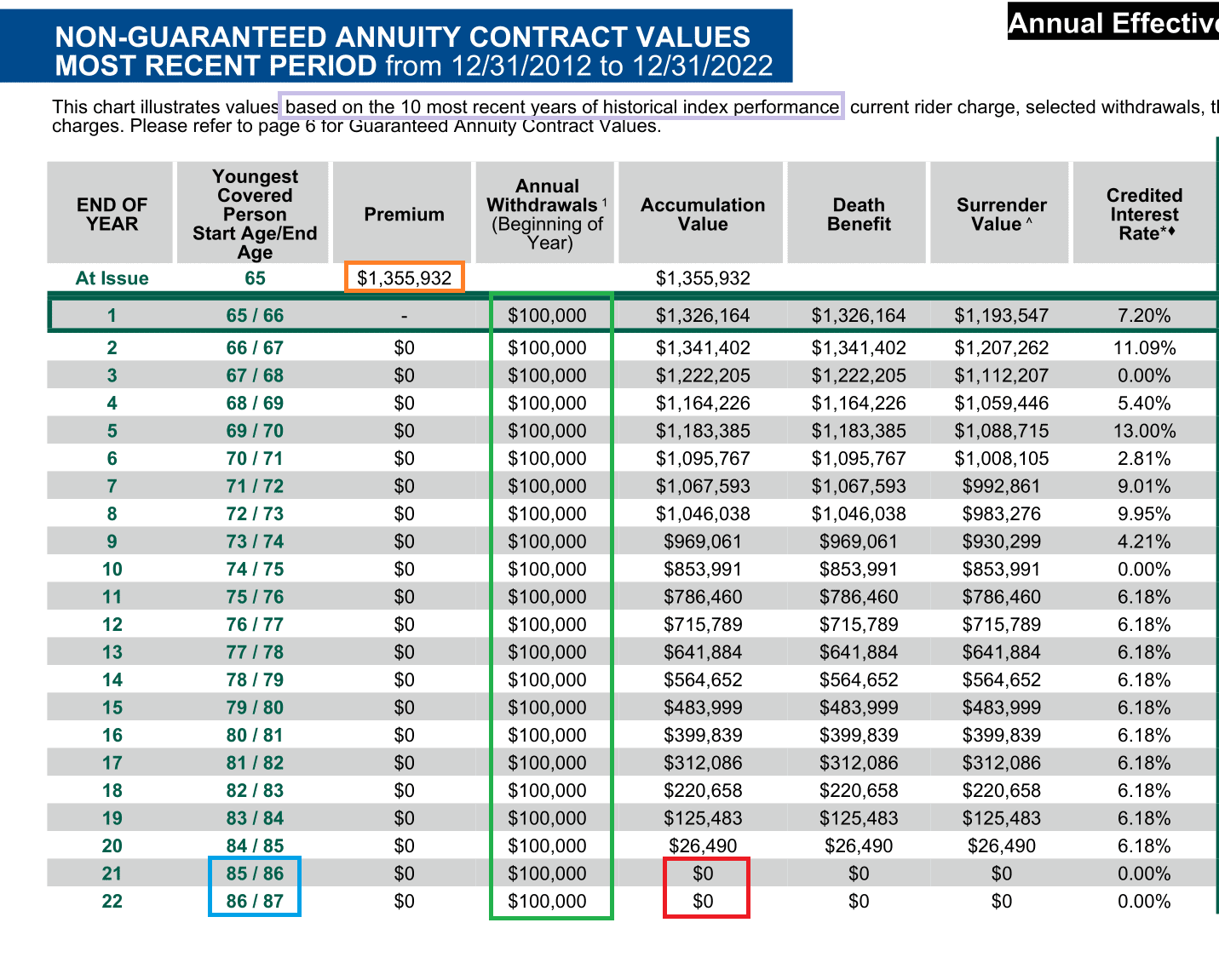

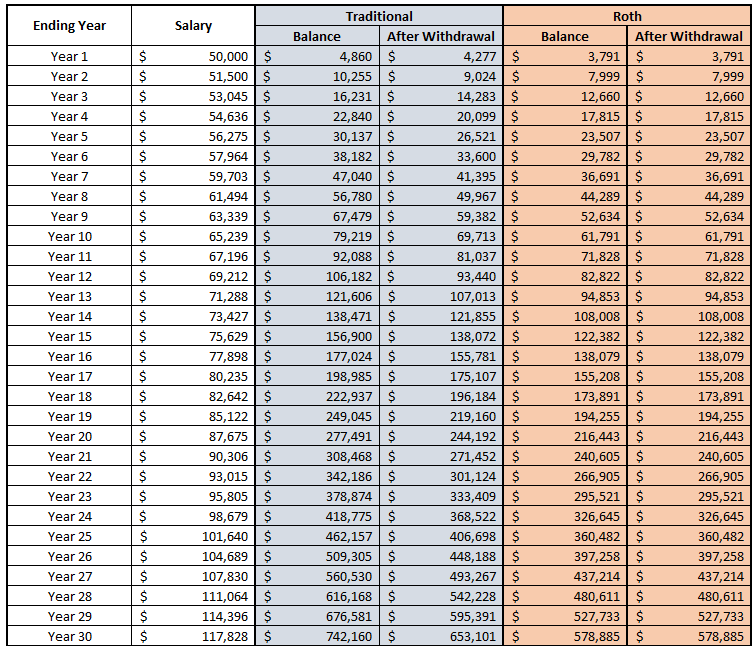

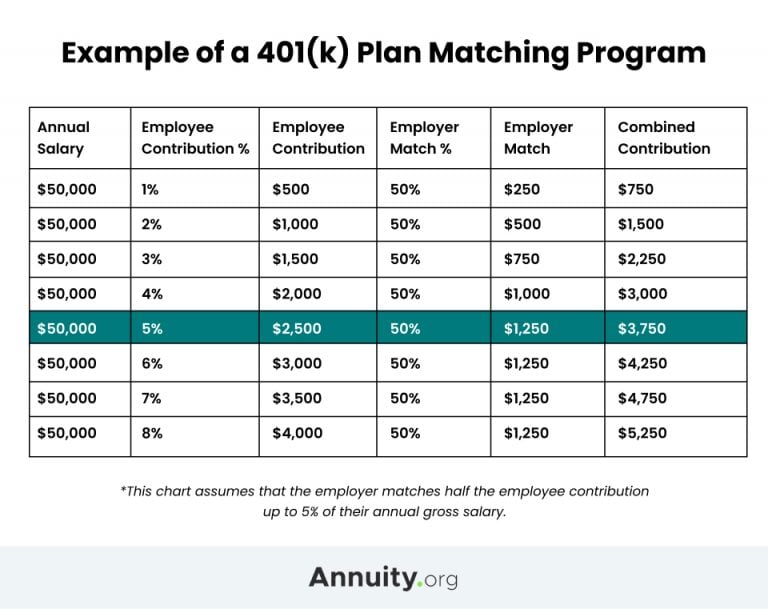

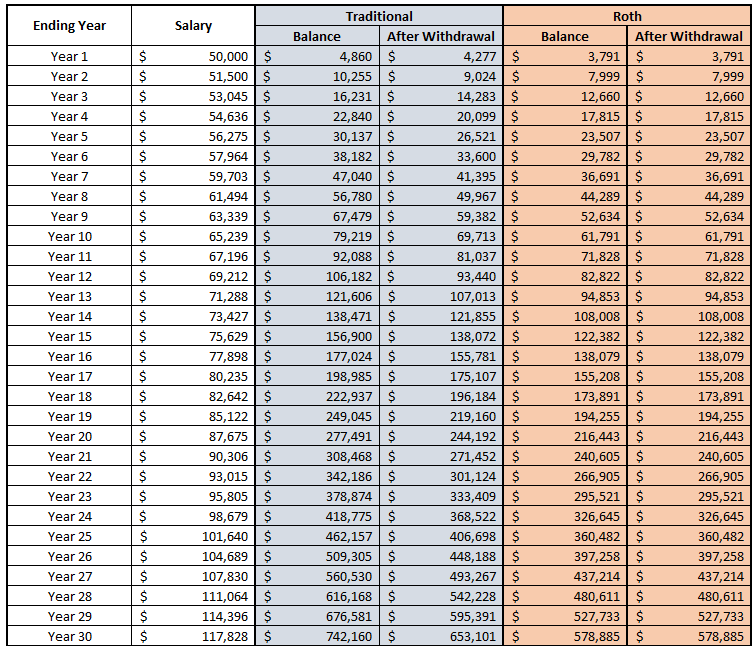

Taxes On 401k Withdrawal At Age 65 Traditional 401 k withdrawals are taxed at the account owner s current income tax rate Roth 401 k withdrawals generally aren t taxable provided the account was opened at least five

Since you don t pay taxes on your contributions or your employer s contributions if you get a match your withdrawals will be taxed at your ordinary income tax rate in retirement You ll also have to pay taxes on At what age can you withdraw from 401k without paying taxes The Rule of 55 is an IRS provision that allows you to withdraw funds from your 401 k or 403 b without a penalty at

Taxes On 401k Withdrawal At Age 65

Taxes On 401k Withdrawal At Age 65

https://www.annuity.org/wp-content/uploads/401k-employer-matching-768x609.jpg

Rmd Worksheets

https://www.merriman.com/wp-content/uploads/ULT.jpg

7 Early Retirement Withdrawal Calculator SumayyahMillan

https://www.annuityexpertadvice.com/wp-content/uploads/IRA-withdrawal-Calculator.png

You can choose to have your 401 k plan transfer a distribution directly to another eligible plan or to an IRA Under this option no taxes are withheld If you are under age 59 at the time of When you retire taxes will come due on any money you take out of your traditional 401 k account since it was put in pre tax Here s what you need to know

Contributing to a traditional 401 k could help reduce your taxable income now but in most cases you ll pay taxes when you withdraw the money in retirement What s the tax rate on a 401 k after age 65 There is no distinct tax rate for 401 k withdrawals after age 65 The tax rate continues to be based on the individual s overall income and tax bracket at the time of withdrawal

More picture related to Taxes On 401k Withdrawal At Age 65

Rmd Table For 2024 Distributions 2024 Joyan Julietta

https://ssd2.s3.amazonaws.com/tmp/2018-08-02/1533216001454-image.png

Irs 401k Contribution Limits 2025 Mario Roy

https://www.annuity.org/wp-content/uploads/401k-employer-matching-768x609.jpg

25 Roth Conversion Calculators MaxySachairi

https://m.foolcdn.com/media/dubs/images/roth-401k-withdrawal-rules-infographic.width-880.png

Once you start withdrawing from your traditional 401 k your withdrawals are usually taxed as ordinary taxable income That said you ll report the taxable part of your distribution directly on your Form 1040 for any tax year that you make Withdrawals from traditional IRAs and 401 k accounts are taxable and can increase your taxable income If your withdrawal pushes you into a higher income bracket you ll pay a higher tax rate

Income tax You may owe federal and state income tax when using money from pre tax retirement accounts or withdrawing earnings from after tax accounts Penalty tax You could owe When you make a withdrawal from a 401 k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made For example if you fall in the 12 tax

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

https://einvestingforbeginners.com/wp-content/uploads/2021/03/word-image-32.png

Irs 401k Required Minimum Distribution Table Brokeasshome

https://i2.wp.com/www.merriman.com/wp-content/uploads/ULT.jpg?resize=618%2C382

https://www.investopedia.com › articles › personal-finance

Traditional 401 k withdrawals are taxed at the account owner s current income tax rate Roth 401 k withdrawals generally aren t taxable provided the account was opened at least five

https://www.northwesternmutual.com › ...

Since you don t pay taxes on your contributions or your employer s contributions if you get a match your withdrawals will be taxed at your ordinary income tax rate in retirement You ll also have to pay taxes on

401k Limits 2024 Employer Match Delila Rochette

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

401k Withdrawal Rules 2024 Lexie Opalina

Free 401k Calculator For Excel Calculate Your 401k Savings

Irs Maximum 401k Contribution 2025 Barbara D Mendez

401 K Limits 2025 Over 50 William S Bell

401 K Limits 2025 Over 50 William S Bell

401k Contribution Limits 2025 Employer Lachlan T Bindon

Retirement Age In Illinois 2024 Kimmi Merline

2025 Individual 401k Contribution Limits Hiro Dehaan

Taxes On 401k Withdrawal At Age 65 - Withdrawals from a 401 k before age 59 1 2 can incur a 10 penalty plus income tax Qualified distributions from a 401 k are tax advantaged after age 59 1 2 and