What Is 7 Year Property Want to know what falls under the 5 to 7 year depreciation asset class How about assets with a useful life of less than 20 years Find out here

MACRS is an acronym for Modified Accelerated Cost Recovery System Under MACRS fixed assets are assigned to a specific asset class which has a designated From IRS Publication 946 Table A 1 Other tables are available for options different from those shown below The 3 5 7 and 10 year classes use 200 and the 15 and 20 year classes use 150 declining balance depreciation All classes convert to straight line depreciation in the optimal year shown with an asterisk

What Is 7 Year Property

What Is 7 Year Property

https://www.housingonline.com/wp-content/uploads/2018/04/Tiberio-Armand-e1523391728521.jpg

Nancy Pearce 2019 NH RA

https://www.housingonline.com/wp-content/uploads/2019/09/Nancy-Pearce-2019-scaled.jpg

Boatman Patterson Tia NH RA

https://www.housingonline.com/wp-content/uploads/2018/04/Boatman-Patterson-Tia.jpg

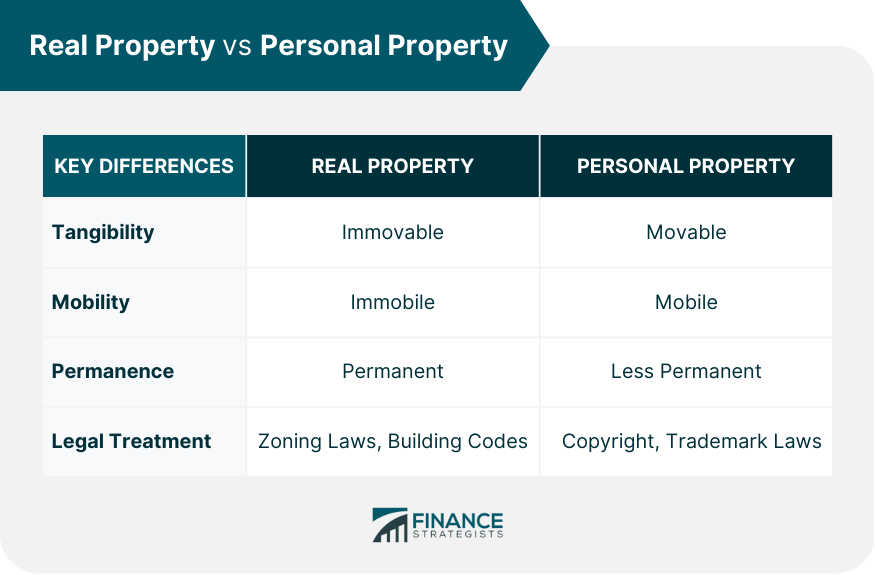

One of the primary distinctions between 5 year and 7 year property lies in the duration of depreciation Assets categorized as 5 year property like autos and trucks can be depreciated The 7 Year Boundary Rule is a legal principle that states that if a property owner has been using a piece of land as their own for at least 7 years they may be entitled to claim

11 rowsFind current rates in the continental United States CONUS Rates Depreciable assets except for buildings fall within a three year five year seven year 10 While the table seems complicated most assets are either five year or seven year property Generally MACRS depreciation is calculated assuming that all assets are placed in service during the middle of the year

More picture related to What Is 7 Year Property

Method Table

https://www.calt.iastate.edu/system/files/images-premium-article/macrs_.png

Forgiveness Seed Of Memory Art

https://seedofmemoryart.co.uk/wp-content/uploads/2023/09/IMG_7403.jpg

Single Wall Paper Cup Food Beverage Coffee Chocolate Customizable

https://gallopack.com/wp-content/uploads/2022/07/single-wall-7.png

Class life is the number of years over which an asset can be depreciated The tax law has defined a specific class life for each type of asset Real Property is 39 year property office furniture is The 7 year boundary rule implies that someone who acquires land from an adverse possessor who has possessed the land adversely for seven years has to own the land for another five years to claim the title In simpler terms an

Property that is an integral part of the gathering treatment or commercial distribution of water and that without regard to this provision would be 20 year property Municipal sewers other than property placed in service under a Under the GDS office furniture qualifies as 7 year property with a recovery period of seven years Since furniture is personal property as opposed to real property and it

Liz Johnston Latest News In Touch Weekly

https://www.intouchweekly.com/wp-content/uploads/2024/01/liz-johnston-work.jpg?resize=1200%2C1200&quality=86&strip=all

Macrs Depreciation Table Cabinets Matttroy

https://www.irs.gov/pub/xml_bc/13081f29.gif

https://ericsheldoncpa.com

Want to know what falls under the 5 to 7 year depreciation asset class How about assets with a useful life of less than 20 years Find out here

https://www.accountingtools.com › articles › what-is...

MACRS is an acronym for Modified Accelerated Cost Recovery System Under MACRS fixed assets are assigned to a specific asset class which has a designated

7 Layer Salad Spend With Pennies

Liz Johnston Latest News In Touch Weekly

Susie And Elizabeth Collab

THE 7 10 OIL SALE GOOD Cannabis

Personal Property

Contrata Beatriz Mur Para Tu Conferencia O Evento

Contrata Beatriz Mur Para Tu Conferencia O Evento

Co Sleeper Bassinet One Stop Baby Products Manufacturer In China KSF

7 Hydroxy Kratom Gummies Alt Distro

Identify The Property Math

What Is 7 Year Property - With this handy calculator you can calculate the depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS