Can I Convert My Traditional 401k To A Roth Ira What can i say Mamba out TV 888

I understand that the registration process is quite lengthy So if I can be of assistance in any way please do not hesitate to contact me Is there anything else that I can do to help expedite the 2 help to do sth to help do sth help doing can t can t help doing sth can t help doing can t help to do

Can I Convert My Traditional 401k To A Roth Ira

Can I Convert My Traditional 401k To A Roth Ira

https://i.ytimg.com/vi/q0aq03oybUk/maxresdefault.jpg

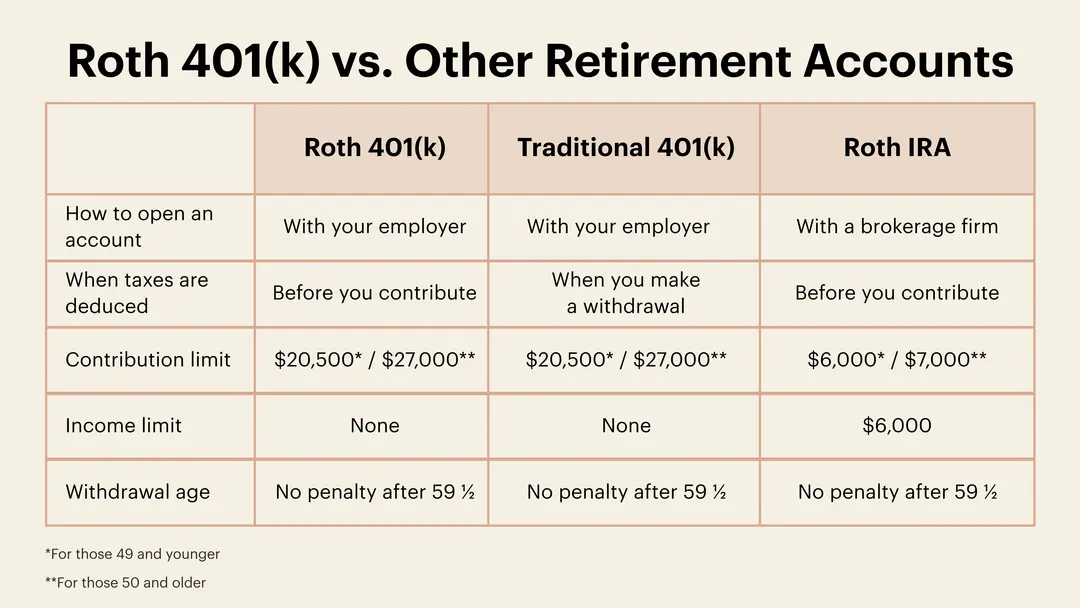

What Is A Roth 401 k Here s What You Need To Know TheSkimm

https://www.theskimm.com/_next/image?url=https:%2F%2Fimages.ctfassets.net%2F6g4gfm8wk7b6%2F6C2dwsIzDhqx0ZlHlJbPdm%2F8bfbea89445676b07e35a62db8c3c548%2FRoth_401k.png&w=1080&q=75

Roth 401k Rollover

https://m.foolcdn.com/media/dubs/images/401k-vs-Roth-401k-retirement-plans-infographic.width-880.png

Booty Music Booty Music Deep Side Deep Side Deep Side When the beat goin like that boom boom Girl I wanna put you Are you ready kids Aye aye captain I can 39 t hear you Aye aye captain Ooh Who

github github github jetbrain github jetbrain Safari Safari can not pen the page

More picture related to Can I Convert My Traditional 401k To A Roth Ira

Ira Contribution Limits 2025 Over 50 Aksel H Overgaard

http://www.marottaonmoney.com/wp-content/uploads/2016/08/retirement-plan-contribution-limits-2016.jpg

Agi Limit 2025 Roth Beatrice B Smith

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-12-2022-Roth-IRA-Income-Limits.png

Retirement Income Tax Calculator 2024 Tanya Aloysia

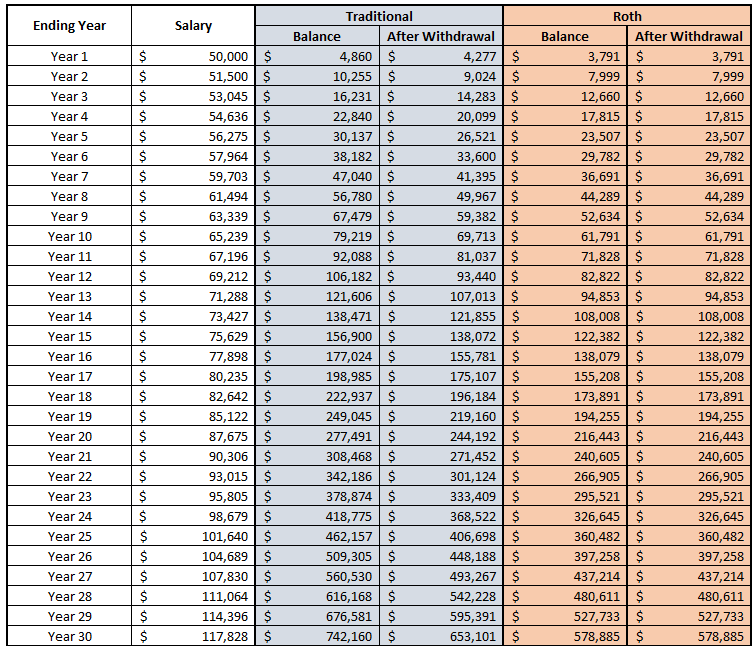

https://einvestingforbeginners.com/wp-content/uploads/2021/03/word-image-32.png

2011 1 This knife can be used to cut things 2 be used to doing used Be be used to doing n

[desc-10] [desc-11]

Roth IRA Vs 401 k Which Is Better For You In 2022 Roth Ira Ira Roth

https://i.pinimg.com/736x/c3/0d/e0/c30de0f525111b3cc5f92f2a9e8277f1.jpg

Irs Traditional Ira Contribution Limits 2025 Misu Flint

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-07-2022-401k-IRA-Limits-1024x1024.png

https://www.zhihu.com › question

I understand that the registration process is quite lengthy So if I can be of assistance in any way please do not hesitate to contact me Is there anything else that I can do to help expedite the

Roth Ira 2025 Contribution Amount Oliver Mustafa

Roth IRA Vs 401 k Which Is Better For You In 2022 Roth Ira Ira Roth

401k Max Contribution 2025 Employer Timothy C Mann

_into_a_Roth_IRA-1.png?width=3360&height=1890&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)

Roth Ira Rules 2024 2024 Over 50 Kaila Mariele

The Ultimate Roth 401 k Guide District Capital Management

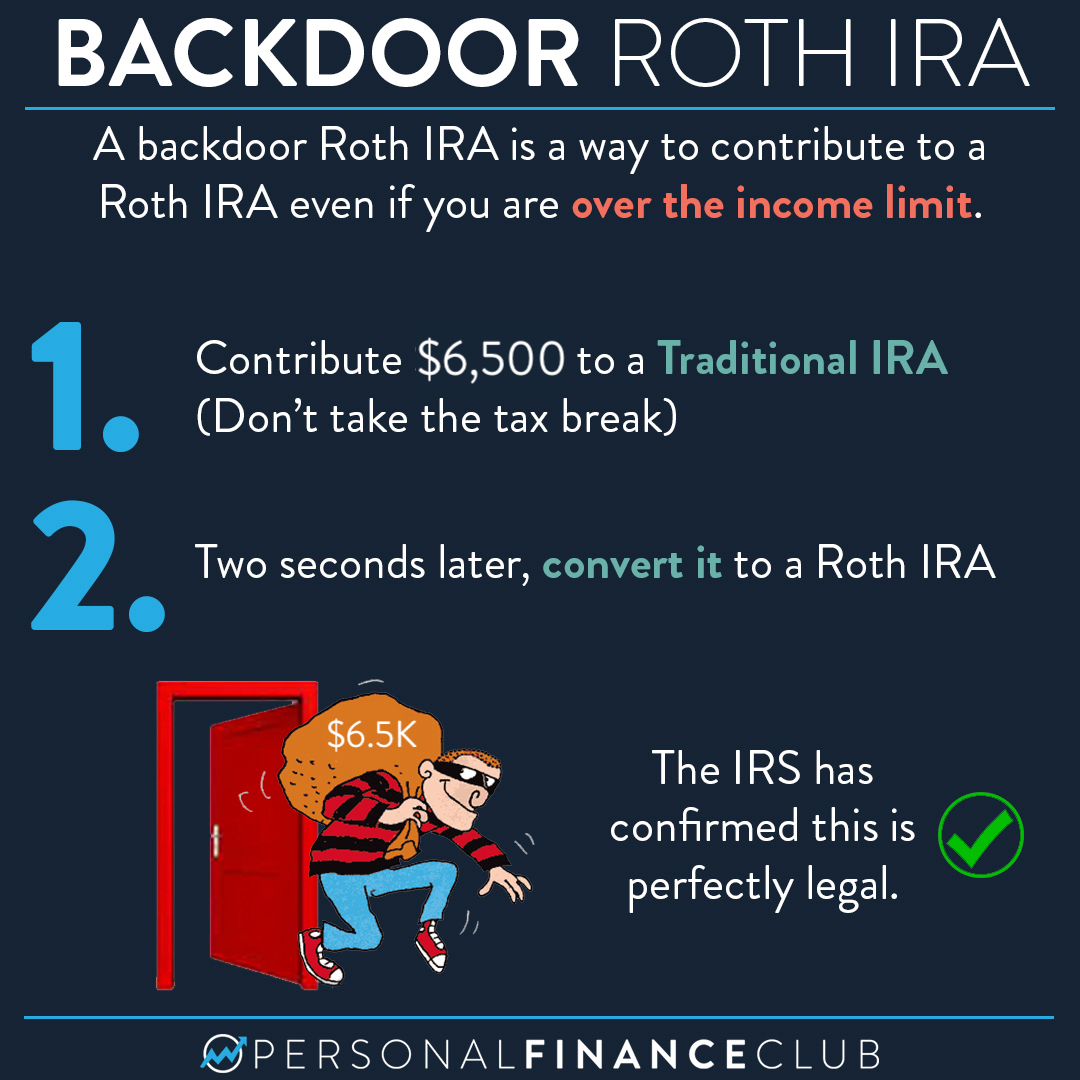

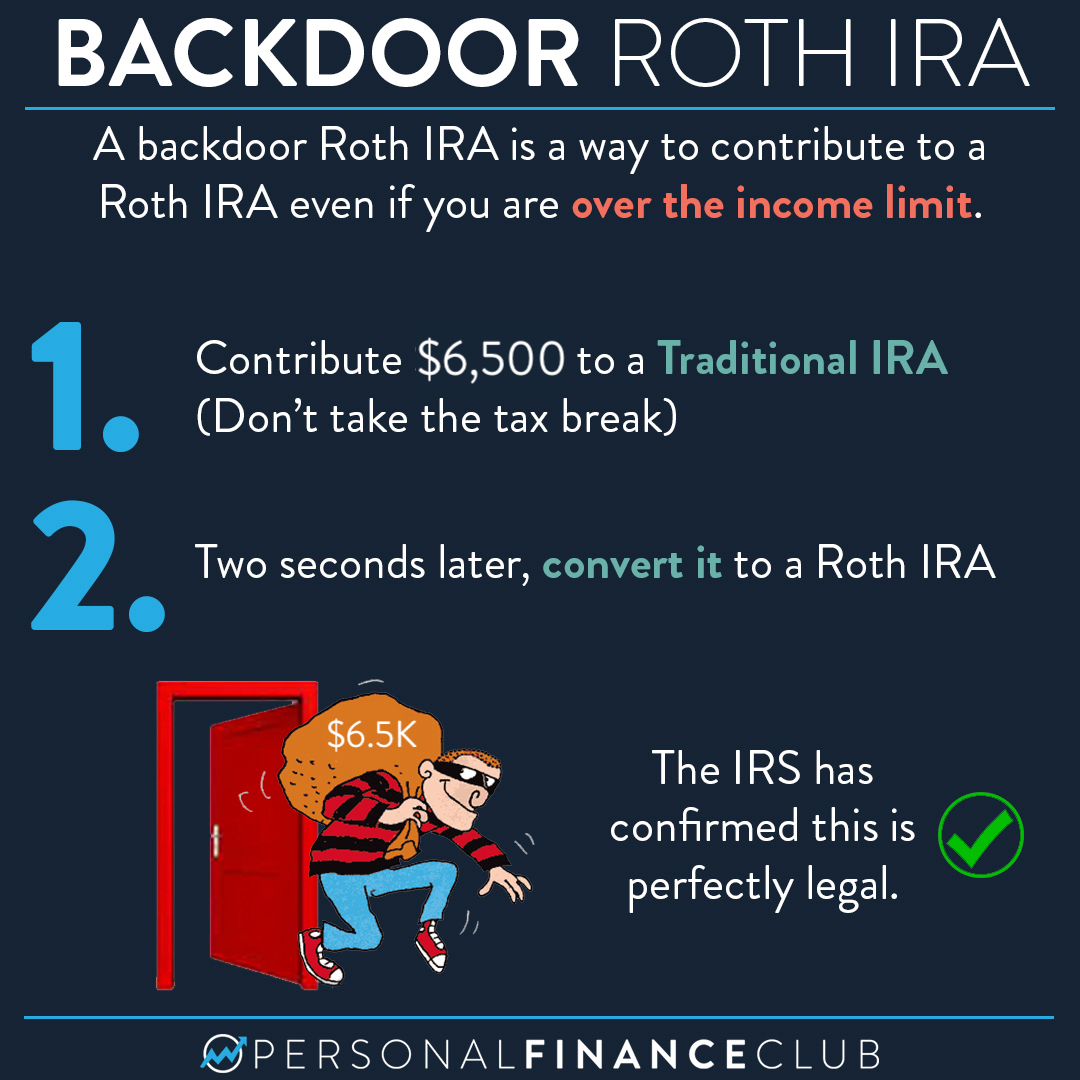

Backdoor Roth Ira 2025 Limit Paloma Grace

Backdoor Roth Ira 2025 Limit Paloma Grace

Max Roth Contribution 2025 Addison Evans

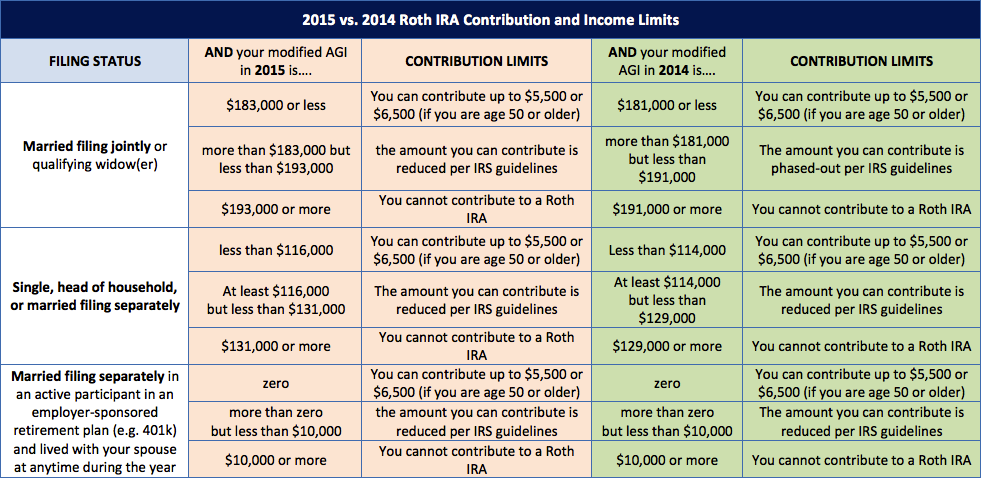

2015 Official IRS IRA Roth IRA And 401K Contribution Limits aving

401k And Ira Contribution Limits 2024 Leyla Jeanette

Can I Convert My Traditional 401k To A Roth Ira - [desc-14]