What Is A Simple Ira And Who Can Open One Who can establish a SIMPLE IRA Plan Any employer including self employed individuals tax exempt organizations and governmental entities that had no more than 100 employees with

There are three steps to establishing a SIMPLE IRA plan You can use Form 5304 SIMPLE PDF or Form 5305 SIMPLE PDF to set up a SIMPLE IRA plan Each form is a model Savings A SIMPLE IRA plan is a retirement plan for small businesses with fewer than 100 employees Here s how SIMPLE plans work how to establish one and rules to know

What Is A Simple Ira And Who Can Open One

What Is A Simple Ira And Who Can Open One

https://m.foolcdn.com/media/dubs/images/401k-vs-SIMPLE-IRA-retirement-plans-infographi.width-880.png

2025 Max Sep Ira Contribution Liam Michael

https://www.investors.com/wp-content/uploads/2019/12/wFAP-contribution-122719.jpg

Irs 2025 Simple Ira Contribution Limits Annie Nicolina

https://www.theentrustgroup.com/hs-fs/hubfs/2024-ira-contribution-limits.jpg?width=3072&height=2925&name=2024-ira-contribution-limits.jpg

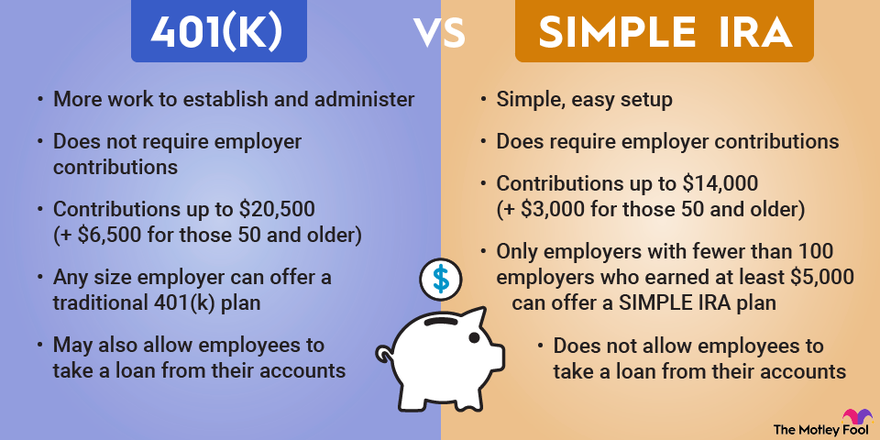

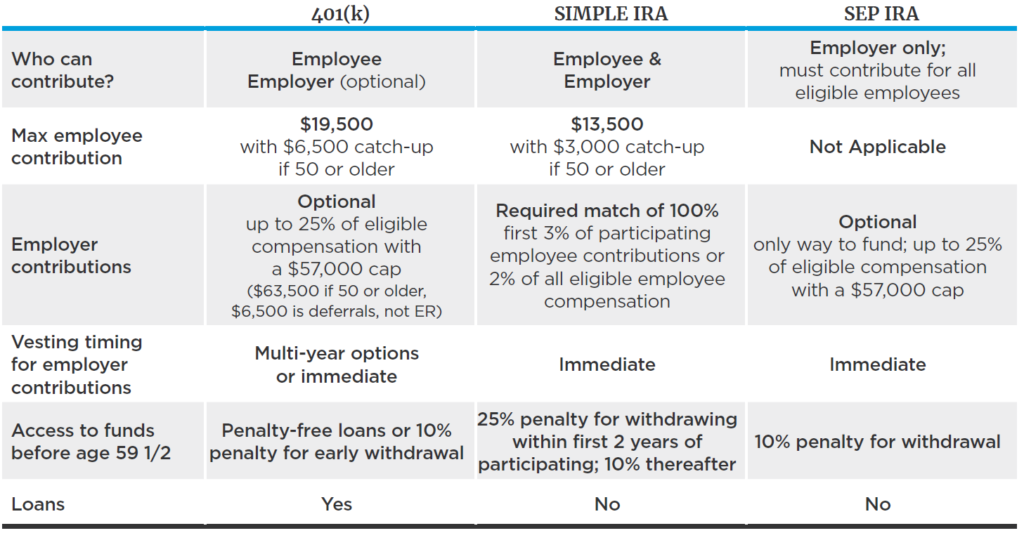

What Is a SIMPLE IRA A SIMPLE IRA is a retirement savings plan that most small businesses with 100 or fewer employees can use SIMPLE stands for Savings Incentive Match Plan for Traditional IRAs are set up by individuals while SIMPLE IRAs are set up by small business owners for employees and themselves Traditional IRA contributions are made by the individual

SIMPLE IRAs were designed for small businesses that don t have the resources to handle the administrative duties involved with larger retirement plans They also do not require the What is a SIMPLE IRA A SIMPLE IRA is a retirement plan that s offered through small businesses to their employees An employee can choose to contribute a portion of their

More picture related to What Is A Simple Ira And Who Can Open One

Irs 2025 Simple Ira Contribution Limits Annie Nicolina

https://www.marinerwealthadvisors.com/wp-content/uploads/2019/11/401k-Advantages-Over-SEP-and-Simple-IRAs-1024x533.png

Sep Ira Contribution Limits 2025 Due Date Marya Leanora

https://www.carboncollective.co/hs-fs/hubfs/A_Side_by_Side_Comparison_of_SEP_and_Simple_IRA.png?width=3588&name=A_Side_by_Side_Comparison_of_SEP_and_Simple_IRA.png

Roth Ira Limits 2024 Married Ardyce Corette

https://millennialwealthllc.com/wp-content/uploads/2018/01/Roth-IRA-vs-IRA-768x1920.png

What Is a SIMPLE IRA A SIMPLE IRA or Savings Incentive Match Plan for Employees Individual Retirement Arrangement is a savings option for small firms with 100 or fewer employees It is governed by many of the A Savings Investment Match Plan for Employees plan SIMPLE IRA is an easy and low cost way for small employers to set up a retirement program for their employees These plans offer lower costs reduce taxes and

SIMPLE is an abbreviation for Savings Incentive Match Plan for Employees This type of Individual Retirement Account IRA makes it optional for employees to contribute to their SIMPLE IRA plans are employer sponsored retirement accounts for businesses with 100 or fewer employees They are also retirement accounts for the self employed and sole

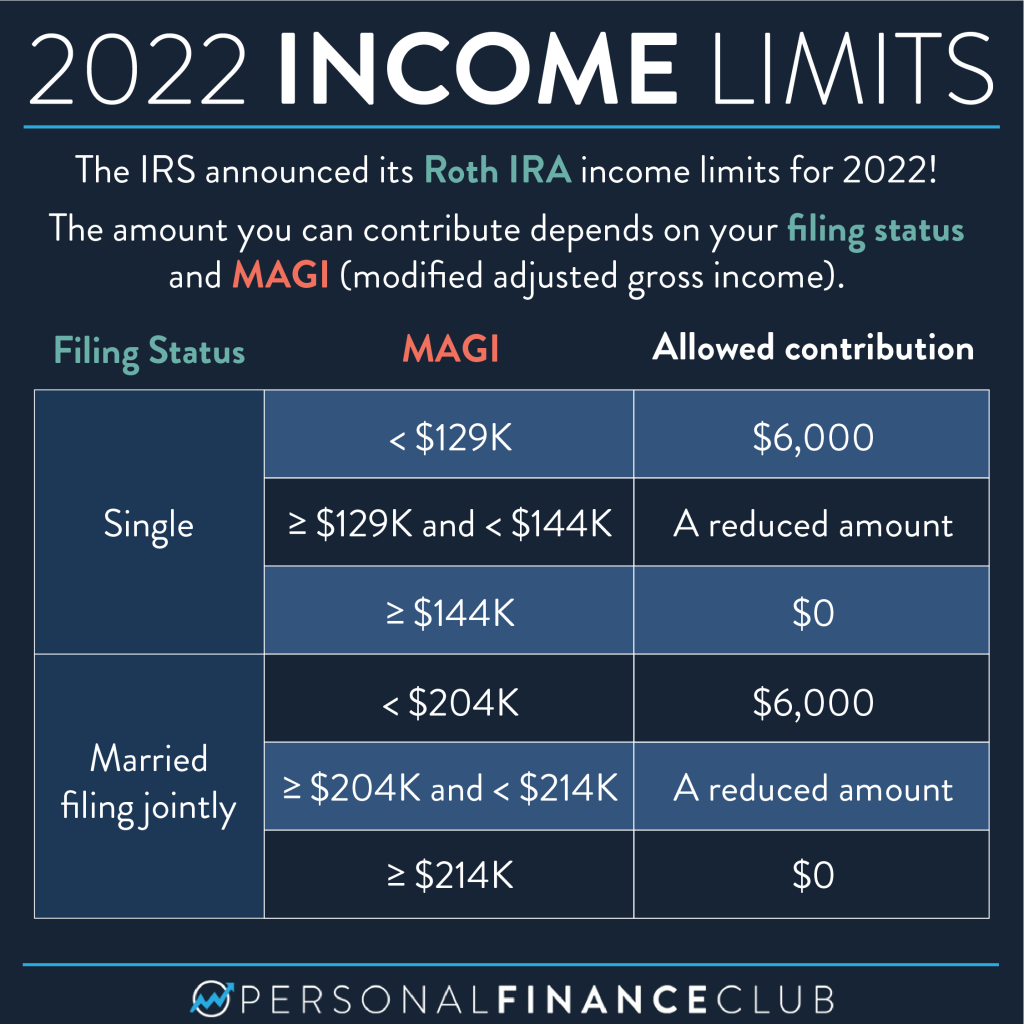

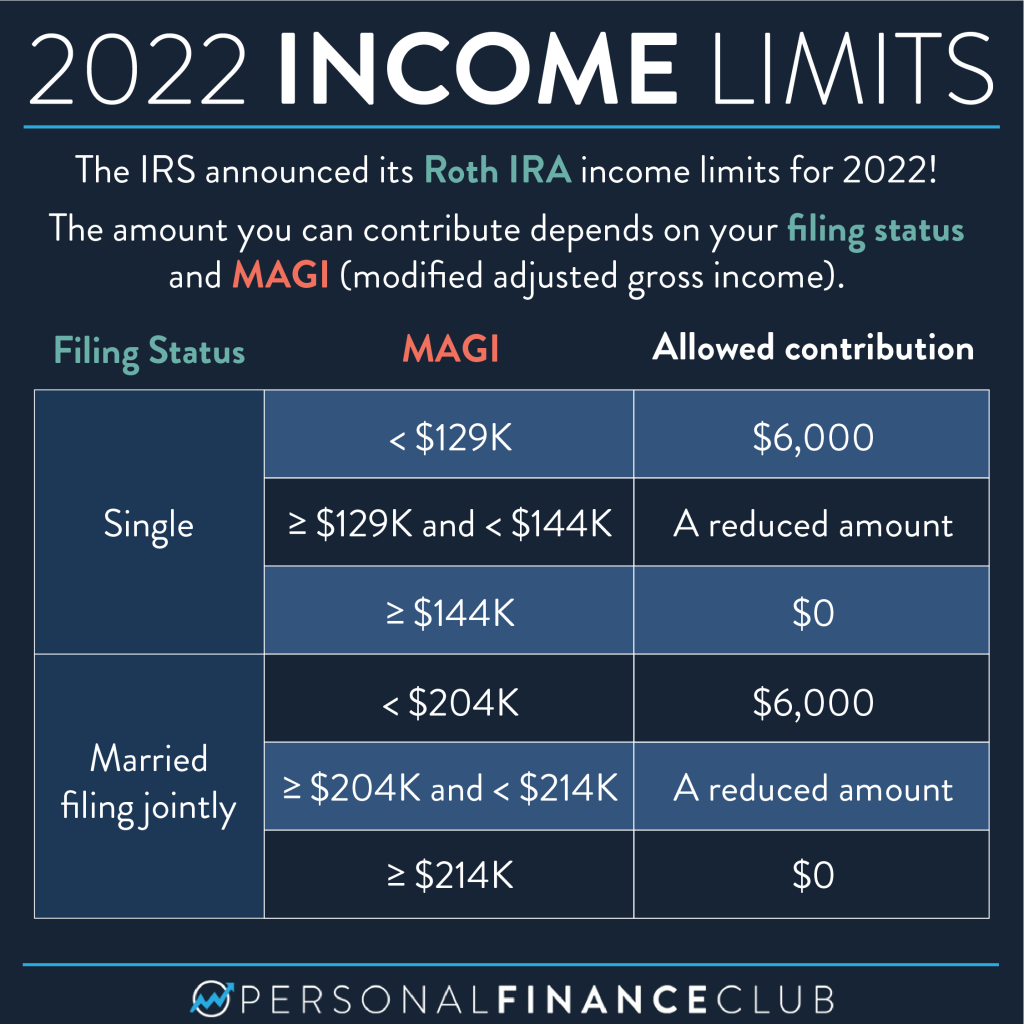

The IRS Announced Its Roth IRA Income Limits For 2022 Personal

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-12-2022-Roth-IRA-Income-Limits-1024x1024.png

Roth Contribution Limits 2025 Single Hinda Maegan

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-12-2022-Roth-IRA-Income-Limits-1536x1536.png

https://www.irs.gov › retirement-plans › retirement...

Who can establish a SIMPLE IRA Plan Any employer including self employed individuals tax exempt organizations and governmental entities that had no more than 100 employees with

https://www.irs.gov › retirement-plans › plan-sponsor › simple-ira-plan

There are three steps to establishing a SIMPLE IRA plan You can use Form 5304 SIMPLE PDF or Form 5305 SIMPLE PDF to set up a SIMPLE IRA plan Each form is a model Savings

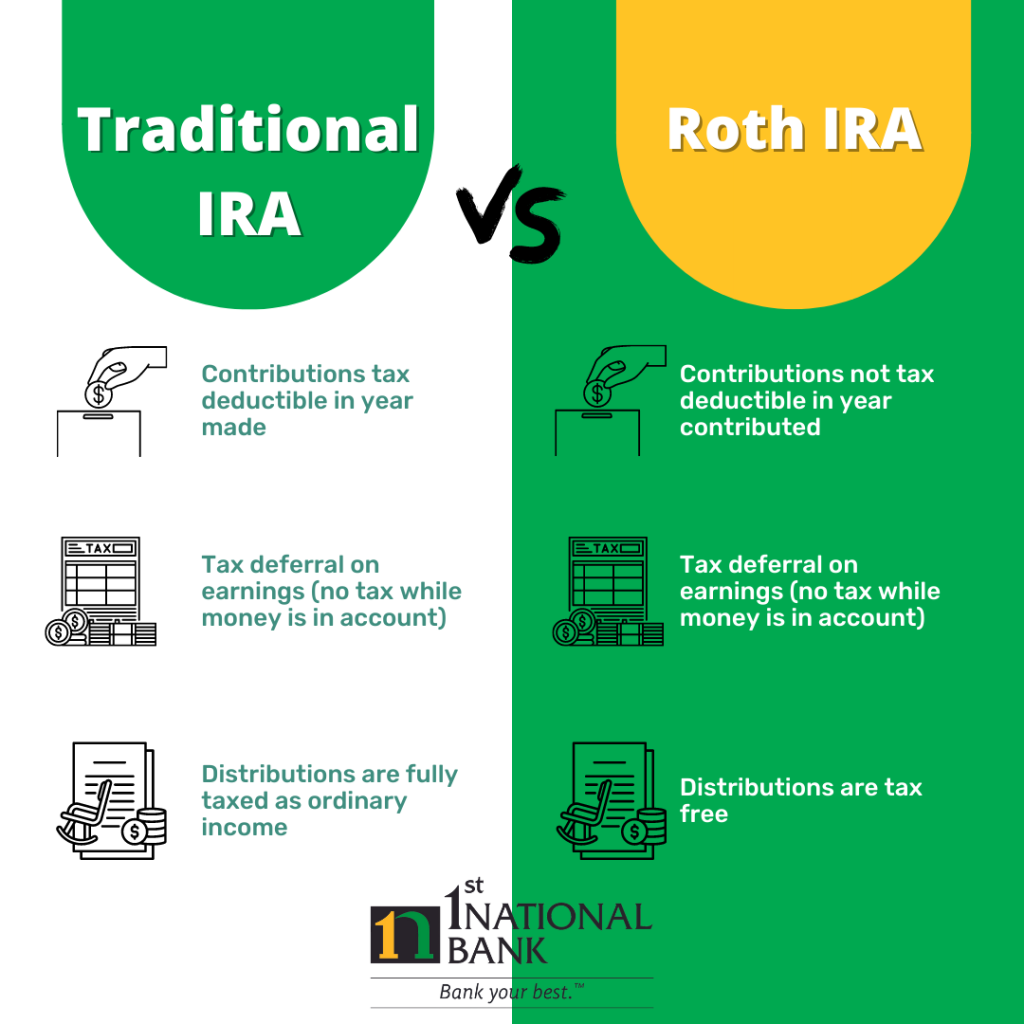

Traditional IRAs Vs Roth IRAs 1st National Bank

The IRS Announced Its Roth IRA Income Limits For 2022 Personal

2025 401k Limits Contributions Over 50 Kathleen Basso

Simple Ira 2024 Contribution Deadline Ibby Theadora

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Roth Ira Income Cap 2024 Binnie Madelyn

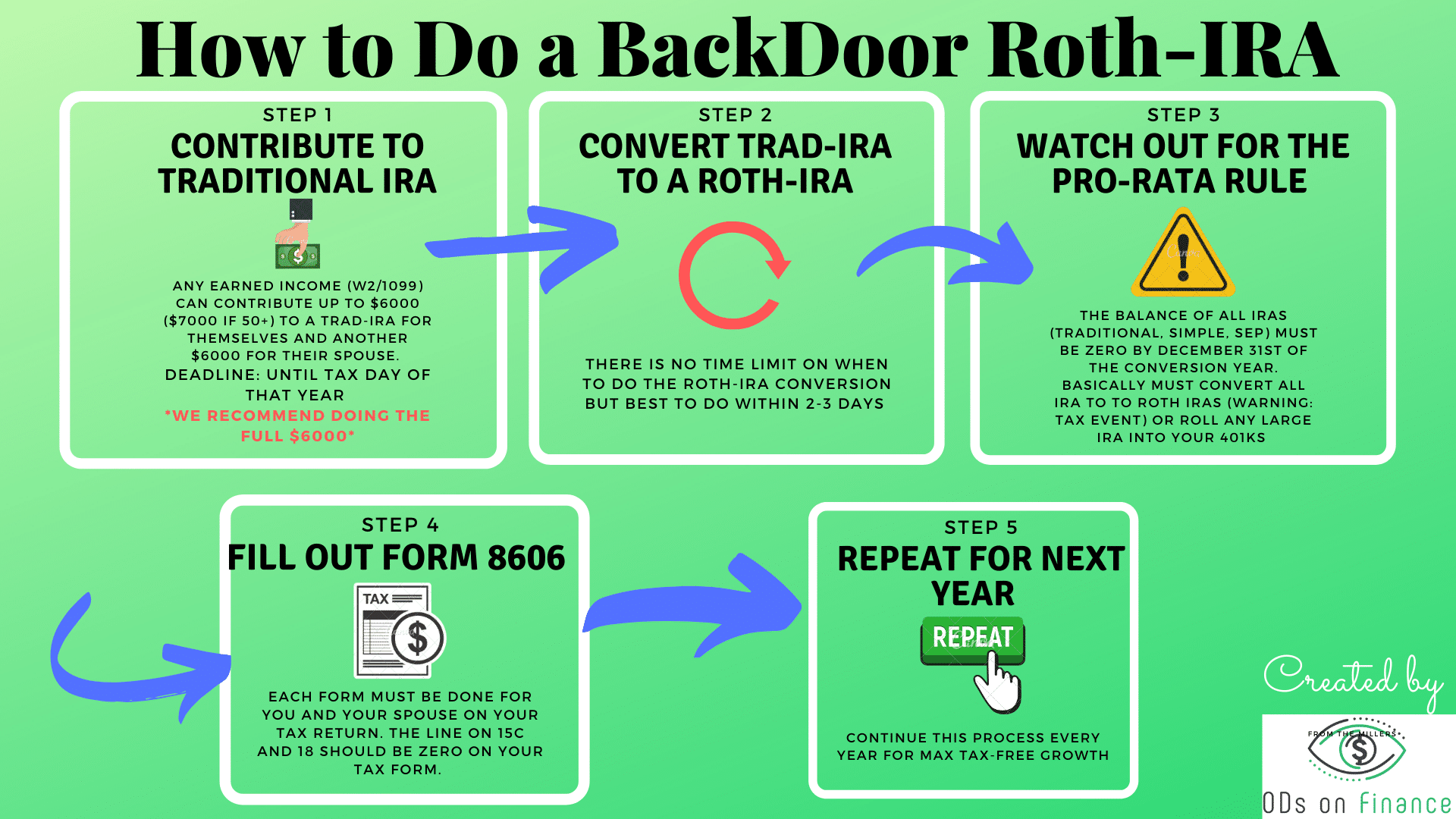

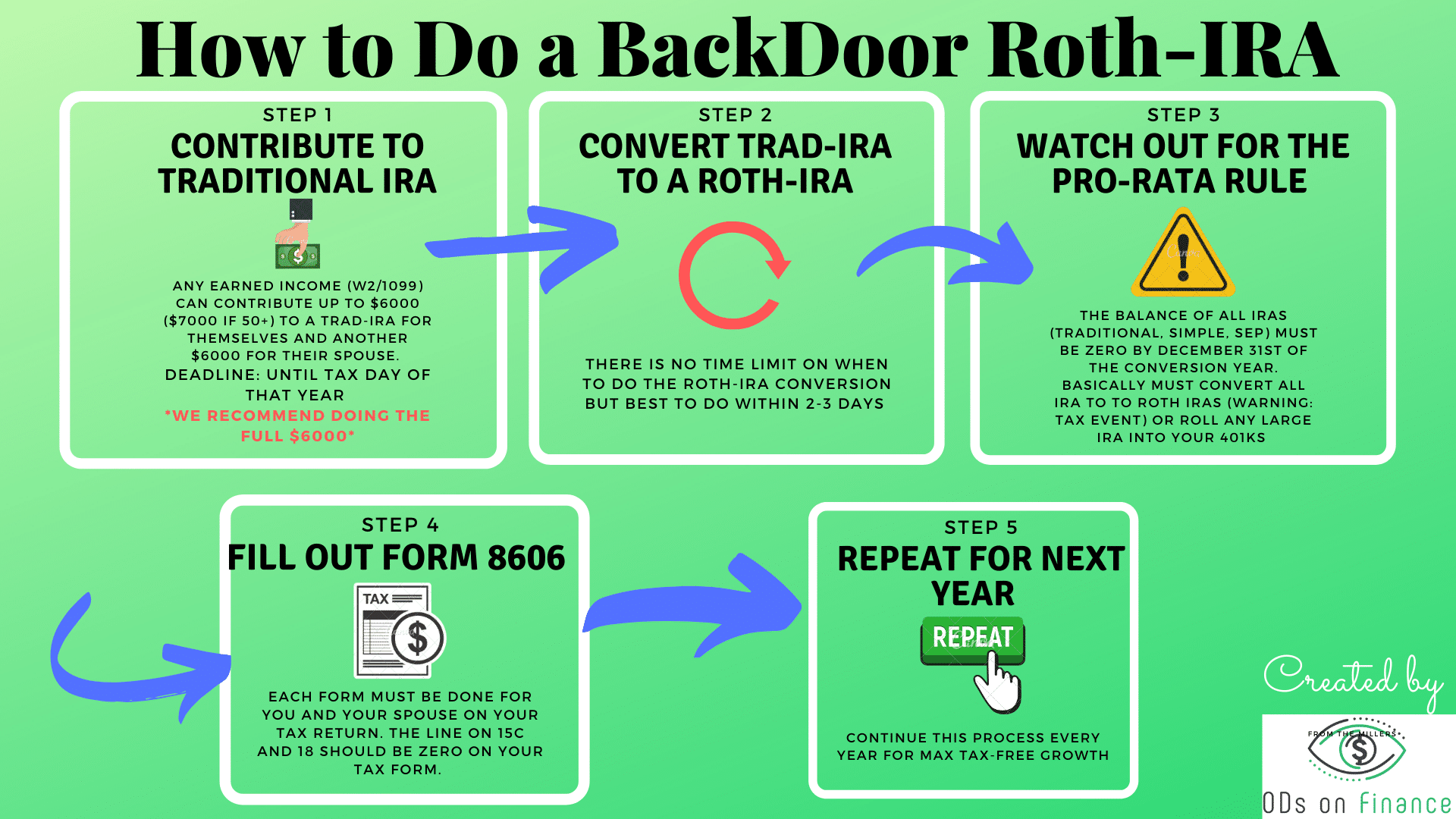

Ira Income Limits 2025 For Backdoor Sara G Jackson

Ira Income Limits 2025 For Backdoor Sara G Jackson

What Is The 401k Limit For 2025 Sami Omar

Open Enrollment Retirement Savings 401k Or IRA

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth IRA What s The Difference

What Is A Simple Ira And Who Can Open One - Traditional IRAs are set up by individuals while SIMPLE IRAs are set up by small business owners for employees and themselves Traditional IRA contributions are made by the individual