What Is Tax Form 8889 Used For Income tax Personal business corporation trust international and non resident income tax

Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services The Government of Canada sets the federal income tax rates for individuals Each province and territory determines their own income tax rates Provincial or territorial income tax rates apply

What Is Tax Form 8889 Used For

What Is Tax Form 8889 Used For

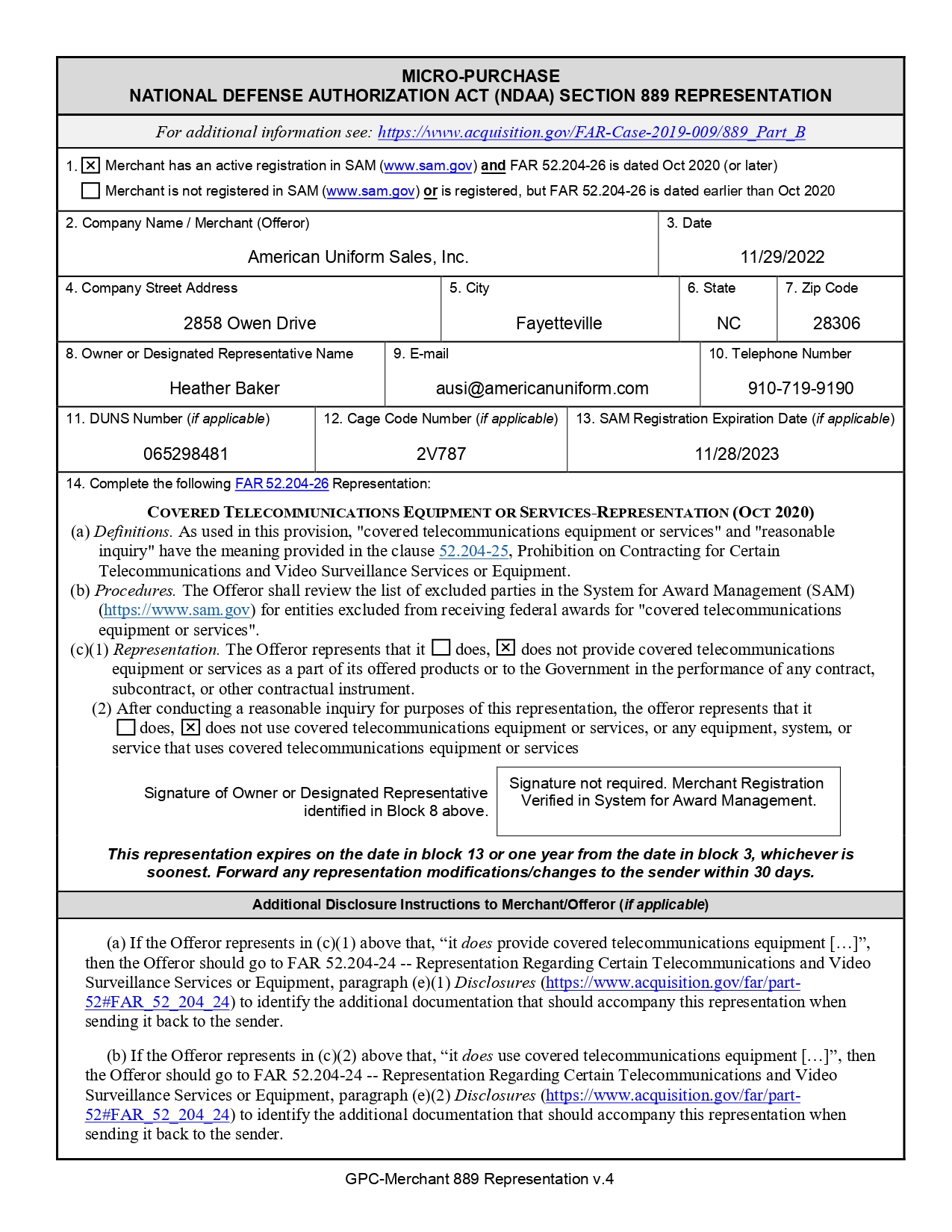

https://imagedelivery.net/Qd8b2GDHhuvG49jL2LdYLQ/e88dcda2-53e3-4f2c-1e96-683c79c39400/5x?width=1600

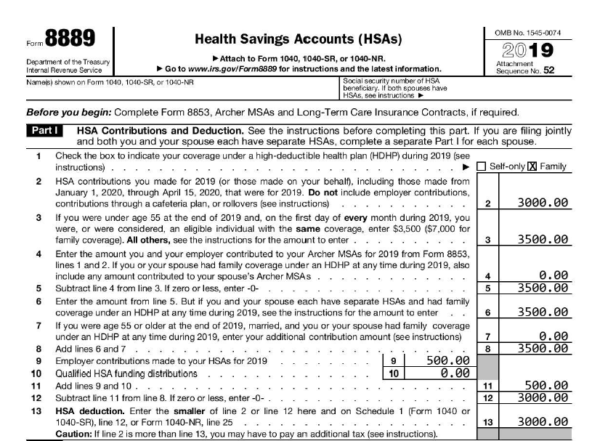

2019 HSA Form 8889 How To And Examples HSA Edge ReportForm

https://www.reportform.net/wp-content/uploads/2023/08/2019-hsa-form-8889-how-to-and-examples-hsa-edge.png

Form Fillable V5 Character Sheet Printable Forms Free Online

https://cdn11.bigcommerce.com/s-wxna2g66j4/images/stencil/original/image-manager/form-889-1-new.jpg

Information on taxes including filing taxes and get tax information for individuals businesses charities and trusts Income tax The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown

When using certified tax software the Auto fill my return service automatically fills in parts of your income tax and benefit return with information that the CRA has available at Who should file a tax return how to get ready for taxes filing and payment due dates reporting your income and claiming deductions and how to make a payment or check the status of your

More picture related to What Is Tax Form 8889 Used For

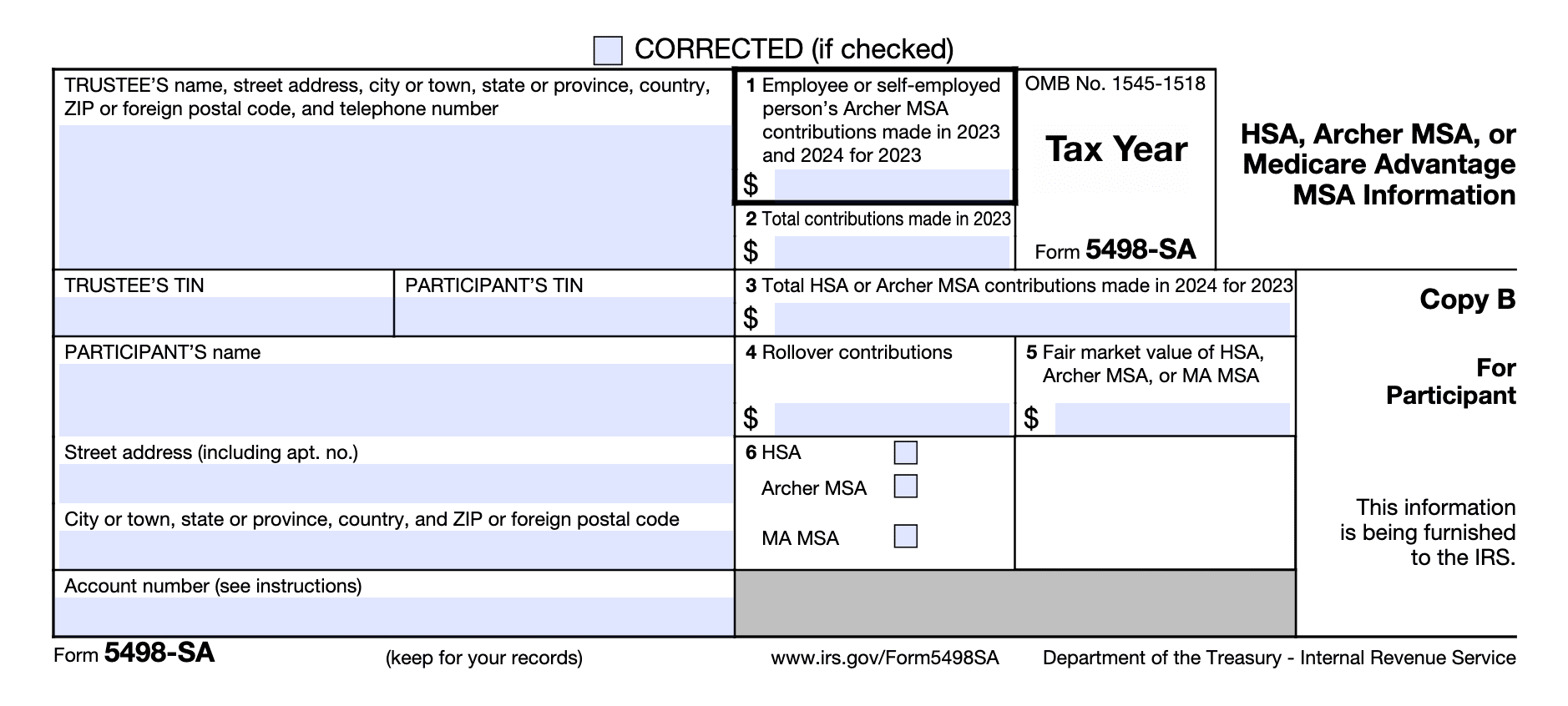

How Much Can You Put Into An Hsa In 2024 Tonye Rachael

https://www.efile.com/image/hsa-contributions-form-5498-sa.png

IRS Schedule B Instructions Interest And Ordinary Dividends

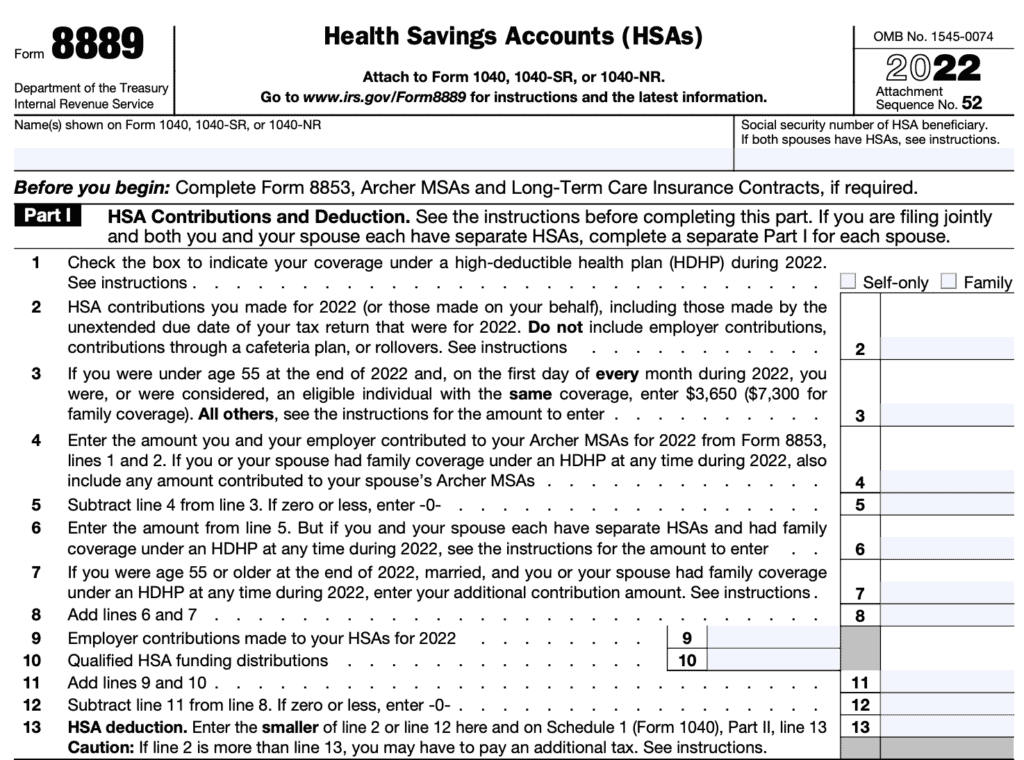

https://www.teachmepersonalfinance.com/wp-content/uploads/2022/12/irs_form_8889_featured_image-2048x1152.png

IRS Form 8889 Instructions A Guide To Health Savings Accounts

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/03/irs_form_8889_part_i-1024x760.png

Filing an income tax and benefit return might not be the highlight of your year but it allows you to receive any benefit and credit payments you re entitled to and you may even get Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

[desc-10] [desc-11]

IRS Form 8853 Instructions A Guide To Archer MSAs

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/01/irs_form_8853_featured_image.png

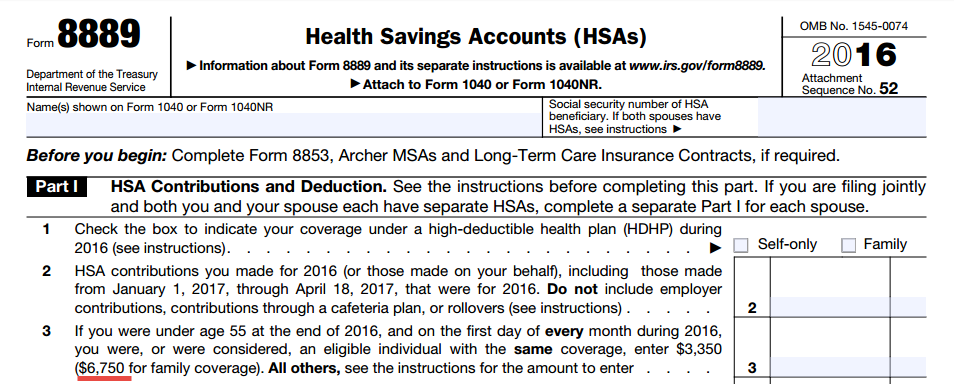

2016 HSA Form 8889 Instructions And Example HSA Edge

https://hsaedge.com/wp-content/uploads/2017/01/2016_form_8889_family_contribution_amount.png

https://www.canada.ca › en › services › taxes › income-tax

Income tax Personal business corporation trust international and non resident income tax

https://www.canada.ca › en › revenue-agency › services › e-services › cr…

Sign in or register for My Account My Business Account or Represent a Client with the CRA and get help with using the CRA sign in services

2019 HSA Form 8889 How To And Examples HSA Edge

IRS Form 8853 Instructions A Guide To Archer MSAs

[img_title-10]

[img_title-11]

[img_title-12]

[img_title-13]

[img_title-13]

[img_title-14]

[img_title-15]

[img_title-16]

What Is Tax Form 8889 Used For - Who should file a tax return how to get ready for taxes filing and payment due dates reporting your income and claiming deductions and how to make a payment or check the status of your