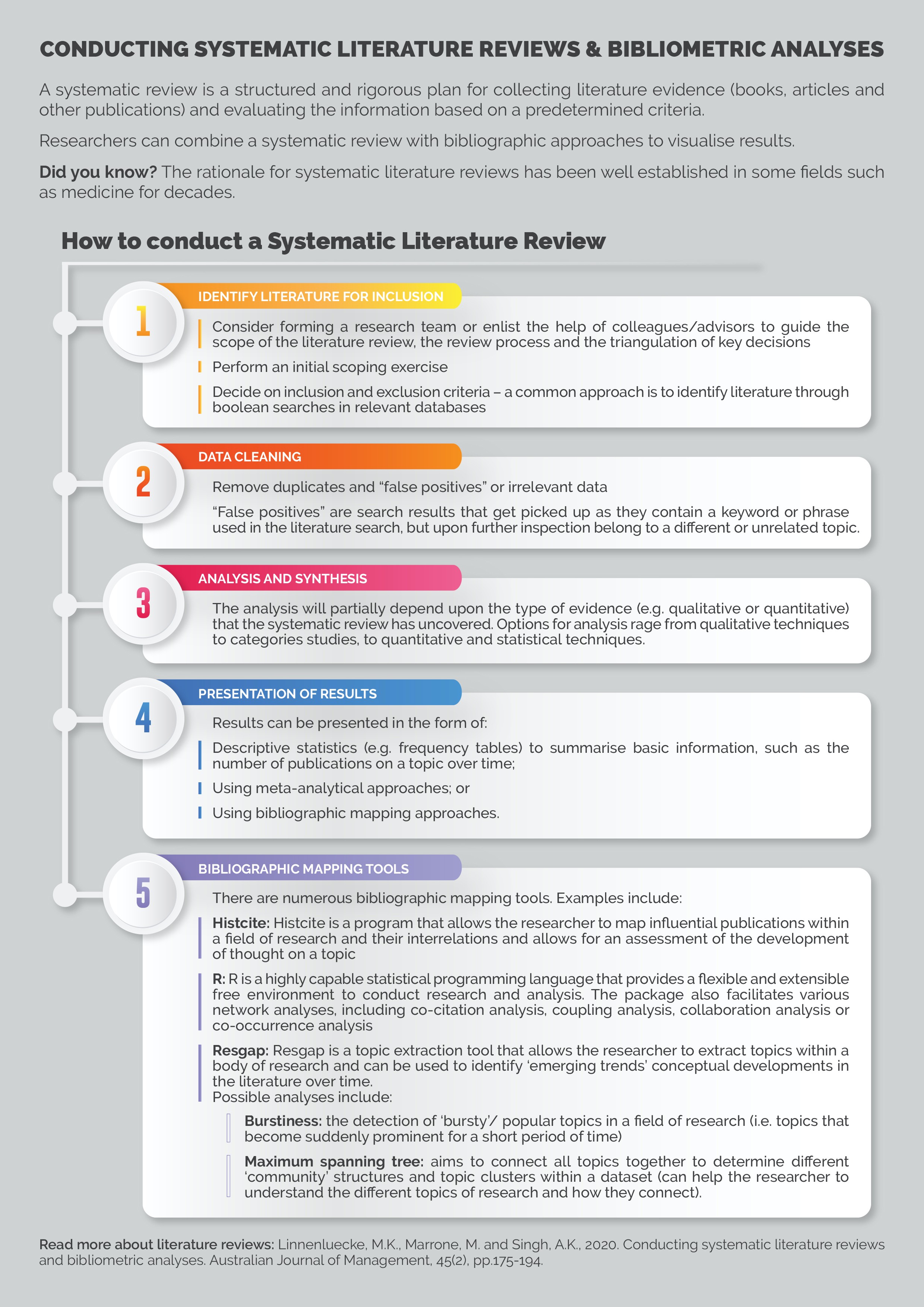

What Is Systematic Risk Systematic risk refers to the probability of loss linked with the whole market segment such as changes in government policy for a specific industry In contrast risks associated with a particular industry is referred to as unsystematic risks like labor strike

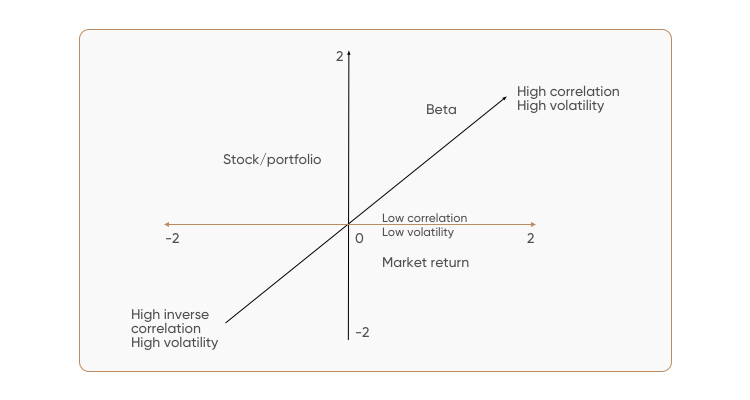

Systematic risk is defined as the risk that is inherent to the entire market or the whole market segment as it affects the economy as a whole and cannot be diversified away thus is also known as an undiversifiable risk or market risk or even volatility risk Systematic risk is that part of the total risk that is caused by factors beyond the control of a specific company such as economic political and social factors It can be captured by the sensitivity of a security s return with respect to the overall market return

What Is Systematic Risk

What Is Systematic Risk

https://www.ferventlearning.com/wp-content/uploads/2021/01/articleImagery_IAPMEX-ABF-15_2-1024x576.jpg

What Is Systematic Risk aka Beta How To Calculate Beta Of A Stock

https://www.ferventlearning.com/wp-content/uploads/2020/12/articleFeature_IAPMEX-ABF-15_880-360.png

What Is Systematic Risk aka Beta How To Calculate Beta Of A Stock

https://www.ferventlearning.com/wp-content/uploads/2021/01/articleImagery_IAPMEX-ABF-15_3-scaled.jpg

Systematic risk also known as market risk refers to the potential for an investor to experience losses due to factors that affect the overall performance of financial markets This type of risk is inherent in all investments and cannot be mitigated through diversification alone In finance and economics systematic risk in economics often called aggregate risk or undiversifiable risk is vulnerability to events which affect aggregate outcomes such as broad market returns total economy wide resource holdings or aggregate income

Systematic risk is external to organization and affects all of the investment and securities In simple terms it is pervasive eternal and far reaching market risk that brings in variety of troubling factors Systematic risk is both unpredictable and unavoidable in nature Systematic risk also known as market risk or undiversifiable risk refers to the potential for losses in a financial market due to factors that affect the entire market or a large segment of the market

More picture related to What Is Systematic Risk

What Is Systematic Risk Personal Finance Beast

https://personalfinancebeast.com/wp-content/uploads/2024/03/What-is-Systematic-Risk.jpg

What Is Systematic Risk With Example

https://jp.blograng.com/boxfiles/r_what-is-systematic-risk-with-example--1ad1eeee688f07115e73a7b4c6809ebb.wepb

Introduction To Systematic And Unsystematic Risk YouTube

https://i.ytimg.com/vi/JvoBGCABiwQ/maxresdefault.jpg

Systematic risk synonymous with undiversifiable risk volatility risk or market risk is inherent to the entire market or market segment It stems from economic geopolitical and financial factors affecting the overall market rather than specific stocks or industries Definition Systematic risk also known as market risk or volatility risk signifies the inherent danger in the unexpected nature of the market This form of risk has an impact on the entire market and not on individual securities or sectors

[desc-10] [desc-11]

25 Difference Between Systematic And Unsystematic Risk YouTube

https://i.ytimg.com/vi/HaQrCWa6dk8/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLC6Md1s-Lj7r0kyk5koiuWv9Pp17A

Systematic Risk Vs Unsystematic Risk Explained With Examples YouTube

https://i.ytimg.com/vi/YxktTjRIEGQ/maxresdefault.jpg

https://efinancemanagement.com › investment-decisions...

Systematic risk refers to the probability of loss linked with the whole market segment such as changes in government policy for a specific industry In contrast risks associated with a particular industry is referred to as unsystematic risks like labor strike

https://www.wallstreetmojo.com › systematic-risk

Systematic risk is defined as the risk that is inherent to the entire market or the whole market segment as it affects the economy as a whole and cannot be diversified away thus is also known as an undiversifiable risk or market risk or even volatility risk

Systematic Sampling What Is It And How Is It Used In 52 OFF

25 Difference Between Systematic And Unsystematic Risk YouTube

Risk Of Bias Systematic Reviews LibGuides At Weill Cornell Medical

:max_bytes(150000):strip_icc()/systematicrisk.asp-final-f38c64261b2945e89722e5e0163cbfc0.png)

Systematic Risk Definition And Examples

Systematic Sampling

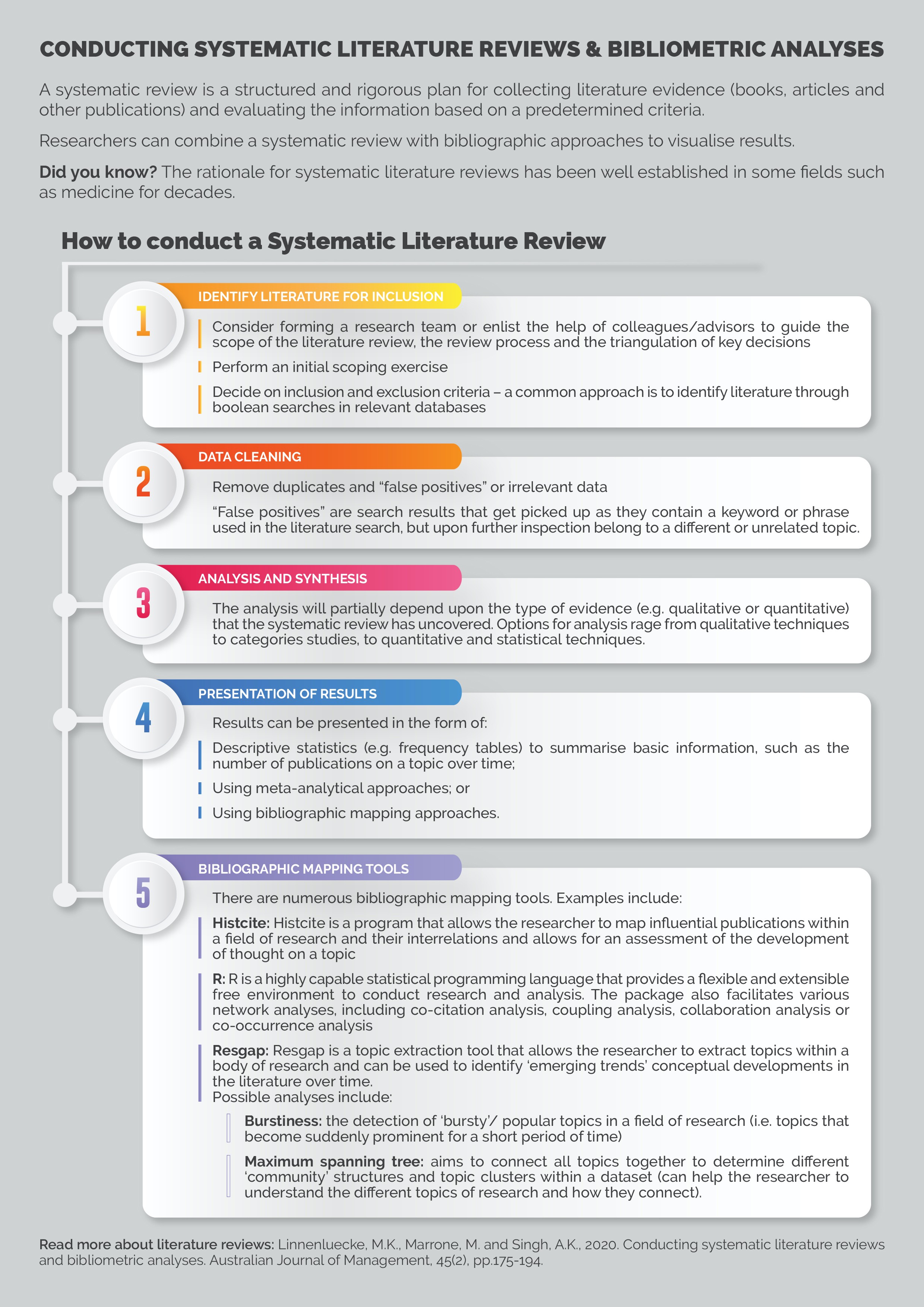

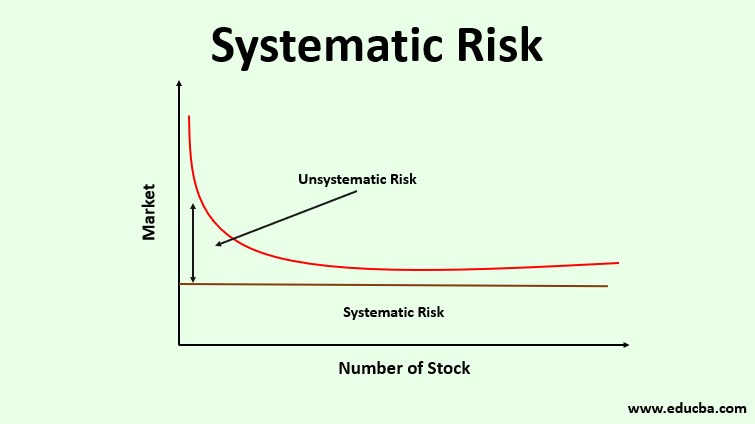

How To Conduct A Systematic Literature Review ResGap

How To Conduct A Systematic Literature Review ResGap

Systematic Risk Examples Explanation With Excel Template

Systematic Review Critical Appraisal

What Is Systematic Risk Definition And Meaning Capital

What Is Systematic Risk - [desc-12]