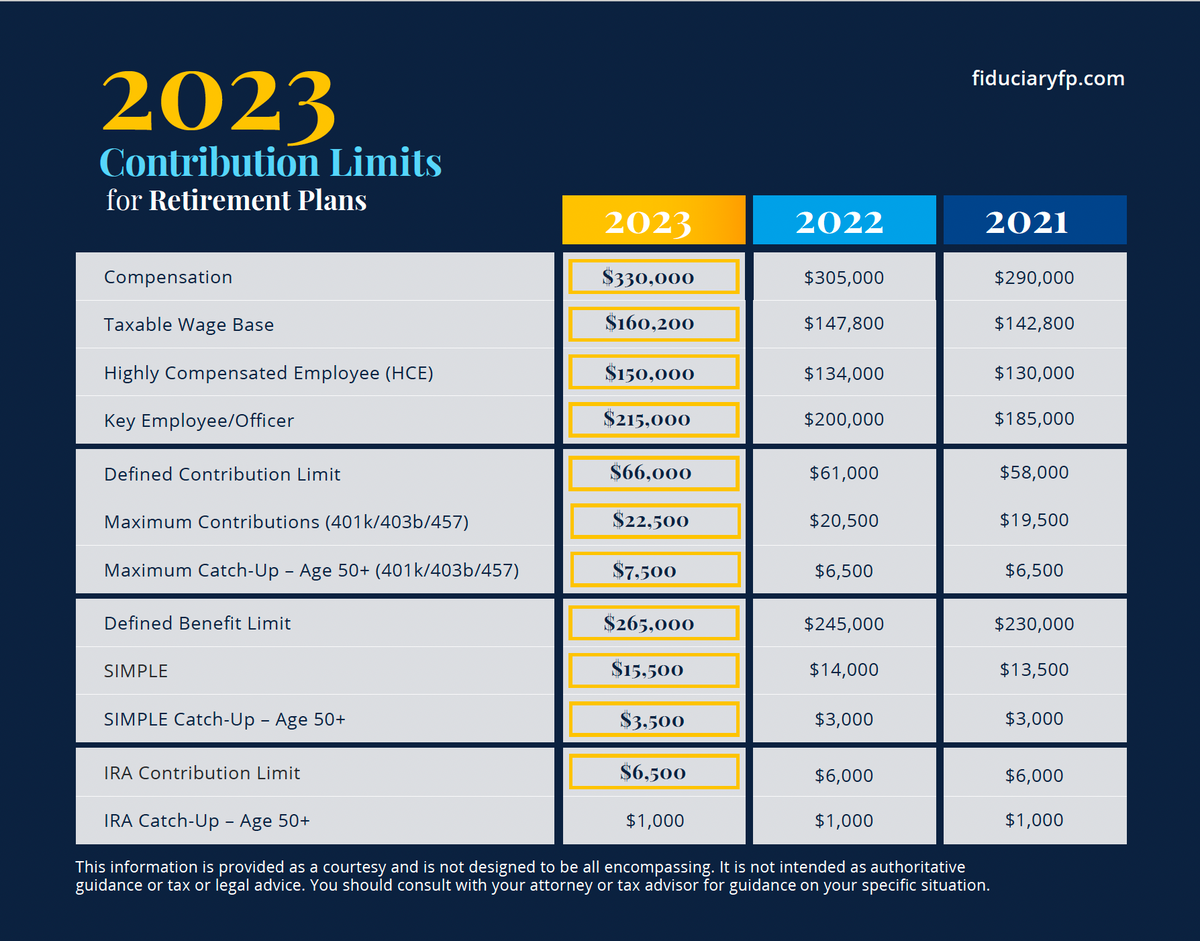

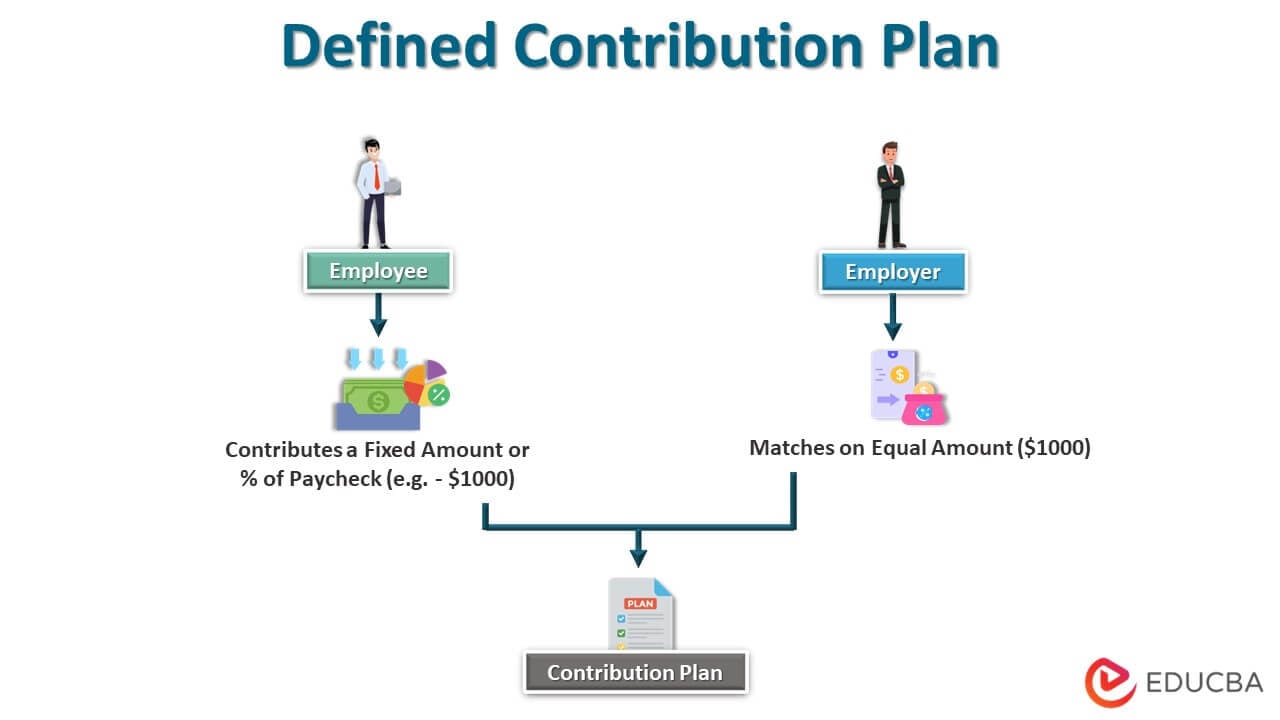

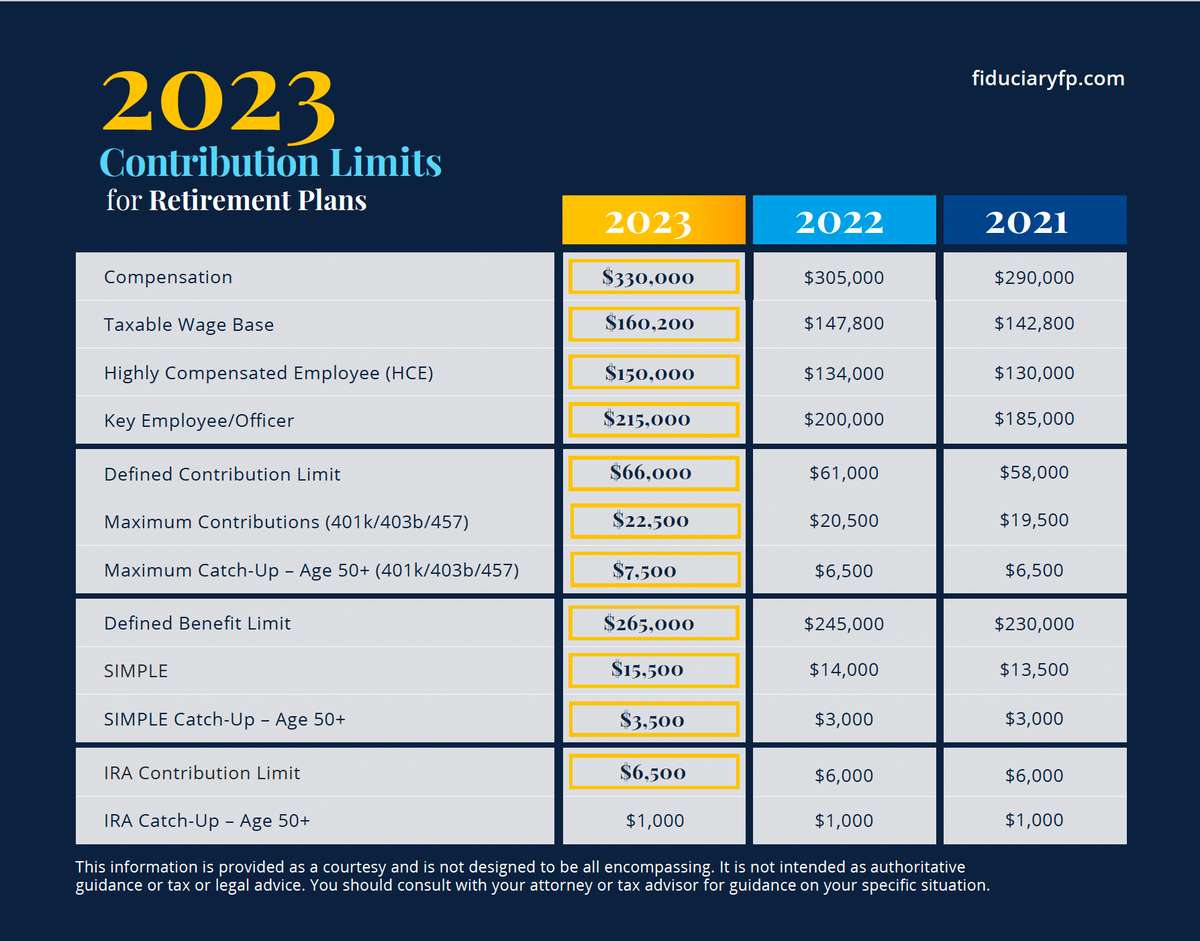

A 401k Plan Is A Defined Contribution Retirement Plan In the United States a 401 k plan is an employer sponsored defined contribution personal pension savings account as defined in subsection 401 k of the U S Internal Revenue

What is a 401 k Named for the tax code section that created it a 401 k is an employer sponsored retirement savings plan with special tax benefits The exact tax Learn how 401 k retirement plans work and get answers to questions on contribution limits distributions and more

A 401k Plan Is A Defined Contribution Retirement Plan

A 401k Plan Is A Defined Contribution Retirement Plan

https://www.investors.com/wp-content/uploads/2019/12/wFAP-contribution-122719.jpg

2024 Hce Compensation Limit Nevsa Adrianne

http://static.fmgsuite.com/media/ContentFMG/variantSize/3200b0a4-7611-4c9e-939d-926be2e79115.png

Hsa Contribution Limits For 2023 And 2024 Image To U

https://www.newfront.com/_next/image?url=https:%2F%2Fimages.ctfassets.net%2Fc3s9zap8g5rq%2Fn5UfnFbDw42W71il9suS0%2Fce4bcccb3d7e5ab3c97af5c6fba1d703%2F5eaebf24-2cce-43a7-b597-292edead893d_Screen_Shot_2023-05-23_at_9.49.27_AM.png%3Fw%3D1338&w=3840&q=75

A 401 k is a staple for many people s retirement planning so it s important to understand how they work Browse Investopedia s expert written library to learn more How do I invest my 401k money Your plan provider usually your employer offers a list of investment options such as stocks bonds and mutual funds You choose where to

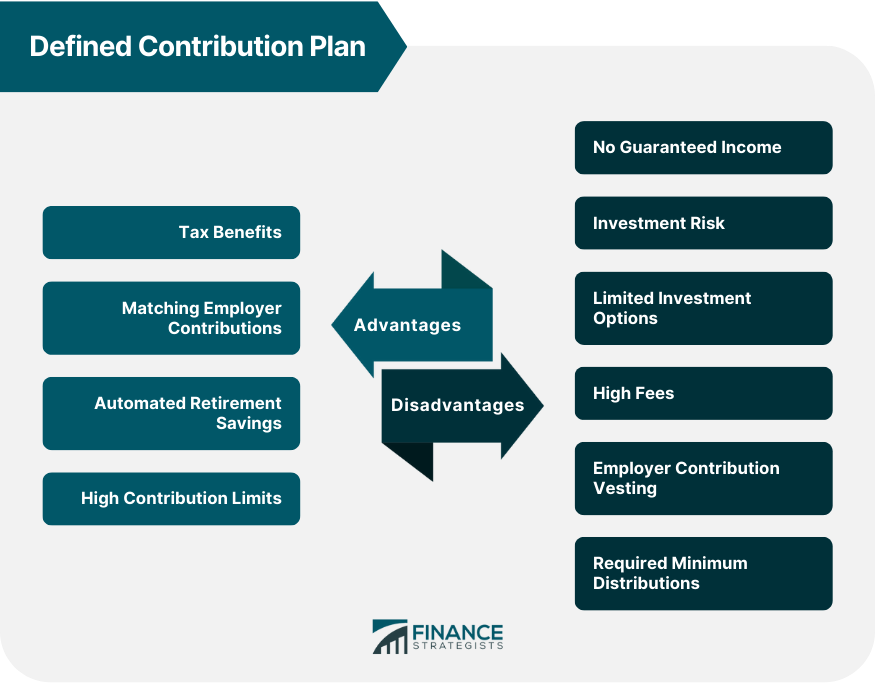

If you re working and saving for retirement educating yourself on how investing in a 401 k plan works and how it can help you build a sizable nest egg makes good financial sense The 401 k is one of the most popular retirement savings tools Many employers offer this type of plan helping their workers save for the future in a tax advantaged way If

More picture related to A 401k Plan Is A Defined Contribution Retirement Plan

401k 2025 Images References Clara Pacheco

https://insights.wjohnsonassociates.com/hubfs/Contribution Limits_BP_Blog_2023_11_1600x900_Over 50.png#keepProtocol

401k Limits 2025 Brandon J Soriano

https://www.annuity.org/wp-content/uploads/401k-employer-matching-768x609.jpg

Simple Plan 2024 Contribution Veda Allegra

https://cdn.educba.com/academy/wp-content/uploads/2021/03/Contribution-Plan.jpg

401 k s are popular retirement investment plans that have special tax incentives Learn the benefits variations and considerations for 401 k plans Any money you contribute to a Roth 401 k is post tax meaning you ll owe income taxes on the money upfront And then your funds will grow tax free until you withdraw

[desc-10] [desc-11]

Maximum Allowable 457 Contribution 2025 Olympics Martha A Radel

https://cdn.statically.io/img/www.401kinfoclub.com/f=auto/wp-content/uploads/retirement-plan-contribution-limits-will-increase-in-2020-ward-and.jpeg

Catch Up Contributions 2025 Ira Saki Vanlinden

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-07-2022-401k-IRA-Limits-1024x1024.png

https://en.wikipedia.org › wiki

In the United States a 401 k plan is an employer sponsored defined contribution personal pension savings account as defined in subsection 401 k of the U S Internal Revenue

https://www.fidelity.com › learning-center › smart-money

What is a 401 k Named for the tax code section that created it a 401 k is an employer sponsored retirement savings plan with special tax benefits The exact tax

Wa Pers Employer Contribution 2024 Josie Malorie

Maximum Allowable 457 Contribution 2025 Olympics Martha A Radel

2025 401k Limits Contributions Over 50 John E Anderson

Catch Up 2025 401k Ryker Steele

Retirement Max Contribution 2025 Thomas Marshall

401 K 2025 Contribution Limit Naomi A Bentley

401 K 2025 Contribution Limit Naomi A Bentley

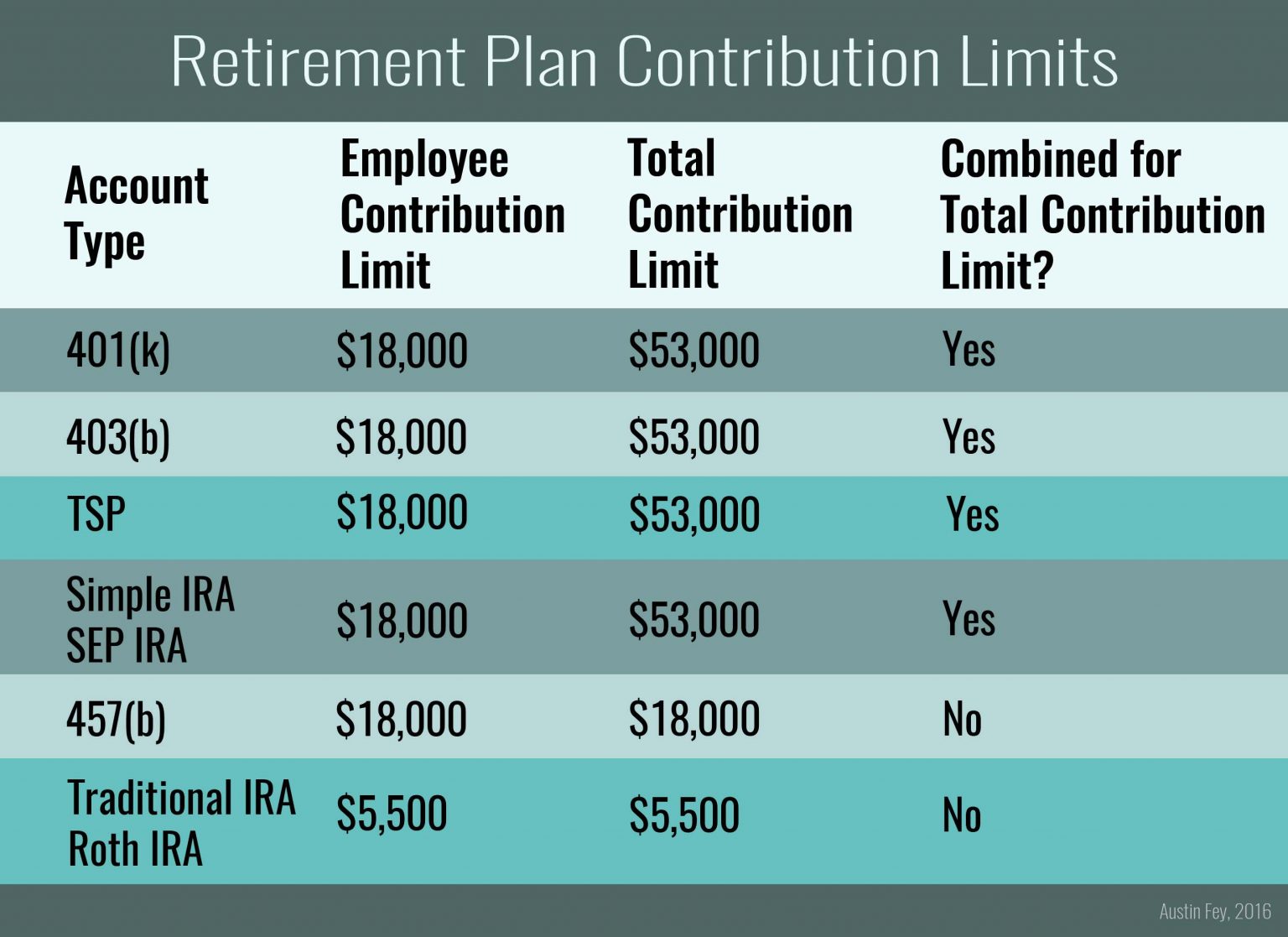

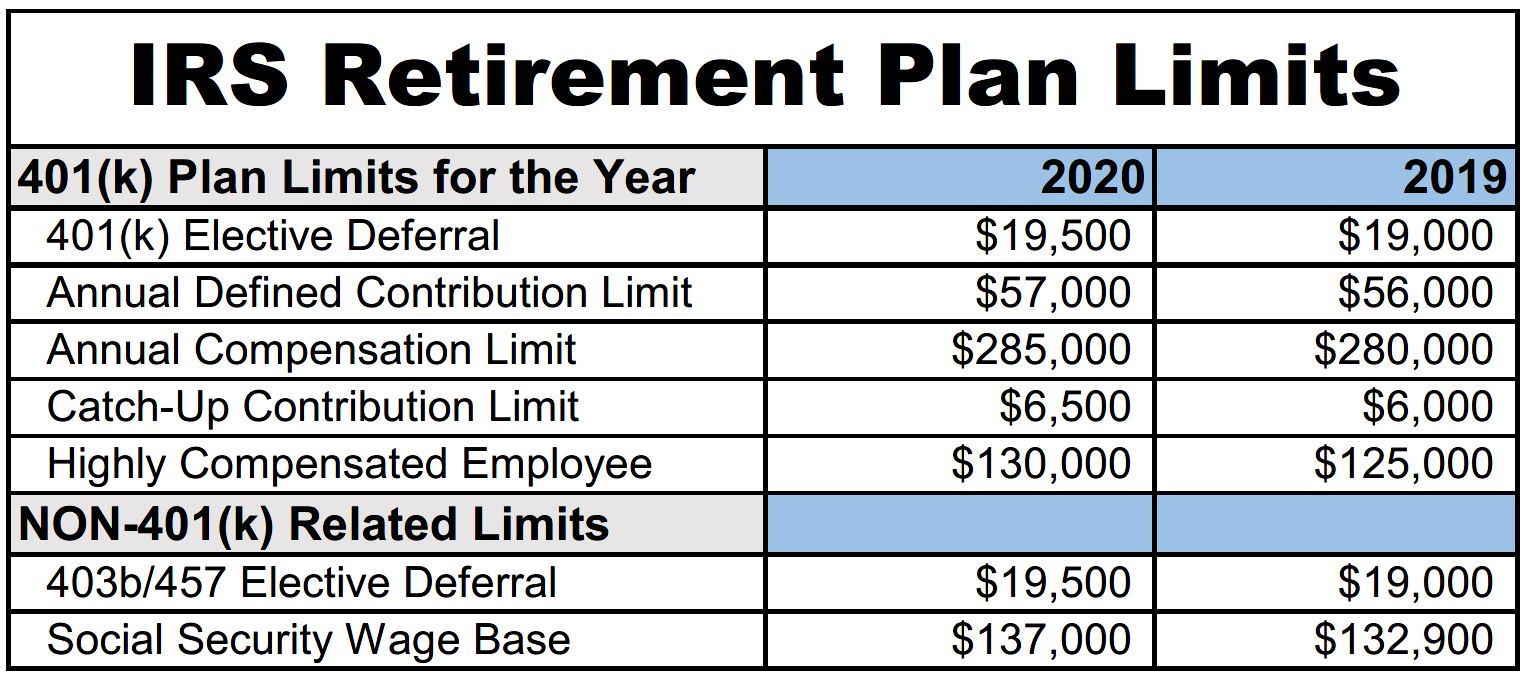

Retirement Plan Contribution Limits Will Increase In 2020 Global

2025 Roth 401k Contribution Limits Over 50 Ricki Chrissie

Max 401k Contribution 2024 Employer Match Limit Ethel Rozalie

A 401k Plan Is A Defined Contribution Retirement Plan - The 401 k is one of the most popular retirement savings tools Many employers offer this type of plan helping their workers save for the future in a tax advantaged way If