Buying A House Off Plan Deposit If a developer needs a buyer to pay a certain amount of money before the end date this is called an off plan payment If the buyer doesn t pay up by the end date they could be liable

In the majority of cases this is through the National House Building Council although it is subject to policy limits which are typically 10 of the sale or a maximum of 100k The HBF adds that where larger deposits are taken protection will usually be through some kind of trust or client account with solicitors Top tips when buying off plan When you commit to buying a property off plan you have to put down a deposit with the rest only being payable when it s finished The deposit is often as low as 10 but it can be higher Say you buy a property off plan for 200 000 by putting down a 10 deposit of 20 000 A year later the property is still being built but rising

Buying A House Off Plan Deposit

![]()

Buying A House Off Plan Deposit

https://static.vecteezy.com/system/resources/previews/012/304/936/original/3d-red-house-icon-with-arrow-graph-banknote-stack-isolated-buying-a-house-renting-house-and-land-prices-increase-concept-3d-render-illustration-png.png

Jermaine Medley Lafayette Federal Credit Union

https://www.lfcu.org/files/medley.j_headshot_fenixfoto-0Q6A2619-9-1638x2048.jpg

Buying A House Lupon gov ph

https://i.etsystatic.com/36385697/r/il/a212f6/3973355832/il_fullxfull.3973355832_eepf.jpg

This means your current LVR is 80 i e your loan of 400 000 divided by the property value of 500 000 The property s value has gone up in value to 550 000 Even if you still need to borrow 400 000 your LVR will go 80 to around 73 This is because 400 000 is only 73 of the current property value tips on saving for a deposit Purchasing a house or flat before it s been built known as off plan can be a great way of potentially grabbing a property in an up and coming area at a bargain price With schemes such as Help to Buy equity loans and the supposedly upcoming Starter Homes Initiative for first time buyers in England no start date has yet been announced it

In order to purchase off plan property you usually need to provide a deposit of just 10 20 of the property s value making securing the property simple and affordable Whether you plan to resell or live in the apartment one of the biggest advantages of buying off plan is selection Unlike in completed buildings you can usually select the Your solicitor will be able to liaise with your developer s solicitor and your mortgage lender to help ensure the process of buying your off plan home runs smoothly 5 Complete your mortgage application Once you ve reserved your property it s time to complete your mortgage application ahead of you exchanging contracts with your developer

More picture related to Buying A House Off Plan Deposit

Why You Should Buy A House During The Pandemic LNC Cavite

https://www.lancasternewcity.com.ph/wp-content/uploads/2022/09/Article-18-scaled.jpg

The Floor Plan For A House With Two Pools And An Outdoor Swimming Pool

https://i.pinimg.com/originals/0e/d0/73/0ed07311450cc425a0456f82a59ed4fd.png

Julie Bauer Real Estate Agent Compass

https://www.compass.com/m/13/5459579c-f8c1-4bed-84ed-8727a1943fe5/origin.jpg

Reward You can pick your own fittings Another reward of buying a property off plan is that you might get the opportunity to influence the look and feel inside the house by choosing your own fixtures fittings and finishes We spoke to one of our colleagues Lucy a first time buyer who recently bought off plan She said How to buy a home off plan When you have found a suitable development it is a good idea to speak to a mortgage advisor first to make sure you will be able to get the mortgage you need If this all goes well you can then reserve a home or plot at pay a reservation fee this is usually around 500 1000

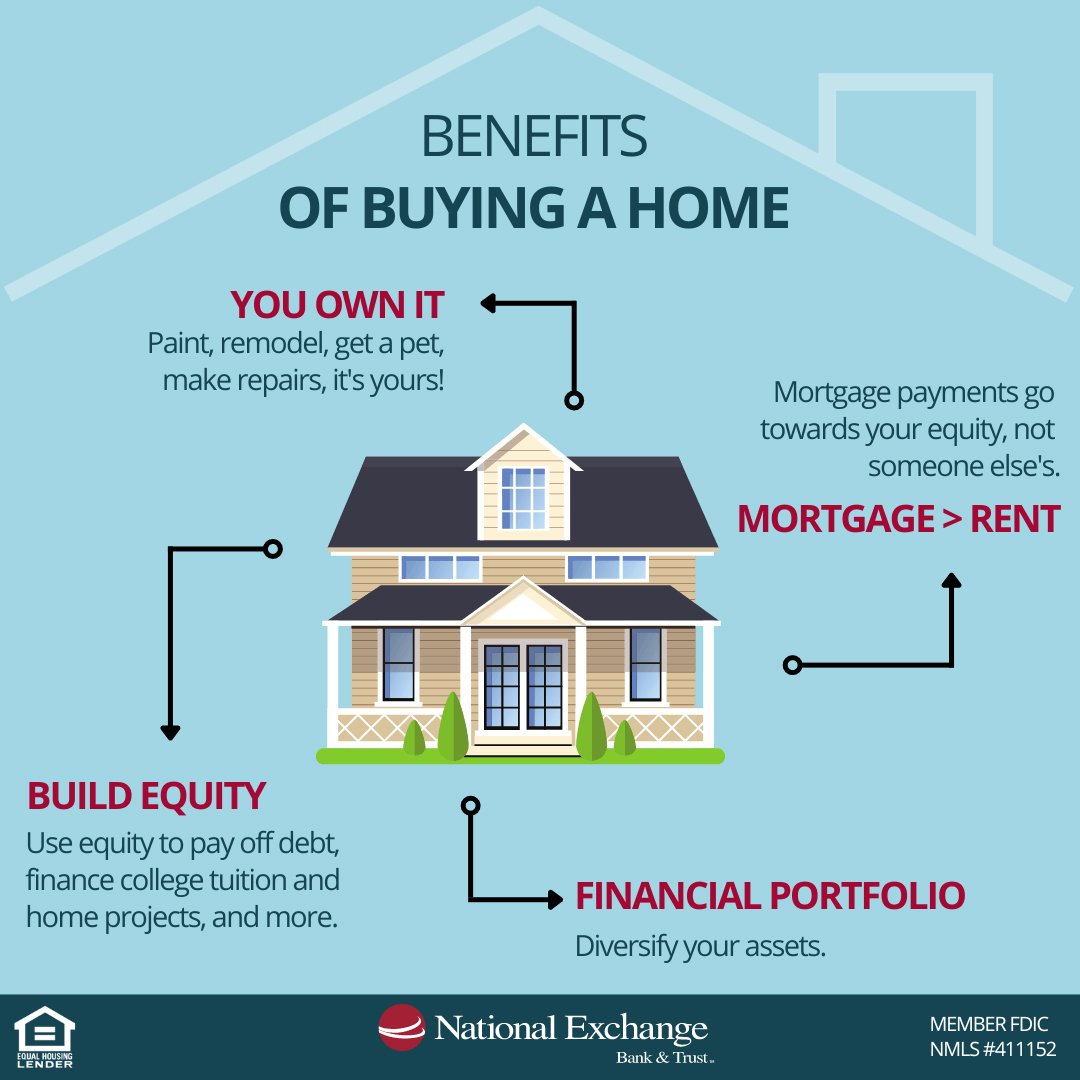

1 Smaller home loan balance A larger down payment means starting out with a smaller loan amount which has a few advantages One of these is that it creates a cushion of home equity even if housing market values decline That could make the difference in being able to refinance or sell your home in the years ahead Buying a home is a highly personal decision But when a buyer walks away from a sale the decision usually happens due to one of the following reasons The buyer loses their income and is ineligible for financing The house is appraised for less than the sale price The inspection reveals major issues The buyer can t sell their own house

Buying A House In 2022 Starterpack r starterpacks Starter Packs

https://i.kym-cdn.com/photos/images/original/002/439/181/6f9.jpg

19 Questions To Ask When Making An Offer To Buy A House Home Buying

https://i.pinimg.com/originals/aa/71/7b/aa717b6a94e366265ef7ba6dbc9e7e3a.png

https://www.linkedin.com/pulse/buying-off-plan-property-smart-way-26-questions-you-should-uche-moses

If a developer needs a buyer to pay a certain amount of money before the end date this is called an off plan payment If the buyer doesn t pay up by the end date they could be liable

https://www.yourmoney.com/mortgages/first-time-buyer/news-first-time-buyer/buying-property-off-plan-pros-cons/

In the majority of cases this is through the National House Building Council although it is subject to policy limits which are typically 10 of the sale or a maximum of 100k The HBF adds that where larger deposits are taken protection will usually be through some kind of trust or client account with solicitors Top tips when buying off plan

Buying A House As Is A Guide To Making Smart Decisions Kurby Real

Buying A House In 2022 Starterpack r starterpacks Starter Packs

How To Prepare To Buy A House Fifth Third Bank

How To Buy A House In Mexico As An Expat Mexico Real Estate Houses

Buying A Home Versus Renting NEBAT Blog

Buyer Resources The Homestead Co

Buyer Resources The Homestead Co

Peric Guo s Post Lemon8

What To Do After Buying A House New Home Checklist

Claire Henry And Blair Monroe s Wedding Website

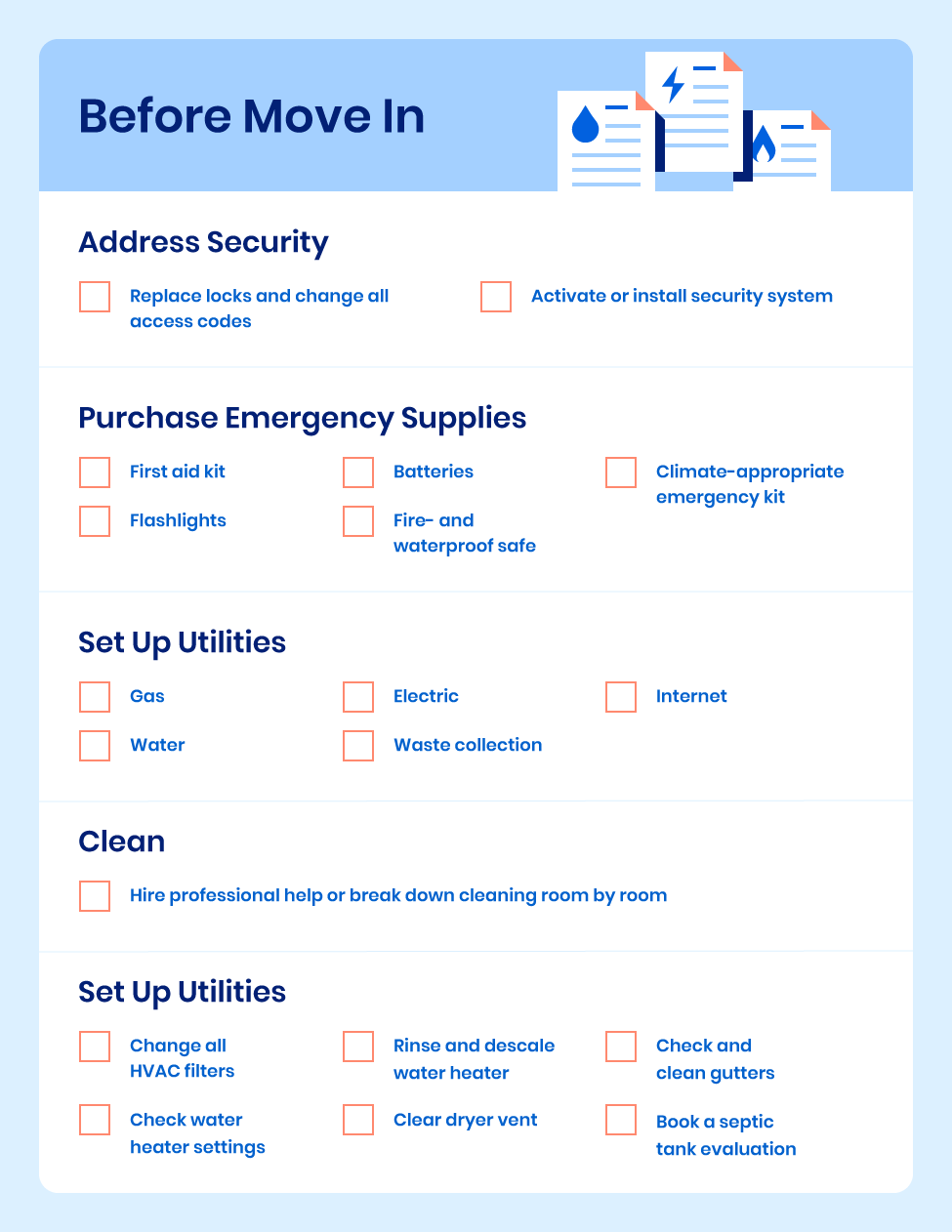

Buying A House Off Plan Deposit - Appoint a solicitor Your solicitor will go through the same legal process as when you re buying any property including local searches and looking at the contract This process typically takes around 3 4 weeks Arrange your mortgage Unless you are a cash buyer you will need to arrange a mortgage Most mortgage providers have stricter