What Is A Sep Ira Retirement Plan A SEP IRA is a traditional IRA that holds contributions made by an employer under a SEP plan You can both receive employer contributions to a SEP IRA and make regular annual

SEP IRAs are defined contribution retirement plans that let small business owners and their employees save for retirement A SEP IRA is a retirement plan option for small business owners and qualified employees It has higher contribution and income limits than other retirement plans

What Is A Sep Ira Retirement Plan

What Is A Sep Ira Retirement Plan

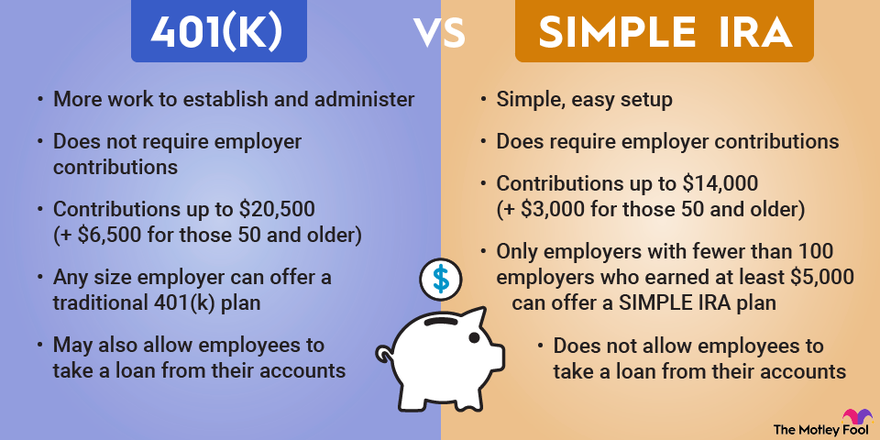

https://m.foolcdn.com/media/dubs/images/401k-vs-SIMPLE-IRA-retirement-plans-infographi.width-880.png

SEP IRA SEP Retirement Plan

https://bcmadvisors.com/wp-content/uploads/2021/06/sep-ira.jpg

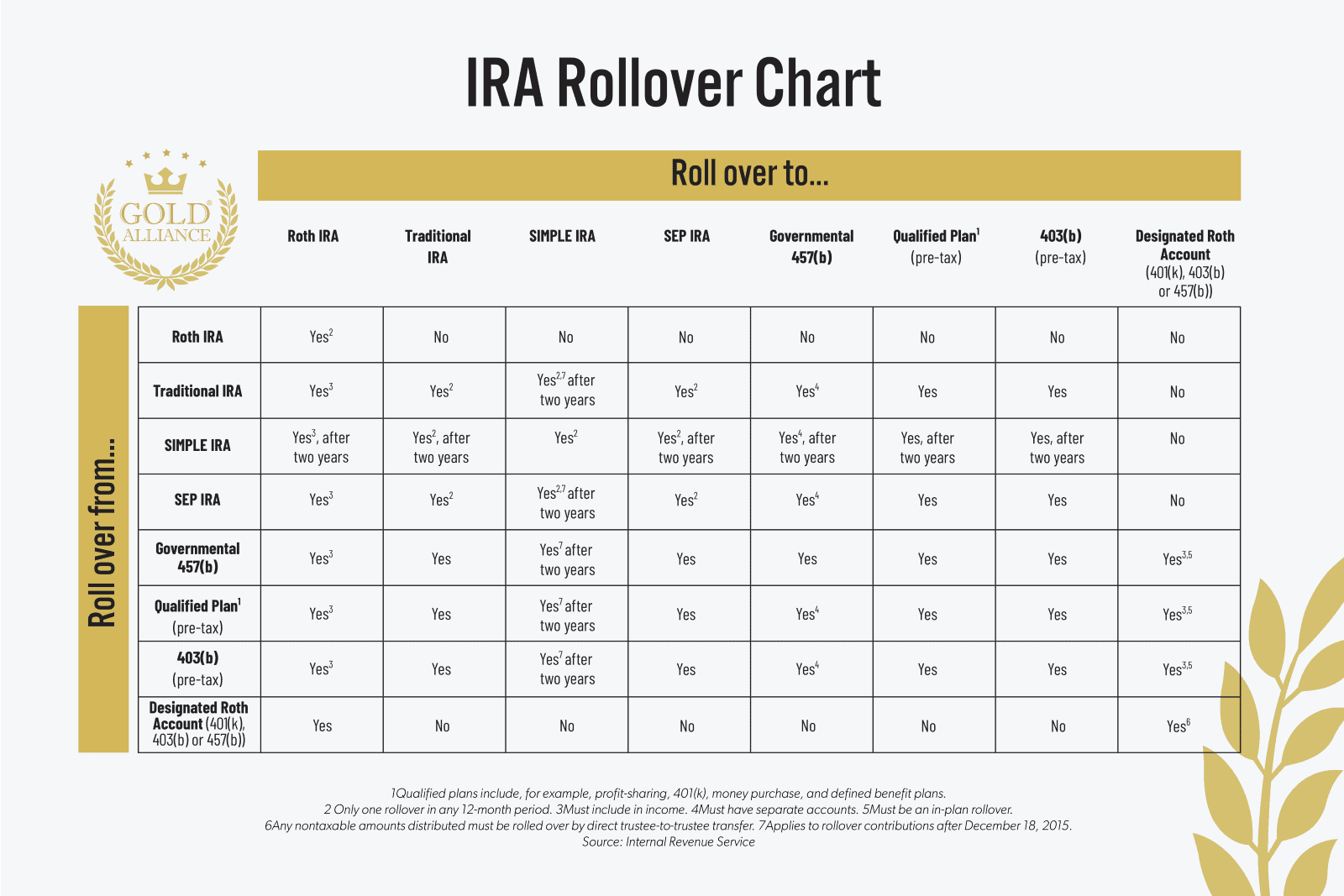

Ira Rollover Rules Choosing Your Gold IRA

https://goldalliance.com/wp-content/uploads/2022/03/image.png

A SEP IRA is a tax deferred account that lets you as the employer contribute up to 25 of compensation for employees with a maximum of 69 000 for 2024 Learn how SEP A simplified employee pension SEP IRA is a retirement savings plan established by employers for the benefit of their employees and themselves It can also be established by

What is a SEP IRA And how does it work A SEP IRA is a tax advantaged account that allows small business owners to save for their own and their employees retirements When you fund a SEP This helpful guide answers key questions about simplified employee pension SEP IRAs including the benefits of SEP IRA plans for small business owners

More picture related to What Is A Sep Ira Retirement Plan

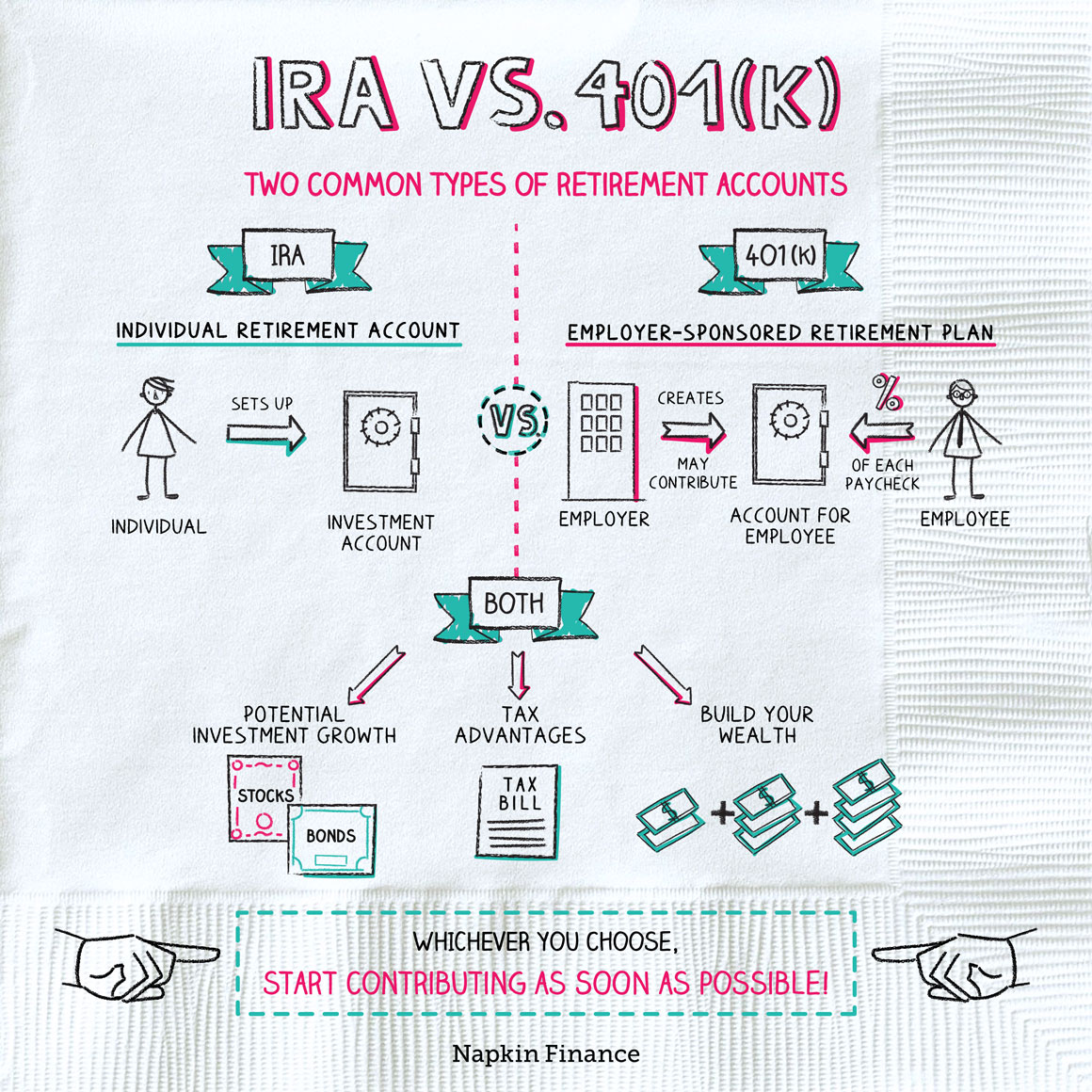

What Is 401K IRA Vs 401K Retirement Answers From Napkin Finance

https://napkinfinance.com/wp-content/uploads/2019/01/NapkinFinance-IRAvs401k-Napkin-08-16-20-v06.jpg

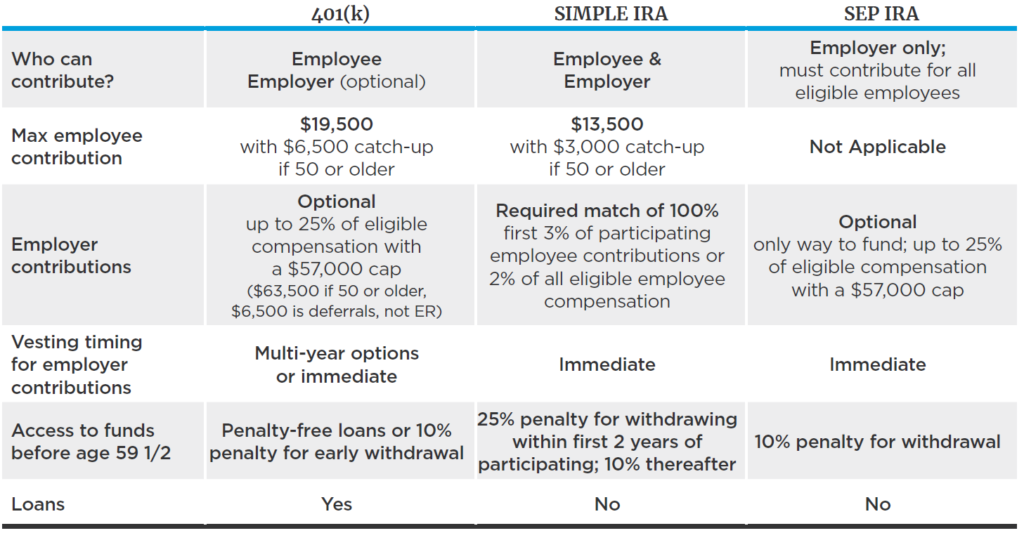

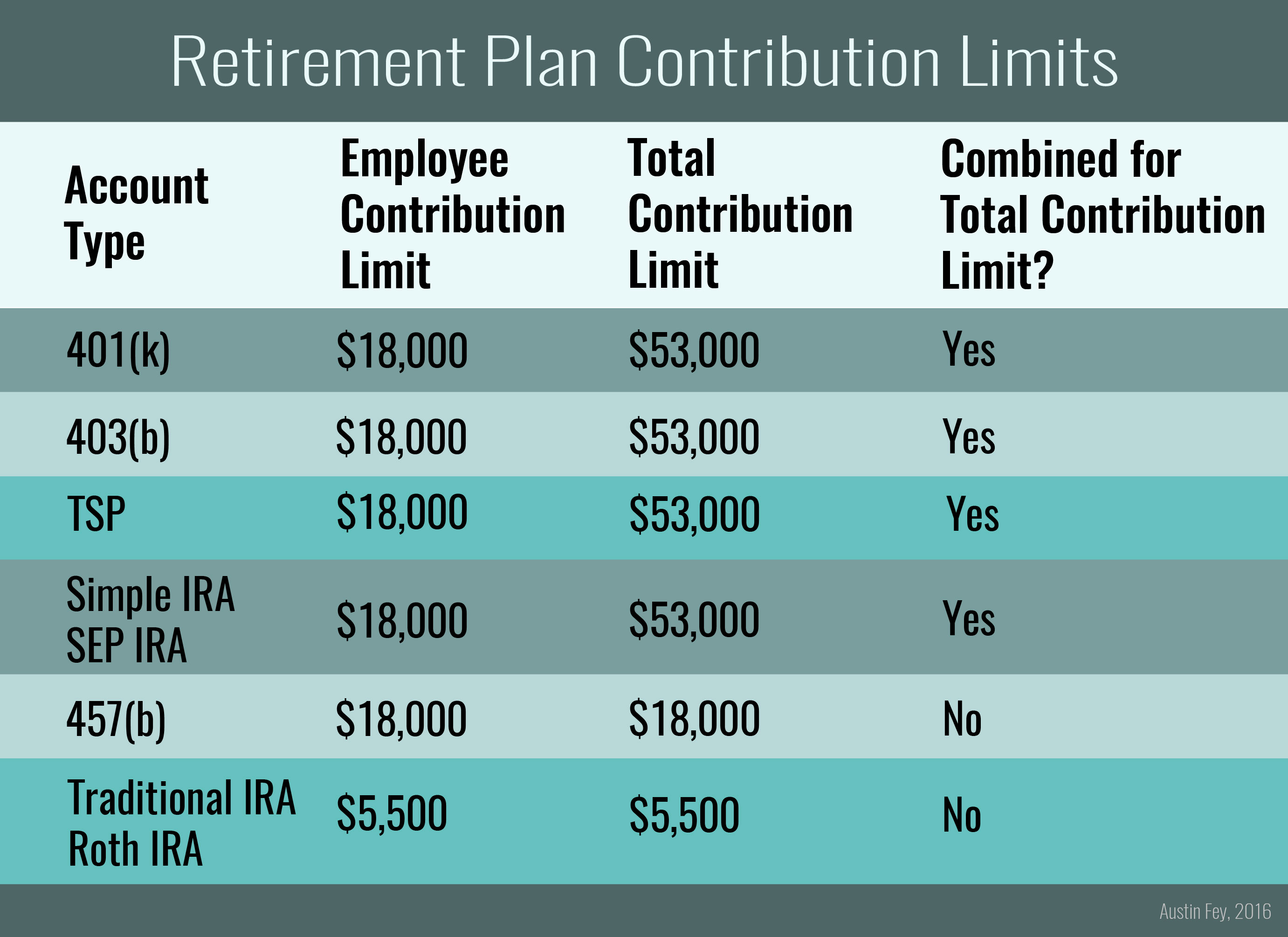

Retirement Comparison Chart

https://www.moneylend.net/wp-content/uploads/retirement_compare.jpg

Pin On Personal Finance

https://i.pinimg.com/originals/55/2a/3e/552a3e864de76a1ee2d47729745b30ec.png

A SEP IRA simplified employee pension is a type of individual retirement plan geared toward helping business owners and self employed individuals to save for retirement It s similar to a A SEP IRA is a retirement savings plan for small business owners and self employed individuals Under a SEP IRA employers can make contributions on behalf of their employees up to 25 of each employee s pay

A SEP IRA is a tax deferred retirement plan for anyone who is self employed owns a business employs others or earns freelance income Here s everything you need to SEP stands for Simplified Employee Pension plan say that five times fast It s technically a type of traditional IRA and it functions a lot like one but with one big difference

2025 Max Ira Contribution Khodadad Ruby

https://www.marinerwealthadvisors.com/wp-content/uploads/2019/11/401k-Advantages-Over-SEP-and-Simple-IRAs-1024x533.png

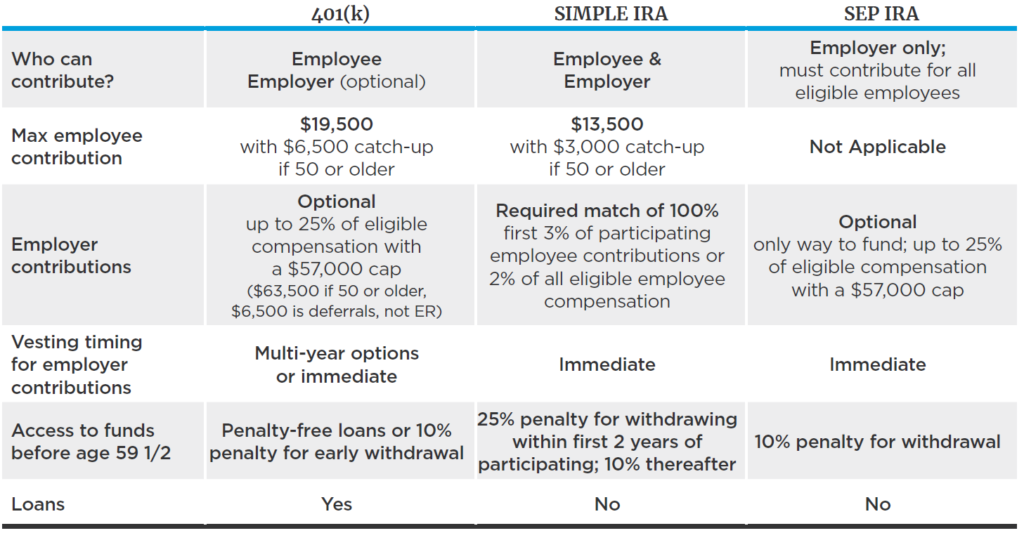

Sep Ira Contribution Limits 2025 Due Date Marya Leanora

https://www.carboncollective.co/hs-fs/hubfs/A_Side_by_Side_Comparison_of_SEP_and_Simple_IRA.png?width=3588&name=A_Side_by_Side_Comparison_of_SEP_and_Simple_IRA.png

https://www.irs.gov › retirement-plans › retirement...

A SEP IRA is a traditional IRA that holds contributions made by an employer under a SEP plan You can both receive employer contributions to a SEP IRA and make regular annual

https://www.forbes.com › advisor › retirem…

SEP IRAs are defined contribution retirement plans that let small business owners and their employees save for retirement

401k Contribution Limits 2025 Chart William K Taylor

2025 Max Ira Contribution Khodadad Ruby

Sep Ira Contribution Limits 2025 For Married Couples Kathleen Simpson

SEP IRA Definition Features Contribution Limits Rules

Roth Ira Contribution Limit In 2025 Silas Junaid

Maximum Ira Contribution 2025 Deadline James Henry

Maximum Ira Contribution 2025 Deadline James Henry

Retirement Plans For Self Employed Inflation Protection

Simplified Employee Pension SEP IRA Rules The Motley Fool

401k Contribution Limits 2024 Including Match Limit Tonye Shandeigh

What Is A Sep Ira Retirement Plan - The SEP in SEP IRA stands for Simplified Employee Pension Simplified might be overstating it a little since nothing involving the IRS is exactly simple But a SEP IRA does provide a