Will I Pay Taxes On My 401k When I Retire When you retire taxes will come due on any money you take out of your traditional 401 k account since it was put in pre tax Here s what you need to know

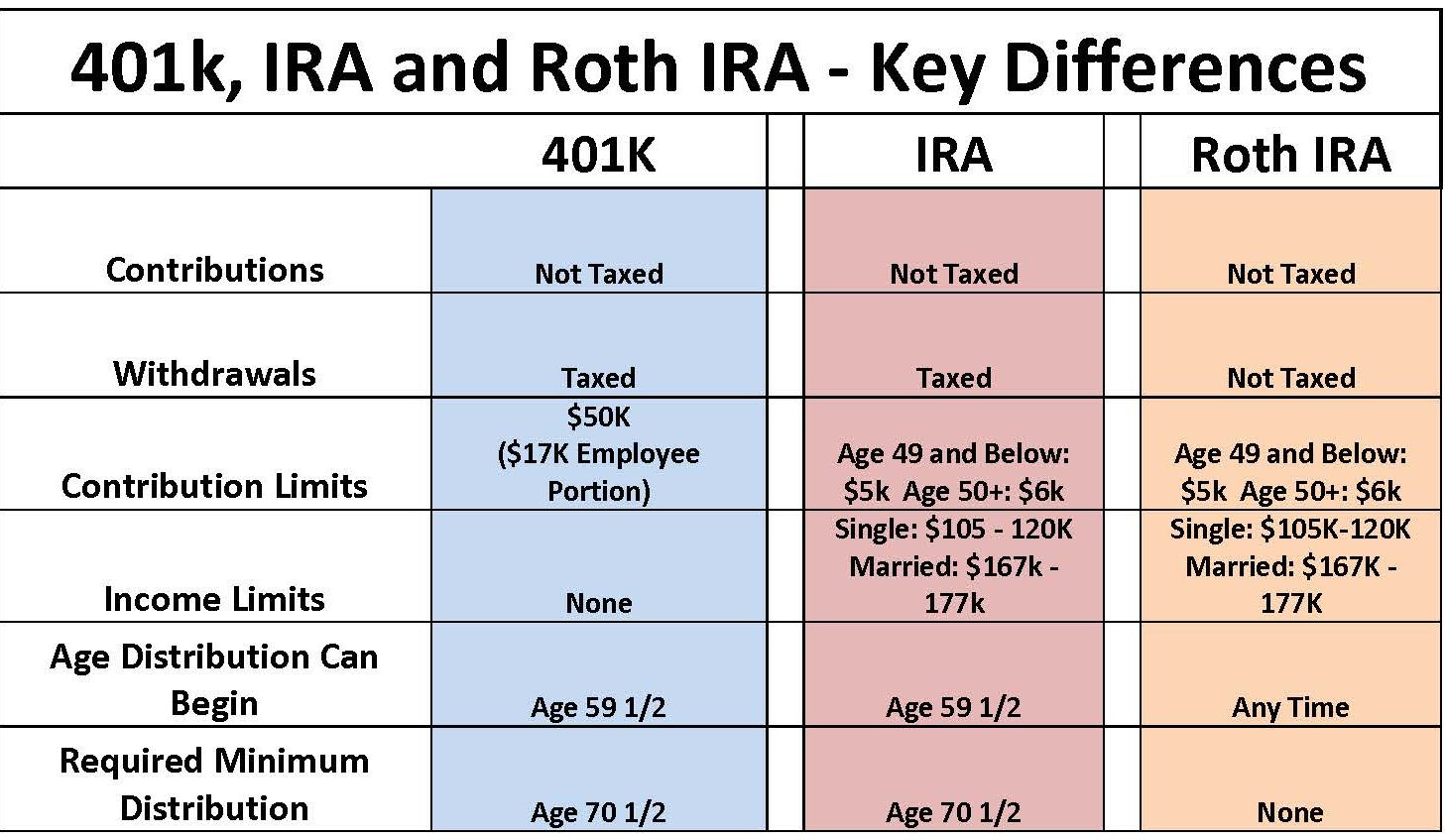

With a 401 k your contributions are excluded from your taxable income and your money can grow tax deferred you only pay income taxes once you start taking withdrawals Since you don t pay taxes on your contributions or your employer s contributions if you get a match your withdrawals will be taxed at your ordinary income tax rate in retirement You ll also have to pay taxes on any funds your employer contributed 401 k withdrawals are never tax free at any age

Will I Pay Taxes On My 401k When I Retire

Will I Pay Taxes On My 401k When I Retire

https://i.ytimg.com/vi/MjkX-veEUxI/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYNiBSKH8wDw==&rs=AOn4CLCWzAssoeZGqpSgYVf0tFmFLE8ycA

1099 Pension

https://www.solo401k.com/wp-content/uploads/Screen-Shot-2023-01-11-at-2.58.47-PM-1024x709.png

What Is A Roth 401 k Here s What You Need To Know TheSkimm

https://www.theskimm.com/_next/image?url=https://images.ctfassets.net/6g4gfm8wk7b6/6C2dwsIzDhqx0ZlHlJbPdm/8bfbea89445676b07e35a62db8c3c548/Roth_401k.png&w=3840&q=75

Because the money wasn t taxed when you contributed it you ll have to pay income tax on your distributions regardless of your age This is where some strategy comes in You can choose to take smaller withdrawals over a long period of time or group withdrawals into larger lump sums Contributing to a traditional 401 k could help reduce your taxable income now but in most cases you ll pay taxes when you withdraw the money in retirement

You ll most likely continue to pay taxes in retirement They re calculated on your retirement income each year as you receive it much like how it works before you retire Different tax rules can apply to each type of income you receive Understand how tax deferred 401 k plans work when you re taxed on withdrawals from your 401 k and how to avoid a tax penalty with your retirement savings

More picture related to Will I Pay Taxes On My 401k When I Retire

Do I HAVE To Pay Taxes On My 401K 457B When Withdraw

https://i.ytimg.com/vi/1uHbxT63zxU/oar2.jpg?sqp=-oaymwEkCJUDENAFSFqQAgHyq4qpAxMIARUAAAAAJQAAyEI9AICiQ3gB&rs=AOn4CLDJkR_A9bIFRkKDYCY15qfFdrQeBg

401k Limits 2025 Brandon J Soriano

https://www.annuity.org/wp-content/uploads/401k-employer-matching-768x609.jpg

401k Contribution Max 2025 Luna Faith

https://www.financialsamurai.com/wp-content/uploads/2018/11/401k-max-contribution-potential.png

You ll pay your 401 k taxes at retirement not before However separated plan participants with vested balances under 7 000 are subject to the plan s force out provisions if applicable Merely retiring doesn t count as a taxable event when it comes to the money in your 401 k plan All 401 k accounts are tax sheltered which means that you don t have to pay taxes while the money stays in the account

When you start making withdrawals from your 401 k in retirement you ll start paying taxes on your money with a few provisos Here are some basics to know before you set your 401 k distributions into motion Traditional 401 k s are tax deferred accounts which means the account is funded with pre tax dollars and you pay taxes on your distributions in retirement Alternately Roth 401 k s are funded with post tax money so you don t pay taxes on your distributions in retirement

401k Employer Match Limit 2024 Luise Robinia

https://sheetsforinvestors.com/wp-content/uploads/2021/06/401k-employer-matching.jpg

2024 401k Contribution Limit Employer Match Davita Anastassia

https://www.annuity.org/wp-content/uploads/401k-employer-matching.jpg

https://retirable.com › advice › retirement-accounts

When you retire taxes will come due on any money you take out of your traditional 401 k account since it was put in pre tax Here s what you need to know

https://www.forbes.com › advisor › retirement

With a 401 k your contributions are excluded from your taxable income and your money can grow tax deferred you only pay income taxes once you start taking withdrawals

Roth 401k 2024 Andra Blanche

401k Employer Match Limit 2024 Luise Robinia

Federal Tax Taken Out Of Paycheck 2024 Estel Janella

401 K Limits 2025 Over 50 William S Bell

401k Contribution Limits 2025 Employer Lachlan T Bindon

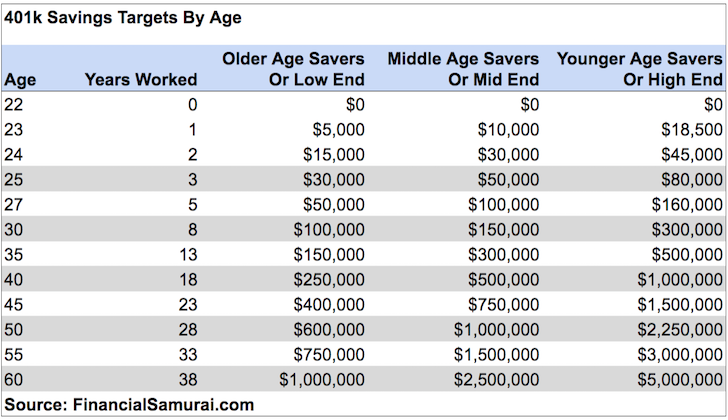

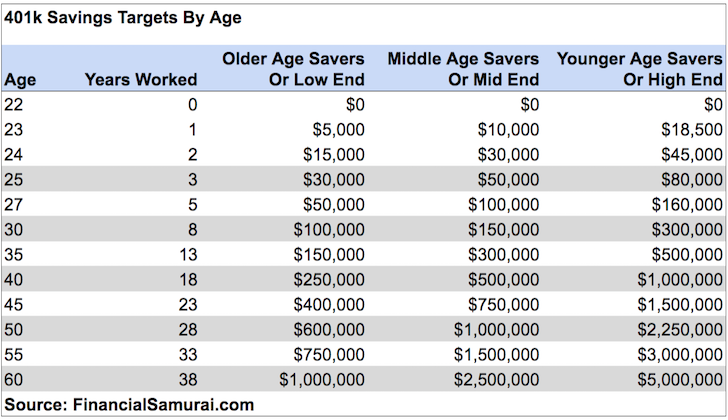

The Maximum 401k Contribution Limit Financial Samurai

The Maximum 401k Contribution Limit Financial Samurai

:max_bytes(150000):strip_icc()/when-you-haven-t-filed-tax-returns-in-a-few-years-3193355-c6f6b92413334c7284aecb6b2162b900.png)

When Do You File Taxes 2025 Usa Joseph B Johnson

401k Calculator Estimate Employer Match Growth Contributions 2024

Roth 401 k Or Traditional 401 k A Simple Guide

Will I Pay Taxes On My 401k When I Retire - Contributing to a traditional 401 k could help reduce your taxable income now but in most cases you ll pay taxes when you withdraw the money in retirement