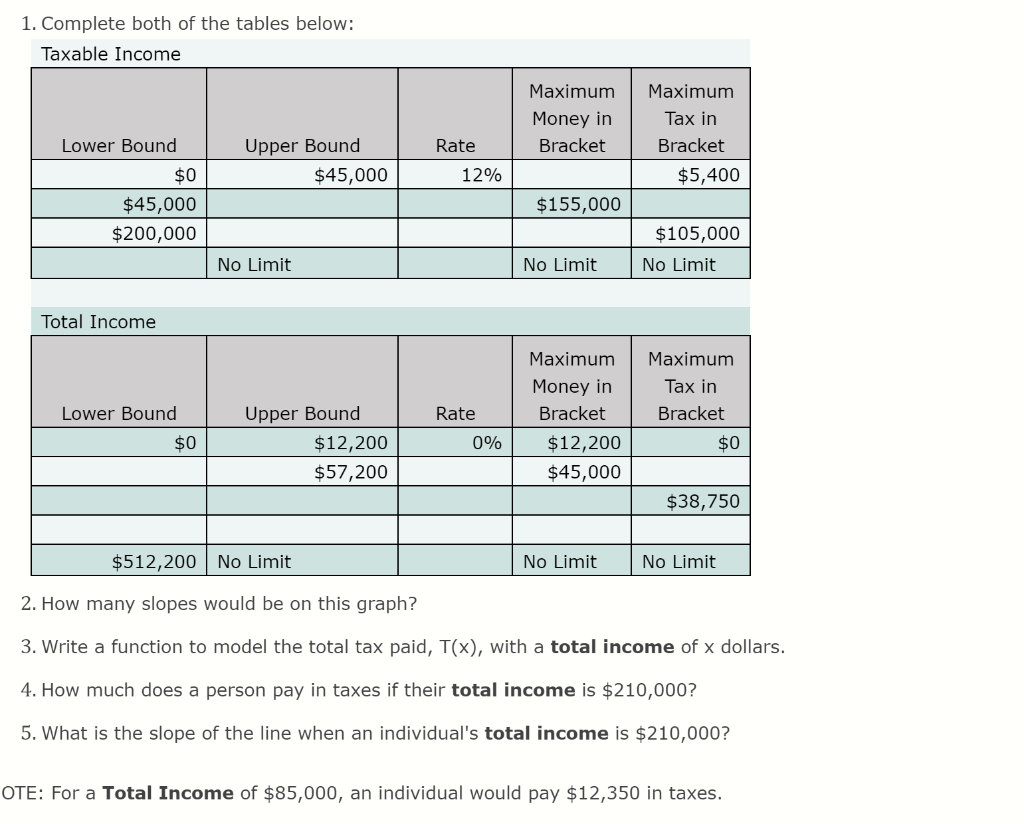

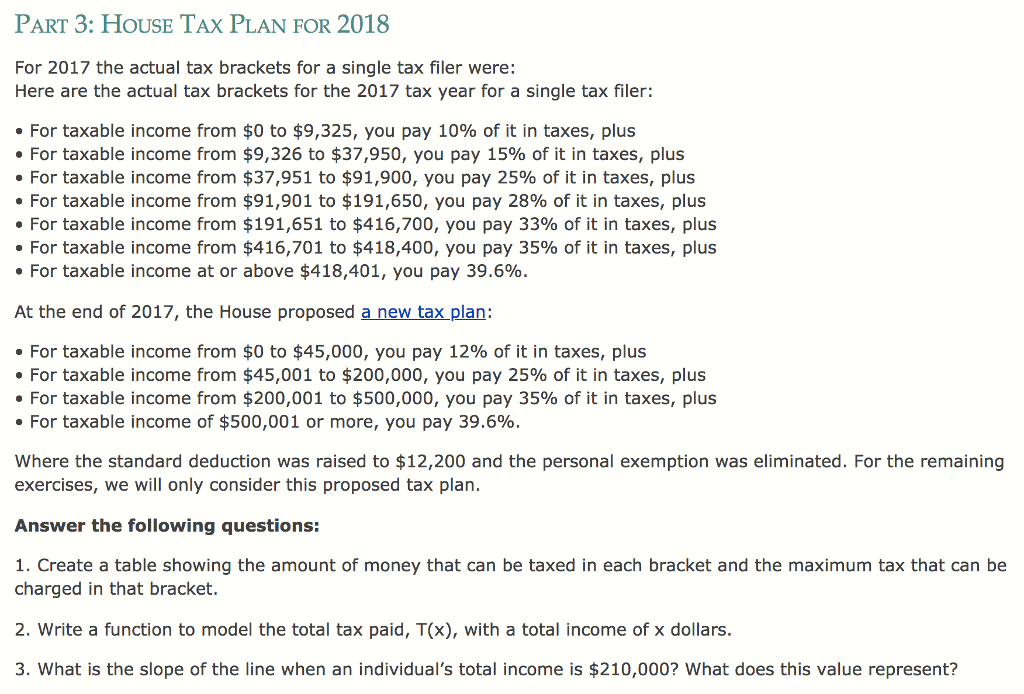

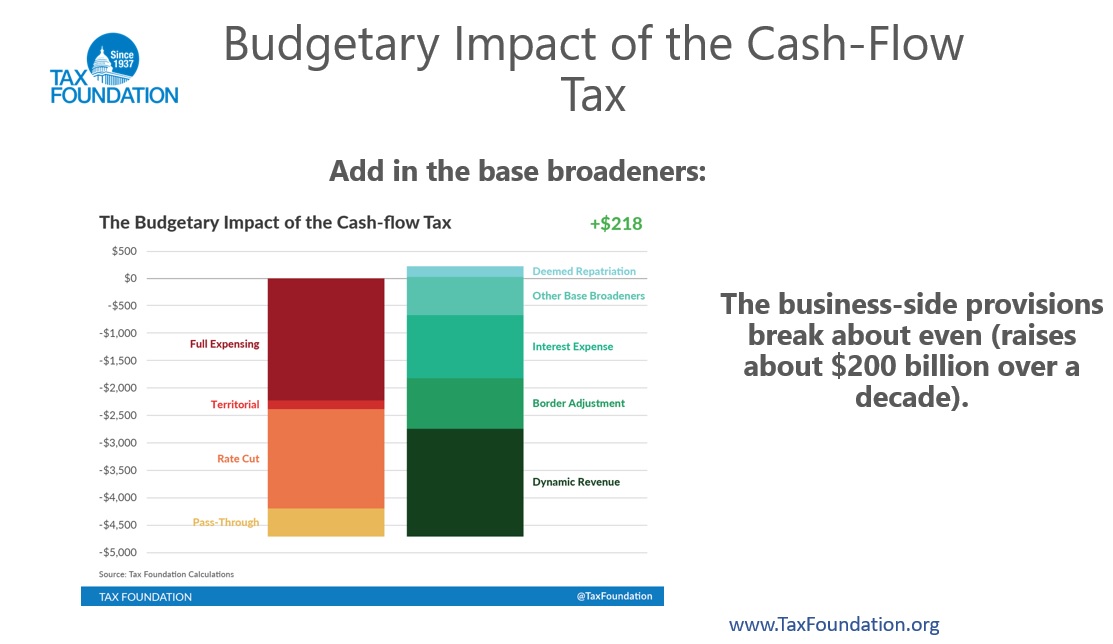

PART 3 HOUSE TAX PLAN FOR 2018 For 2017 The Actual Chegg

https://media.cheggcdn.com/study/1eb/1ebe30fe-e752-4da3-afa9-e51a44103f9a/image.png

On April 28 2021 Biden announced the American Families Plan with an estimated cost of 1 8 trillion The plan includes proposals to increase taxes for wealthy individuals including a Democrats plan to pay for 3 5 trillion spending bill House Democrats on Monday outlined a bevy of tax hikes on corporations and wealthy people to fund an investment in the social safety net

10 min White House officials released a plan Thursday that they say would raise approximately 2 trillion in new revenue over 10 years to pay for their Build Back Better spending package the 6 min A powerful panel of House Democrats on Sunday circulated a draft plan that would raise 2 9 trillion in new taxes and revenue predominantly targeted toward wealthy Americans corporations

More picture related to Tax Plan House

Solved PART 3 HOUSE Tax PLAN FOR 2018 For 2017 The Actua Chegg

https://media.cheggcdn.com/media/e52/e52819e2-ef06-4384-af0e-1959a0e2b6dc/phpx2mddc.png

House Tax Plan Build Your Own House How To Plan Floor Plans

https://i.pinimg.com/originals/dc/6b/5c/dc6b5c6859e5375739596e38918c2bce.jpg

Part 3 House Tax Plan For 2018 For Taxable Income Chegg

https://media.cheggcdn.com/media/75c/75c05999-dea7-47c8-8955-cc68c5696511/phpGcnMIS.png

House Democrats are proposing to raise the top personal income tax rate to 39 6 from 37 That higher rate would reverse a cut signed into law by Trump The committee also proposed a 3 surtax The new ideas discussed by the administration officials represent a substantial departure from the more than 2 trillion tax plan put forward by House Democrats That plan rejected the tax on

The House on Friday passed a roughly 2 trillion bill incorporating the core of President Joe Biden s economic agenda ramping up funding for the social safety net and increasing taxes on The tax plan proposes to reduce the number of brackets for personal income tax from the current seven to three with rates of 10 25 and 35 Individual tax payers will face higher or lower

House Inheritance Tax Phaseout Differs From aggressive Senate Plan LaptrinhX News

https://iowacapitaldispatch.com/wp-content/uploads/2021/03/IMG-0970-2048x1345.jpg

Here s How Biden s Tax Plan Would Affect Each U S State Video

https://s.yimg.com/os/creatr-uploaded-images/2020-10/3687d260-1a0d-11eb-96fd-134050311d7d

https://taxfoundation.org/blog/house-tax-plan-impact/

The House Build Back Better tax plan reduces economic output by reducing the after tax return to investment opportunities for firms and the incentive to work through higher tax rates on labor income About 25 percent of the plan s economic impact is due to increasing the tax burden on corporations which is the most economically costly way to

https://www.kiplinger.com/taxes/602109/build-back-better-tax-passed-in-house

Published January 20 2021 President Biden s Build Back Better social spending and tax bill is slowly working its way through Congress It was recently passed by the House of Representatives

Solved PART 3 HOUSE Tax PLAN FOR 2018 For 2017 The Actua Chegg

House Inheritance Tax Phaseout Differs From aggressive Senate Plan LaptrinhX News

Solved PART 3 HOUSE TAX PLAN FOR 2018 For 2017 The Actual Chegg

Use Tax Planner Software To Offer Tax Planning Corvee

Concerns About The Border Adjustable Tax Plan From The House GOP Part II Cato At Liberty Blog

This Tax Plan Is Going To Cost A Lot More Than Advertised

This Tax Plan Is Going To Cost A Lot More Than Advertised

What To Look For In House GOP Tax Plan Center On Budget And Policy Priorities

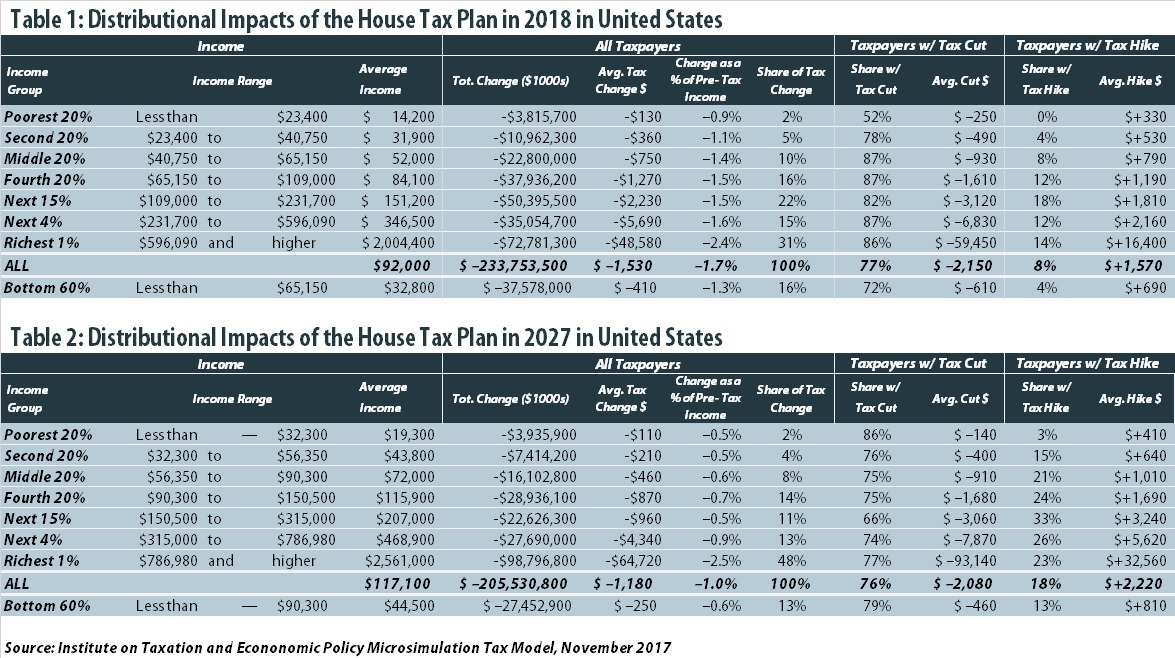

Analysis Of The House Tax Cuts And Jobs Act ITEP

How The New Tax Plan Will Ruin Your Life If You re Not Careful

Tax Plan House - Democrats plan to pay for 3 5 trillion spending bill House Democrats on Monday outlined a bevy of tax hikes on corporations and wealthy people to fund an investment in the social safety net