Do You Pay Property Tax On Mobile Homes In California Mobilehomes in California are taxed either through the local property tax system administered by the county in which the mobilehome is situated or by payment of vehicle in lieu license fees

Property taxes for mobile homes are billed separately from the parcel where the mobile home is located A mobile home attached to a foundation is considered a modular home A modular home is listed as an improvement on the yearly Yes you do pay property taxes on mobile homes in California The property taxes are typically paid annually or bi annually depending on the jurisdiction Types of Mobile

Do You Pay Property Tax On Mobile Homes In California

Do You Pay Property Tax On Mobile Homes In California

https://i.ytimg.com/vi/RQct5d085yM/maxresdefault.jpg

Do You Pay Property Tax On Mobile Homes In Florida YouTube

https://i.ytimg.com/vi/coIopyTJCXQ/maxresdefault.jpg

Pcmc Property Tax Online Payment How To Pay Property Tax Online

https://i.ytimg.com/vi/s4jnhbIwcpI/maxresdefault.jpg

Mobile homes that were sold as new prior to July 1 1980 are subject to In Lieu Taxes ILT a fee paid to the California Department of Housing and Community Development A mobile home How are manufactured homes taxed in California Manufactured homes in California are generally subject to two taxes Sales tax or use tax at the time of sale or resale and Either the

Property taxes As the owner of the land you will be responsible for paying property taxes on both the land and the mobile home In California these taxes are based on the assessed value of Mobile homes in California used to get taxed in the same way as vehicles with owners paying license and registration fees After state law changed in 1979 mobile homes sold after July 1 1980 were subject to

More picture related to Do You Pay Property Tax On Mobile Homes In California

Property Tax Online Payment PCMC Pay Property Tax On Mobile Pay

https://i.ytimg.com/vi/F0H2ns02CvE/maxresdefault.jpg

Do You Pay Property Tax On A Car In Florida YouTube

https://i.ytimg.com/vi/mi-ZkB-x0_E/maxresdefault.jpg

State property tax rates The Arizona Ground Game

https://azgroundgame.org/wp-content/uploads/2021/03/state-property-tax-rates.png

A manufactured home is subject to local property taxation if sold new on or after July 1 1980 or if the owner of the manufactured home requests conversion from the vehicle license fee to local All Manufactured Homes purchased new after June 30 1980 and those on permanent foundations are subject to property taxes As with real property the assessed value of mobile homes cannot be increased by more than 2

In California mobile home owners may legally be required to pay for park property taxes usually through their rent or sometimes through separate pass through fees This can be confusing as it may seem the you re paying Manufactured homes in California are generally subject to two taxes Sales tax or use tax at the time of sale or resale and Either the annual local property tax or the annual

Treasurer Grant County MN Official Website

https://www.co.grant.mn.us/ImageRepository/Document?documentID=3246

Tax Letter Template Format Sample And Example In PDF Word

https://bestlettertemplate.com/wp-content/uploads/2020/10/Tax-Clearance-Letter.png

https://countytreasurer.org › mobilehome-property-tax-information

Mobilehomes in California are taxed either through the local property tax system administered by the county in which the mobilehome is situated or by payment of vehicle in lieu license fees

https://ttc.lacounty.gov › mobile-home-ta…

Property taxes for mobile homes are billed separately from the parcel where the mobile home is located A mobile home attached to a foundation is considered a modular home A modular home is listed as an improvement on the yearly

Car Lease

Treasurer Grant County MN Official Website

Tax Brackets 2025 25 Richard D Hart

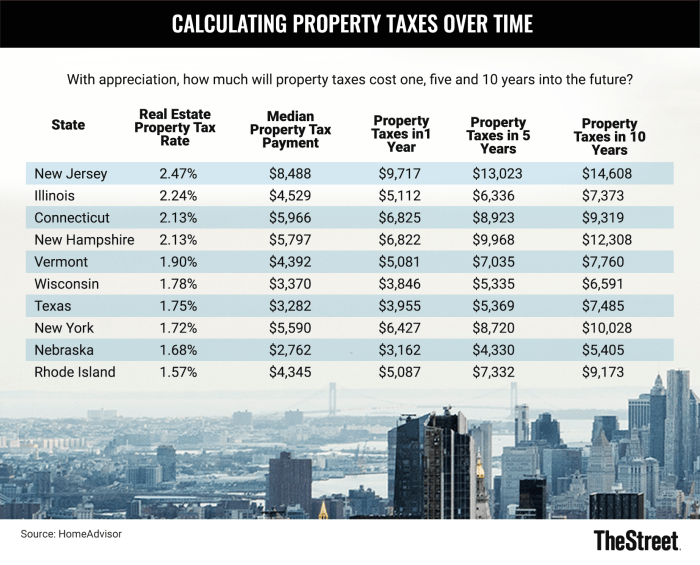

These States Have The Highest Property Tax Rates TheStreet

2024 Honolulu Real Property Tax Guide

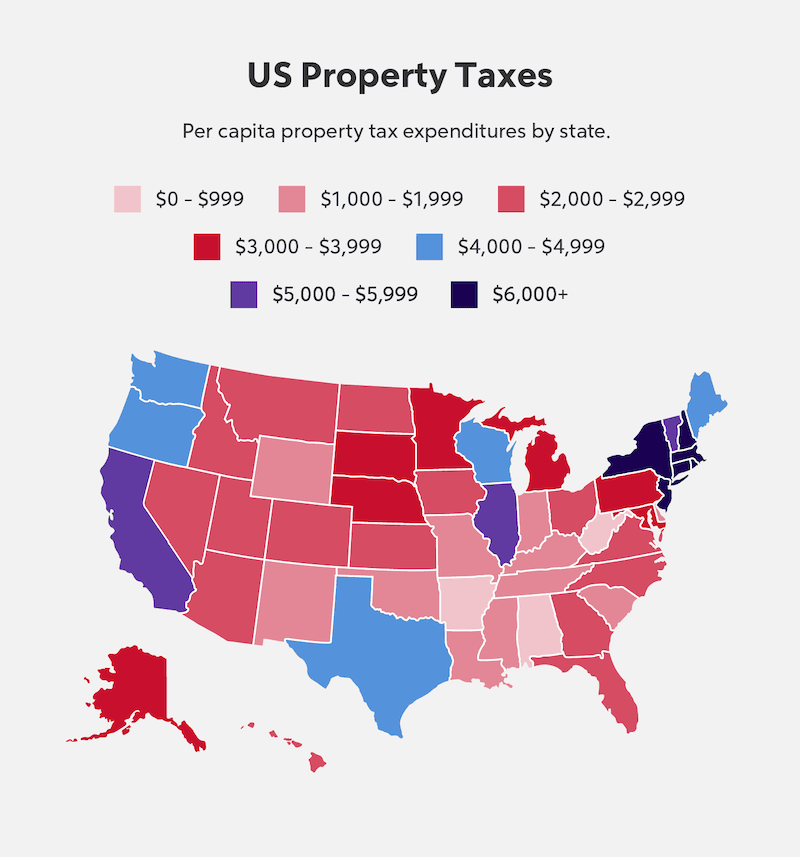

Property Tax Singapore MoeezMiryiam

Property Tax Singapore MoeezMiryiam

When Are Property Taxes Due In Indiana 2024 Aleda Aundrea

Why Do You Pay Property Taxes Tax Ease

Property Tax Information Worksheets

Do You Pay Property Tax On Mobile Homes In California - Who Pays Mobile Home Property Taxes Property taxes for a mobile home must be paid by the owner of the home But are they paying personal property tax or real estate tax If you own