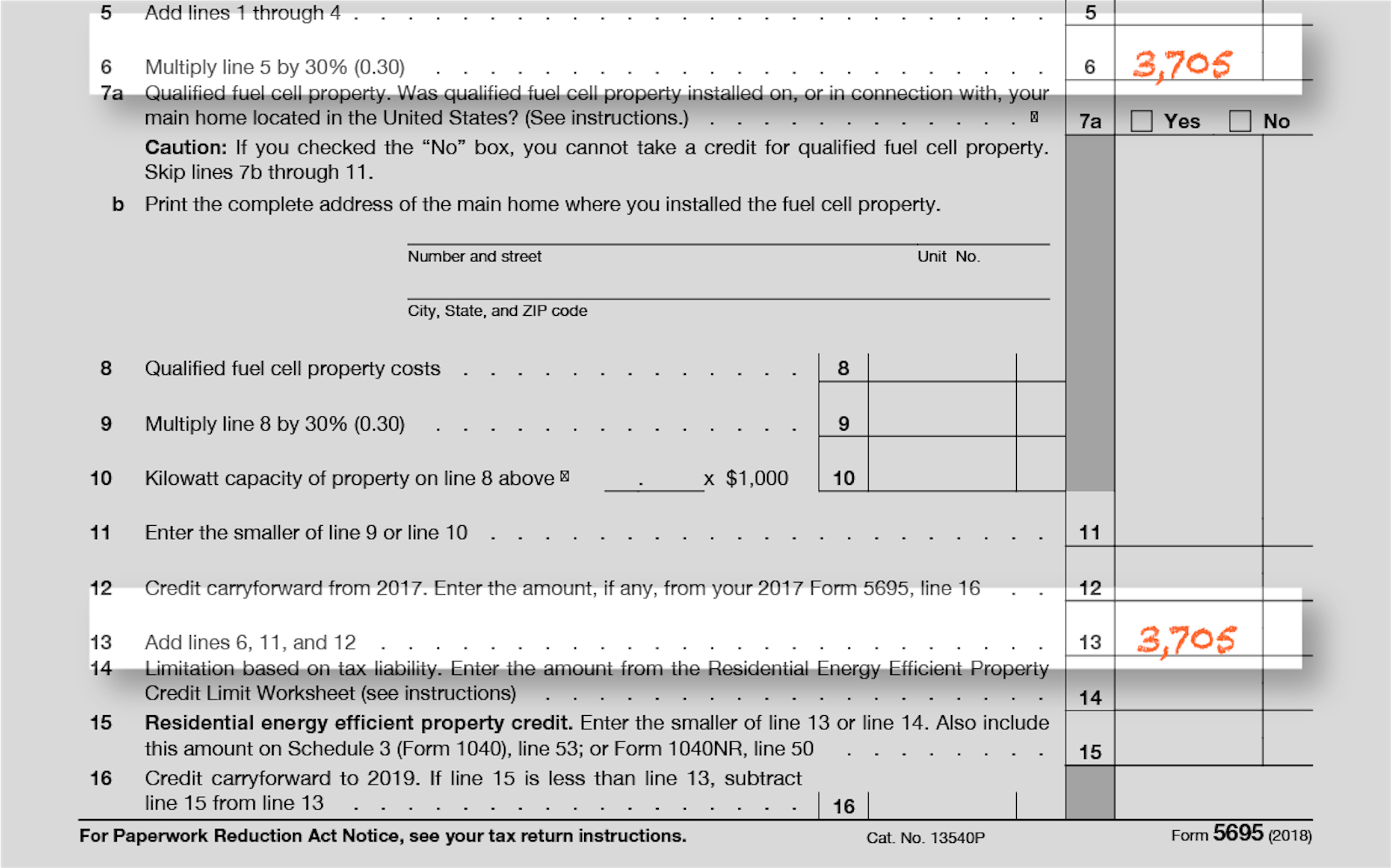

What Is The Limit For Form 5695 Residential Energy Credits Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy

For the energy efficient home improvement credit the lifetime limitation has been replaced by an annual credit limit A 30 credit up to a maximum of 1 200 may be allowed for Home Residential clean energy credit limits The residential clean energy credit is 30 of the total expenditure costs for a qualified project The Inflation Reduction Act extended this

What Is The Limit For Form 5695 Residential Energy Credits

What Is The Limit For Form 5695 Residential Energy Credits

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

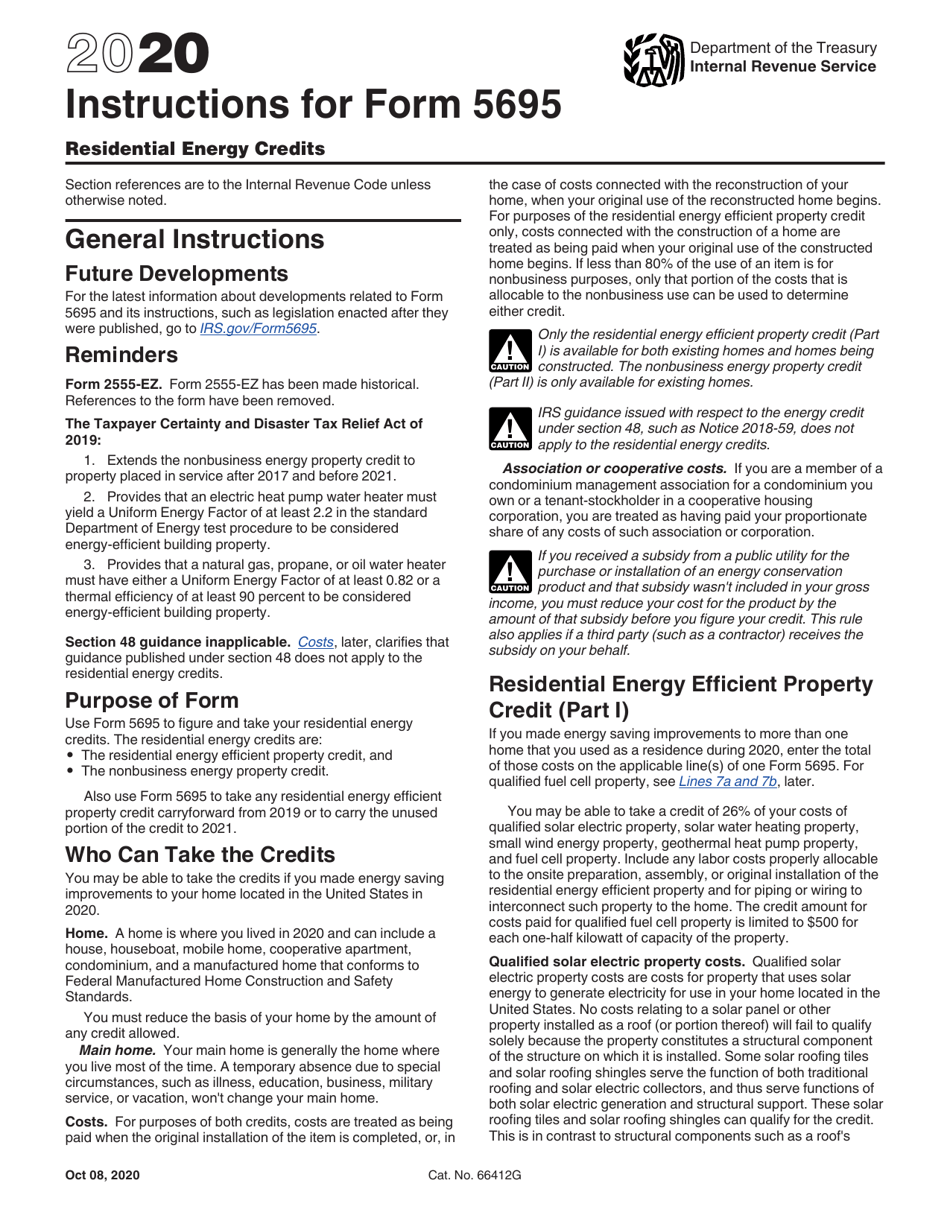

Lifetime Limitation Worksheet Instructions

https://everlightsolar.com/wp-content/uploads/2020/11/Everlight-Solar-Form-5695-5.jpg

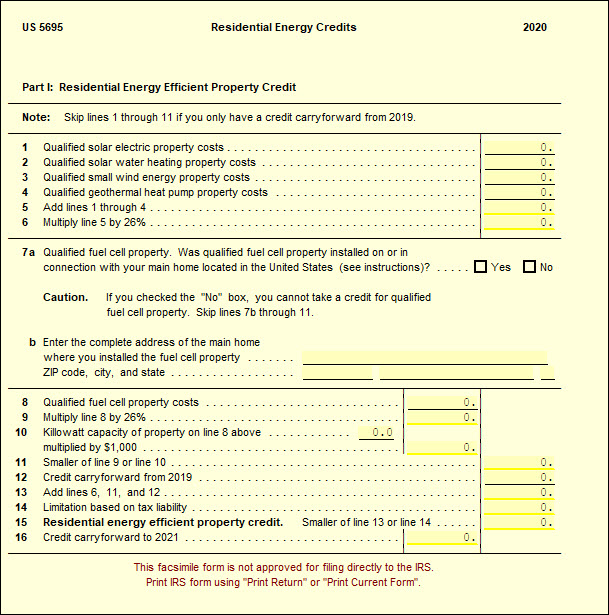

5695 Residential Energy Credits UltimateTax Solution Center

https://support.ultimatetax.com/hc/article_attachments/4406296967703/2021-08-10_13-20-44.jpg

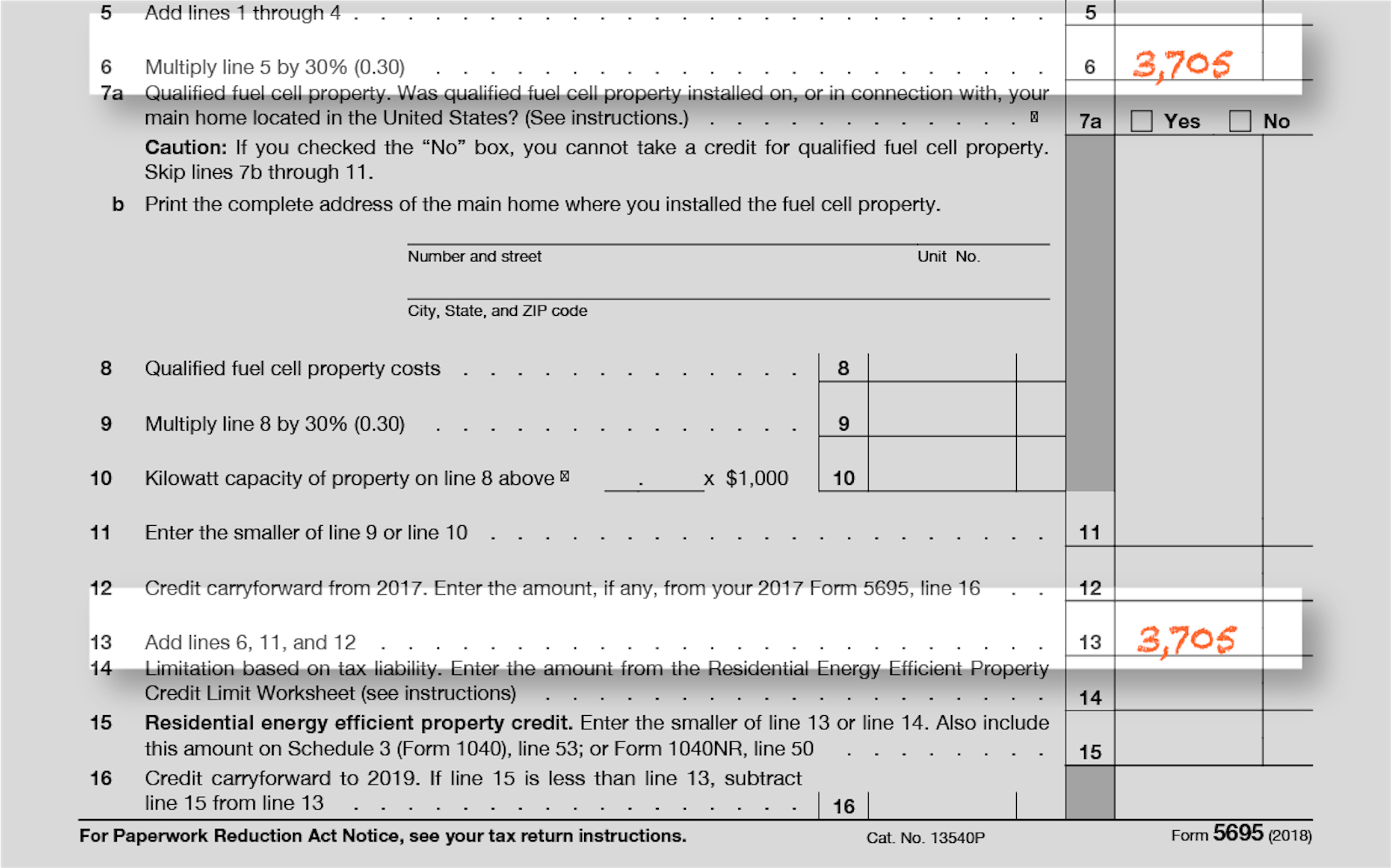

The Residential Clean Energy Credit Limit Worksheet Form 5695 helps calculate the maximum credit amount you can claim based on the type of property and costs The credit No the residential energy credits on Form 5695 are exclusively for primary residences or second homes and generally do not apply to rental properties However there is

A 1 200 aggregate yearly credit limit applies across any combination of building envelope components home energy audits and residential energy property For details on qualified Form 5695 allows you to claim two main residential energy credits the Residential Energy Efficient Property Credit for solar wind and geothermal systems and the

More picture related to What Is The Limit For Form 5695 Residential Energy Credits

Lifetime Limitation Worksheet 2021

https://images.unboundsolar.com/media/5695-line-6.png?auto=compress%2Cformat&fit=scale&h=582&ixlib=php-3.3.0&q=45&w=1024&wpsize=large&s=fbfd88192467a8403e174915202d4de5

Quick Guide To IRS Form 5695 For 2024

https://static.wixstatic.com/media/1ecde3_90e82b2f98ad48f88c2613214ef1e71e~mv2.jpeg/v1/fill/w_1000,h_525,al_c,q_85,usm_0.66_1.00_0.01/1ecde3_90e82b2f98ad48f88c2613214ef1e71e~mv2.jpeg

2025 Tax Credits For Eva Lydia Hope

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/03/irs_form_5695_featured_image.png

The Nonbusiness Energy Property credit can reduce your tax bill for some of the costs you incur to make energy efficient improvements to your home with a maximum total The maximum credit for residential energy property costs is 50 for any advanced main air circulating fan 150 for any qualified natural gas propane or oil furnace or hot water boiler

[desc-10] [desc-11]

Instructions For Filling Out IRS Form 5695 Everlight Solar

https://everlightsolar.com/wp-content/uploads/2020/10/AdobeStock_302996690-1.jpg

5695 Form 2025 Ruby Sanaa

https://s3.amazonaws.com/solarassets/wp-content/uploads/solar-form-5695.png

https://www.irs.gov › forms-pubs

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness energy

https://www.irs.gov › pub › irs-pdf

For the energy efficient home improvement credit the lifetime limitation has been replaced by an annual credit limit A 30 credit up to a maximum of 1 200 may be allowed for Home

Puget Sound Solar LLC

Instructions For Filling Out IRS Form 5695 Everlight Solar

Lifetime Limitation Worksheet For Form 5695

Da Form 5695 Fillable Printable Forms Free Online

Residential Energy Credits 2024 Kelci Melinda

Irs Energy Tax Credits For 2024 Callie Koralle

Irs Energy Tax Credits For 2024 Callie Koralle

Form 5695 Claiming Residential Energy Credits Jackson Hewitt

Residential Energy Efficient Property Credit Limit Worksheet

Form 5695 Fill And Sign Printable Template Online US Legal Forms

What Is The Limit For Form 5695 Residential Energy Credits - The Residential Clean Energy Credit Limit Worksheet Form 5695 helps calculate the maximum credit amount you can claim based on the type of property and costs The credit