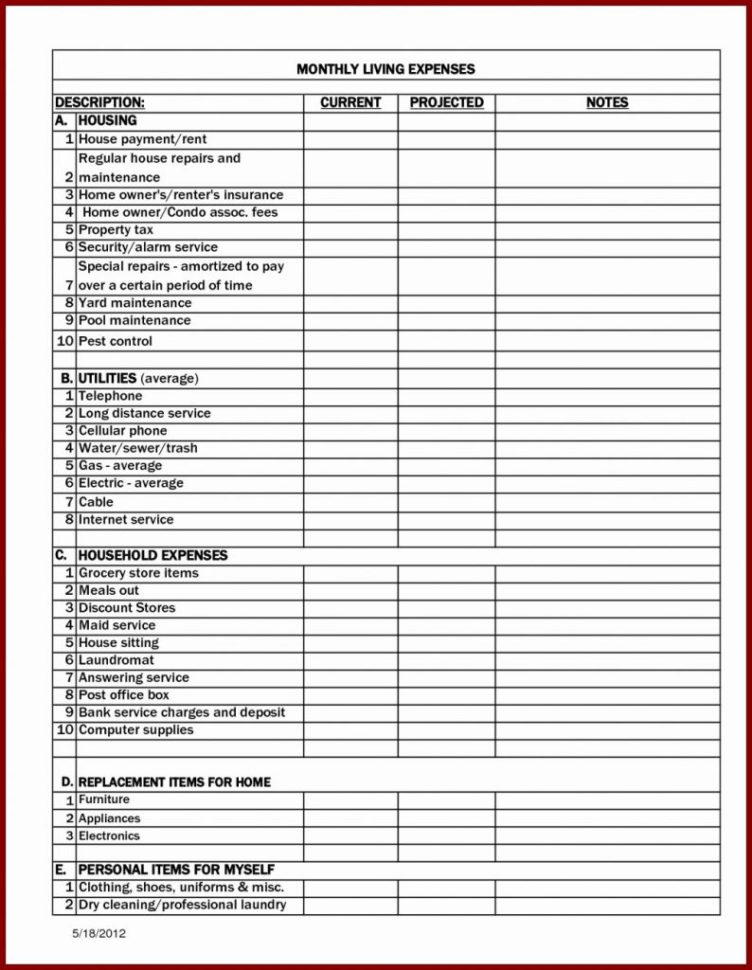

What Percentage Of Internet Can I Claim For Home Office 13 How do I determine my business use percentage for my home office For each of the partially deductible items you must determine the business use percentage of your home You can use

Internet expenses associated with your home office are deductible on the Utilities line of Form 8829 Expenses associated with an office in the home either are considered a direct expense or an indirect expense Direct To qualify for the home office deduction your home office must be your principal place of business used exclusively and regularly for administrative or management tasks As a result

What Percentage Of Internet Can I Claim For Home Office

What Percentage Of Internet Can I Claim For Home Office

https://www.typecalendar.com/wp-content/uploads/2023/03/Claim-Letter.jpg

TMT

https://tmt.com.sa/Uploads/Contents/Images/full_2023_08_28.14_21_03_8832.png

Percent Change Calculator Mashup Math

https://images.squarespace-cdn.com/content/v1/54905286e4b050812345644c/29cdac0f-142b-428d-8b26-b242647cb60b/Percent-Change-Banner.jpg

Roughly 37 of filers qualify How does the home office tax deduction work You can claim the deduction whether you re a homeowner or a renter and you can use the deduction for any type of However if you rent an office where the internet is used solely for business you can deduct 100 of your internet bill How to Write Off Internet on Taxes Self Employed

The cost of utilities and internet accounts Upkeep and repair costs Rental payments To claim the home office deduction retrieve Form 8829 Expenses for Business Use of You ll deduct your actual expenses based on Remote workers can deduct a portion of home expenses such as utilities internet and insurance based on the percentage of space used exclusively for business Costs of office equipment

More picture related to What Percentage Of Internet Can I Claim For Home Office

Letter Of Claim Template

https://templatelab.com/wp-content/uploads/2019/01/claim-letter-04-790x1022.jpg

Car Insurance Claim Letter Sample Master Of Template Document

https://lh6.googleusercontent.com/proxy/OK22hEckYLPeXAr8glY3y4nT4FKmgR2dRkWvWDxg8rd8fB3BM5E_H9ncXXdklLRPrmBsyz4vmIrQIb7vg7tl-CCbrz5t2q7jIFtA1EE=s0-d

Images Of Page 4 JapaneseClass jp

https://templatelab.com/wp-content/uploads/2019/01/claim-letter-13.jpg

If you re not taking the home office write off you ll need to report your internet deduction on Schedule C and attach it to your Form 1040 You can use Form 8829 to figure out allowable expenses on Schedule C Taxes are Utilities A portion of electricity heating and water bills can be deducted based on home office usage Internet and Phone Costs related to business communications may be partially

The home office deduction can provide significant tax savings for those working from home whether self employed or an employee Understanding the eligibility criteria expense Can I write off my Internet bill if I work from home If an Internet connection is necessary to make money for your business it is a direct expense and is deductible on your

Sharing Porn Links Or Else The Bored Room The Bore Site

https://cdn.statcdn.com/Infographic/images/normal/16959.jpeg

Us Population 2024 Live Updates Gelya Joletta

https://cdn.internetadvisor.com/2022/6/1655212263946-1._Number_of_People_Online_Worldwide_by_Year.png

https://www.irs.gov › pub › irs-regs

13 How do I determine my business use percentage for my home office For each of the partially deductible items you must determine the business use percentage of your home You can use

https://www.taxaudit.com › tax-audit-blog › …

Internet expenses associated with your home office are deductible on the Utilities line of Form 8829 Expenses associated with an office in the home either are considered a direct expense or an indirect expense Direct

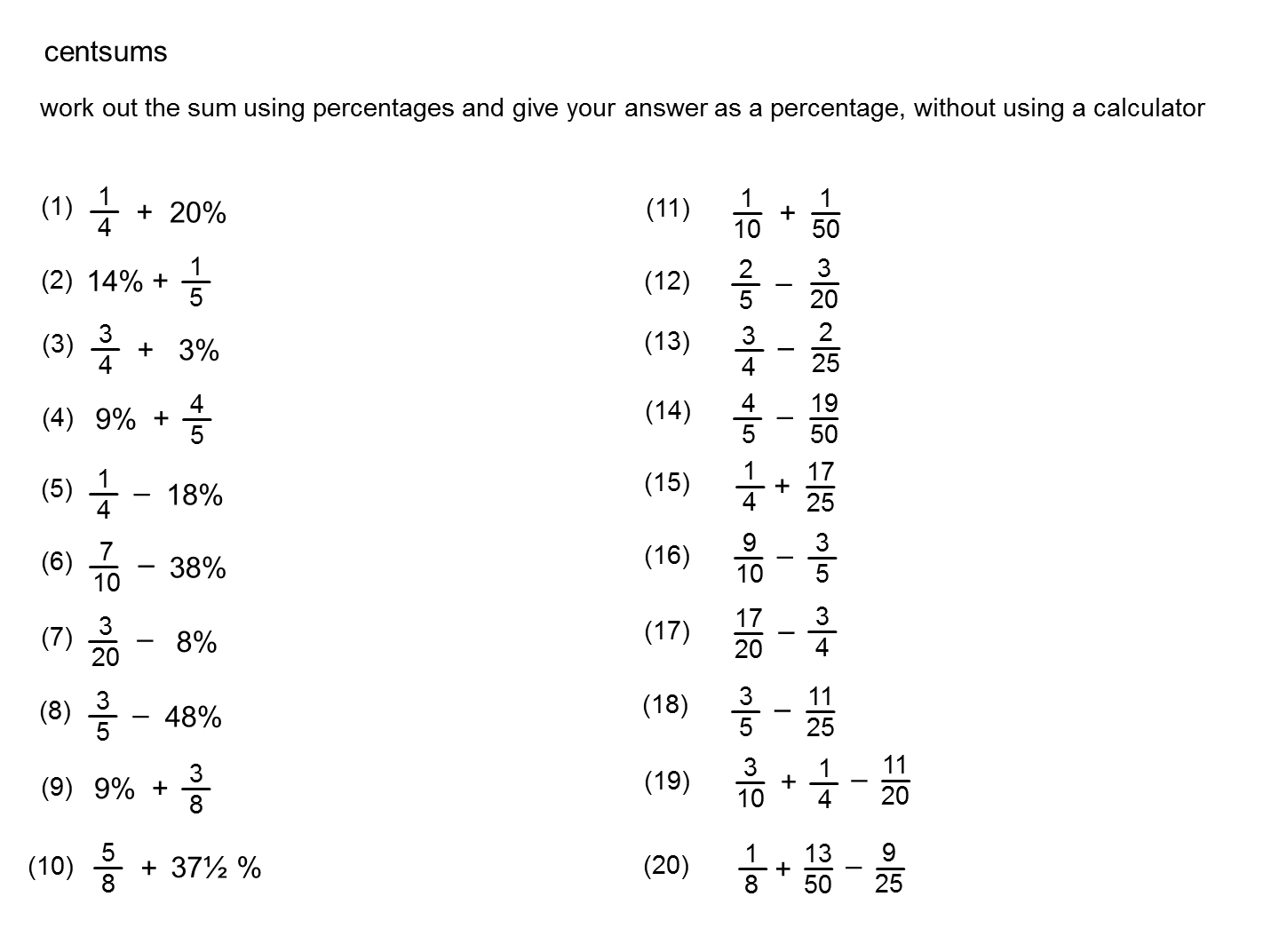

Changing Fractions To Percents

Sharing Porn Links Or Else The Bored Room The Bore Site

Dezinformace R realSlovakia

Investment Projection Spreadsheet Spreadsheet Downloa Investment

Percentage Questions For Class 6 Worksheets

-p-2000.png)

Understanding The Replacement Of Domestic Items Relief

-p-2000.png)

Understanding The Replacement Of Domestic Items Relief

Claim Evidence Reasoning Science Examples

1500 Health Insurance Claim Form Instructions ClaimForms

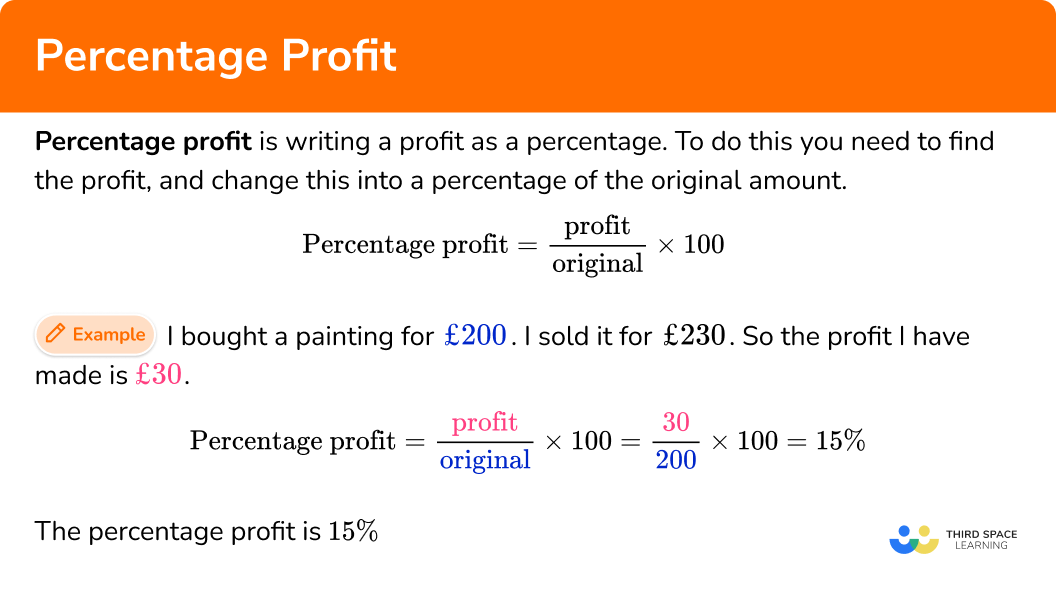

Percentage Profit GCSE Maths Steps Examples Worksheet

What Percentage Of Internet Can I Claim For Home Office - The cost of utilities and internet accounts Upkeep and repair costs Rental payments To claim the home office deduction retrieve Form 8829 Expenses for Business Use of You ll deduct your actual expenses based on