What Is Exempt From Sales Tax In Texas What purchases are exempt from the Texas sales tax While the Texas sales tax of 6 25 applies to most transactions there are certain items that may be exempt from taxation This page discusses various sales tax exemptions in Texas

Generally exempt organizations must get a sales tax permit and collect and remit sales tax on all goods and taxable services they sell See our Publication 96 122 Nonprofit and Exempt Organizations Purchases and Sales for a list of limited exceptions For most of the year Texas collects a sales tax on the sale of book bags notebooks pencil boxes and other school supplies However the state s annual sales tax holiday exempts school supplies under 100

What Is Exempt From Sales Tax In Texas

What Is Exempt From Sales Tax In Texas

https://www.pdffiller.com/preview/50/825/50825271/large.png

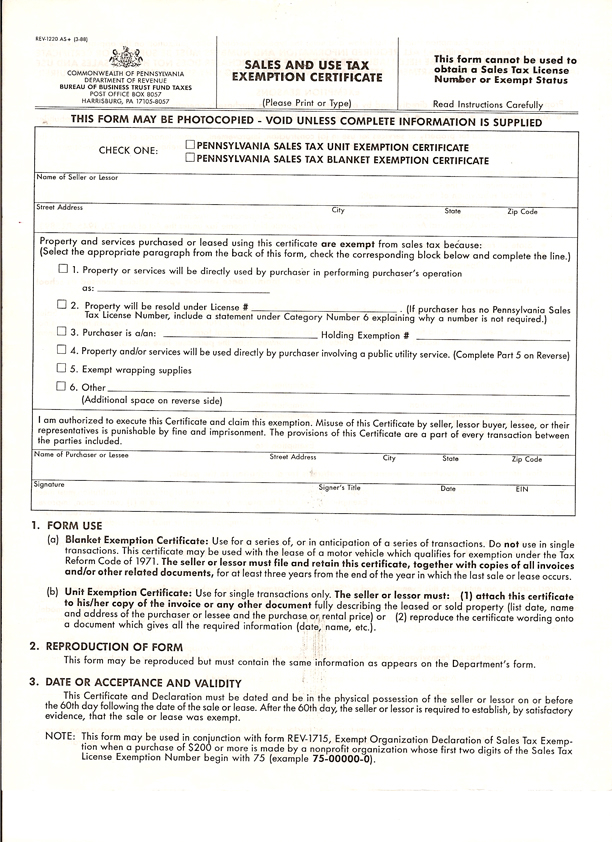

Mississippi Sales And Use Tax Exemption Form ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/17-lovely-florida-tax-exempt-certificate.png

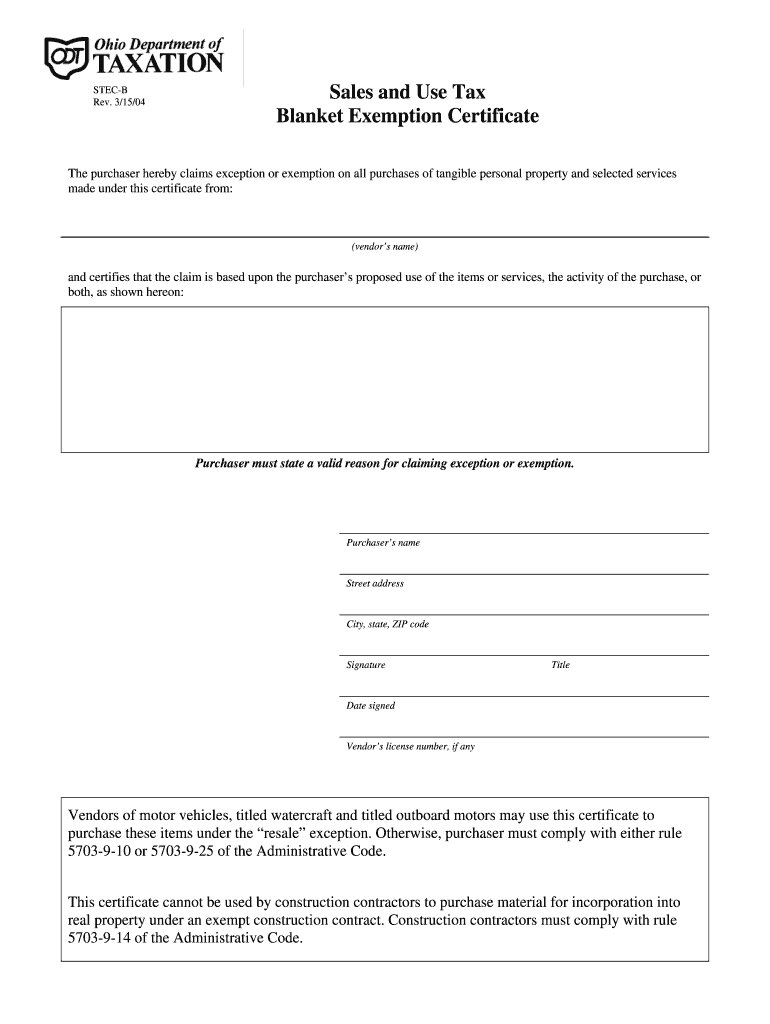

Oh Sales Tax Blanket Exemption Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/ohio-sales-and-use-tax-blanket-exemption-certificate-fill-online.png

Certain items are exempt from sales tax in Texas providing relief to consumers Some common exemptions include Food including groceries and food products intended for human consumption However prepared foods such as meals from restaurants or food sold at concession stands are generally subject to sales tax Businesses that operate in Texas have to wrangle with more than just a few odd sales tax exemptions For example soft drinks and candy are taxable if sold through a retail store however these items are exempt if sold by certain organizations such as

Sec 151 304 OCCASIONAL SALES a An occasional sale of a taxable item and the storage use or consumption of a taxable item the sale or transfer of which to a consumer is made by an occasional sale are exempted from the taxes imposed by this chapter b In this section occasional sale means What s taxable and exempt Texas imposes a 6 25 sales tax on most retail sales leases and rentals of most goods and taxable services Local jurisdictions can also add a 2 sales and use tax for a maximum combined sales tax of 8 25 in Texas Exemptions from sales tax in Texas The following are some exemptions from sales tax in Texas

More picture related to What Is Exempt From Sales Tax In Texas

Sales Tax Exemptions In Arkansas

https://www.exemptform.com/wp-content/uploads/2022/08/how-to-get-a-sales-tax-certificate-of-exemption-in-north-carolina-3.png

Sales Tax Exemption Certificate Canada

https://www.pdffiller.com/preview/100/53/100053612/large.png

1040 Sr Social Security Worksheets

https://www.marottaonmoney.com/wp-content/uploads/2022/04/Form1040.png

What is Exempt From Sales Tax In Texas The state of Texas levies a 6 25 state sales tax on the retail sale lease or rental of most goods and some services Local jurisdictions impose additional sales taxes up to 2 The range of total sales tax rates within the state of Texas is between 6 25 and 8 25 What transactions are generally subject to sales tax in Texas In the state of Texas sales tax is legally required to be collected from all tangible physical products being sold to a consumer An example of items that are exempt from Texas sales tax are items specifically purchased for

[desc-10] [desc-11]

Tax Letter Template Format Sample And Example In PDF Word

https://bestlettertemplate.com/wp-content/uploads/2020/10/IRS-Tax-exempt-Letter.png

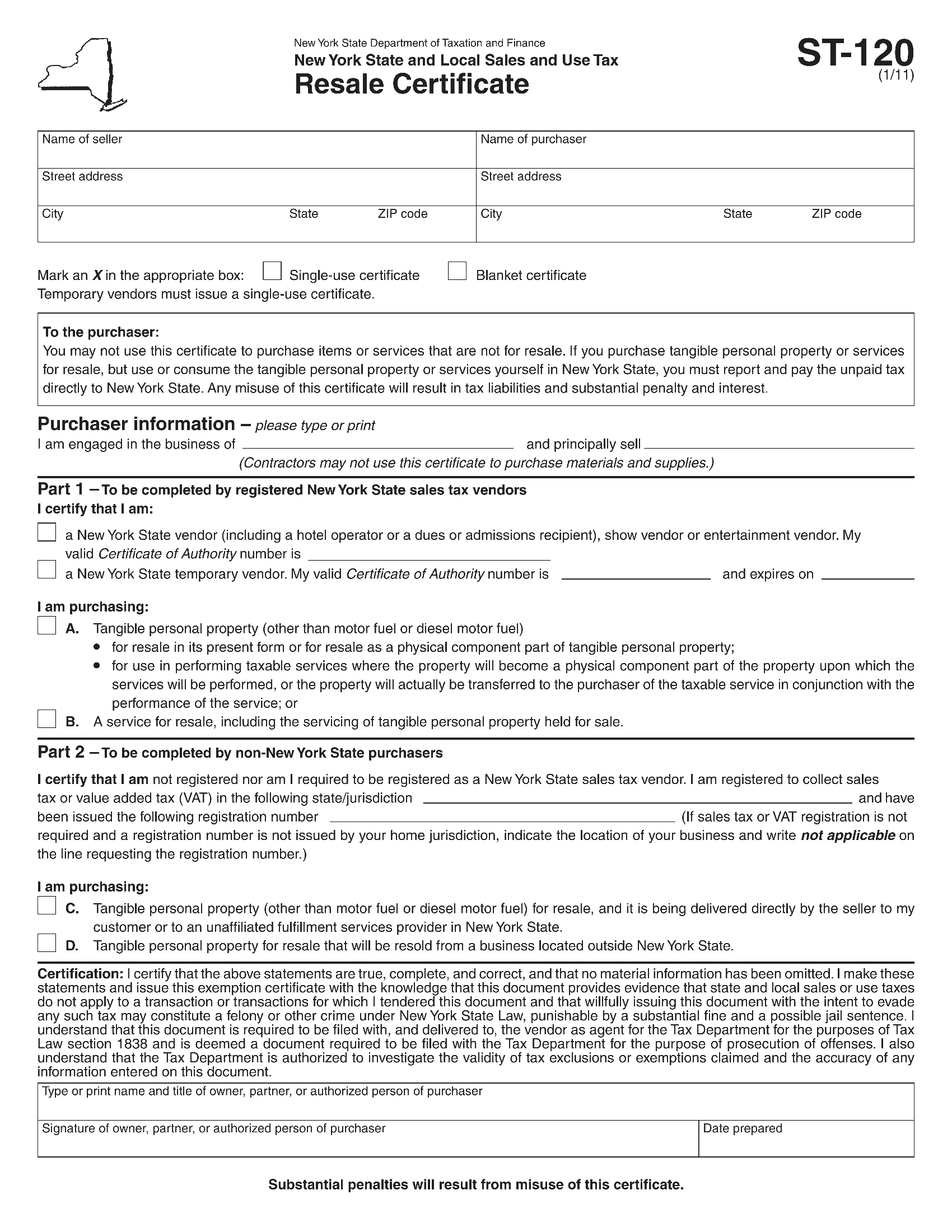

Nevada Resale Certificate Sample

https://s3-us-west-2.amazonaws.com/display-templates/resale-cert/pa-cert.png

https://www.salestaxhandbook.com › texas › sales-tax-exemptions

What purchases are exempt from the Texas sales tax While the Texas sales tax of 6 25 applies to most transactions there are certain items that may be exempt from taxation This page discusses various sales tax exemptions in Texas

https://comptroller.texas.gov › taxes › exempt › faq.php

Generally exempt organizations must get a sales tax permit and collect and remit sales tax on all goods and taxable services they sell See our Publication 96 122 Nonprofit and Exempt Organizations Purchases and Sales for a list of limited exceptions

Pa 40 2024 Schedule A Tax Form Bab Gertrude

Tax Letter Template Format Sample And Example In PDF Word

California Sales Tax 2024 Exemption Jany Oralle

What Do Tax Exemption And W9 Forms Look Like GroupRaise

Flsa Duties Test Worksheets 2022

Sales Tax Exempt Form 2024 Va

Sales Tax Exempt Form 2024 Va

.png)

Minnesota Tax Rates 2025 Bella Yasmin

Pennsylvania Estate Tax Exemption 2025 Lorrai Nekaiser

Luxury Tax Exemption Certificate Prntbl concejomunicipaldechinu gov co

What Is Exempt From Sales Tax In Texas - [desc-14]