What Is Tax Burden In Economics When you are on your Sign In Partner s website ensure it is your information that is entered and not that of somebody else If you register with someone else s banking credentials by mistake

Income tax Personal business corporation trust international and non resident income tax Information on taxes including filing taxes and get tax information for individuals businesses charities and trusts Income tax

What Is Tax Burden In Economics

What Is Tax Burden In Economics

https://i.ytimg.com/vi/1-8O5AHIb6s/maxresdefault.jpg

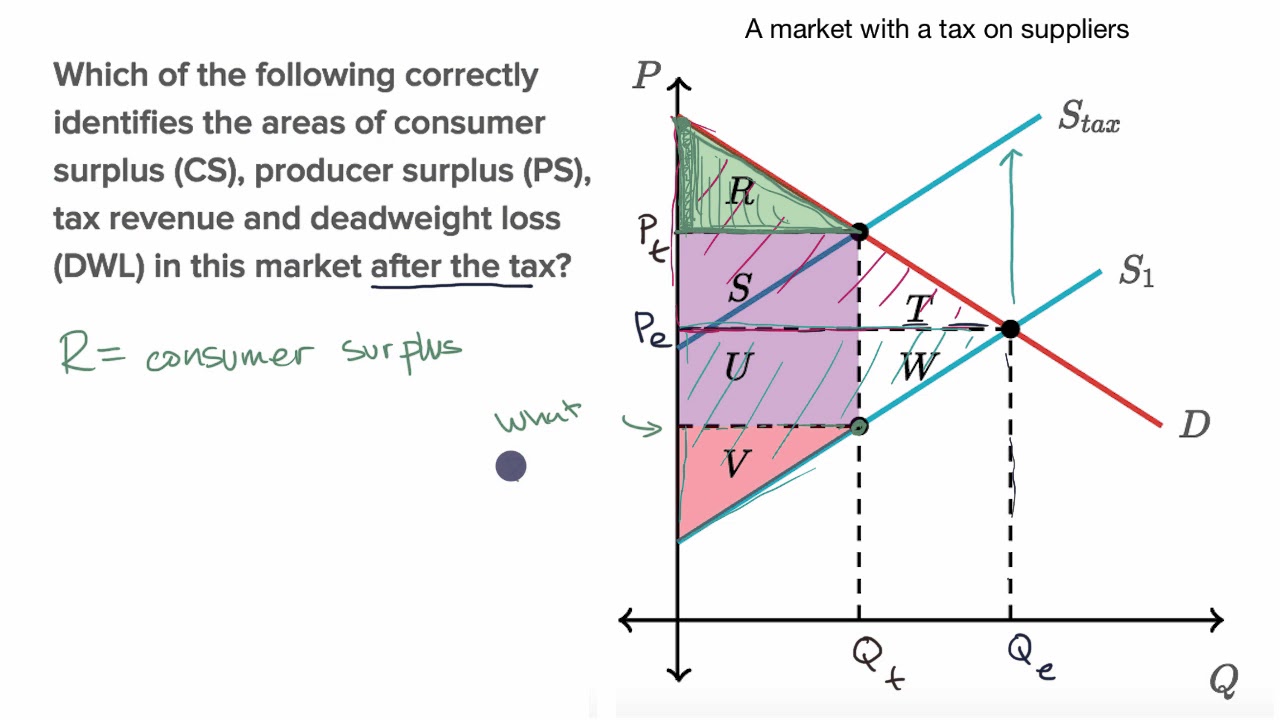

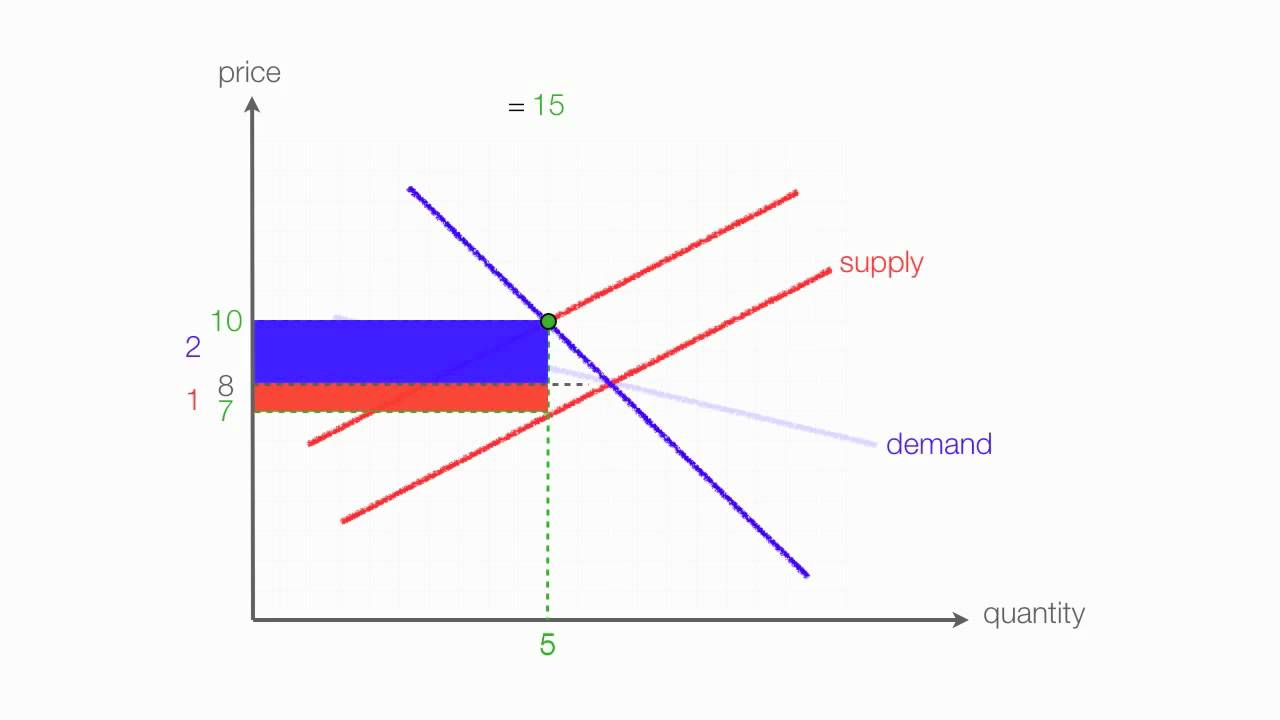

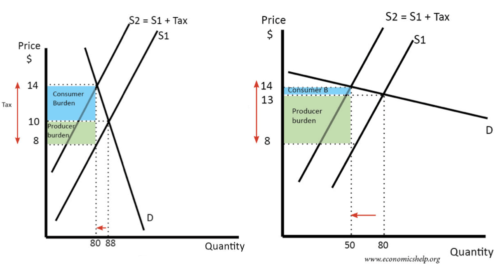

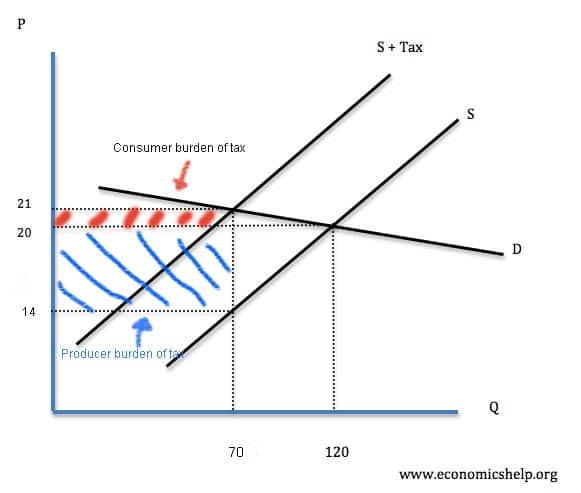

How To Calculate Excise Tax And Determine Who Bears The Burden Of The

https://i.ytimg.com/vi/UlWCAdp6sys/maxresdefault.jpg

The Burden Of The Tax On Buyers Is YouTube

https://i.ytimg.com/vi/uDLfidTDom4/maxresdefault.jpg

Who should file a tax return how to get ready for taxes filing and payment due dates reporting your income and claiming deductions and how to make a payment or check the status of your How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund or

The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

More picture related to What Is Tax Burden In Economics

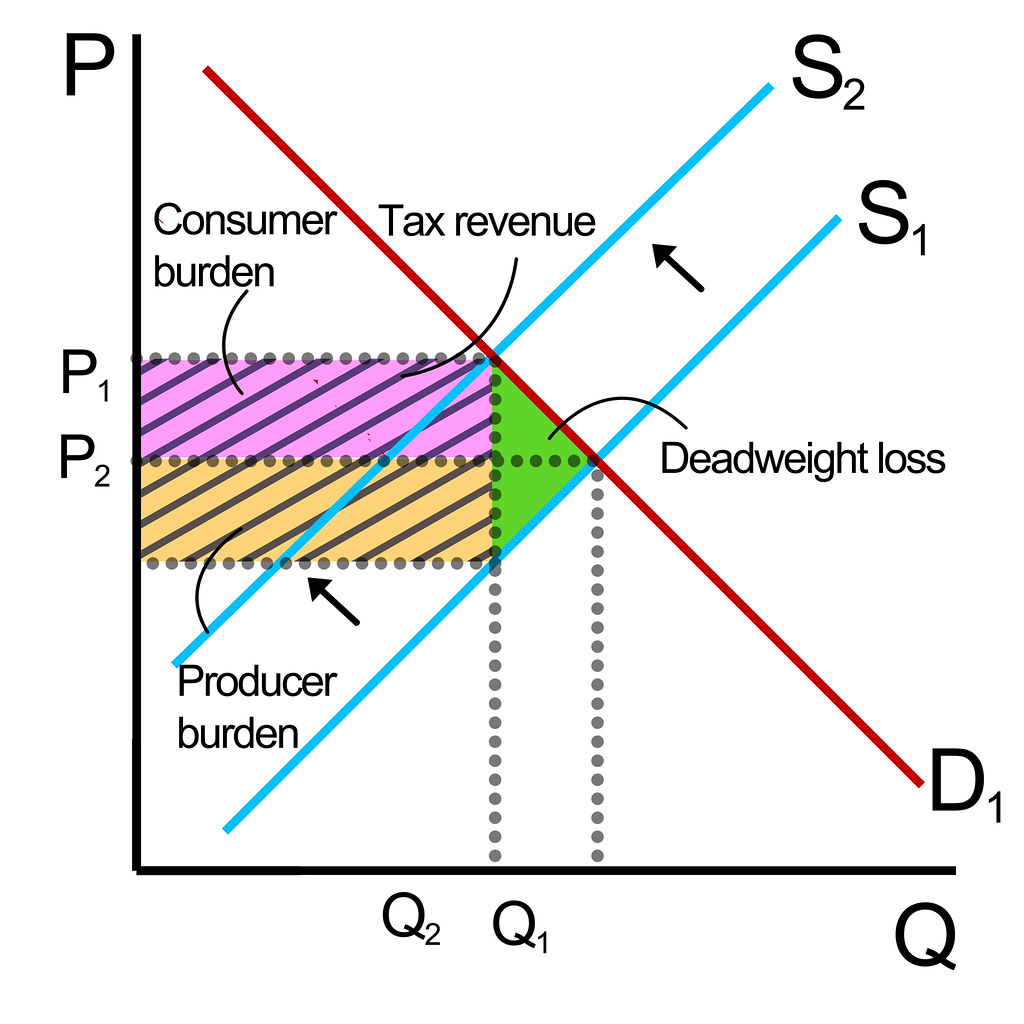

Economics Graph tax burden Marika Shimomura Flickr

https://c1.staticflickr.com/9/8325/8366845931_553fba2502_b.jpg

curve Economics Help

https://www.economicshelp.org/wp-content/uploads/2012/11/tax-depends-elasticity.png

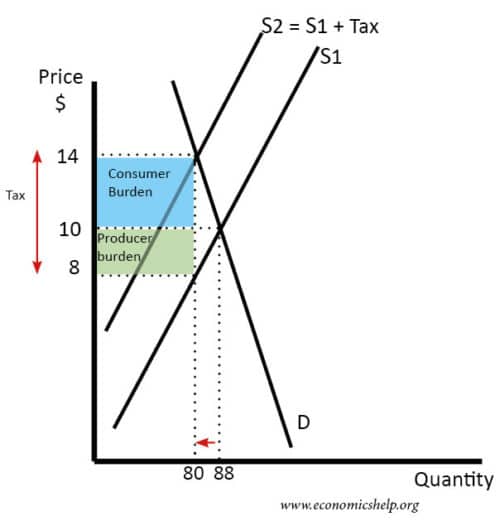

Specific Tax Economics Help

https://www.economicshelp.org/wp-content/uploads/2008/05/tax-on-inelastic-demand-500x521.jpg

Personal income tax Ways to do your taxes The Digital File My Return service is no longer available To file your tax return select one of the options listed below Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

[desc-10] [desc-11]

Indirect Taxes Economics Help

https://www.economicshelp.org/wp-content/uploads/2012/11/tax-depends-elasticity-500x267.png

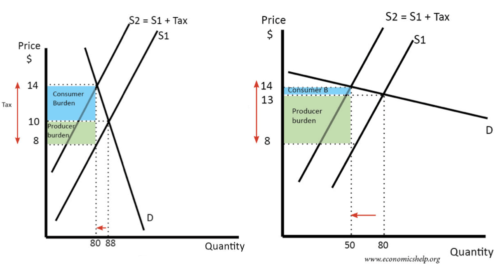

Tax Incidence Economics Help

https://www.economicshelp.org/wp-content/uploads/2014/12/producer-burder-consumer-burden-2.jpg

https://www.canada.ca › en › revenue-agency › services › e-services › cr…

When you are on your Sign In Partner s website ensure it is your information that is entered and not that of somebody else If you register with someone else s banking credentials by mistake

https://www.canada.ca › en › services › taxes › income-tax

Income tax Personal business corporation trust international and non resident income tax

Tax Burden Meaning Formula Calculation Example

Indirect Taxes Economics Help

GOV Intervention

Tax Incidence Meaning Formula Graph Example

Tax Incidence Macroeconomics

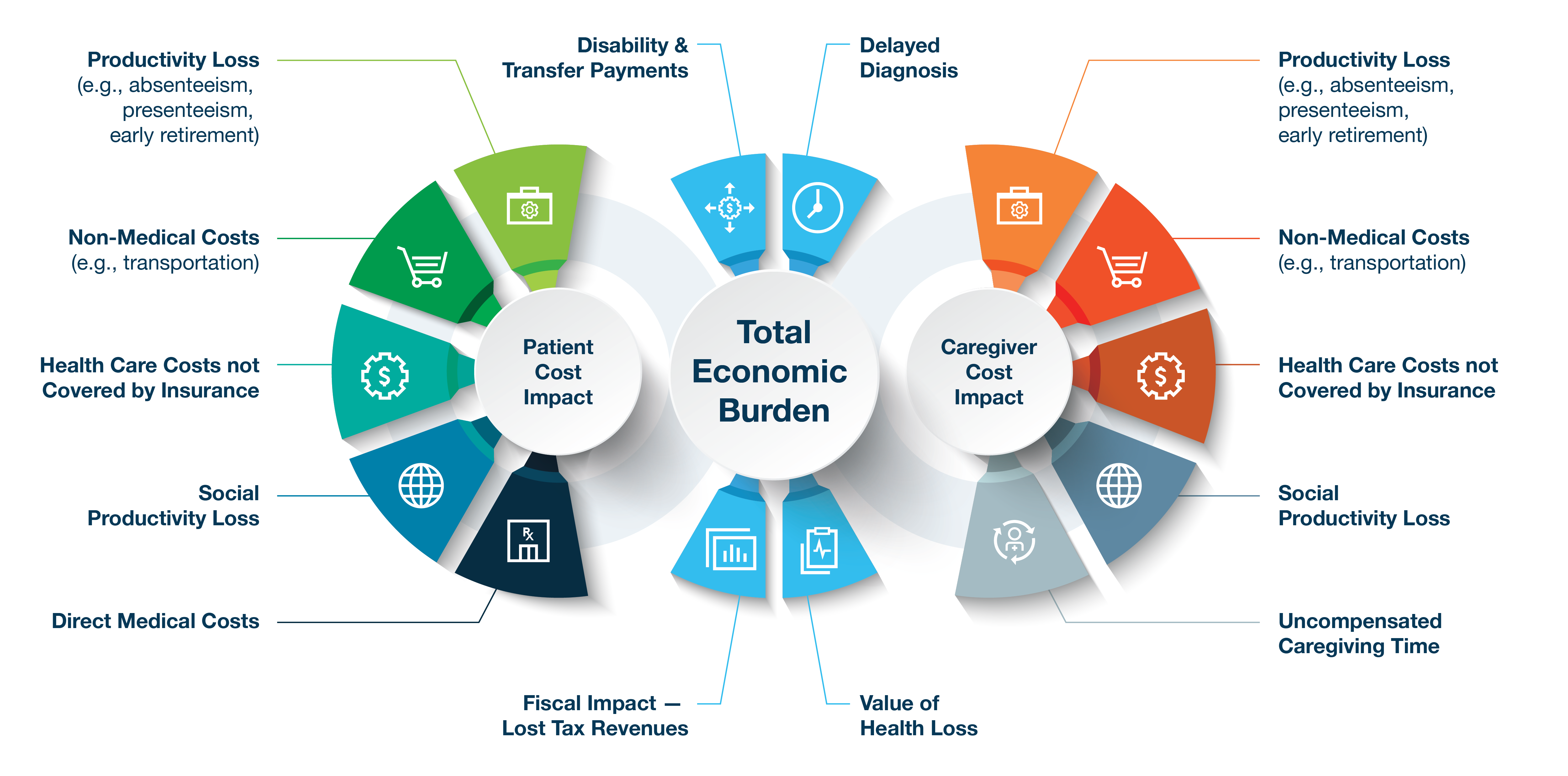

Burden Of A Tax Economic Vs Legal Incidence Atlas Of Public Management

Burden Of A Tax Economic Vs Legal Incidence Atlas Of Public Management

How To Calculate Tax Incidence

Assessing The Total Economic Burden Of Rare Disease Avalere

No Fim Das Contas Quem Paga O Imposto Fundo Versa

What Is Tax Burden In Economics - How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund or