Does A 100 Disabled Vet Pay Property Taxes In Texas Yes A disabled veteran with a service connected disability awarded 100 percent disability compensation and a disability rating of 100 percent or determination of individual

A disabled veteran who owns property other than a residence homestead may apply for a different disabled veteran s exemption under Tax Code Section 11 22 that applied according to the Property tax exemptions are available to Texas veterans who have been awarded 10 to 100 disability rating from the VA The following are the exemptions based on Veterans Administration disability ratings 100

Does A 100 Disabled Vet Pay Property Taxes In Texas

Does A 100 Disabled Vet Pay Property Taxes In Texas

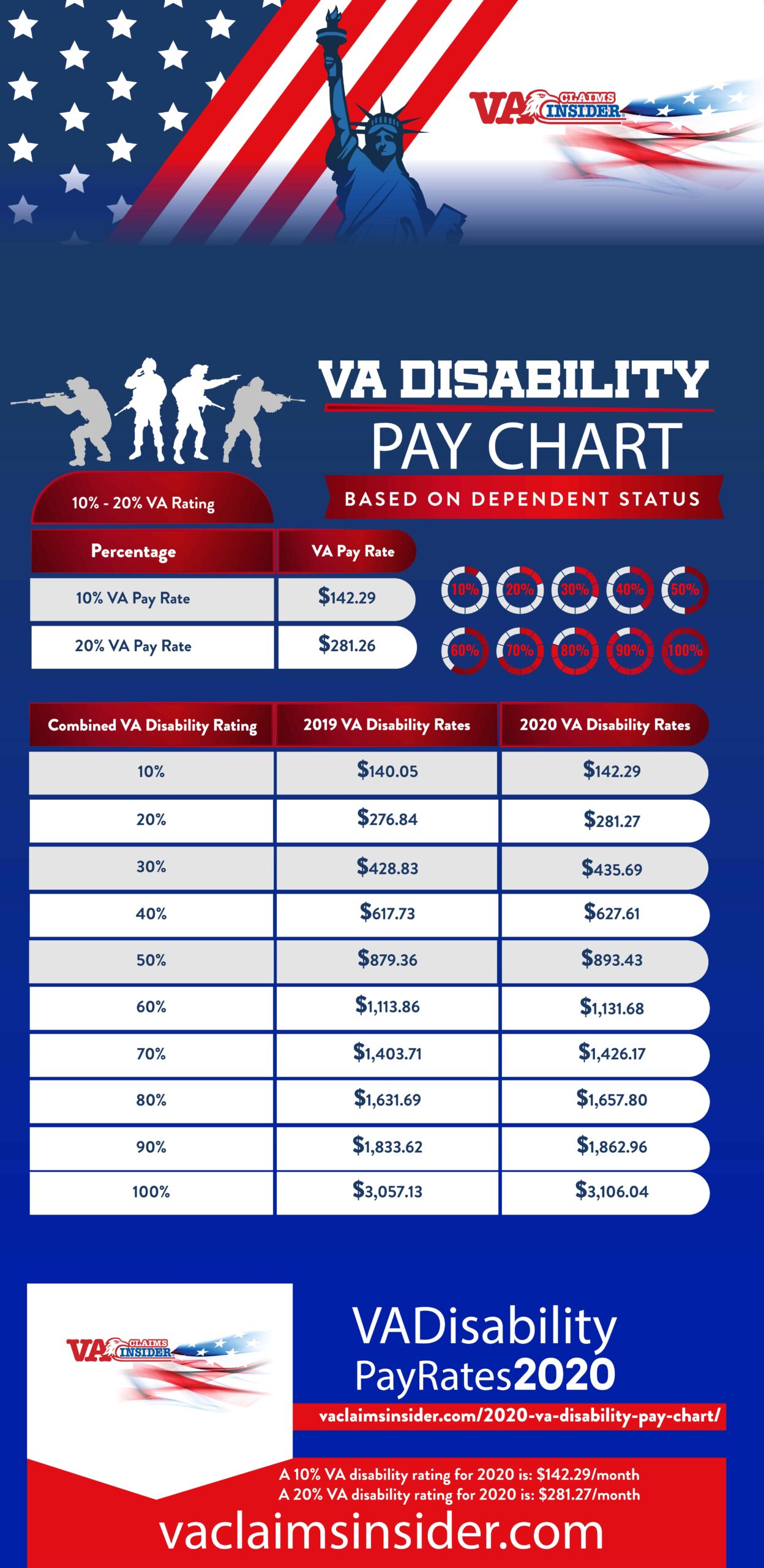

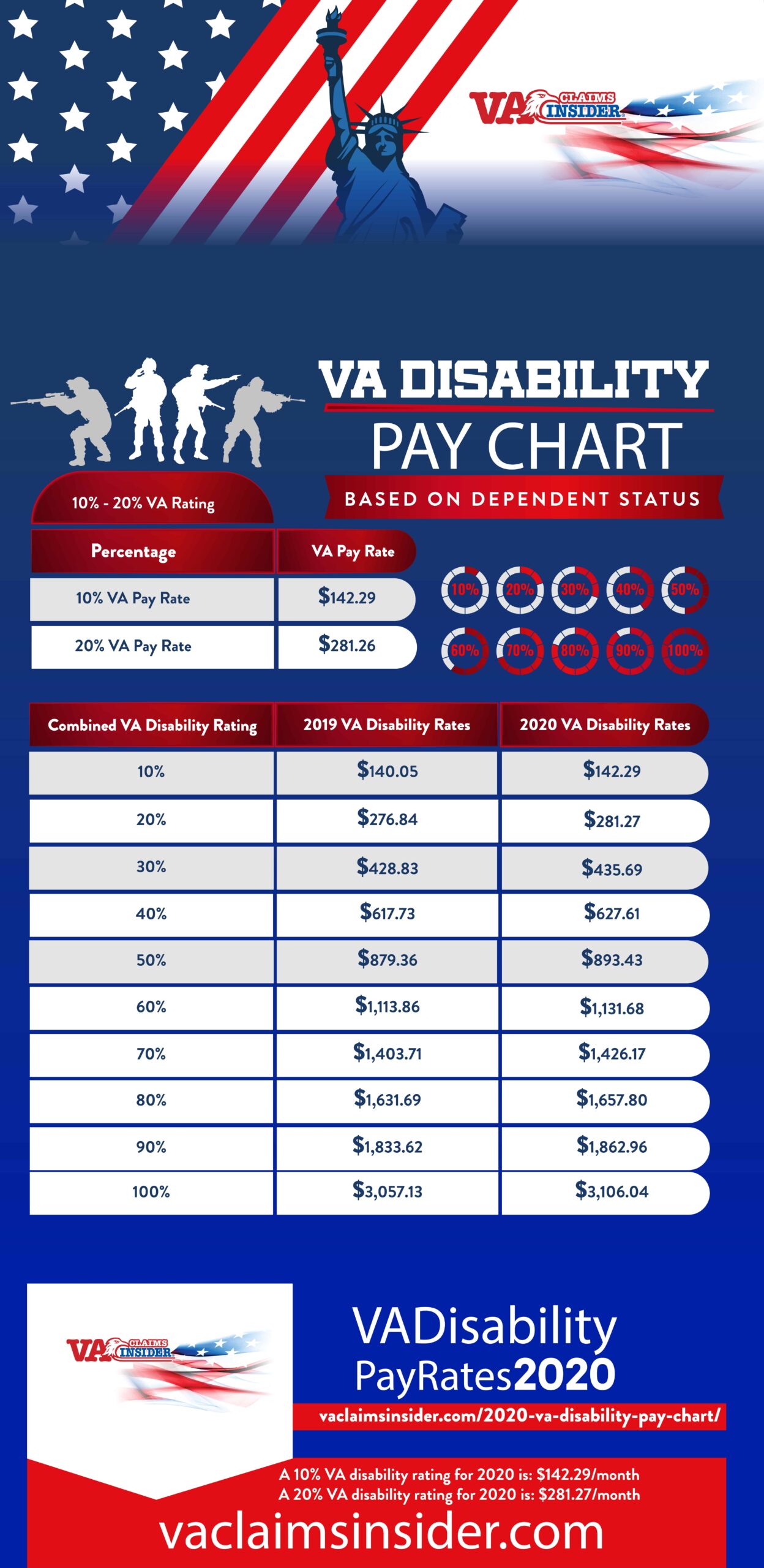

https://vaclaimsinsider.com/wp-content/uploads/2019/10/2020-VA-Disability-Pay-Chart.jpg

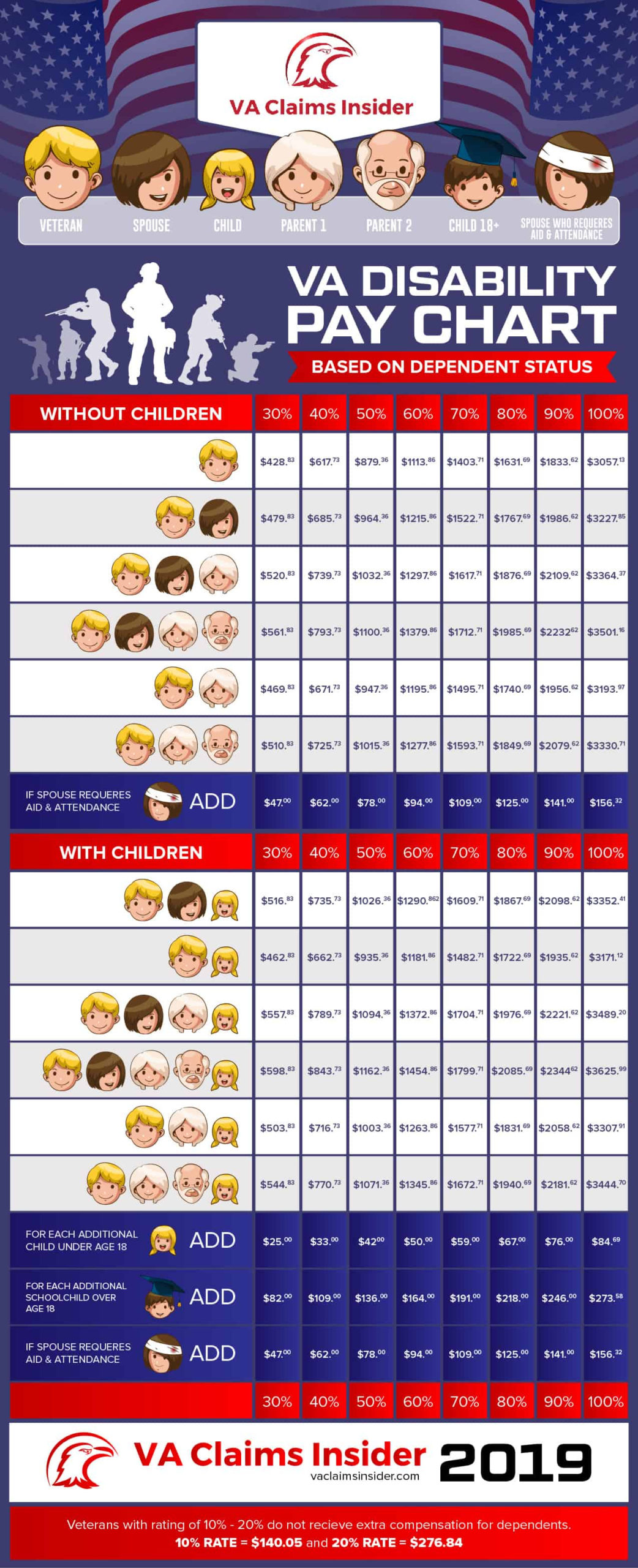

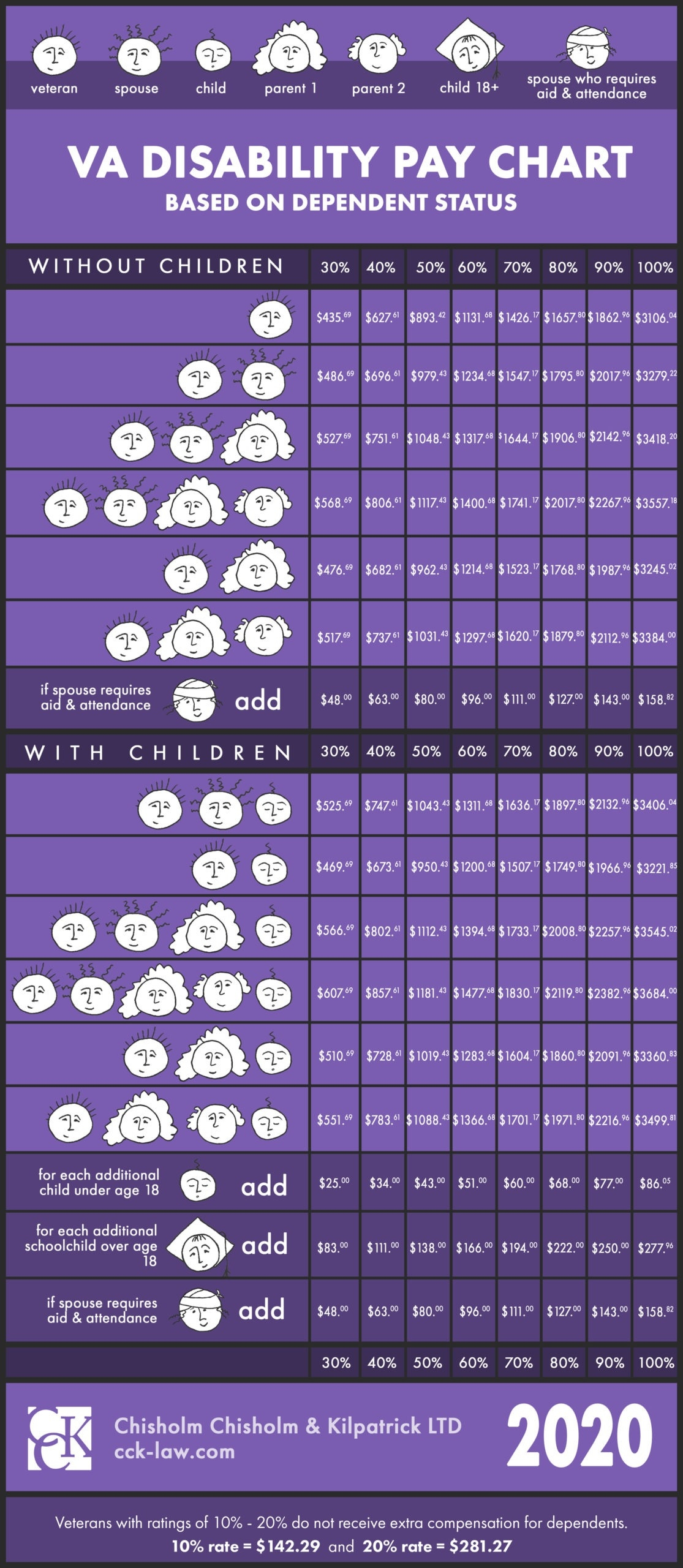

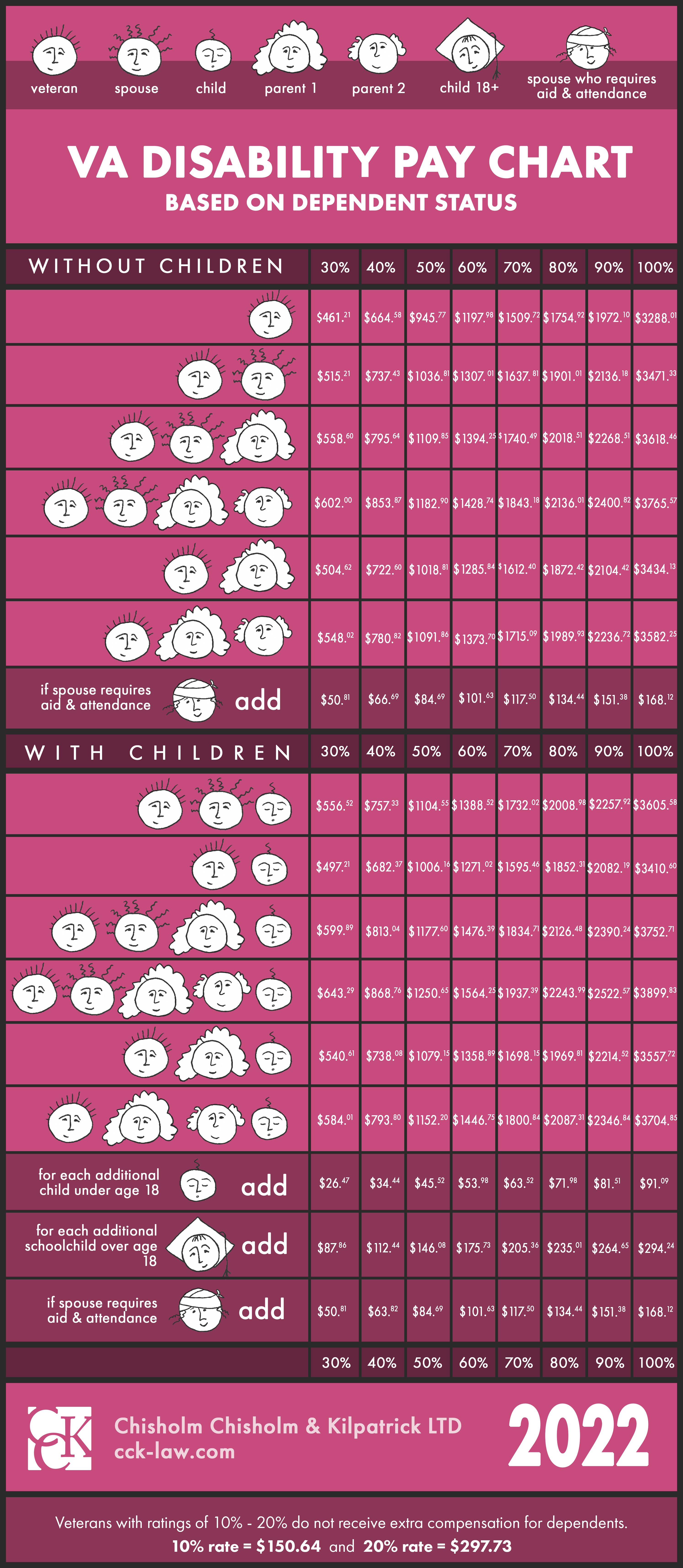

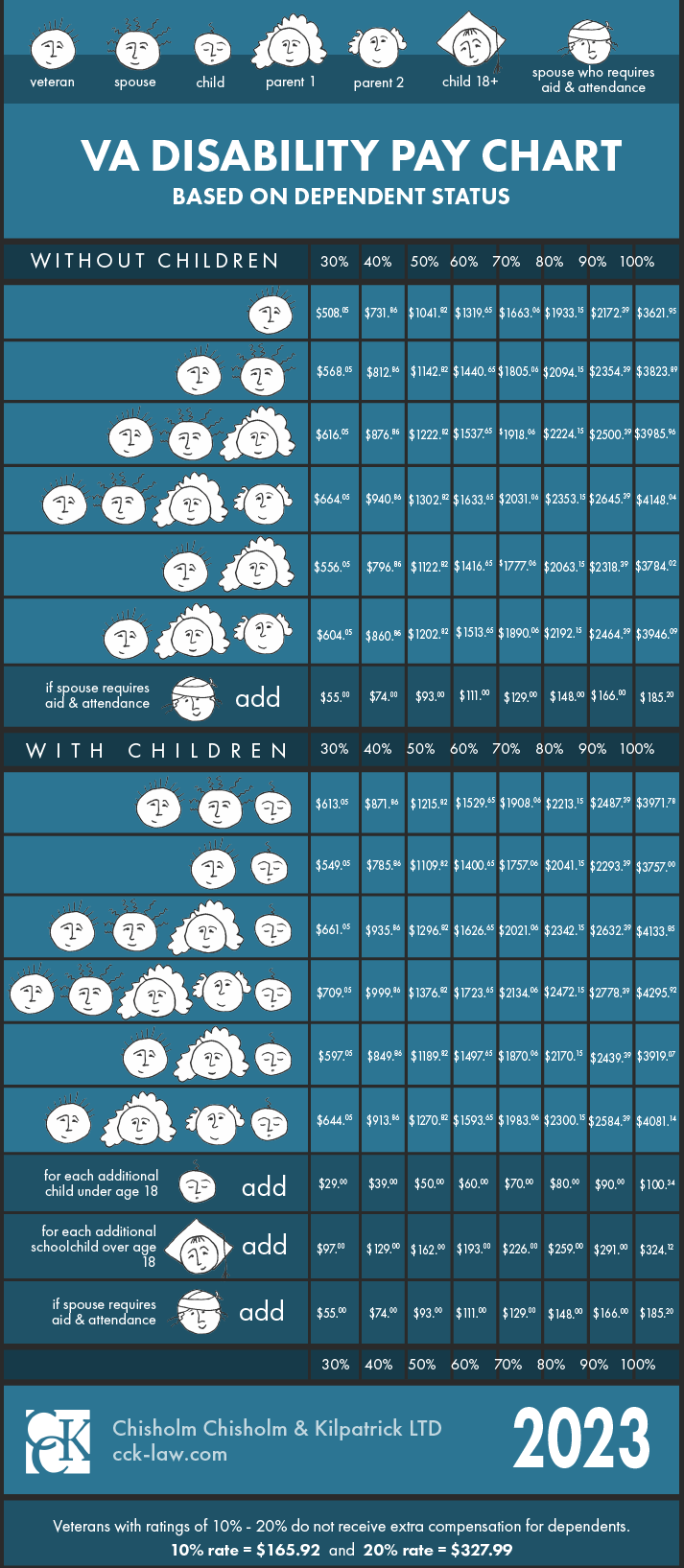

2025 Va Disability Pay Chart Lila Mariyah

https://vaclaimsinsider.com/wp-content/uploads/2022/10/2023-VA-Disability-Pay-Chart-2048x1229.jpg

2025 Va Disability Rating Payments Zara Azalea

https://vaclaimsinsider.com/wp-content/uploads/2022/08/The-Official-2023-VA-Disability-COLA-is-8.7-scaled.jpg

A disabled veteran with a disability rating of less than 100 percent may qualify for an exemption on their residence homestead donated by a charitable organization The percentage amount The disabled veteran must be a Texas resident and must choose one property to receive the exemption In Texas veterans with a disability rating of 100 are exempt from all property

Veterans with a service connected disability are encouraged to file an exemption application form to have their property taxes lowered Some veterans may even qualify for a 100 percent tax What is the 100 Percent Disabled Veterans Residence Exemption The Texas Legislature enacted House Bill 3613 which added Section 11 131 to the Texas Property Tax Code This

More picture related to Does A 100 Disabled Vet Pay Property Taxes In Texas

Civilian Cac Cards For Retirees

https://i.redd.it/66ge8og8n90a1.jpg

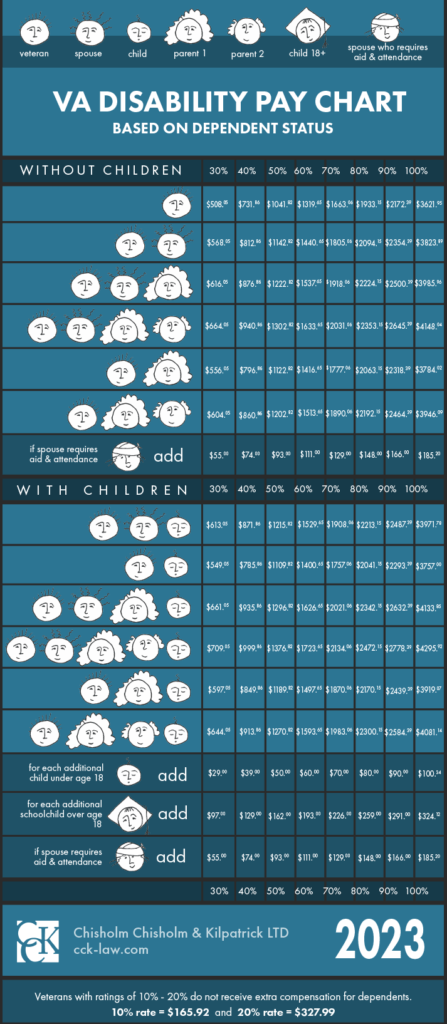

Va Chapter 35 Payment Chart

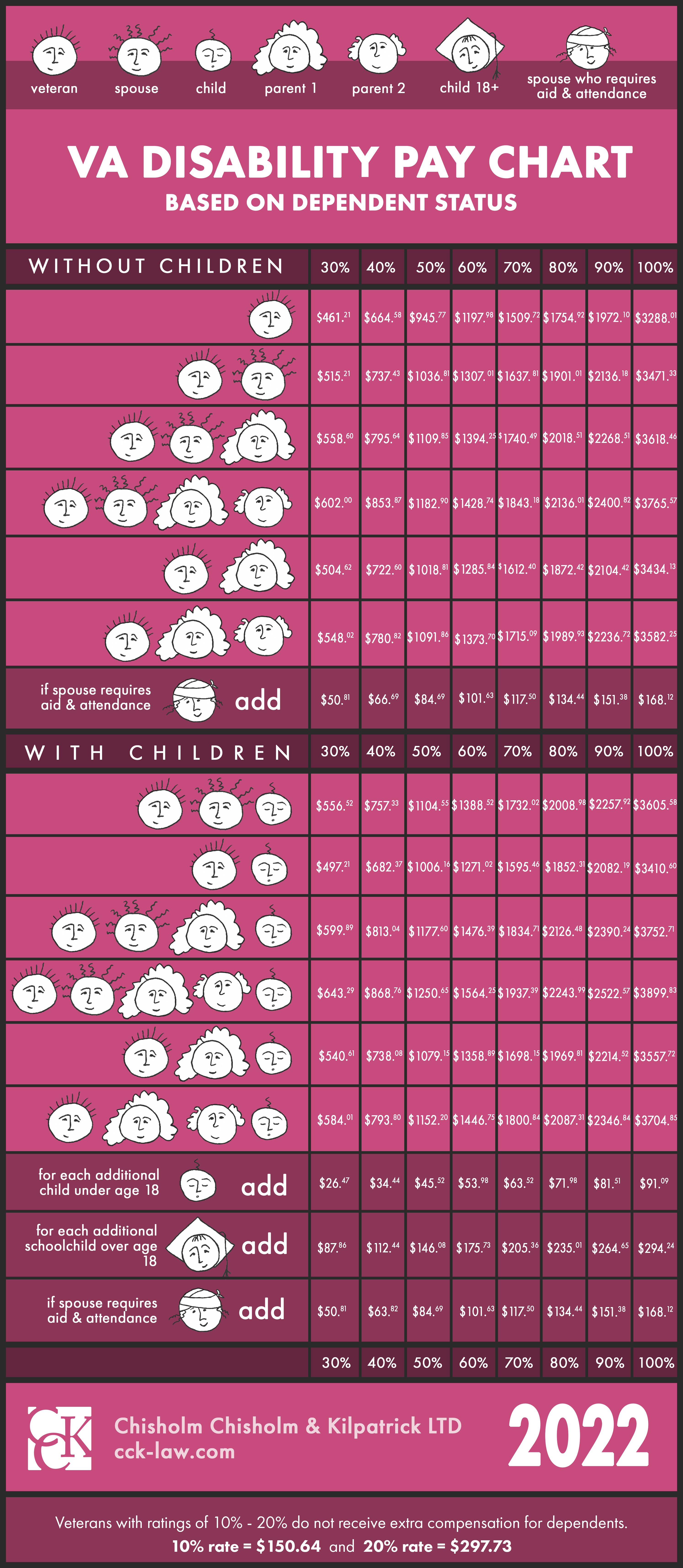

https://cck-law.com/wp-content/uploads/2022/08/VA-Pay-Chart-2023-UPDATED-447x1024.png

Va Disability Payment Scale 2024

https://va-disability-rates.com/wp-content/uploads/2021/08/2019-va-disability-pay-chart-based-on-dependent-status-1-scaled.jpg

Veterans with a 100 disability rating are eligible for the highest level of compensation total elimination of property taxes This exemption is also available to veterans meeting the criteria for Individual Unemployability A concise guide detailing property tax exemptions for Texas disabled veterans including eligibility exemption amounts based on disability rating benefits for donated properties and specifics

You must be 100 disabled or have a rating of individual unemployability to qualify for the new exemption You must also be receiving 100 disability compensation from the VA Veterans who are 100 disabled or unemployable are exempt from paying property taxes The exemption is transferrable to the surviving spouse Requirements You must own your house

Va Benefits Rating Chart 2024

https://cck-law.com/wp-content/uploads/2021/07/2022-Pay-Chart-_4.5.png

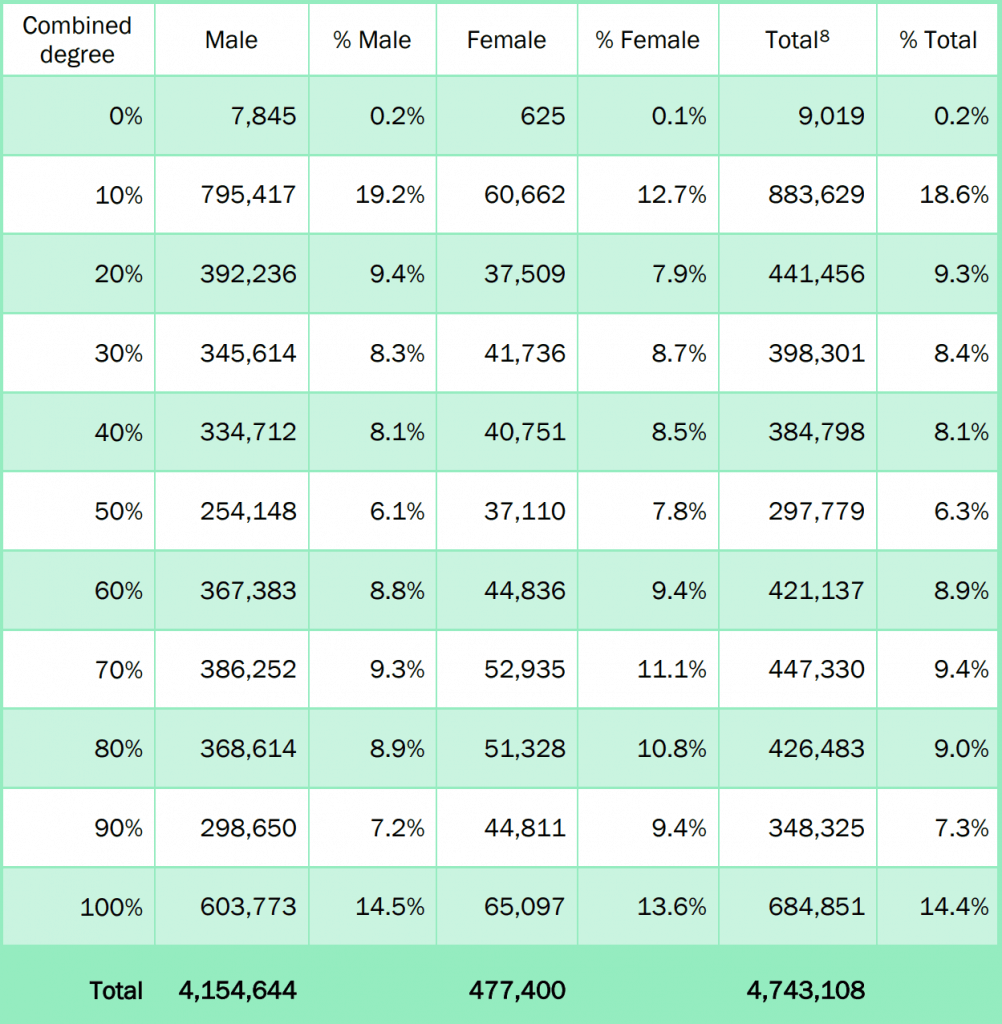

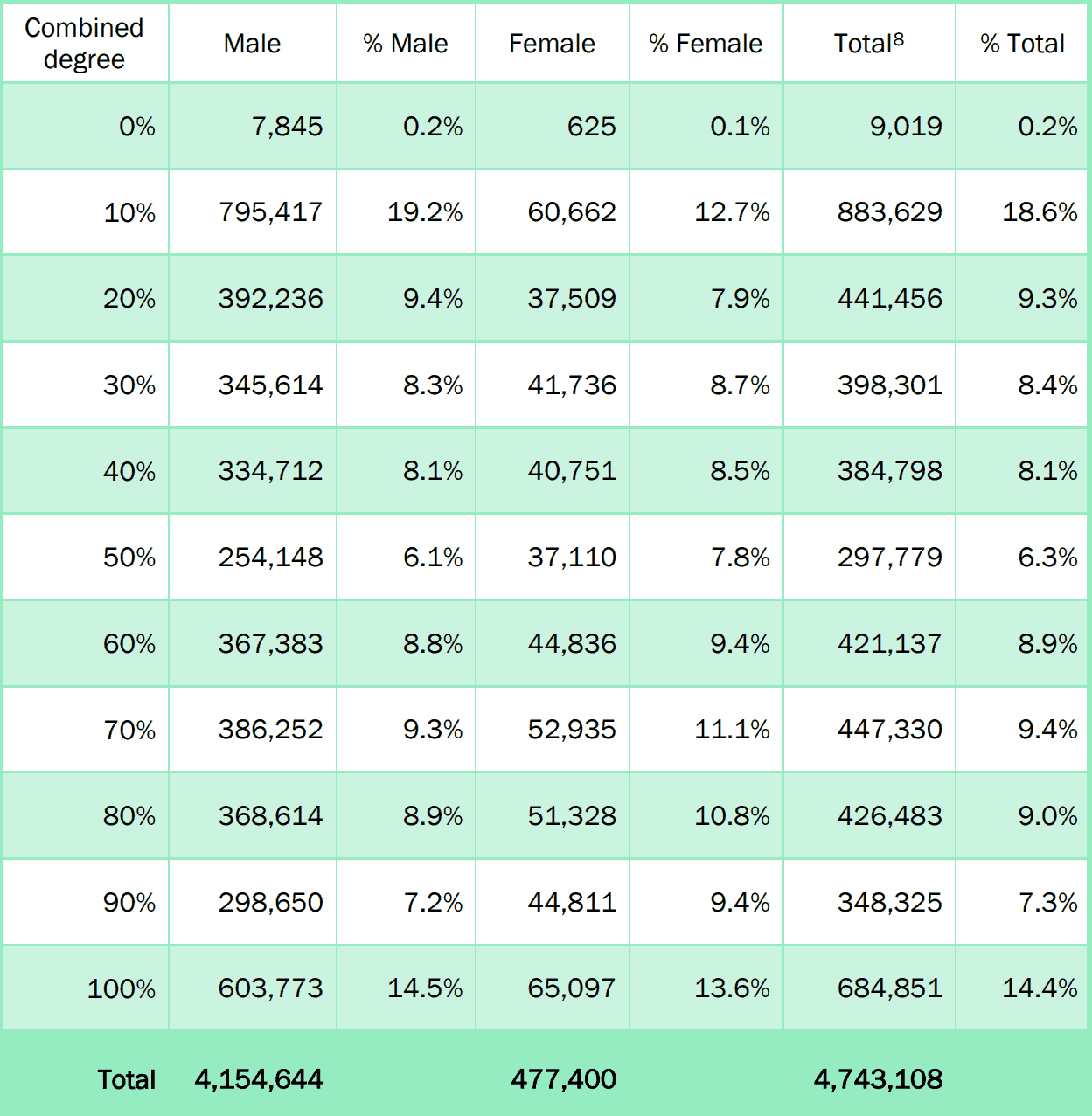

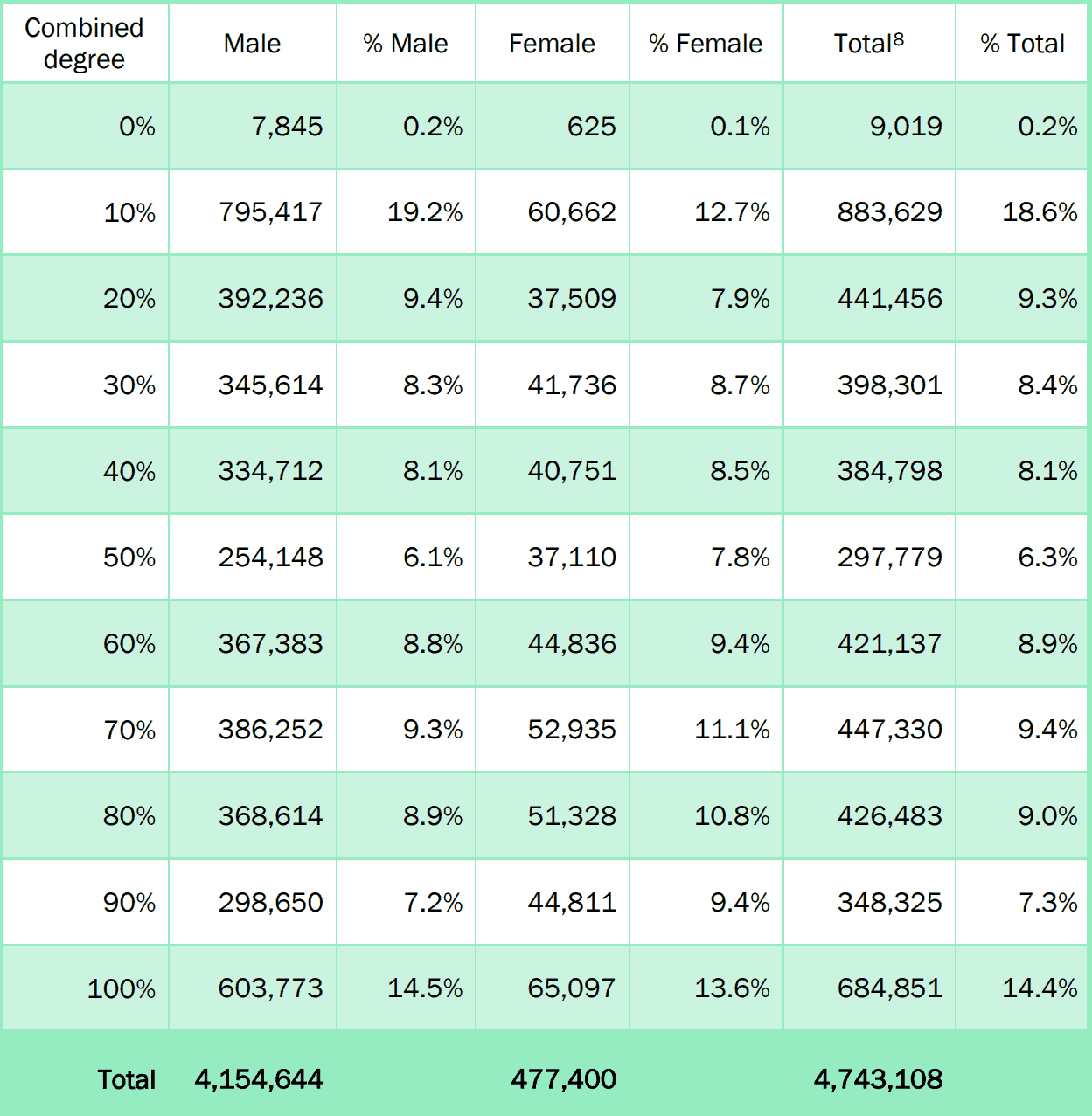

Va Disability Compensation Calculator 2024

https://vaclaimsinsider.com/wp-content/uploads/2020/07/VA-Disability-Rating-Statistics-1002x1024.png

https://comptroller.texas.gov › taxes › property-tax › exemptions

Yes A disabled veteran with a service connected disability awarded 100 percent disability compensation and a disability rating of 100 percent or determination of individual

https://gov.texas.gov › organization › disabilities › tax_exemptions

A disabled veteran who owns property other than a residence homestead may apply for a different disabled veteran s exemption under Tax Code Section 11 22 that applied according to the

Va Health Income Limits 2024

Va Benefits Rating Chart 2024

What Happens If You Don t Pay Property Taxes In Texas

2024 Va Benefit Chart For Veterans

New Property Tax Laws In Texas 2024 Kyle Shandy

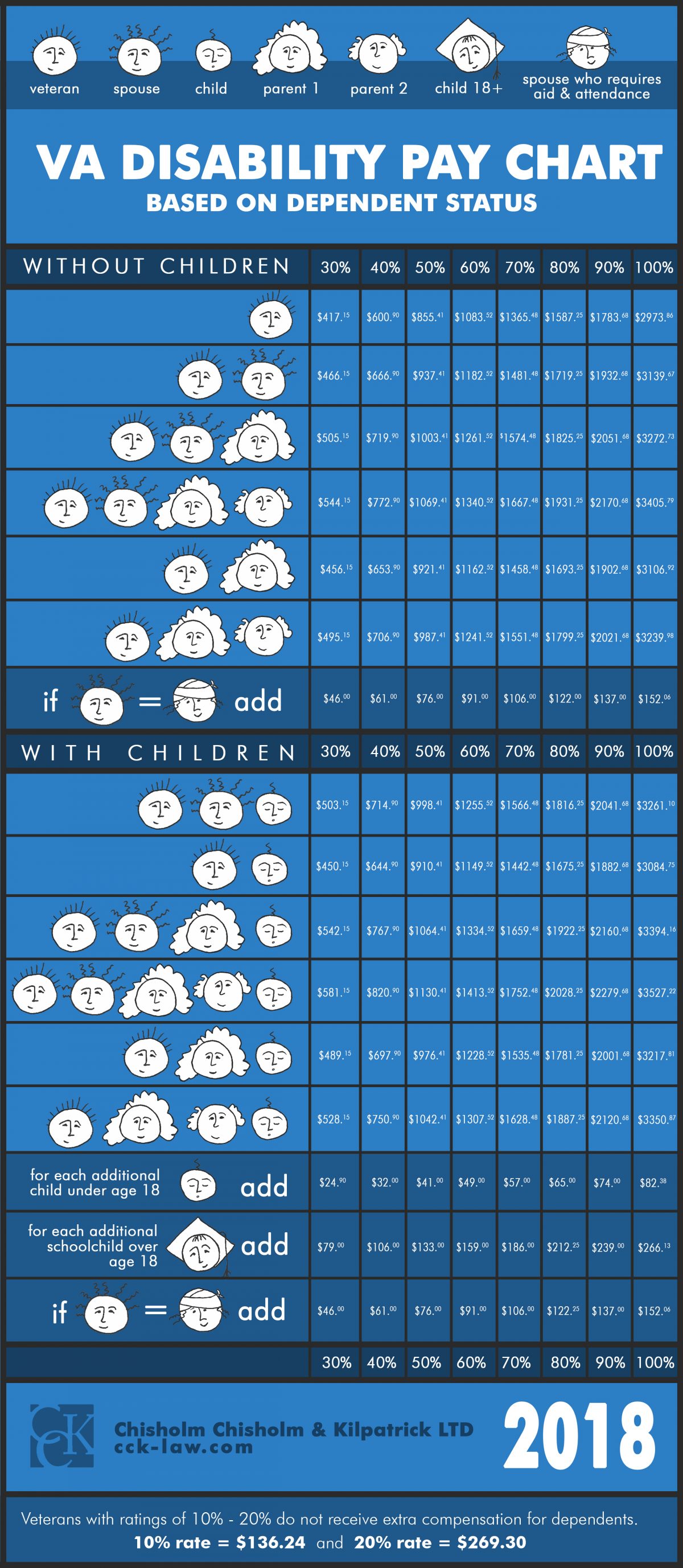

Va Disability Benefits Pay Chart 2021

Va Disability Benefits Pay Chart 2021

Pay Chart For Disabled Veterans

Texas Veteran Property Tax Exemption Disabled Veteran Benefits

Pay Rate For 100 Disabled Veteran

Does A 100 Disabled Vet Pay Property Taxes In Texas - Veterans with a service connected disability are encouraged to file an exemption application form to have their property taxes lowered Some veterans may even qualify for a 100 percent tax