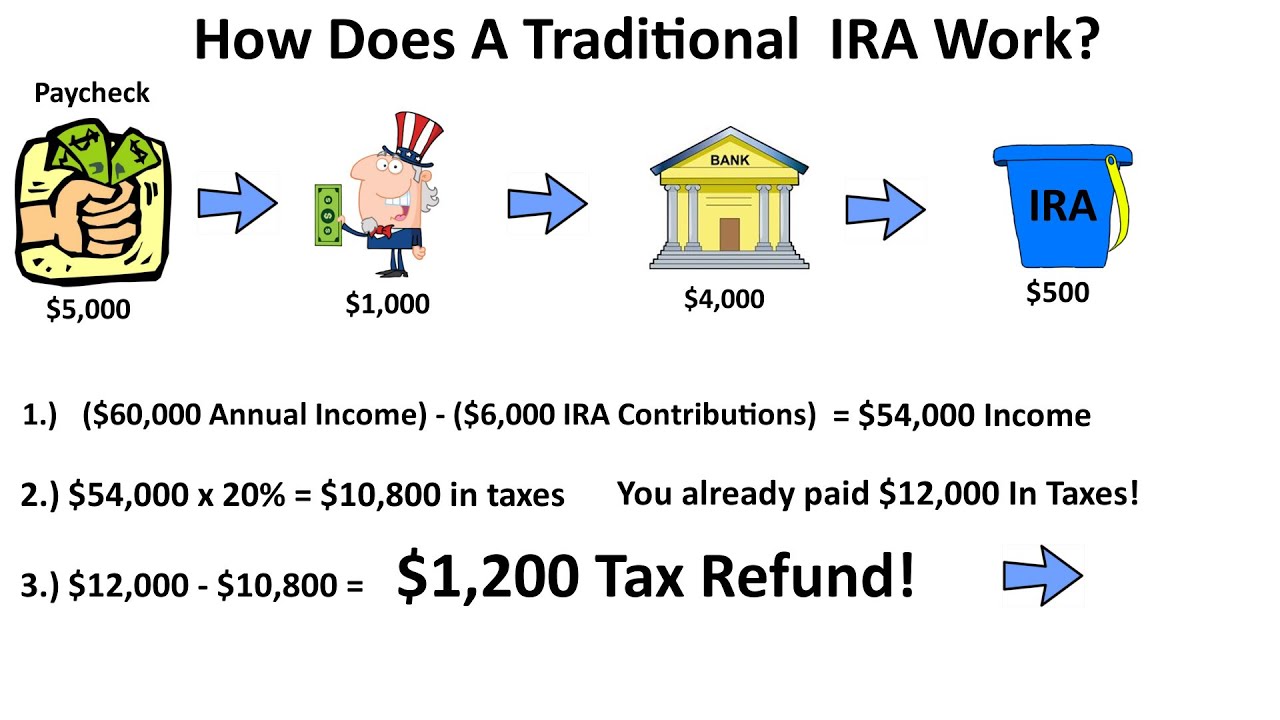

Are Simple Iras Subject To Erisa Simplified Employee Pension Plan SEP A plan in which the employer makes contributions on a tax favored basis to individual retirement accounts IRAs owned by the employees If

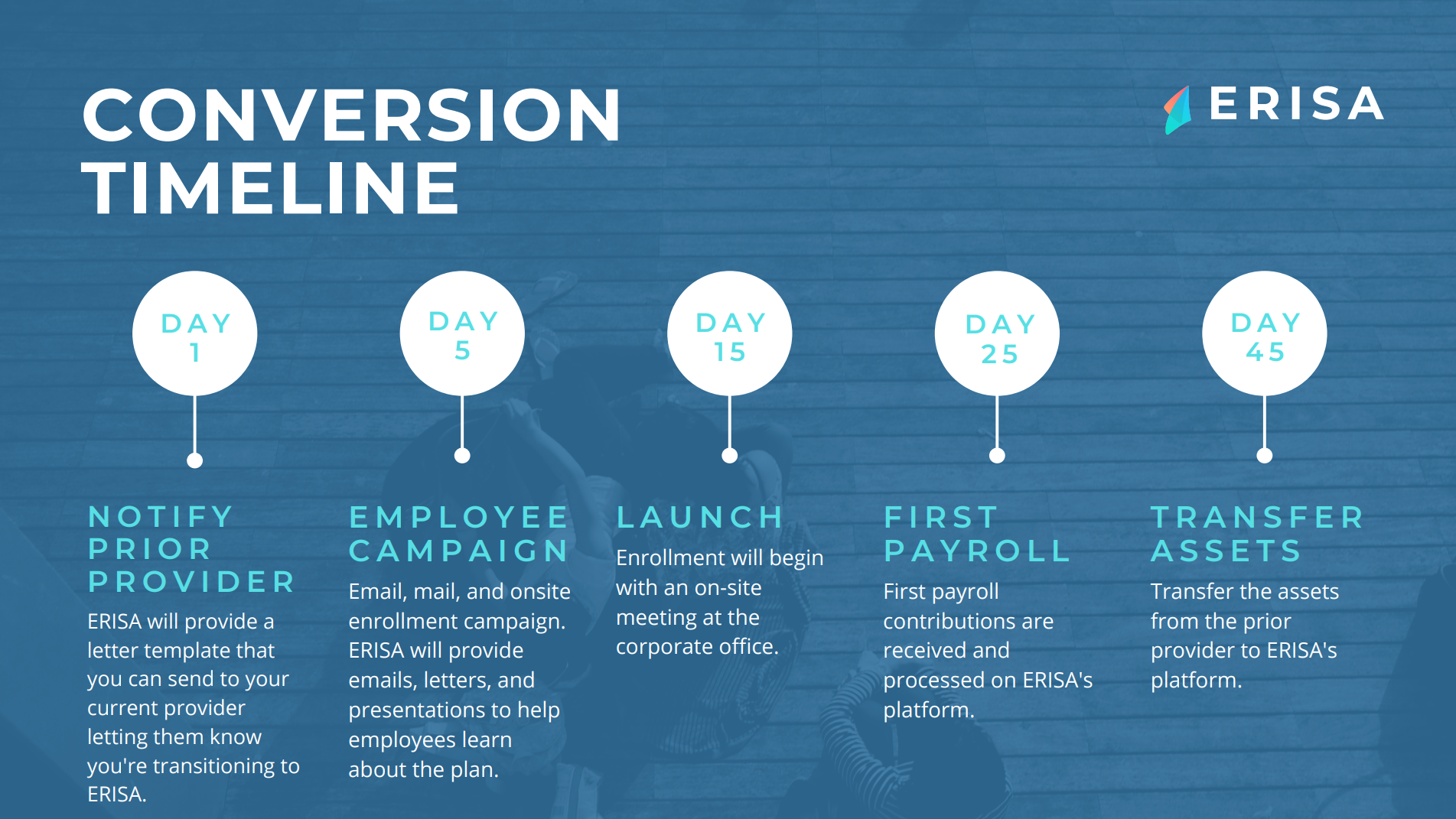

The correct answer is C ERISA covers most employer sponsored retirement plans But public employee plans such as the state pension plan in answer B are exempt from coverage SIMPLE IRAs are subject to ERISA rules However they are exempt from some of the more complex administrative requirements that apply to other plans such as 401 k s This is because SIMPLE IRAs are intended to

Are Simple Iras Subject To Erisa

Are Simple Iras Subject To Erisa

https://files.helpdocs.io/yzlo7q9u2n/articles/gro0n1tnez/1562697284051/image.png

Singapore GST Invoice Template Sales

https://www.boostexcel.com/template/screenshots/singaporegst-sales.png

:max_bytes(150000):strip_icc()/what-is-erisa-law-3515060-v3-HL-FINAL-5bf4604fc9e77c00270ddb1b.png)

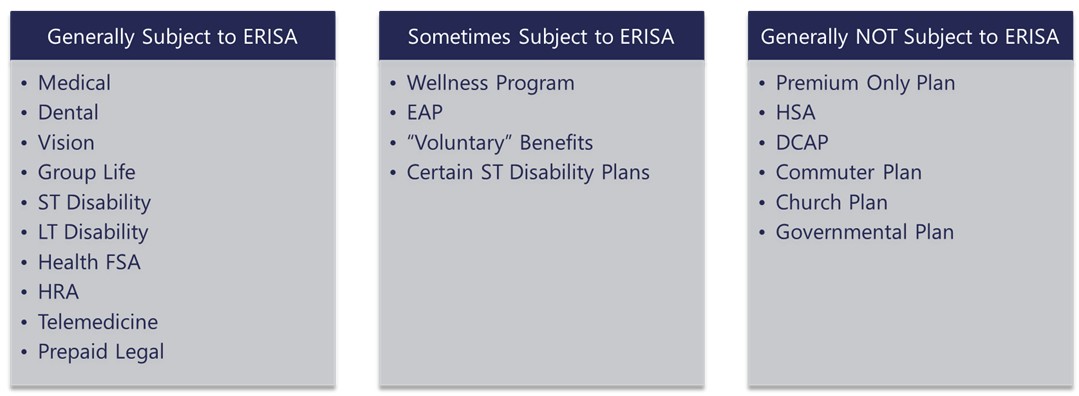

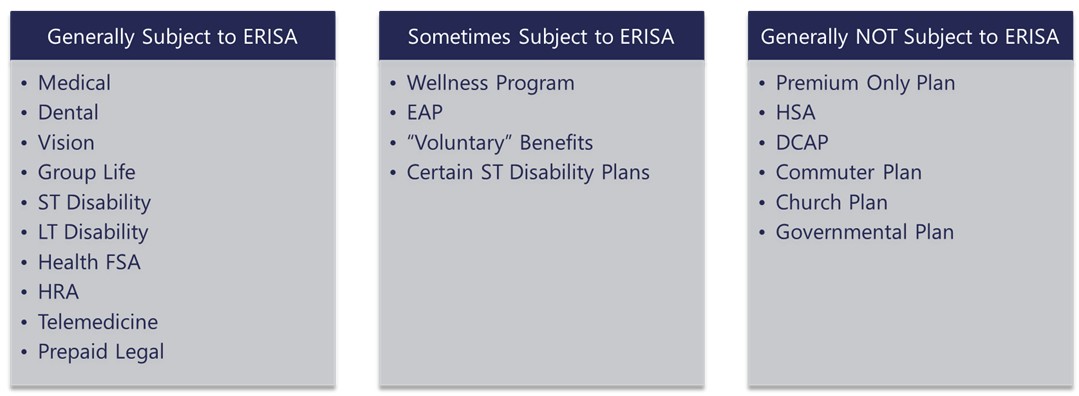

What Does ERISA Cover

https://www.liveabout.com/thmb/TYrYy6vZo0tDl0N_h35k40XQW4g=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/what-is-erisa-law-3515060-v3-HL-FINAL-5bf4604fc9e77c00270ddb1b.png

Certain small business retirement plans including SEP IRAs and SIMPLE IRAs are exempt from most ERISA requirements They are covered under ERISA but were established by Congress to be much simpler and SEP and SIMPLE IRAs are also retirement plans sponsored by employers so therefore are ERISA qualified What protections does ERISA offer to participants Plan sponsors must design and administer their plans in

Q Do ERISA rules apply SIMPLE IRAs are not subject to ERISA Q What are the employee contribution limits Employee deferrals are limited to 11 500 2011 and subject to annual A SIMPLE IRA is an employer sponsored plan similar to a 401K but it offers simpler and less expensive administration rules and it is not subject to ERISA regulations Limits Contribution

More picture related to Are Simple Iras Subject To Erisa

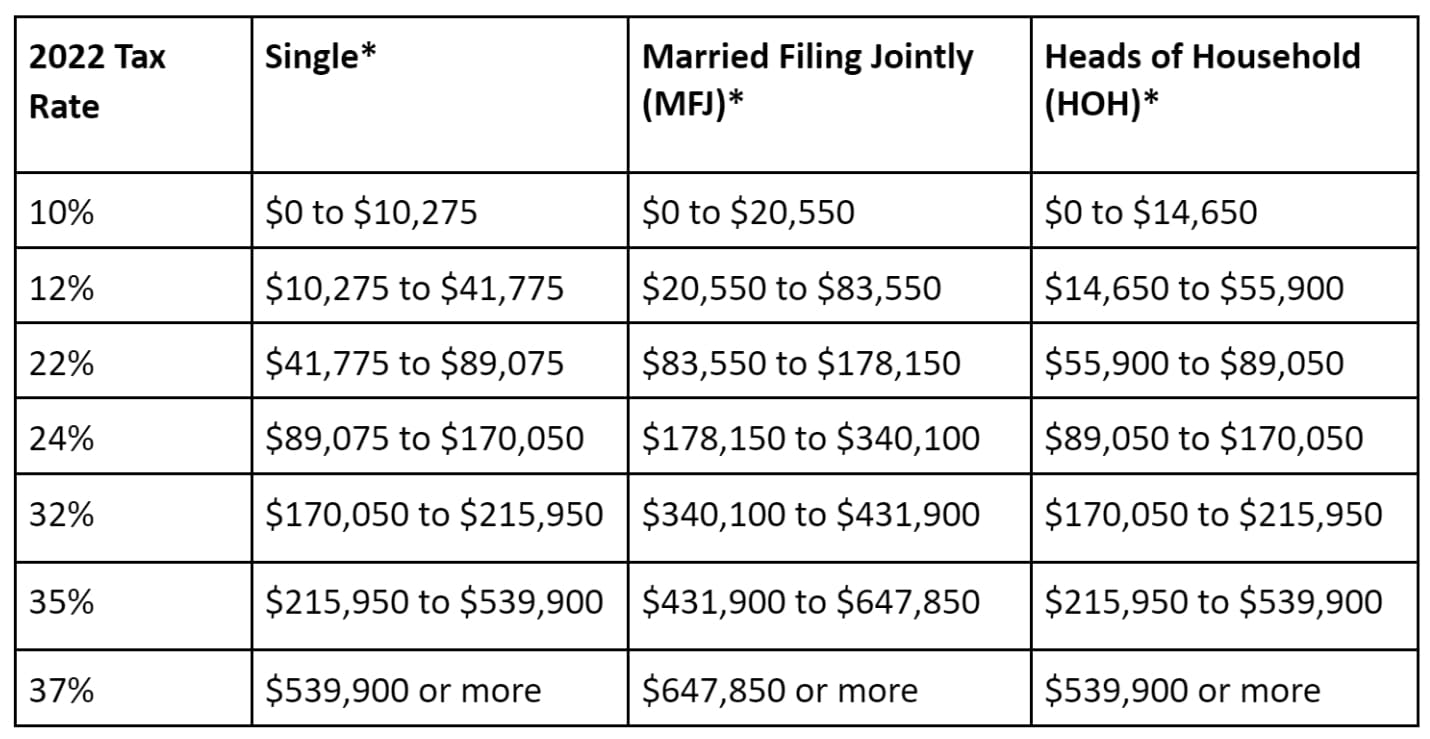

Tax Rebate 2025 Iras 2025 Ruth Slater

https://www.bluechippartners.com/wp-content/uploads/2022/01/Roth-IRA-and-Taxes-Graph2-tax-rates.jpg

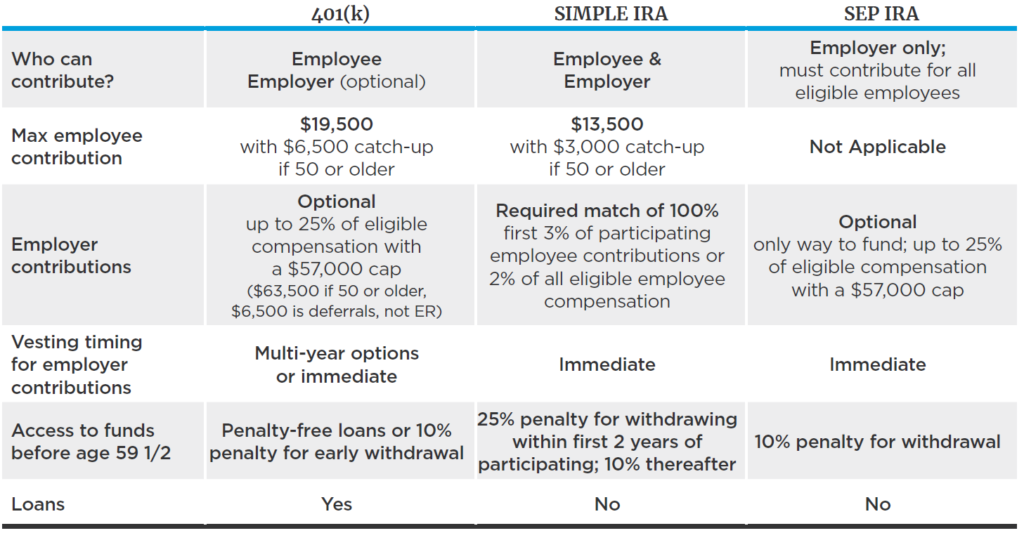

Exploring Retirement Plans For Small Businesses Financial Outfitters

https://fmg-websites-custom.s3.amazonaws.com/Infographics/retirement-plan-choices-for-small-business/RPCforSB-5.png

Individual Ira Limits 2025 Kareem Ayaan

https://www.marinerwealthadvisors.com/wp-content/uploads/2019/11/401k-Advantages-Over-SEP-and-Simple-IRAs-1024x533.png

SIMPLE IRAs are subject to ERISA rules which cover most employer sponsored retirement plans ERISA dictates how a plan is structured and administered Requirements for SIMPLE IRAs include spelling out who is eligible to Consequently the employees of qualified financial institutions that hold SEP IRA and SIMPLE IRA plan assets need not be covered by an ERISA fidelity bond

The Department of Labor classifies SIMPLE IRAs as ERISA qualified because employers are involved in the plan To find out if your IRA is ERISA qualified start by identifying the type of IRA you contribute to and SEP IRAs and SIMPLE IRAs are technically covered by ERISA but are exempt from most ERISA rules If you re in an ERISA plan you generally have more protection than if

Compliance For Voluntary Worksite Benefits Blog Medcom Benefits

https://medcombenefits.com/images/uploads/blog/Subject_to_ERISA.jpg

:max_bytes(150000):strip_icc()/401a-plan.asp-final-0350e5f196e84d0e99699f9d429bd567.png)

No Retirement Plan

https://www.investopedia.com/thmb/lAbqkUDvzBqru0CYBbd4WonRb7A=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/401a-plan.asp-final-0350e5f196e84d0e99699f9d429bd567.png

https://www.dol.gov › sites › dolgov › files › EBSA › about...

Simplified Employee Pension Plan SEP A plan in which the employer makes contributions on a tax favored basis to individual retirement accounts IRAs owned by the employees If

https://www.investopedia.com › ask › ans…

The correct answer is C ERISA covers most employer sponsored retirement plans But public employee plans such as the state pension plan in answer B are exempt from coverage

Compliance Overview What Is An ERISA Plan

Compliance For Voluntary Worksite Benefits Blog Medcom Benefits

Traditional Ira Flowchart Inflation Protection

Navigating The Complexities Of An Inherited IRA

Exploring Retirement Plans For Small Businesses Lee Nolan Koroghlian

How Much Can I Contribute To A Roth Ira 2024 Lotta Rhiamon

How Much Can I Contribute To A Roth Ira 2024 Lotta Rhiamon

Is Your Benefit Plan Subject To ERISA

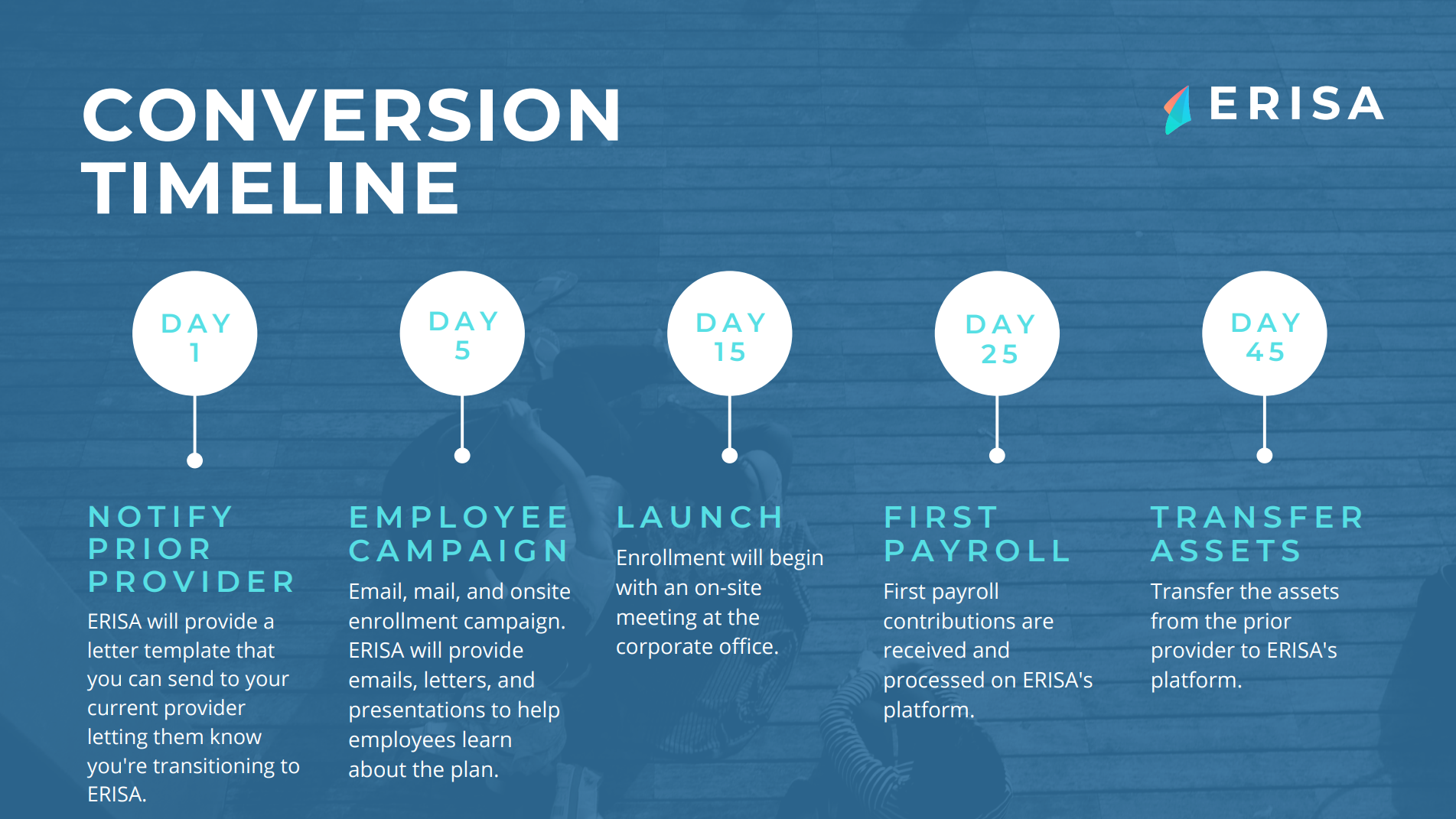

Preparing For A DOL Health Plan Audit Ppt Download

Roth Contribution Limits 2024 Calculator 2024 Ines Crystal

Are Simple Iras Subject To Erisa - SEP IRAs and SIMPLE IRAs are not subject to ERISA However BAPCPA states these plans are excluded from bankruptcy for unlimited amounts and are not part of the