At What Age Do You Stop Paying Property Taxes In North Carolina At what age do you stop paying property taxes in North Carolina In North Carolina you have to be at least 65 or totally or permanelty disabled to stop paying property taxes There are other exemptions too

At what age do you stop paying taxes in North Carolina There is no specific age at which you stop paying taxes in North Carolina However seniors who qualify for the Elderly or Disabled Homestead Exemption may receive property tax exclusions based on their age and eligibility criteria At what age do you stop paying property taxes in North Carolina North Carolina and Charlotte offer programs for seniors regarding property taxes If you are totally and permanently disabled or age 65 and over and make below an income limit of 30 200 you can exempt from property tax half of your home s assessed value or 25 000

At What Age Do You Stop Paying Property Taxes In North Carolina

At What Age Do You Stop Paying Property Taxes In North Carolina

https://image-cdn.carrot.com/uploads/sites/76554/2023/09/[email protected]

At What Age Do You Stop Paying Property Taxes In North Carolina

https://image-cdn.carrot.com/uploads/sites/76554/2023/09/[email protected]

At What Age Do You Stop Paying Property Taxes In AZ YouTube

https://i.ytimg.com/vi/pfxGNxaKVzM/maxresdefault.jpg

At what age do you stop paying property taxes in NC In North Carolina property tax deferral is available for senior adults aged 65 or older or totally and permanently disabled individuals who have owned and occupied their property for at least five years If you are elderly or disabled and own your home you may qualify for a reduction of your property taxes To be eligible you must be either 65 or older or totally and permanently disabled You also must own and live in your home unless you are living elsewhere for medical reasons

For property tax purposes in North Carolina the age at which an individual is considered a senior citizen is 65 or older Seniors in this age range may be eligible for property tax exclusions based on certain income and residency criteria North Carolina allows property tax exclusions for senior adults and disabled individuals If you qualify you may receive an exclusion of either 25 000 or 50 of the taxable value of your residence whichever is greater

More picture related to At What Age Do You Stop Paying Property Taxes In North Carolina

West Virginia State Taxes Explained Your Comprehensive Guide YouTube

https://i.ytimg.com/vi/ofwbVYtwgyw/maxresdefault.jpg

At What Age Do You Stop Paying Property Taxes In Georgia YouTube

https://i.ytimg.com/vi/IYkYGRh0lV0/maxresdefault.jpg

Why Am I Paying Taxes On My Wages Then Paying Sales Taxes To Spend My

https://i.pinimg.com/736x/81/0d/9c/810d9c401b0f8452059877c491ae9af4.jpg

North Carolina allows for reduced property taxes if homeowners meet certain requirements Below is a summary of the chief programs in North Carolina See also North Carolina Gen Stat 105 277 Homestead exclusion for elderly or disabled At What Age Do Seniors Stop Paying Property Taxes SmartAsset Depending on the state where you live you may be eligible for a property tax exemption Here are the general

[desc-10] [desc-11]

Va Tax Pay Online

https://s3b.cashify.in/gpro/uploads/2022/06/29203010/how-to-pay-property-tax-online.jpg

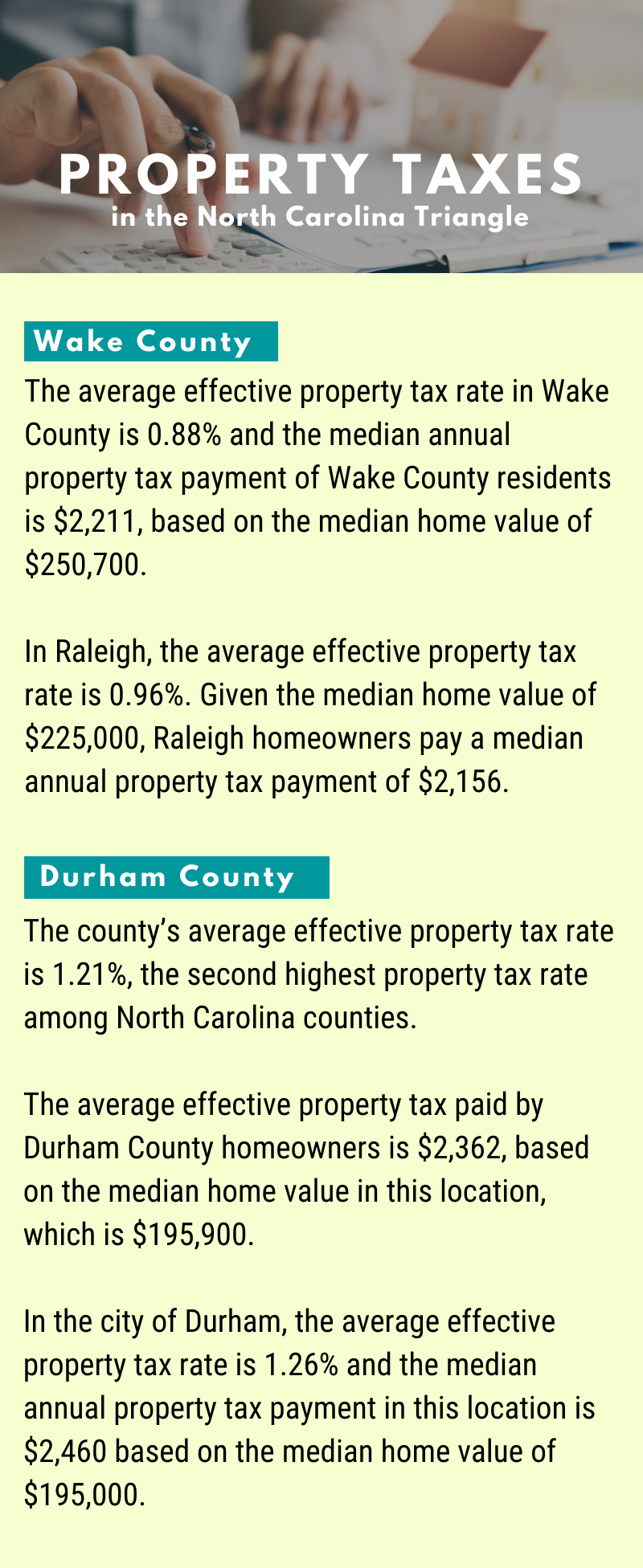

Property Taxes In North Carolina Triangle

https://www.findnctrianglehomes.com/wp-content/uploads/2020/03/Property-Taxes-in-NC-Triangle.png

https://raleighrealty.com › blog › nc-property-taxes

At what age do you stop paying property taxes in North Carolina In North Carolina you have to be at least 65 or totally or permanelty disabled to stop paying property taxes There are other exemptions too

https://www.ncesc.com › geographic-faq › do-seniors...

At what age do you stop paying taxes in North Carolina There is no specific age at which you stop paying taxes in North Carolina However seniors who qualify for the Elderly or Disabled Homestead Exemption may receive property tax exclusions based on their age and eligibility criteria

Property Tax Information Worksheets

Va Tax Pay Online

What Happens If You Don t Pay Property Taxes In Texas

State Sales Tax Rate 2023

Texas Comptroller State Holidays 2025 Roy M Pulido

Cheapest Property Taxes In NJ A Comprehensive Guide

Cheapest Property Taxes In NJ A Comprehensive Guide

Cat Age And Weight Chart Cat Age Weight Chart

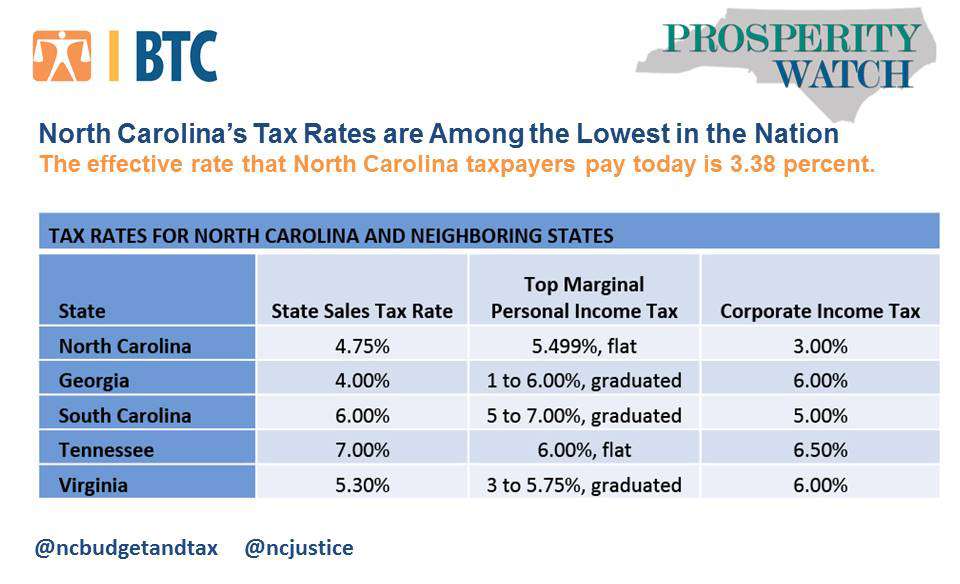

North Carolina State Tax Rates 2024

North Carolina Tax Rates 2024

At What Age Do You Stop Paying Property Taxes In North Carolina - [desc-13]