Can I Claim A Tax Deduction For Living Away From Home There is an expectation that you will return to your usual home at the end of the period of working away A LAFHA paid to you is income tax free and should not be included as assessable

What can you deduct Claiming deductions for travel expenses You can claim deductions for the travel from your home country to Finland only if no reimbursement or You can claim a deduction for travel expenses accommodation meals and incidental expenses if you travel and stay away from your home overnight in the course of

Can I Claim A Tax Deduction For Living Away From Home

Can I Claim A Tax Deduction For Living Away From Home

https://www.basunivesh.com/wp-content/uploads/2020/02/Latest-Income-Tax-Slab-Rates-for-FY-2020-21-AY-2021-22-New-1280x720.jpg

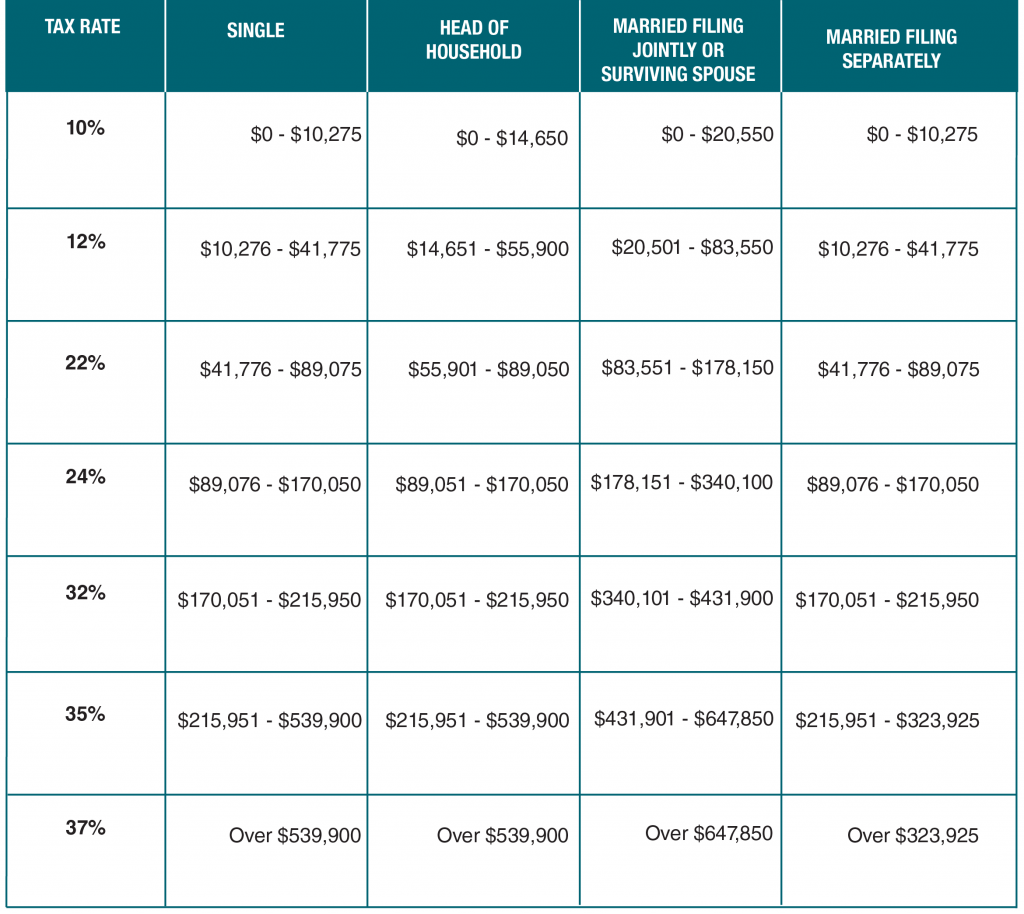

Tax Brackets 2025 Oklahoma Eric I Gibbs

https://image.cnbcfm.com/api/v1/image/107136825-1666125851699-6clBX-marginal-tax-brackets-for-tax-year-2023-single-individuals_1.png?v=1666125859

Deduction In New Tax Regime 2023 24 Image To U

https://lh4.googleusercontent.com/Jym_SBPjj9OhD57Lr3uB5zZ9qvHsHKY5kcXq2ViEbXOMn4bdWDNUKVaMGsYgyx7ATIW7LnvNr1owVfmW9CrCEk1ag31yUthKP5ZAqLnMggWdw9PmOtGnX-wboJCk2Qpaud1W979a4-vecbo0Ai7mk5pH80mvuIhthbVXVFL3rXuN7CYQ03xD1-aBsEDRAQ

No you cannot deduct any expense for living costs while you are waiting to find a permanent home it is simply not a moving cost or temporary living cost that is eligible for You can reduce the taxable value of the benefit by any amounts your employee spends on their accommodation and reasonable food expenses if either your employee

When it comes to your taxes you generally can t claim a deduction for any expenses incurred when you are living away from home as these costs are considered private expenses by the You can generally claim a deduction for the cost of meals you incur when you travel and stay away from your home overnight in the course of your work You may also be

More picture related to Can I Claim A Tax Deduction For Living Away From Home

Tax Bracket Calculator 2025 Sydel Celesta

https://www.millerkaplan.com/wp-content/uploads/2021/11/Ordinary-Income-Tax-Brackets_2022-1024x914.png

2025 Standard Deduction Mfj Bianca Rose

https://www.taxdefensenetwork.com/wp-content/uploads/2021/12/20212022-Standard-Deduction-65-scaled.jpg

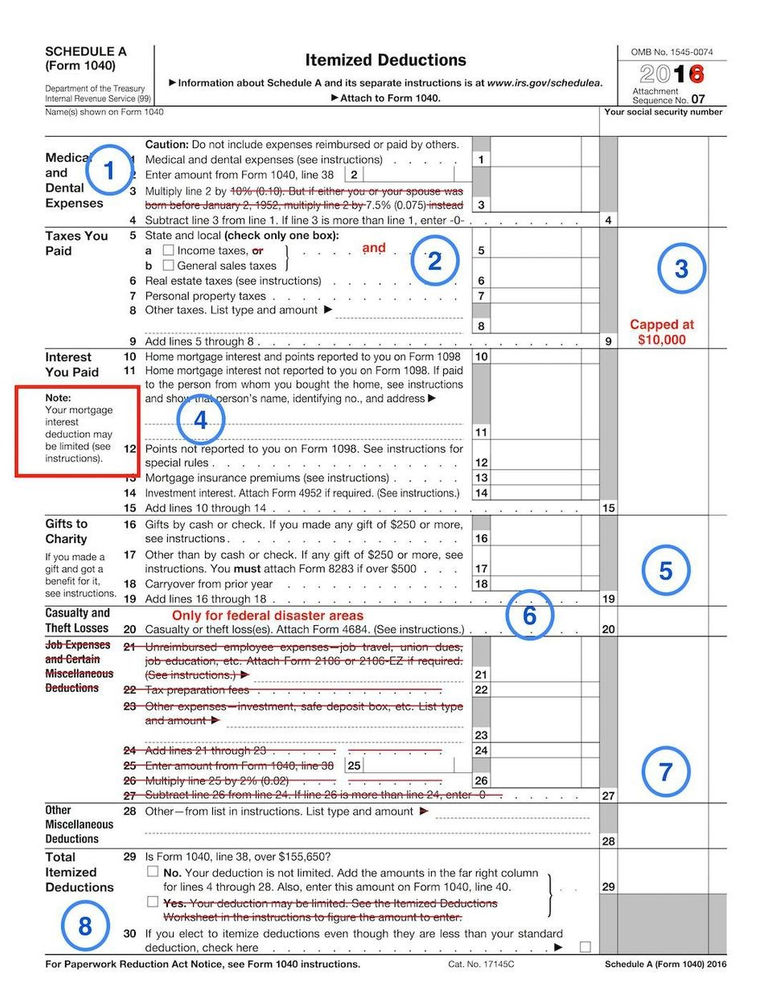

New York State Itemized Deductions 2025 Hana Llevi

https://www.wiztax.com/wp-content/uploads/2022/10/3.png

Ring A Refund discusses three conditions required by the ATO when considering eligibility for living away from home tax exemptions View the full list here Who can claim tax relief You can claim tax relief if you have to work from home for example because your job requires you to live far away from your office your employer does not have

IRS in Topic 511 states that you can can deduct travel expenses paid or incurred in connection with a temporary work assignment away from home A three month assignment For the purposes of Living Away From Home Deductions am I considered Living Away From Home If so can I claim a deduction of the 200 week rent utility bills internet

Nc Income Tax Standard Deduction 2025 Cherin Kara Lynn

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Standard Deduction For Pensioners Ay 2023 24 Image To U

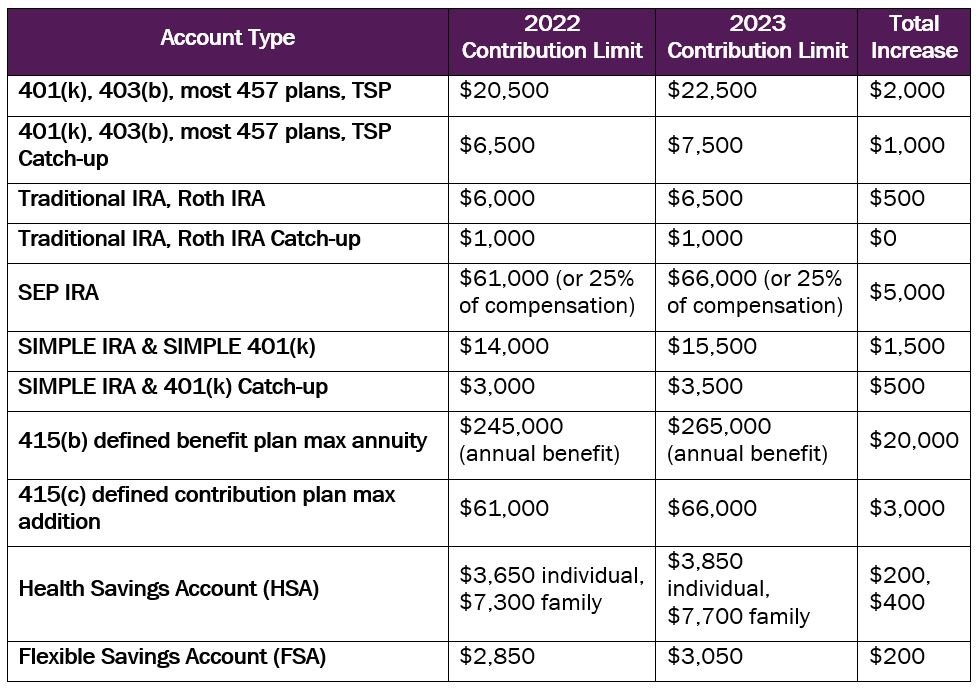

https://images.squarespace-cdn.com/content/v1/5e68f47ca0d8573682071426/db14bc39-72bb-4656-9ad5-416374313bf0/2023-retirement-account-contribution-limits-announced-10.25.2022.JPG

https://www.hrblock.com.au › tax-academy › living-away...

There is an expectation that you will return to your usual home at the end of the period of working away A LAFHA paid to you is income tax free and should not be included as assessable

https://www.vero.fi › en › individuals › tax-cards-and...

What can you deduct Claiming deductions for travel expenses You can claim deductions for the travel from your home country to Finland only if no reimbursement or

Portugal Tax Brackets 2025 Nina Rose

Nc Income Tax Standard Deduction 2025 Cherin Kara Lynn

Standard Tax Deduction 2025 Teresa Coleman

2025 Income Tax Deductions Janean Ceciley

Small Business Tax Breaks 2025 Finnian Monroe

Tax Deduction Template

Tax Deduction Template

New Tax Brackets For 2025 Compared To 2025 Taxes Allyn Thomasin

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)

What Are Tax Write Offs

Can I Claim A Tax Deduction For Living Away From Home - You can reduce the taxable value of the benefit by any amounts your employee spends on their accommodation and reasonable food expenses if either your employee