What Do You Do With A Simple Ira SIMPLE IRA plans can provide a significant source of income at retirement by allowing employers and employees to set aside money in retirement accounts SIMPLE IRA plans do not have the

How do I establish a SIMPLE IRA plan You must complete three basic steps to set up a SIMPLE IRA plan Form 5304 SIMPLE PDF if you permit each employee to choose the financial How does a SIMPLE IRA work SIMPLE IRAs offer employees the tax benefits of a 401 K with the convenience of a personal IRA Each year employees can choose how much of their

What Do You Do With A Simple Ira

What Do You Do With A Simple Ira

https://www.marinerwealthadvisors.com/wp-content/uploads/2019/11/401k-Advantages-Over-SEP-and-Simple-IRAs-1024x533.png

Ira Withdrawal Tax Calculator 2025 Mark Russell

https://www.pdffiller.com/preview/395/43/395043331/large.png

2025 401k Max Contribution Limit Aurora Cooper

https://www.investors.com/wp-content/uploads/2019/12/wFAP-contribution-122719.jpg

Depending on your employer and personal circumstances you may need to wait before using or transferring the funds in your Simple IRA If you part ways with your employer and you re wondering what to do with your SIMPLE IRA you have a few options You can leave it where it is at its current financial institution

One of the main benefits of a SIMPLE IRA is that it is easy for small business owners to set up and maintain Unlike a 401 k plan which can be complex and costly to administer a SIMPLE IRA can be established by In this article we ll break down everything you need to know about withdrawing from a SIMPLE IRA including what rules fees and penalties

More picture related to What Do You Do With A Simple Ira

Roth Contribution Limits 2025 Single Hinda Maegan

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-12-2022-Roth-IRA-Income-Limits-1536x1536.png

2024 Roth Ira Contribution Amounts 2024 Ailyn Giuditta

https://www.carboncollective.co/hs-fs/hubfs/2021_and_2022_Roth_IRA_Income_Limits.png?width=3372&name=2021_and_2022_Roth_IRA_Income_Limits.png

2024 Roth Contribution Limits 2024 Over 50 Max Corrianne

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-12-2022-Roth-IRA-Income-Limits.png

Key Takeaways Employees must wait two years from the time they open a SIMPLE IRA account before transferring those funds into another retirement plan If you withdraw money from a SIMPLE IRA during the two How Does a SIMPLE IRA Work A SIMPLE IRA also known as a Savings Incentive Match Plan for Employees is ideal for small business owners because it lacks the reporting requirements and

A SIMPLE IRA is an employer sponsored retirement plan designed specifically for small businesses SIMPLE IRAs give employees and employers a simple tax deferred way to save for retirement Learn more from The Hartford about what A SIMPLE IRA is a retirement plan for small businesses with no more than 100 employees It allows small employers to contribute to their own and their employee s

What Is The 401k Limit For 2025 Sami Omar

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-07-2022-401k-IRA-Limits-1536x1536.png

Understanding A SIMPLE IRA For Retirement Planning

https://www.westernsouthern.com/-/media/simple-ira-definition-sm.png?rev=9b9652b16daf42b598a85f69f8e288cd&hash=ECD0221C089C6A3249CBD16F386FA712E4FF9678

https://www.irs.gov › retirement-plans › plan-sponsor › simple-ira-plan

SIMPLE IRA plans can provide a significant source of income at retirement by allowing employers and employees to set aside money in retirement accounts SIMPLE IRA plans do not have the

https://www.irs.gov › retirement-plans › retirement...

How do I establish a SIMPLE IRA plan You must complete three basic steps to set up a SIMPLE IRA plan Form 5304 SIMPLE PDF if you permit each employee to choose the financial

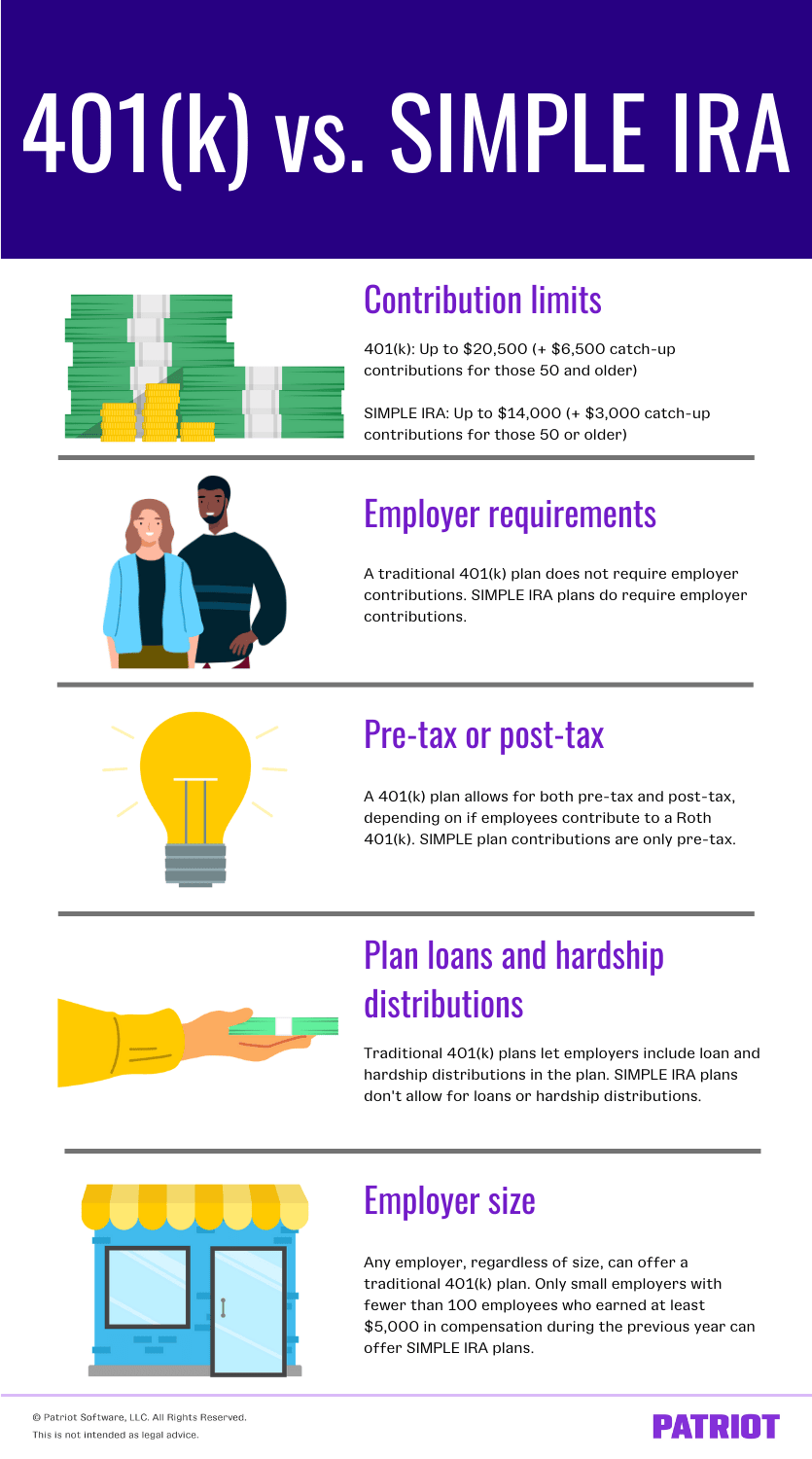

401 k Vs Simple IRA What s The Difference Finansdirekt24 se

What Is The 401k Limit For 2025 Sami Omar

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

What Do You Do With A Simple Ira - One of the main benefits of a SIMPLE IRA is that it is easy for small business owners to set up and maintain Unlike a 401 k plan which can be complex and costly to administer a SIMPLE IRA can be established by