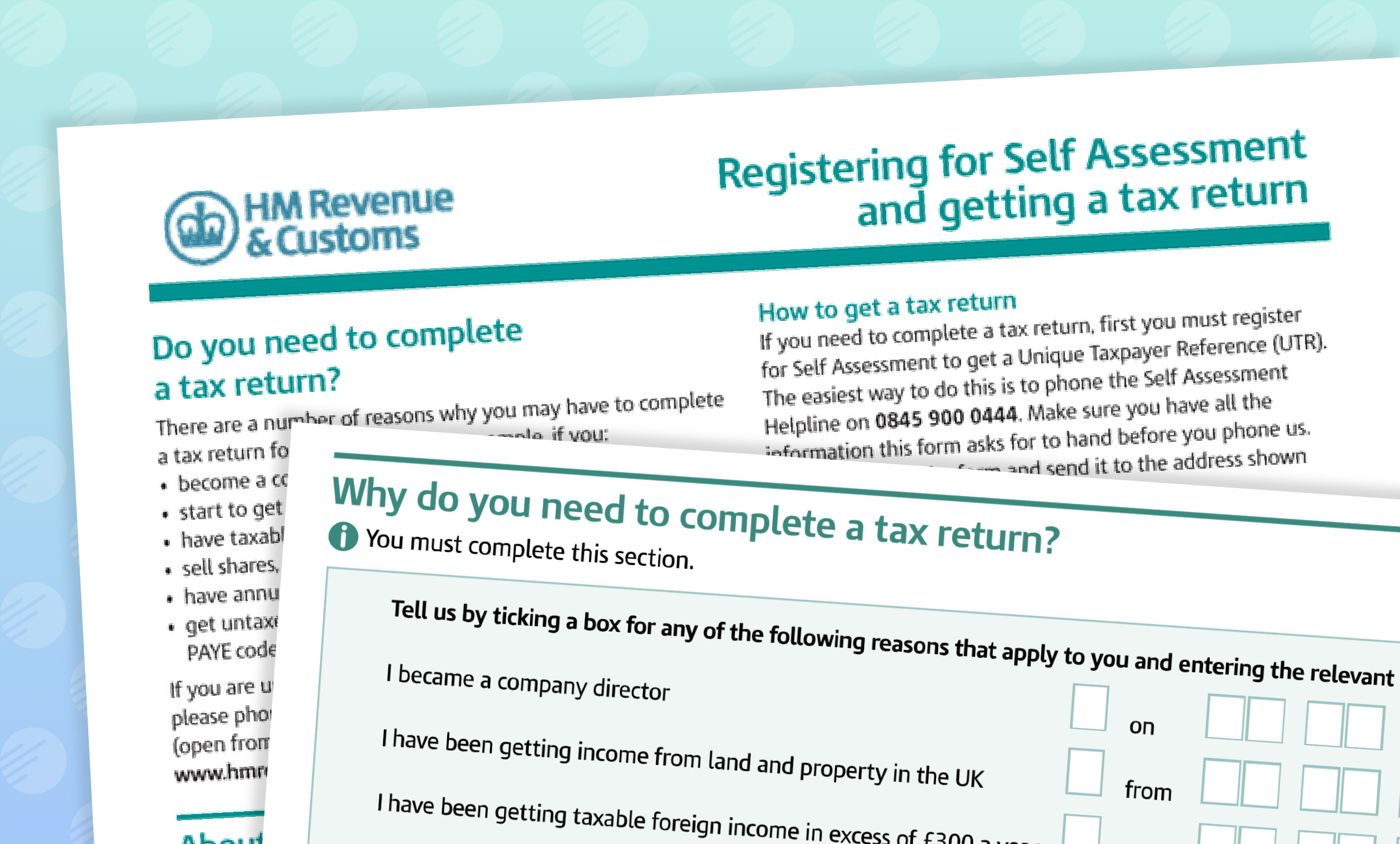

What Is Self Assessment Tax Self Assessment is a system HM Revenue and Customs HMRC uses to collect Income Tax Tax is usually deducted automatically from wages and pensions People and businesses

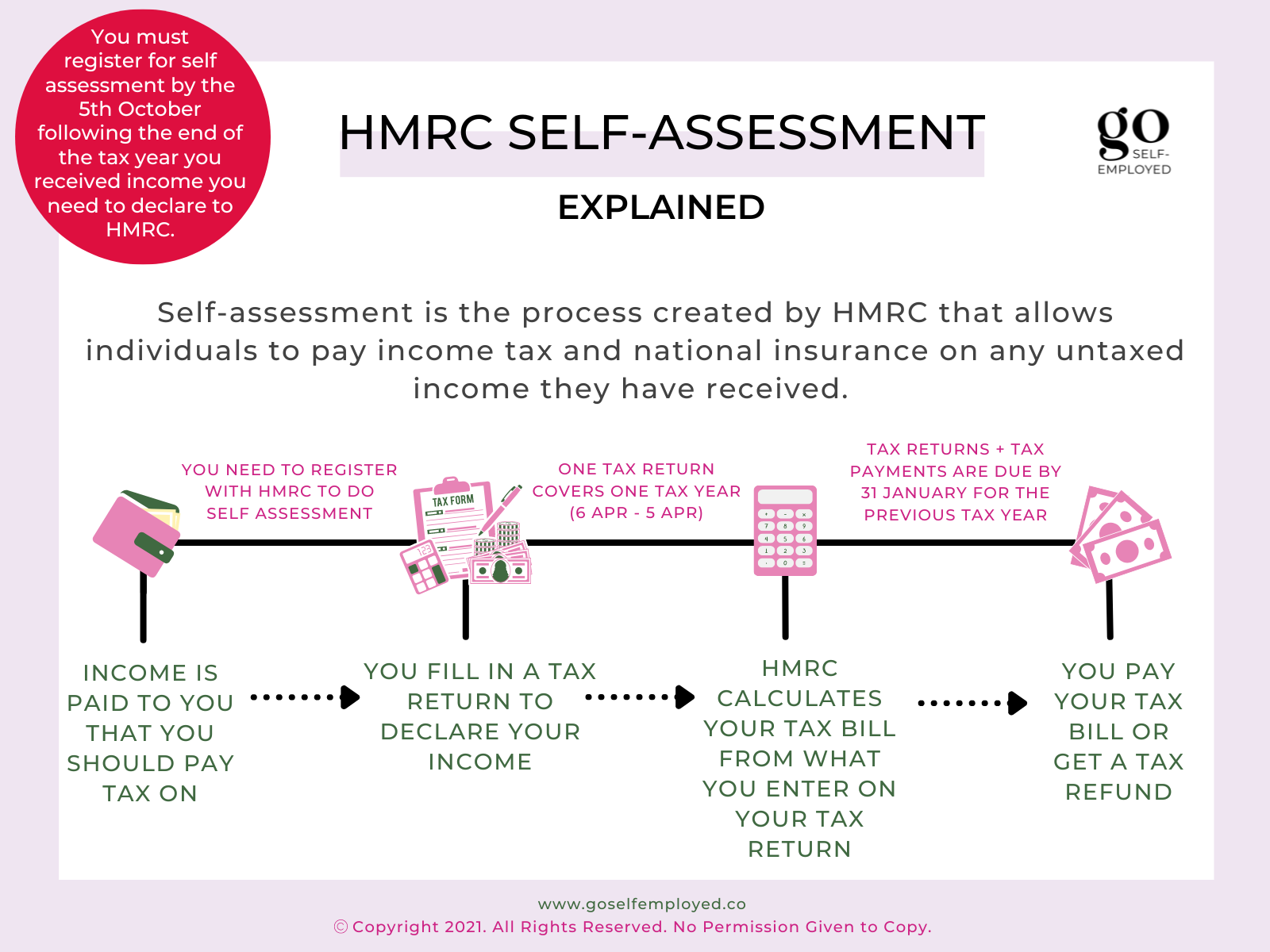

If the amount you paid is not enough you will need to pay the remaining balance to cover the difference which is referred to as self assessment tax It is paid after the end of the financial year but before filing the income tax return Paying this on time helps you avoid any penalty or interest How to calculate self assessment tax Self assessment is a way of reporting your income and paying tax to HM Revenue and Customs HMRC If you are employed your income tax is usually automatically deducted from your wages by your employer

What Is Self Assessment Tax

What Is Self Assessment Tax

https://vakilsearch.com/blog/wp-content/uploads/2023/04/Which-Form-is-Used-For-Self-Assessment-Tax.png

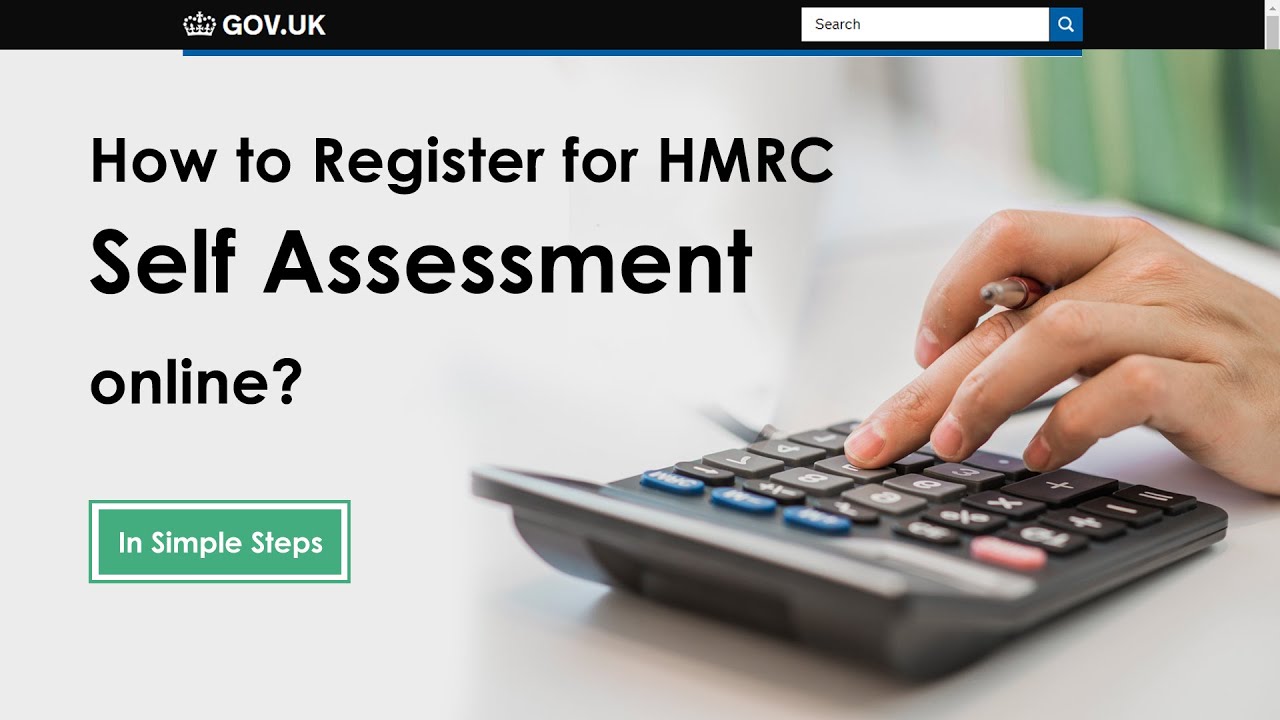

How To Register For HMRC Self Assessment Online YouTube

https://i.ytimg.com/vi/ua7dEV180N8/maxresdefault.jpg

What Is Self Assessment Tax SAT Explained In Hindi Common Gupta

https://i.ytimg.com/vi/VV0YQ0UCetI/maxresdefault.jpg

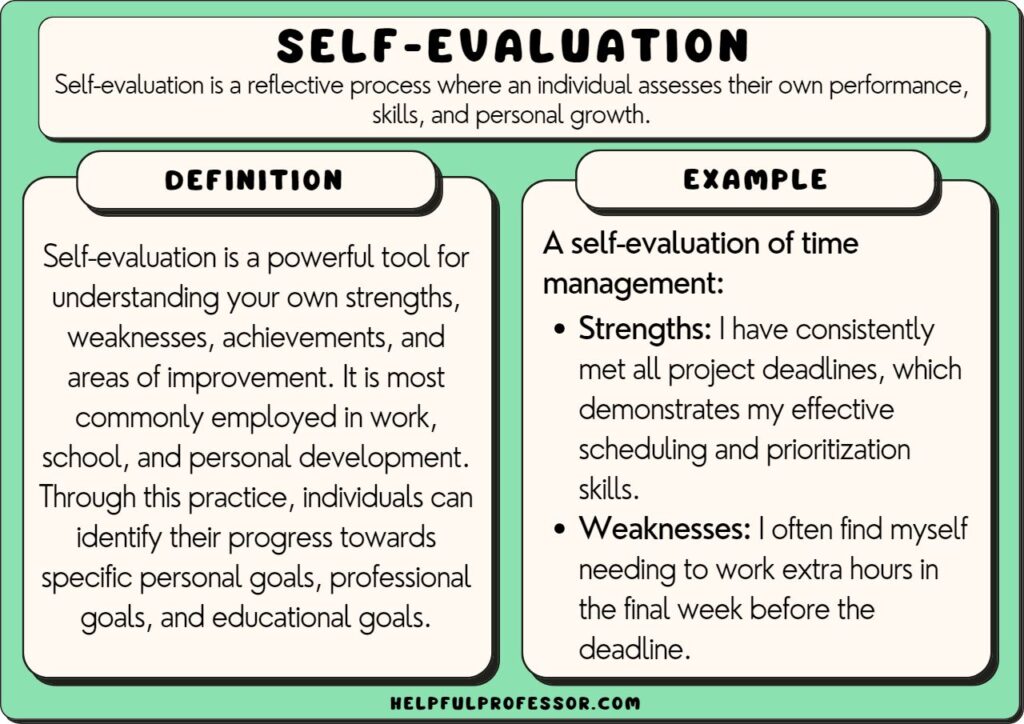

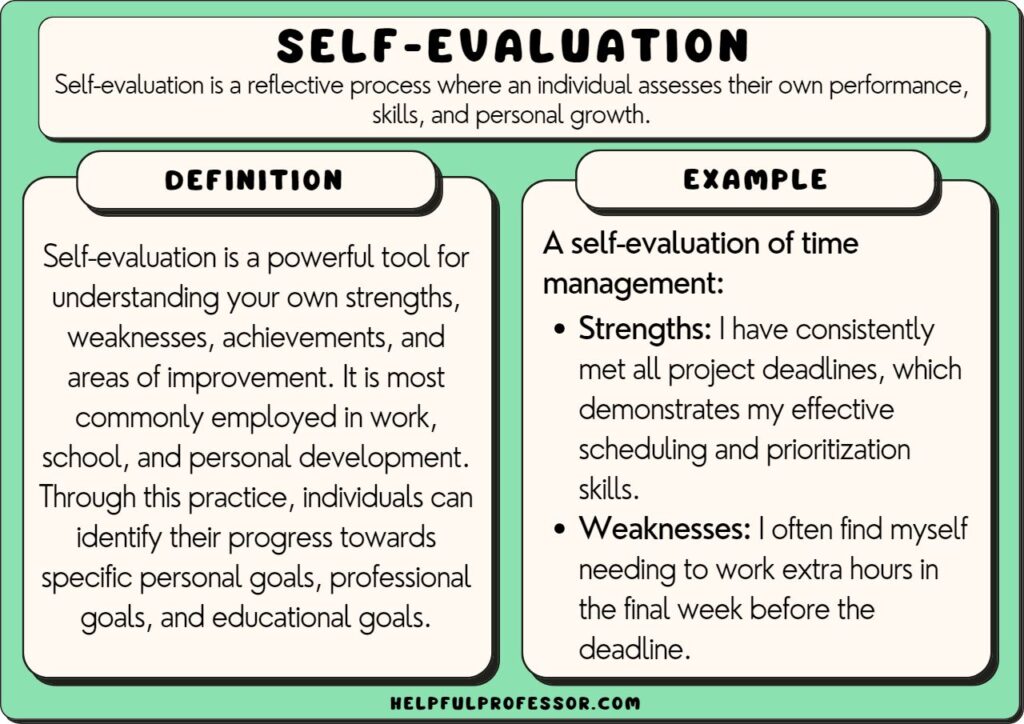

Self assessment is a system wherein taxpayers themselves are responsible for reporting their income determining the amount of tax due and paying it to the tax authorities This system primarily relies on the honesty and accuracy of individuals and businesses to comply with tax laws and regulations Self Assessment is a system that HMRC uses to collect Income Tax Individuals who have earned income that HMRC doesn t yet know about such as profit from a business usually have to report that income to HMRC in a Self Assessment tax return

As the name suggests Self Assessment means you self assess your own taxable income and any expenses you wish to claim by completing a Self Assessment tax return which HMRC then uses to work out your tax bill If you are not employed and paid through the PAYE system you use the self assessment process to tell HMRC how much you ve earned You must fill in a tax return form every year This tells HMRC how much you earn and if you have received money from other sources

More picture related to What Is Self Assessment Tax

What Is Self Assessment Tax When And How To Pay Self Assessment Tax

https://i.ytimg.com/vi/uTVMNL7z9Ck/maxresdefault.jpg

Any Thoughts On This HMRC Compliance Letter 45 OFF

https://images.ctfassets.net/zkj4qptctbba/45TAGl6hQLtTmb35gZONJf/c23376fb026057394fface8488268f6f/2022-09-REGISTER-FOR-SELF-ASSESSMENT-BLOG.png

Unique Taxpayer Reference UTR Number What Is How To 44 OFF

https://assets-global.website-files.com/5d71eeb2a19ee03e3430f50f/618bbbd6e4373f581237eee7_UTR Number v2.png

Self Assessment Tax SAT is the amount that an assessee taxpayer pays on their taxable income after accounting for Advance Tax and Tax Deducted at Source TDS for the given financial year Individuals who are required to file income tax returns are generally liable to pay SAT before submitting their returns HM Revenue and Customs HMRC uses the Self Assessment system to collect Income Tax that s not automatically deducted from people s wages pensions and savings People who earn money from other sources explained below must fill in a Self Assessment tax return to show how much they made and from what sources during a tax year

[desc-10] [desc-11]

Green Hill Publishing

https://greenhillpublishing.com.au/wp-content/uploads/2024/02/The-little-book-of-big-publishing-tips-1280x1545.png

Self Assessment Questionnaires Academic English UK

https://academic-englishuk.com/wp-content/uploads/2022/09/Self-Assessment-Questionnaires-for-Academic-English-AEUK-1080x675.png

https://www.gov.uk › self-assessment-tax-returns

Self Assessment is a system HM Revenue and Customs HMRC uses to collect Income Tax Tax is usually deducted automatically from wages and pensions People and businesses

https://cleartax.in › self-assessment-tax-payment

If the amount you paid is not enough you will need to pay the remaining balance to cover the difference which is referred to as self assessment tax It is paid after the end of the financial year but before filing the income tax return Paying this on time helps you avoid any penalty or interest How to calculate self assessment tax

A Beginners Guide To HMRC Self Assessment

Green Hill Publishing

15 Convergent Validity Examples 2025

Hmrc Self Assessment Login

What Is Self Assessment Blog Akaunting

15 Self Evaluation Examples 2025

15 Self Evaluation Examples 2025

Self Assessment Tax Rules And Calculation Online ITR EFiling

Self Evaluation Examples

CT600 Submission Software For Practitioners

What Is Self Assessment Tax - As the name suggests Self Assessment means you self assess your own taxable income and any expenses you wish to claim by completing a Self Assessment tax return which HMRC then uses to work out your tax bill