Do You Have To Pay School Taxes After 65 In Texas Age 65 or older and disabled exemptions Individuals 65 and older and or disabled residence homestead owners may qualify for a 10 000 homestead exemption for school

The primary benefit of the Texas over 65 property tax exemption is that it freezes school taxes on the property meaning they will NOT go up even when the property value or If you are 65 or older and live in a house in Harris County you definitely need to remember to file for the over 65 exemption Benefits of the over 65 exemptions Deductions for your home

Do You Have To Pay School Taxes After 65 In Texas

Do You Have To Pay School Taxes After 65 In Texas

https://i.pinimg.com/originals/13/56/ae/1356aedeb346315d48611e5255c3ea2c.jpg

The Written Statement Important For 1st June 2023 The Landlord

https://i0.wp.com/thelandlordcommunity.com/wp-content/uploads/2023/02/Original-Logo.png?fit=2783%2C1529&ssl=1

Sample Promise To Pay Letter Template Draft Destiny

https://draftdestiny.com/wp-content/uploads/2022/11/Promise-to-Pay-Letter.jpg

There are several obstacles to creating a school tax exemption for Senior Citizens loss of revenue shifting the tax burden an economic At age 65 Texas homeowners can receive a tax freeze on their school taxes if they qualify for the homestead exemption This means that the school district taxes on your property will not increase as long as you remain

When you qualify for an Over 65 or Disabled Person homestead exemption the school taxes on your house will not increase The ceiling freezes your school taxes at the amount you pay in School exemptions If you are 65 or older your residence homestead will qualify for more exemptions You will qualify for a 10 000 exemption for the school taxes on your home s

More picture related to Do You Have To Pay School Taxes After 65 In Texas

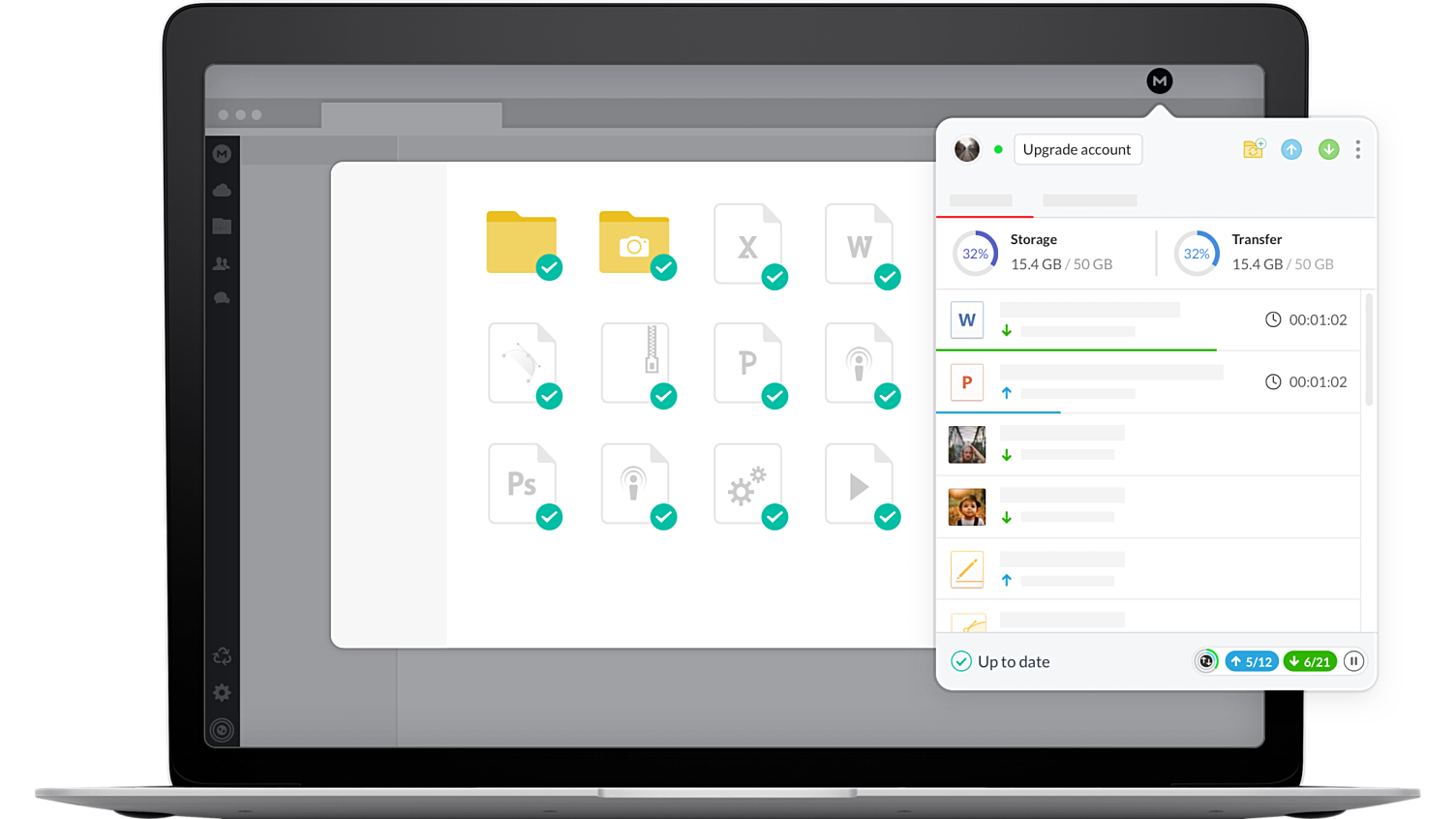

MEGAsync Flathub

https://dl.flathub.org/repo/screenshots/nz.mega.MEGAsync-stable/1504x846/nz.mega.MEGAsync-30c90874e6f684f9a9dde374519a2cac.png

Jinx Cosplay R unstable diffusion

https://preview.redd.it/what-do-you-think-guys-v0-0hulcwvip1qb1.png?width=1080&crop=smart&auto=webp&s=00dca5eab4c4c02dec0d8acab2fae85999ce82d9

Jinx Cosplay R unstable diffusion

https://preview.redd.it/what-do-you-think-guys-v0-r5l6vi4jp1qb1.png?width=1080&crop=smart&auto=webp&s=f2f4f2d91c940b2fc1ede830487dbdcaf83be185

The office of Dallas County Tax Assessor Collector John Ames says last year about 25 of homeowners with tax ceilings owed 0 in school taxes School Taxes are frozen at the dollar amount of the school taxes in the year you turn 65 for your current homestead and at the of current taxes for a new home The tax ceiling continues for age 55 or older surviving

Texas offers several tax breaks to homeowners 65 and older One of them is a freeze on property taxes charged by school districts After you apply for and receive the exemption your school taxes are automatically frozen at the The school tax ceiling available to individuals 65 or older or disabled ensures that the amount of school district tax owed does not increase even if the appraised value of your property rises

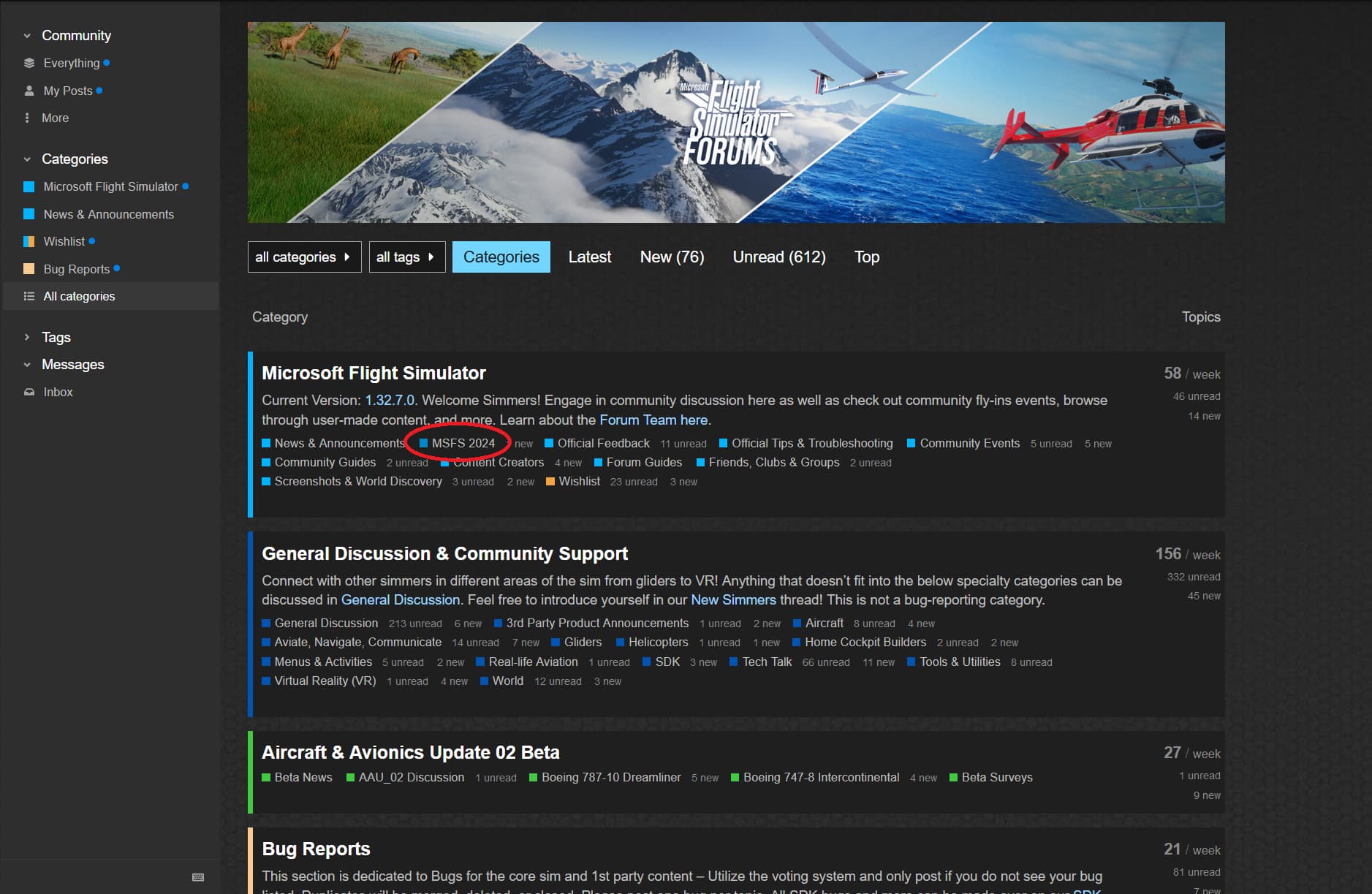

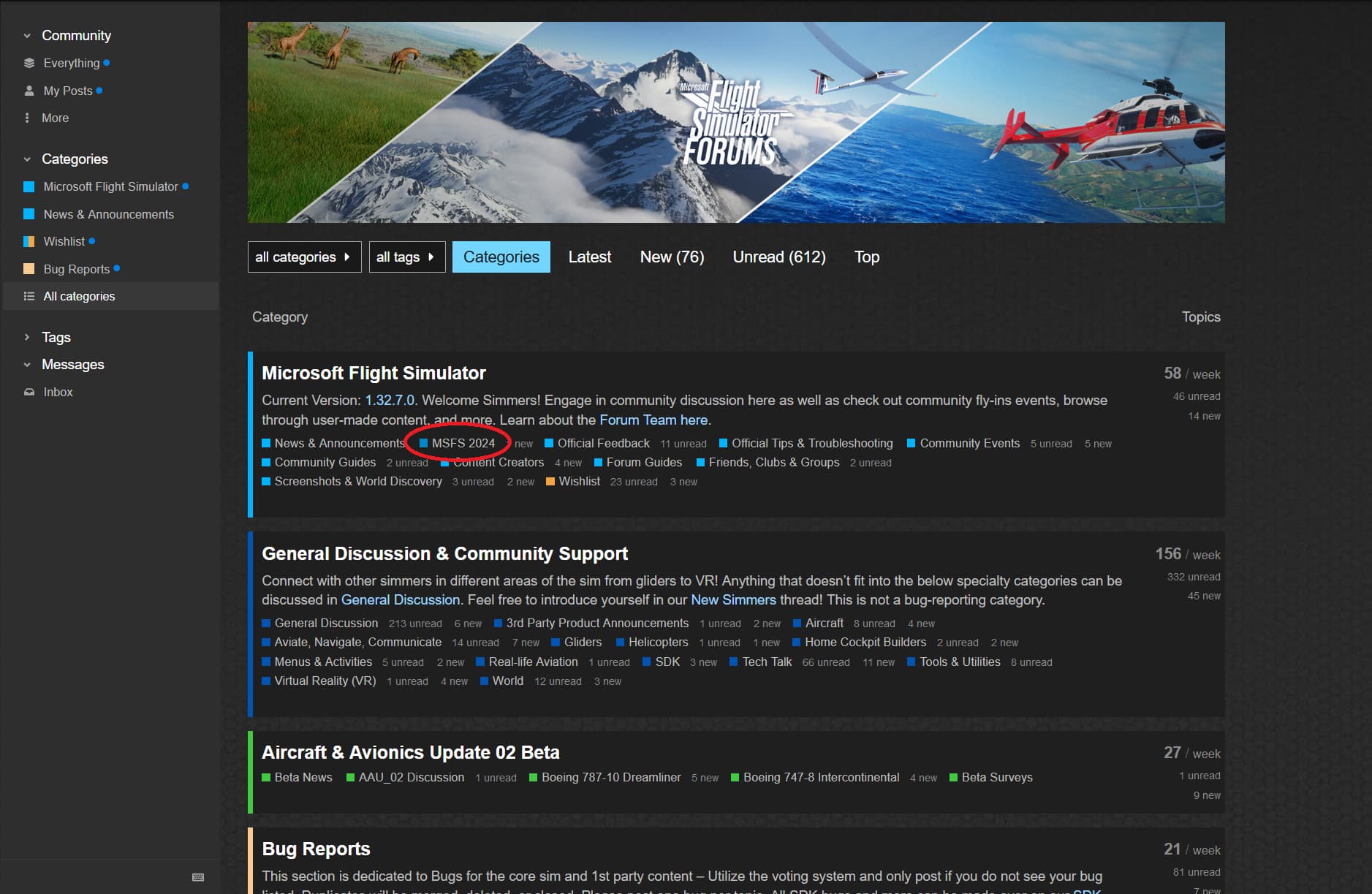

Msfs 2025 System Requirements Donald M Vargas

https://forums.flightsimulator.com/uploads/default/original/4X/c/9/3/c93d08dfb9f2d5bccb77d3cba905425776d9f171.jpeg

Rohit Painuly s Profile Binance Square

https://public.bnbstatic.com/image/pgc/202402/4b000536fec6cae4e98bad3db5c58e9d.png

https://www.justanswer.com › tax

Age 65 or older and disabled exemptions Individuals 65 and older and or disabled residence homestead owners may qualify for a 10 000 homestead exemption for school

https://www.poconnor.com

The primary benefit of the Texas over 65 property tax exemption is that it freezes school taxes on the property meaning they will NOT go up even when the property value or

North Carolina Tax Rates 2024

Msfs 2025 System Requirements Donald M Vargas

Do Public Schools Pay Taxes

How Long Do You Have To Wait For Pending Robux Playbite

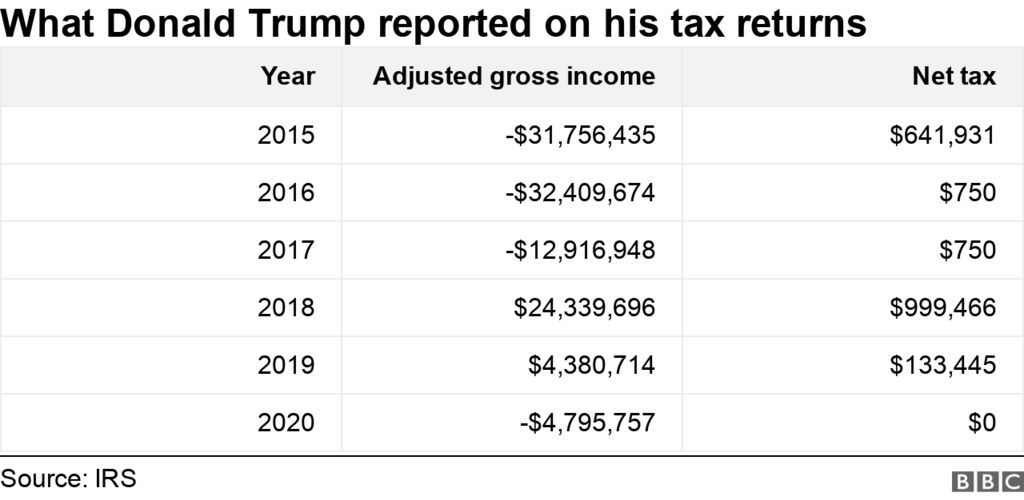

Trump s Tax Returns Reveal President s Foreign Bank Accounts BBC News

How To Use DaVinci Resolve TechRadar

How To Use DaVinci Resolve TechRadar

Microsoft Just Revealed A Major Surprise With Two New Editions Of

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Social Security Tax Limit 2025 Withholding In India Olivia Inaya

Do You Have To Pay Back A Social Security Overpayment What To Know

Do You Have To Pay School Taxes After 65 In Texas - School District Property Tax Freeze Freezing Property Taxes at 65 Sometimes called the senior freeze property owners 65 and over reach what is known as the homestead tax