What Happens If You Pay Someone S Delinquent Property Taxes The short answer is not directly simply paying someone s property taxes does not bestow ownership upon the payer However if property taxes remain unpaid counties may issue a tax lien certificate to investors after a certain period

The straightforward answer to whether paying someone else s property taxes gives you ownership of their property is no Ownership of Unpaid property taxes can lead to tax delinquency triggering interest penalties and potentially foreclosure If taxes remain unpaid local governments may place a lien on the property allowing them to sell it to recover the debt

What Happens If You Pay Someone S Delinquent Property Taxes

What Happens If You Pay Someone S Delinquent Property Taxes

https://wp-assets.stessa.com/wp-content/uploads/2022/09/19122717/late_rent_notice_letter_tempalte.png

Orrery nim On Twitter Amusing Things On The Side About All This

https://pbs.twimg.com/media/Fip4usaWYAAxOno.png

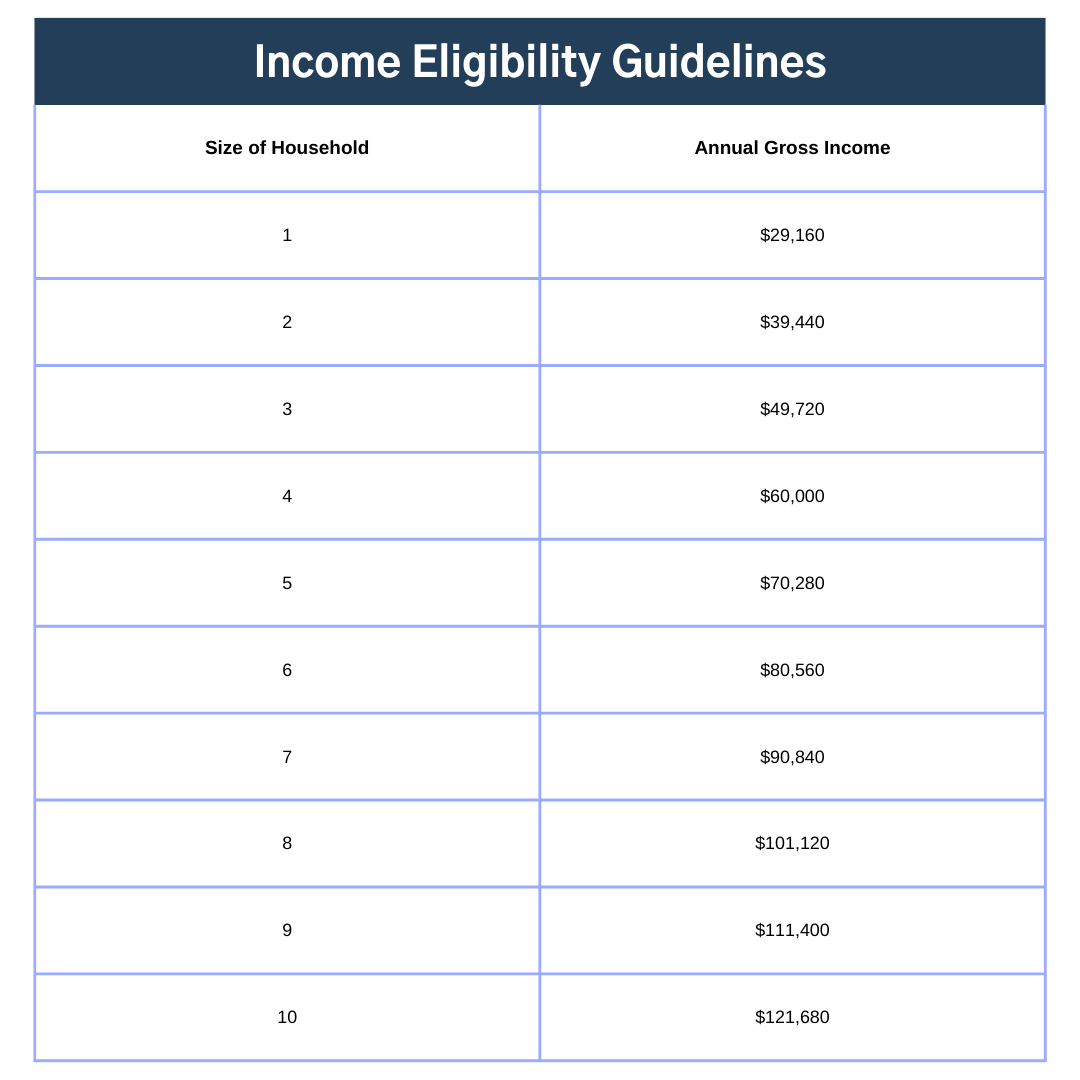

Help Available For Summit County Homeowners With Delinquent Property

https://www.ca-akron.org/sites/default/files/editor/Income Eligibility Guidelines-2023.png

In short getting the deed isn t an automatic result of paying someone s property taxes Important note If you have case specific questions speak to a real estate lawyer with on point experience When someone else pays your property taxes it doesn t change ownership but may create a tax lien leading to possible sale if unpaid It offers temporary financial relief however involves risks including potential loss of

You cannot simply volunteer to pay property taxes and then hope to take over the property However in many states there is a way to obtain ownership of property by paying delinquent property taxes If you decide to pay someone else s property taxes in Florida you will become the legal owner of the tax lien This could be a good investment if the homeowner pays you back the amount of the lien plus interest or if you are

More picture related to What Happens If You Pay Someone S Delinquent Property Taxes

Notice Of Delinquency Los Angeles County Property Tax Portal

http://www.propertytax.lacounty.gov/images/Tax-Bills/nod2016.gif

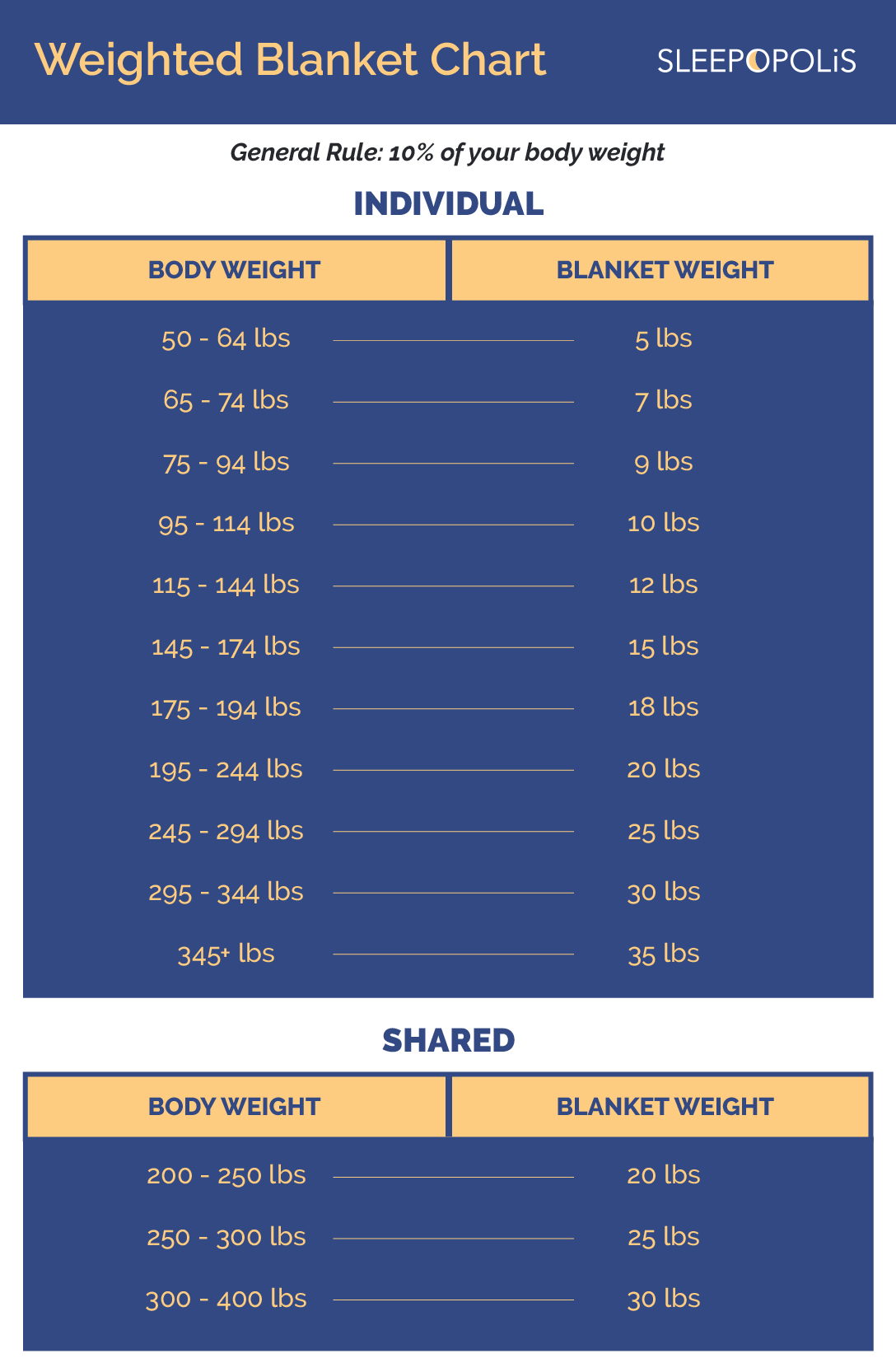

What Happens If You Get A Weighted Blanket Too Heavy Online Www

https://sleepopolis.com/wp-content/uploads/2023/02/Weighted-Blanket-Weight-Chart.png

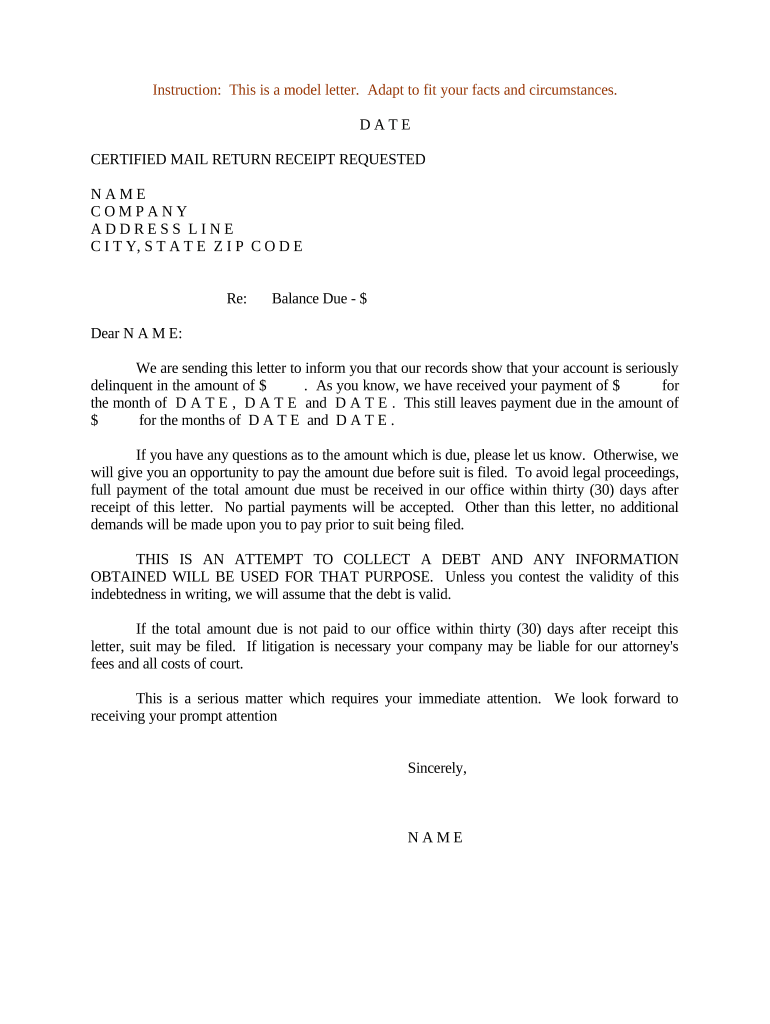

Free 15 Day Demand Letter For Payment PDF Word EForms

https://eforms.com/images/2018/04/15-Day-Demand-Letter-for-Payment.png

You would be extending the estate s ownership as a tax sale would put the property back on the market if the estate failed to pay the taxes It does not mean you will have a claim to the property until you take other actions for the required period of time Unintended Payment If you accidentally pay someone else s non delinquent property taxes there s a chance you can get a refund Contacting the Tax Collector Reach out to the tax collector s office as soon as possible to explain the situation

Under California law paying someone s property taxes does not automatically grant ownership of the property In California paying someone else s taxes even if done in good faith is considered a gesture of goodwill or North Carolina does not allow the purchase of a property by tax certificate or purchase of a tax obligation The only way to obtain a property under delinquent tax is to await the tax foreclosure sale

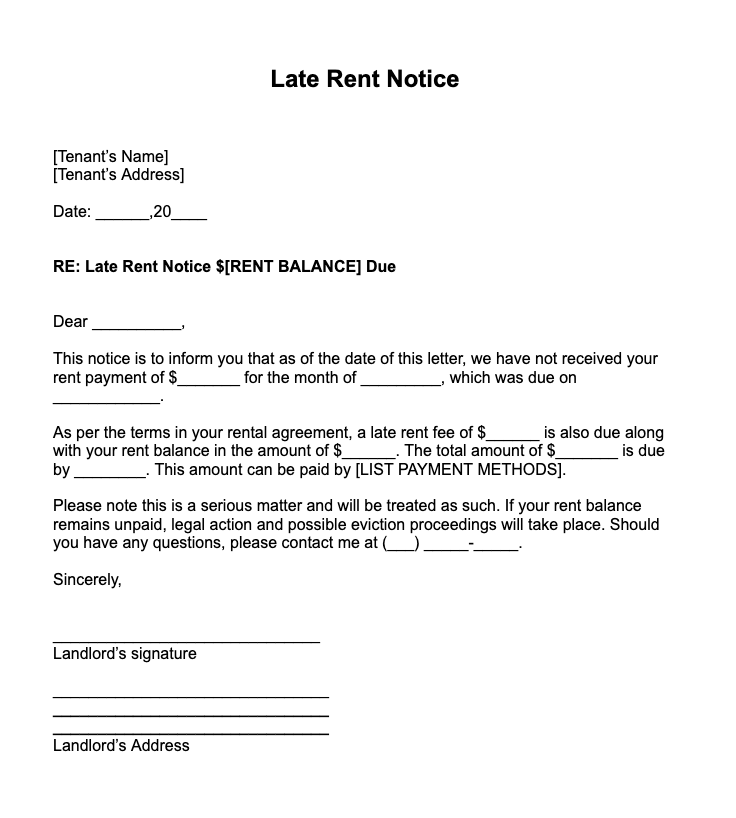

Rent Payment Letter Template Format Sample Examples

https://bestlettertemplate.com/wp-content/uploads/2020/07/Letter-Requesting-Rent-Payment-1086x1536.png

Delinquent Property Taxes Lafourche Parish Sheriff s Office

https://www.lpso.net/wp-content/uploads/2020/01/delinquent-property-taxes.jpg

https://taxexpertshub.com › blog › what-ha…

The short answer is not directly simply paying someone s property taxes does not bestow ownership upon the payer However if property taxes remain unpaid counties may issue a tax lien certificate to investors after a certain period

https://www.propertyleads.com › if-you-pa…

The straightforward answer to whether paying someone else s property taxes gives you ownership of their property is no Ownership of

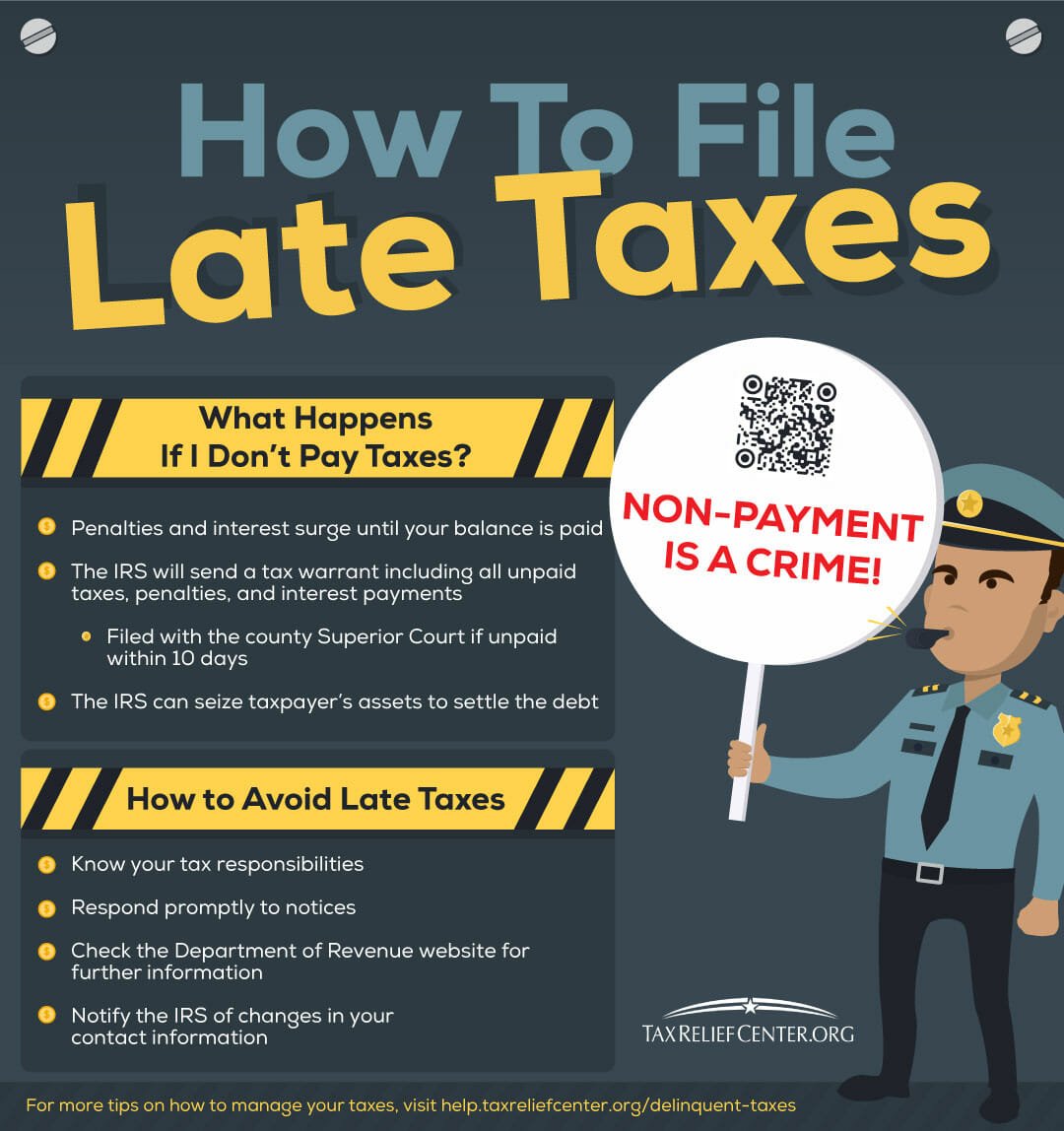

Delinquent Taxes INFOGRAPHIC How To Pay Off Or File Late Taxes

Rent Payment Letter Template Format Sample Examples

Delinquent Notice Template Prntbl concejomunicipaldechinu gov co

Delinquency Notice Template Prntbl concejomunicipaldechinu gov co

What Happens If You Don t Pay Property Taxes In Texas

Muskogee County Delinquent Tax Sale 2025 Carl Morgan

Muskogee County Delinquent Tax Sale 2025 Carl Morgan

NEMRC Tax Administration Reports Delinquent Tax Notices

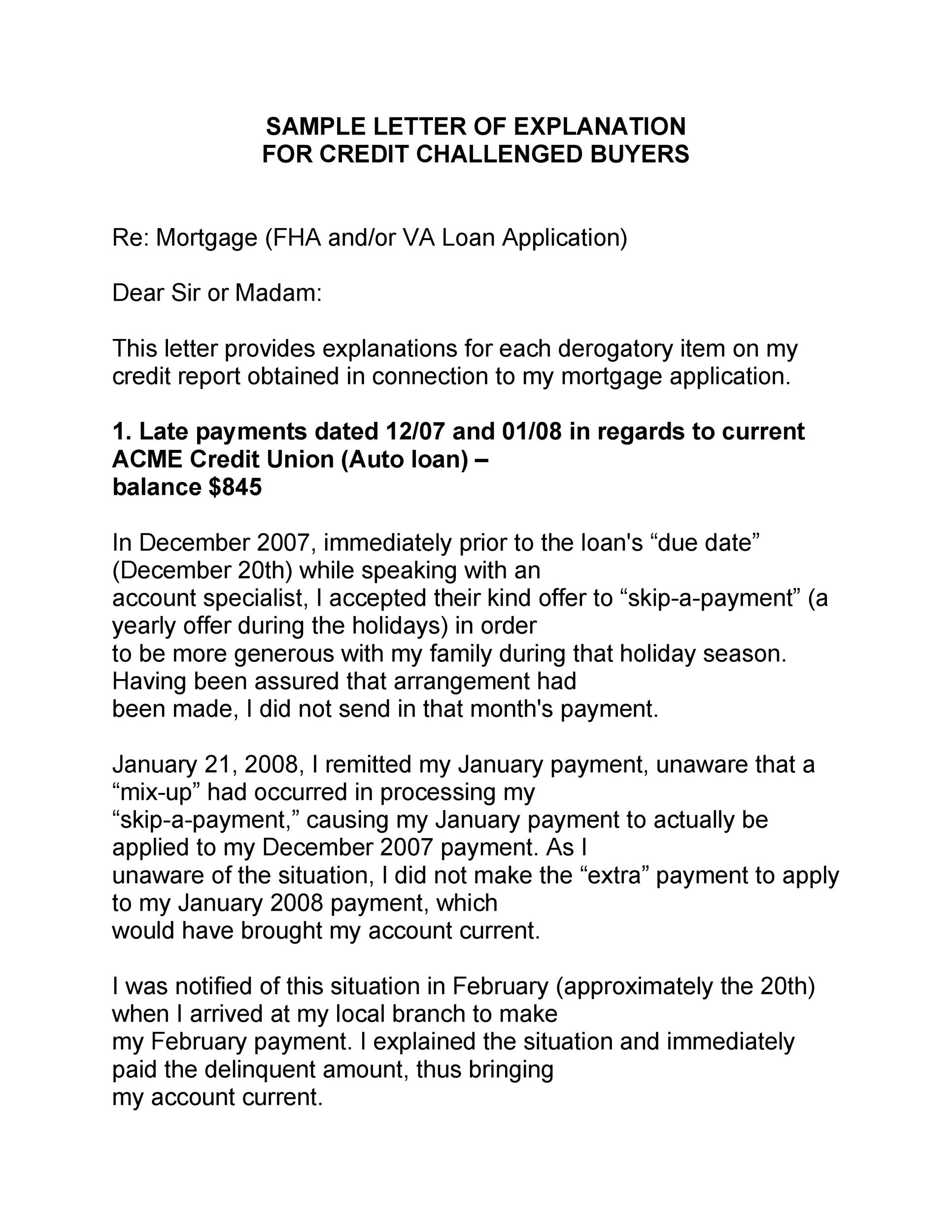

Template Letter Of Explanation 48 Letters Of Explanation Tem

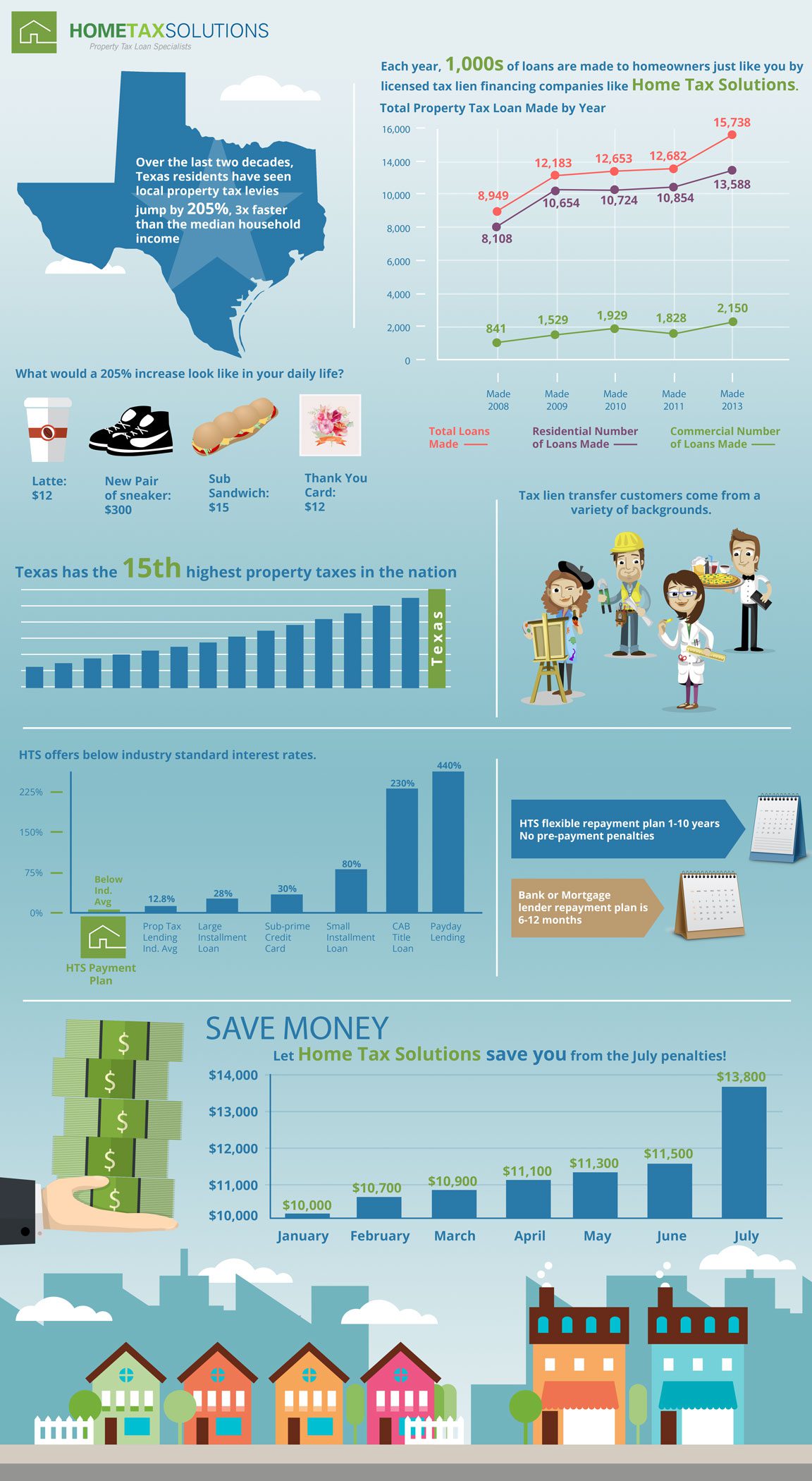

Understanding Delinquent Property Taxes Home Tax Solutions

What Happens If You Pay Someone S Delinquent Property Taxes - When someone else pays your property taxes it doesn t change ownership but may create a tax lien leading to possible sale if unpaid It offers temporary financial relief however involves risks including potential loss of