At What Age Do You Stop Paying Property Taxes In Texas At What Age do Seniors Stop Paying Property Taxes in Texas It s a misconception that seniors don t have to pay property taxes However they can choose to

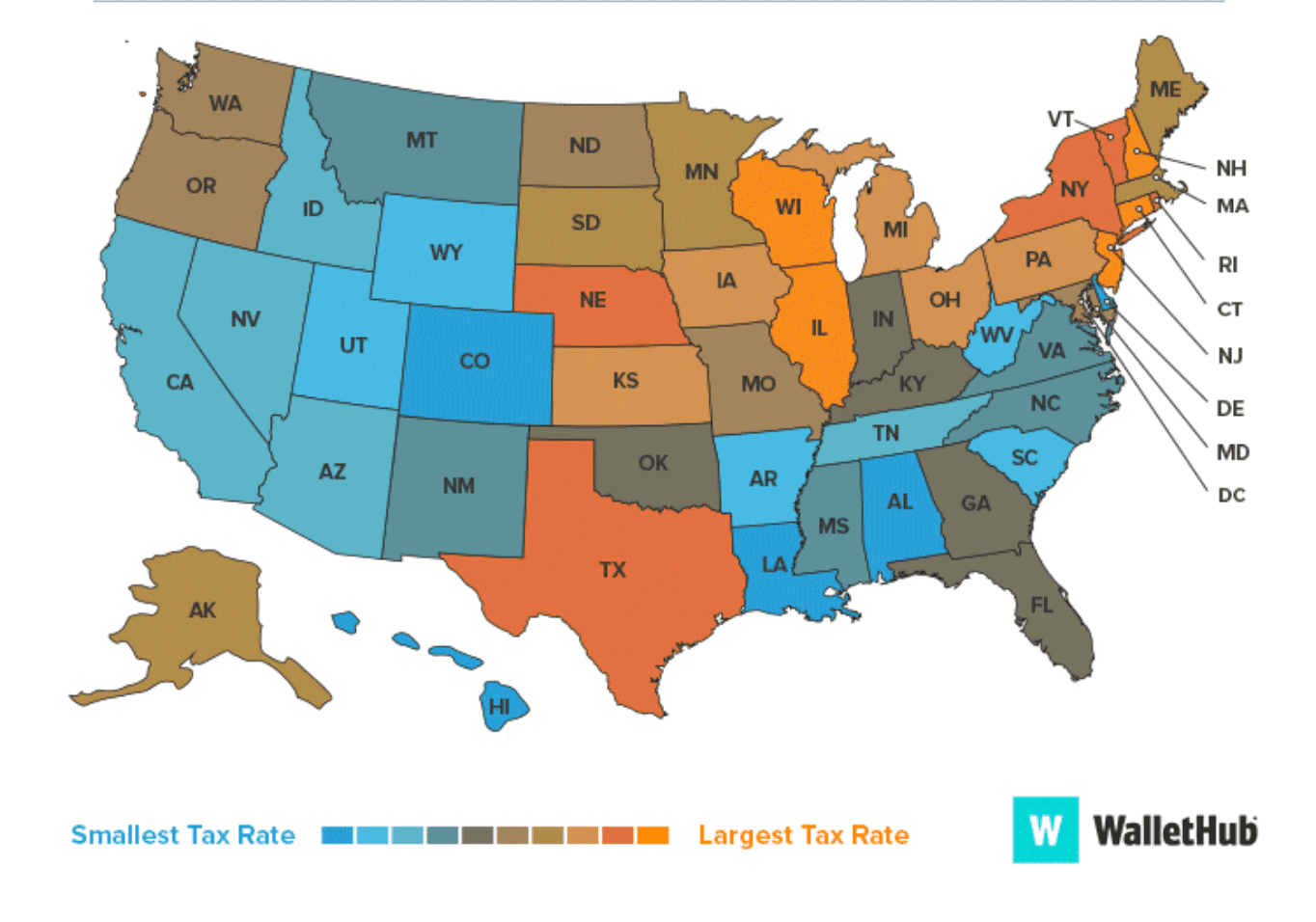

While you do not outright cease paying property taxes at a certain age Texas provides significant tax relief options for homeowners aged 65 and older These options While Texas doesn t eliminate property taxes based on age alone some states offer broader exemptions For example Delaware Hawaii and Louisiana offer full or partial exemptions for

At What Age Do You Stop Paying Property Taxes In Texas

At What Age Do You Stop Paying Property Taxes In Texas

https://i.ytimg.com/vi/pfxGNxaKVzM/maxresdefault.jpg

Property Taxes Harris County How Are Property Taxes Calculated In

https://i.ytimg.com/vi/YLlXILtlMxw/maxresdefault.jpg

At What Age Do You Stop Paying Property Taxes In Georgia YouTube

https://i.ytimg.com/vi/IYkYGRh0lV0/maxresdefault.jpg

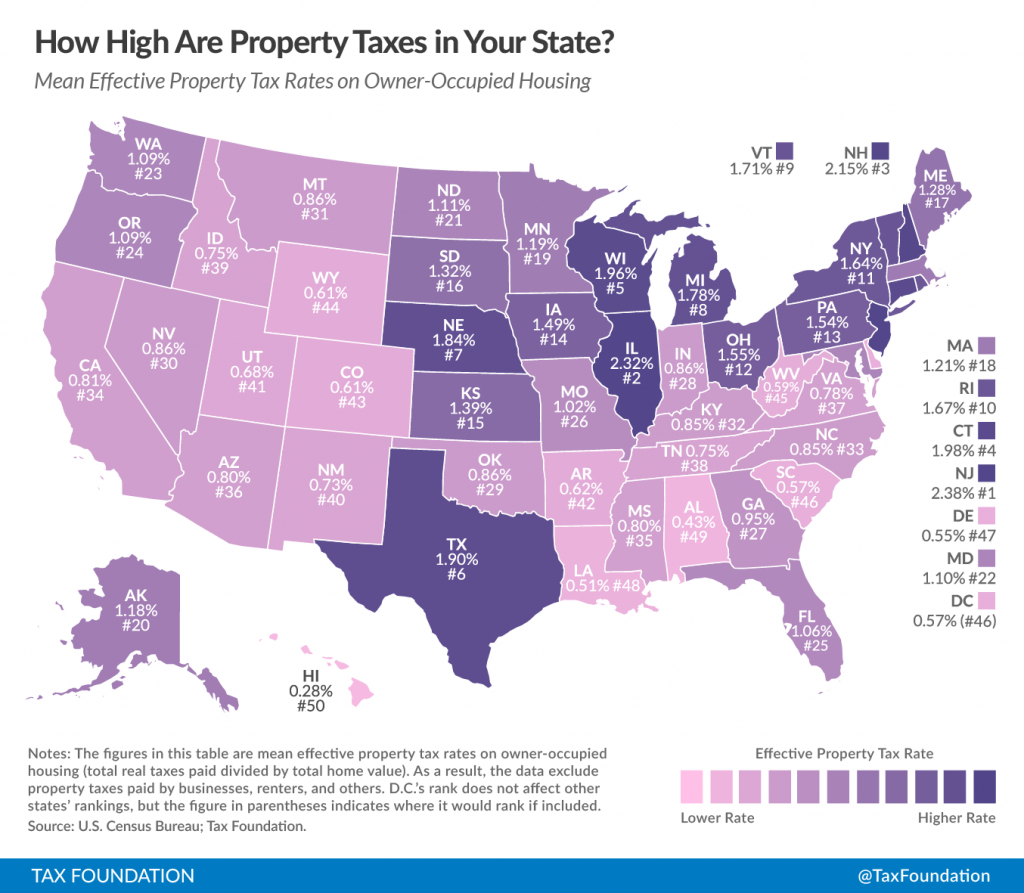

At what age do you stop paying property taxes in Texas Never Texas homeowners never fully stop paying property taxes However if you are 65 or older or At what age do seniors stop paying property taxes The Texas Tax Code Section 33 06 allows taxpayers 65 years of age or older to defer their property taxes until their estates are settled

Find out if there s an age when taxes stop in Texas Learn about senior property tax exemptions tax freezes and deferral options for homeowners 65 and older In Texas a property owner over the age of 65 can t freeze all property taxes However they do have the option of applying for a tax ceiling exemption which will freeze the

More picture related to At What Age Do You Stop Paying Property Taxes In Texas

What Age Do You Stop Paying Property Taxes In Georgia YouTube

https://i.ytimg.com/vi/8K6ks1ryuOA/maxresdefault.jpg

Why Am I Paying Taxes On My Wages Then Paying Sales Taxes To Spend My

https://i.pinimg.com/736x/81/0d/9c/810d9c401b0f8452059877c491ae9af4.jpg

Fiscal

https://texasscorecard.com/wp-content/uploads/2019/07/Screen-Shot-2019-07-16-at-12.24.54-PM.png

65 or older you may defer or postpone paying any delinquent property taxes on your home for as long as you own and live in it To postpone your tax payment file a tax deferral affidavit with Section 33 06 of the Texas Property Code explains the procedures for deferred collection of property taxes A property owner is only qualified to seek a deferral if they are 65

[desc-10] [desc-11]

At What Age Do Seniors Stop Paying Property Taxes At What Age Do U Stop

https://smartasset.com/wp-content/uploads/sites/2/2022/11/overdue-mortgage-payment-senior-man-holding-a-model-house-in-his-hands-in-despair-pledged.jpg_s1024x1024wisk20cJEyM0_VE5o0GP4DhWbftMLOOAP_YZXuBCMSNHU1pYyY.jpg

Property Tax Florida 2025 Ruby Arwa

https://www.armstrongeconomics.com/wp-content/uploads/2017/04/State-Income-Taxes.jpg

https://www.texasrealestatesource.com › blog › texas...

At What Age do Seniors Stop Paying Property Taxes in Texas It s a misconception that seniors don t have to pay property taxes However they can choose to

https://www.ncesc.com › geographic-pedia › at-what-age...

While you do not outright cease paying property taxes at a certain age Texas provides significant tax relief options for homeowners aged 65 and older These options

Medicare Additional Tax 2025 Hunter Mustafa

At What Age Do Seniors Stop Paying Property Taxes At What Age Do U Stop

Property Taxes In Texas 2024 Adel Loella

Tarrant County 2024 Property Tax Rate Maren Sadella

Va Tax Pay Online

Property Tax Information Worksheets

Property Tax Information Worksheets

What Happens If You Don t Pay Property Taxes In Texas

Property Tax Appeal How To Protest Your Property Taxes In Texas

New Property Tax Laws In Texas 2024 Kyle Shandy

At What Age Do You Stop Paying Property Taxes In Texas - [desc-14]