Does A Mobile Home Count As Owning A Home On Taxes Yes the IRS says A home includes a house condominium cooperative mobile home house trailer boat or similar property that has sleeping cooking and toilet facilities

Some states require mobile homes that are affixed to the ground to acquire a real property decal and have it attached to the mobile home The county appraiser assesses mobile homes with the sticker and the owner receives an annual property tax bill as the home is considered real property Under federal tax law a mobile home if used as one s main home can be treated as a primary residence However mobile homes are considered personal property and do not qualify for tax deferral treatment under IRC Section 1031

Does A Mobile Home Count As Owning A Home On Taxes

Does A Mobile Home Count As Owning A Home On Taxes

https://i0.wp.com/files.simplifyingthemarket.com/wp-content/uploads/2019/08/07155125/20190809-MEM.jpg?ssl=1

Benefits Of Having A Pet

https://americascounselors.com/wp-content/uploads/2022/09/Untitled_Artwork-1-1024x1024.jpg

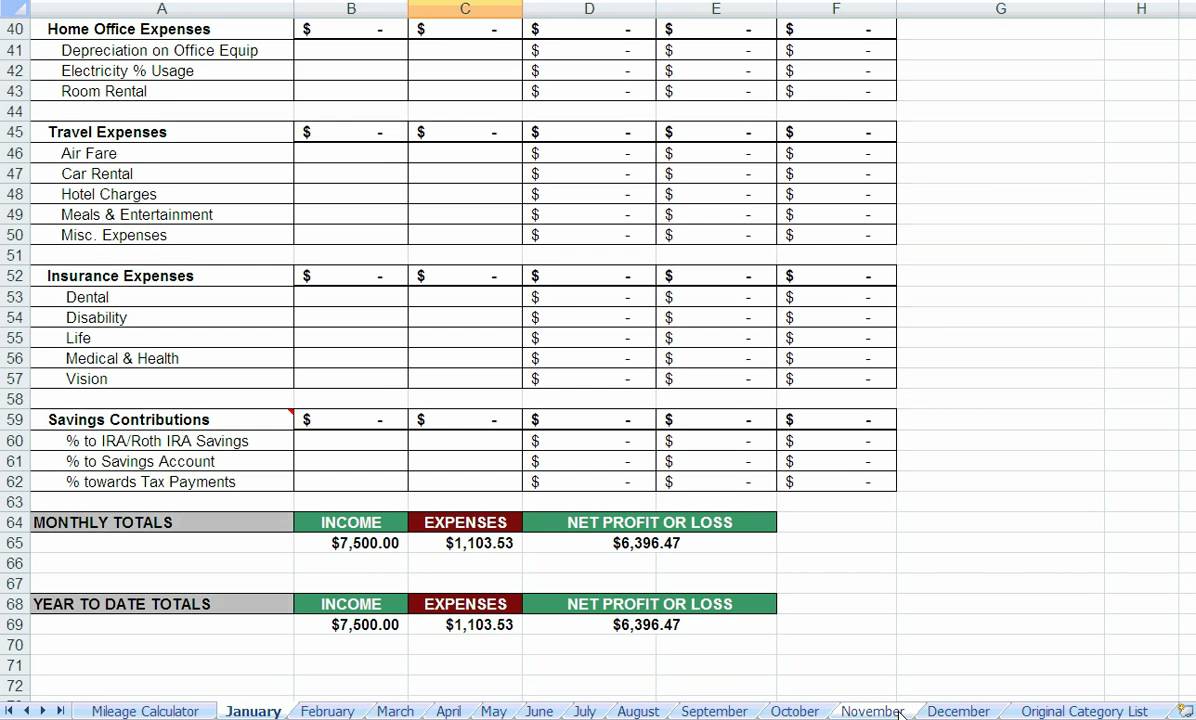

Tax Worksheets

https://i.pinimg.com/originals/04/8e/d9/048ed9b0ad18e9a084a6894507acd617.png

How do i claim the mobile home i bought on my taxes using turbo tax The biggest deduction on a home is almost always the mortgage interest paid during the tax year If you don t have a mortgage you won t qualify for that deduction Buying a mobile home even for a park can reduce your taxes Mobile homes can serve as an affordable and flexible housing option You can buy them with or for your own land or to place on rented space These homes can also afford you tax breaks if you itemize tax deductions

Unlike traditional homes mobile homes may be classified as either real or personal property depending on factors such as permanence and land ownership If a mobile home is affixed to a foundation and the owner possesses the land it is generally considered real property subject to property taxes similar to conventional homes This guide covers everything you need to know about how mobile and manufactured homes are taxed how to make payments exemptions that may apply and what happens if you don t pay your taxes on time

More picture related to Does A Mobile Home Count As Owning A Home On Taxes

Pros And Cons Of Owning A Hamster YouTube

https://i.ytimg.com/vi/9cl9y7Xnuvg/maxresdefault.jpg

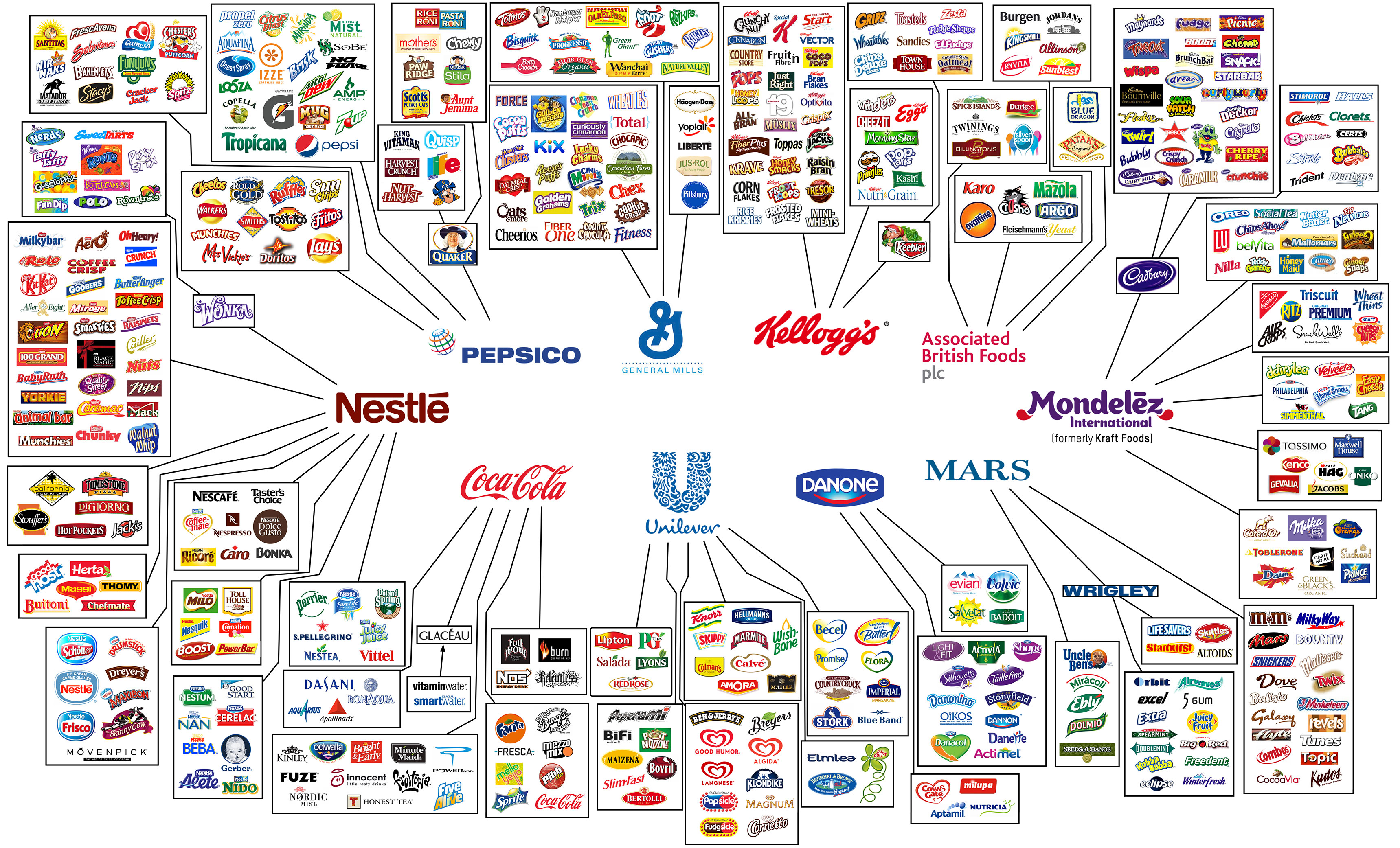

Car Company Owner Diagram

https://farm2.staticflickr.com/1490/24675277932_388ce43d40_o.jpg

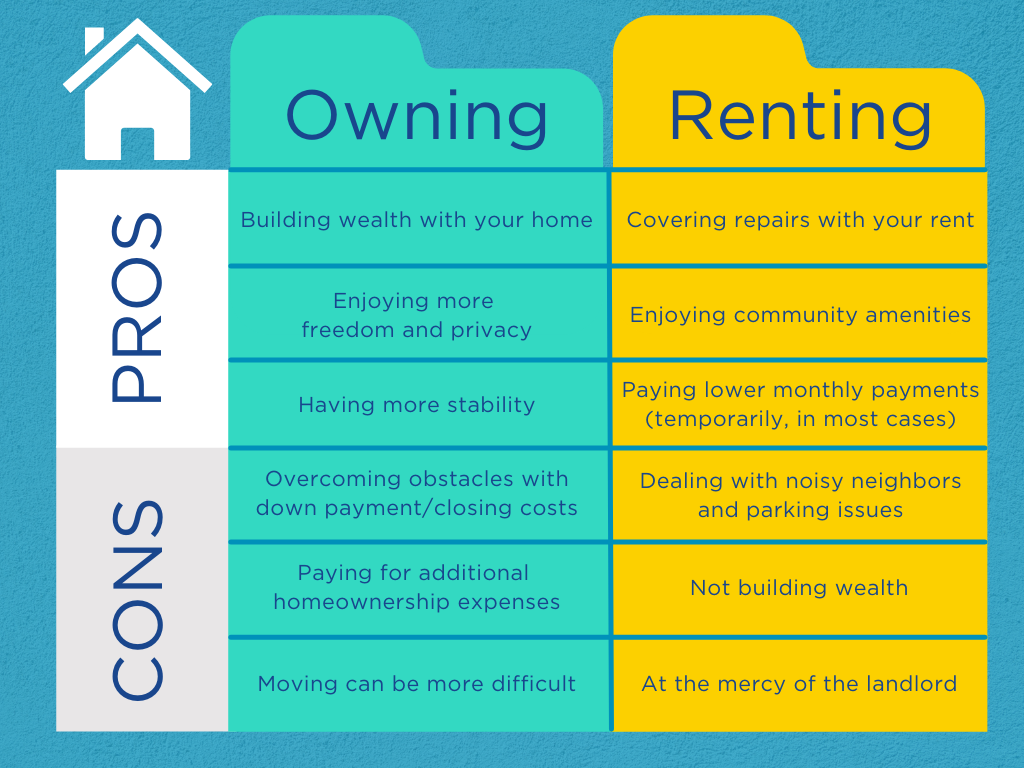

Compareable Oof Living In Your Own Home With Rental Cheap Sale

https://www.sccu.com/getmedia/089818c0-8650-4f0f-bc64-ad932b43a7ec/renting-vs-owning-a-house-comparison-table.png

On the Internal Revenue Service website you ll find that a mobile home qualifies as a home A home includes a house condominium cooperative mobile home house trailer boat or similar property that has sleeping cooking and toilet facilities according to the IRS Whether your home sits on your own land or on a leased lot you can claim a deduction for the property taxes paid to the taxing authority As well the property taxes paid at settlement are fully deductible if you ve purchased your manufactured home in the year you re filing for Energy Efficiency Tax Credits

When your home is placed on land you do not own such as in the case of individuals living in a mobile community taxes will depend on the state and district in which you reside some states require taxes to be paid by the landowner others require payment by the homeowner A gain on the sale of the mobile home is treated as a capital gain and subject to the laws for taxation of capital gains You will need to determine your tax basis in the mobile home and deduct this and your selling costs from the sales proceeds to

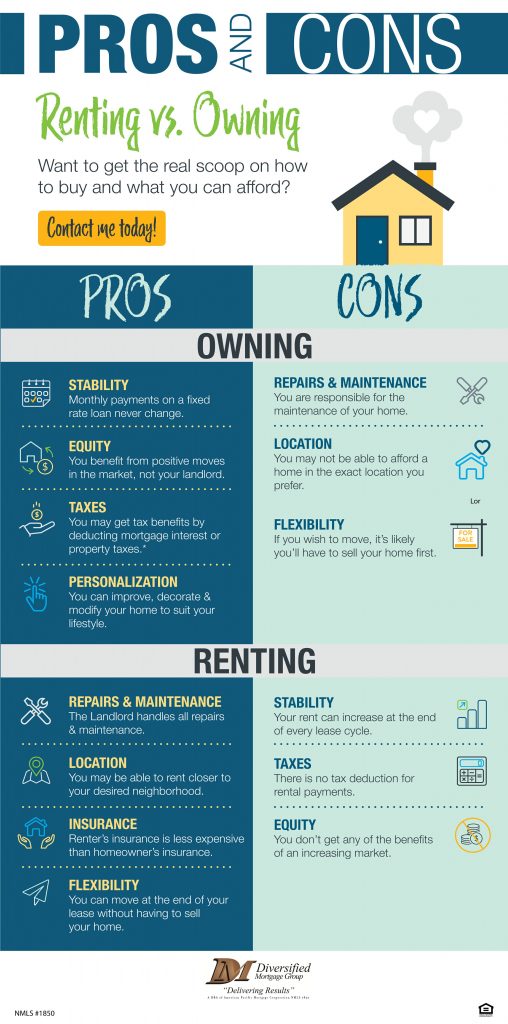

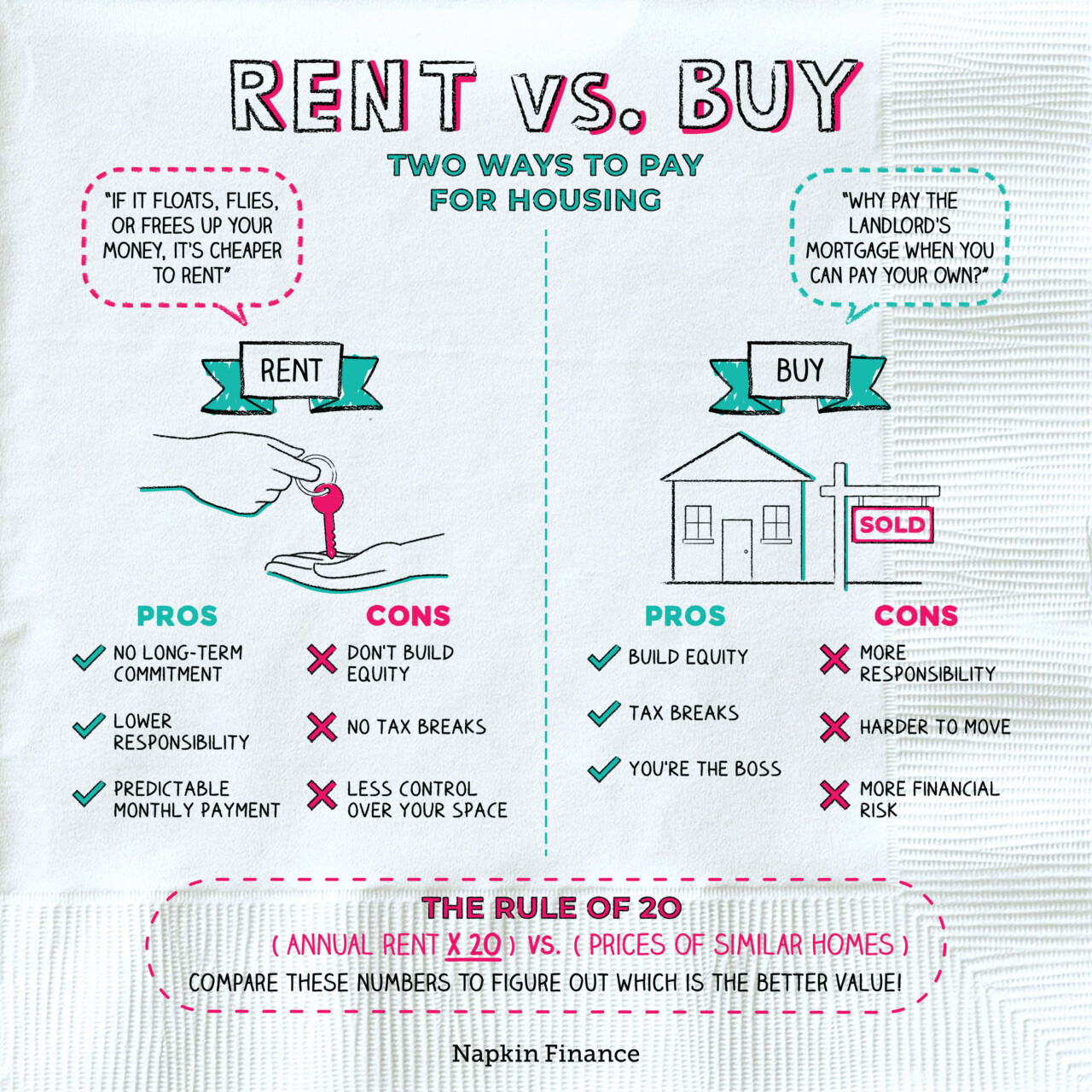

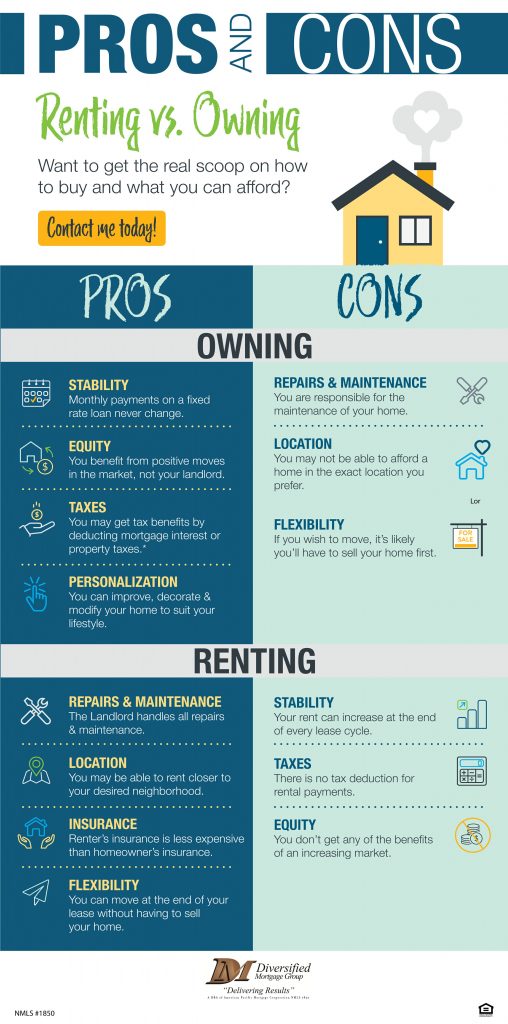

Renting A House Vs Owning A Home Find What Works For You

https://dmgloans.com/wp-content/uploads/2018/12/media-508x1024.jpg

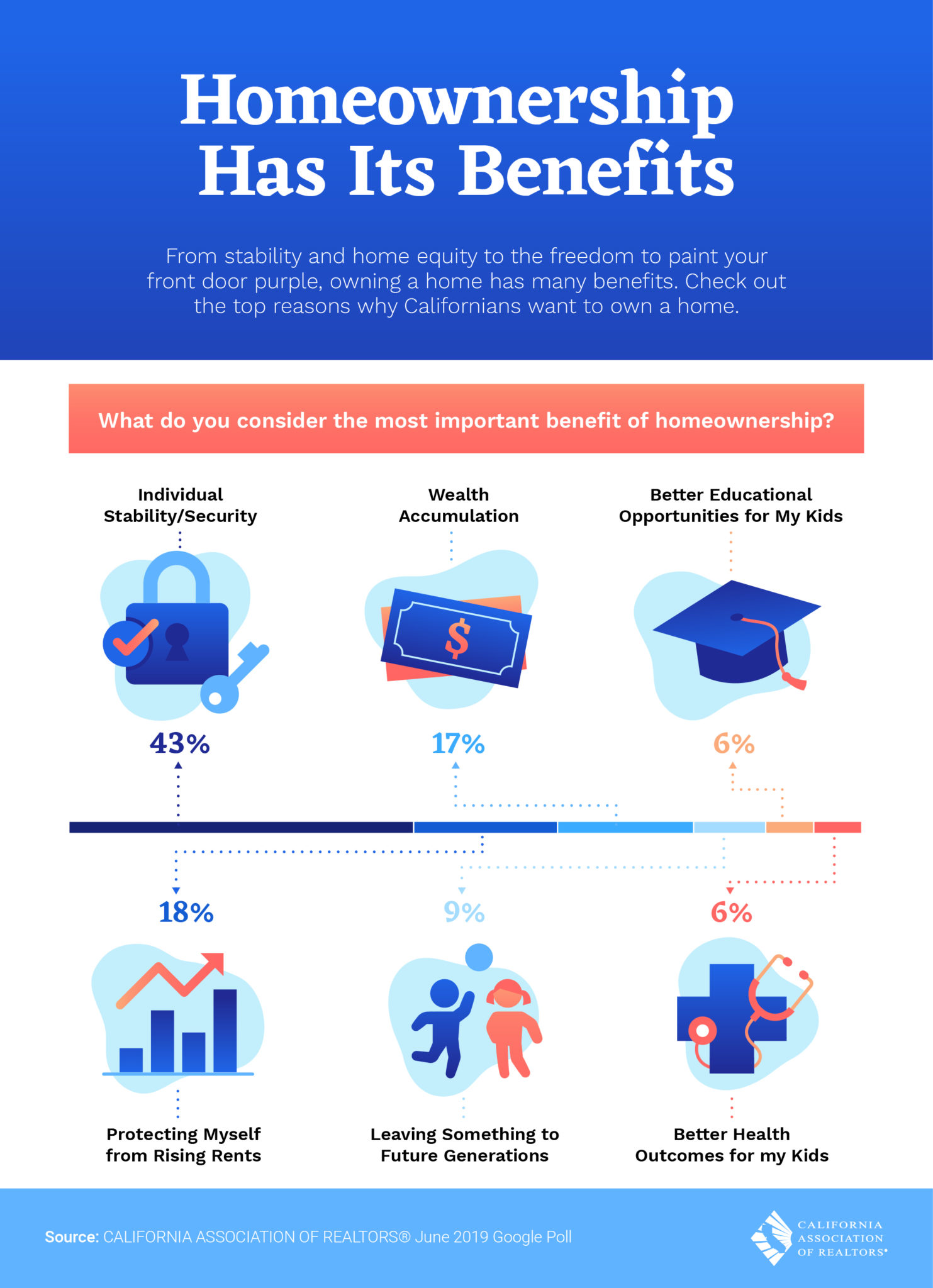

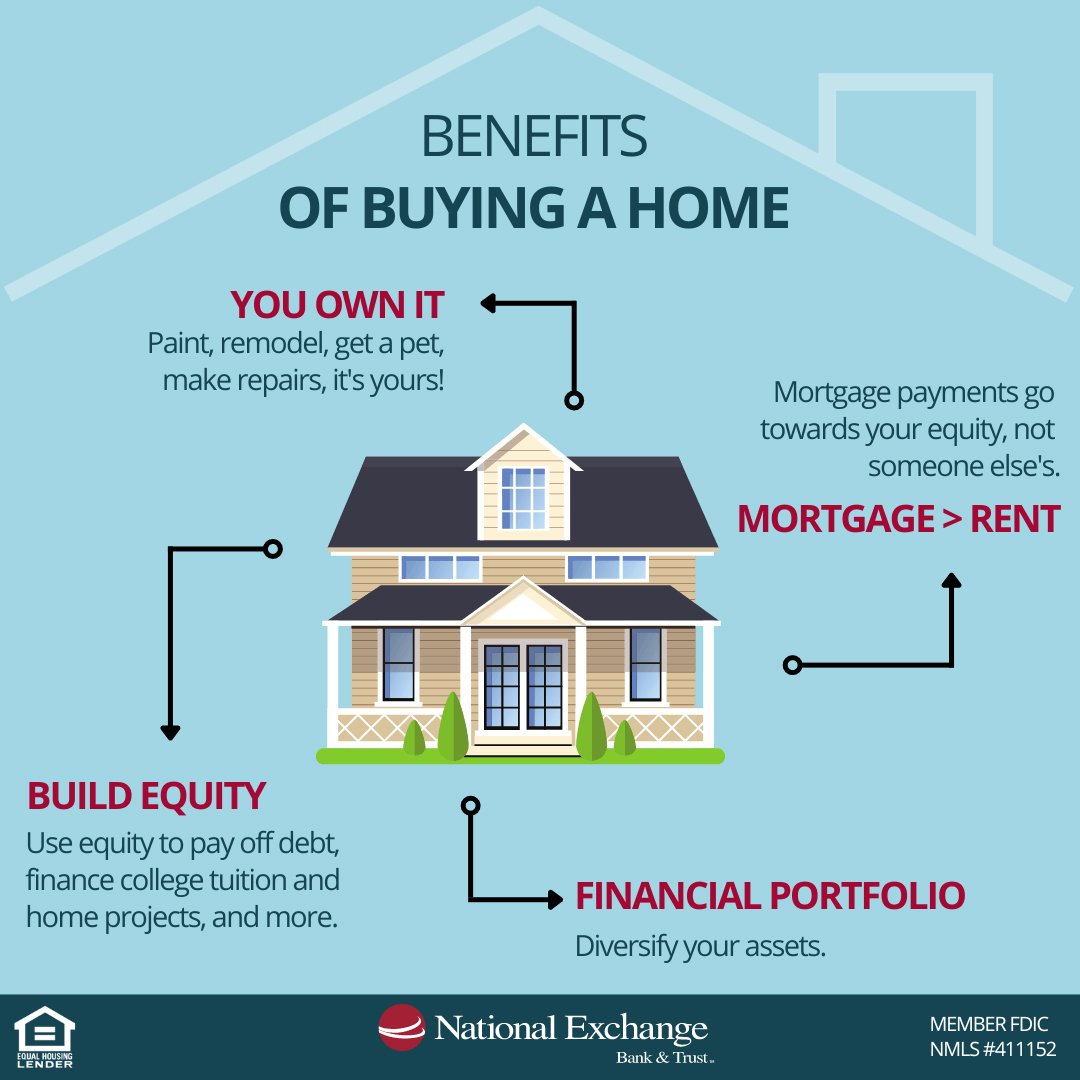

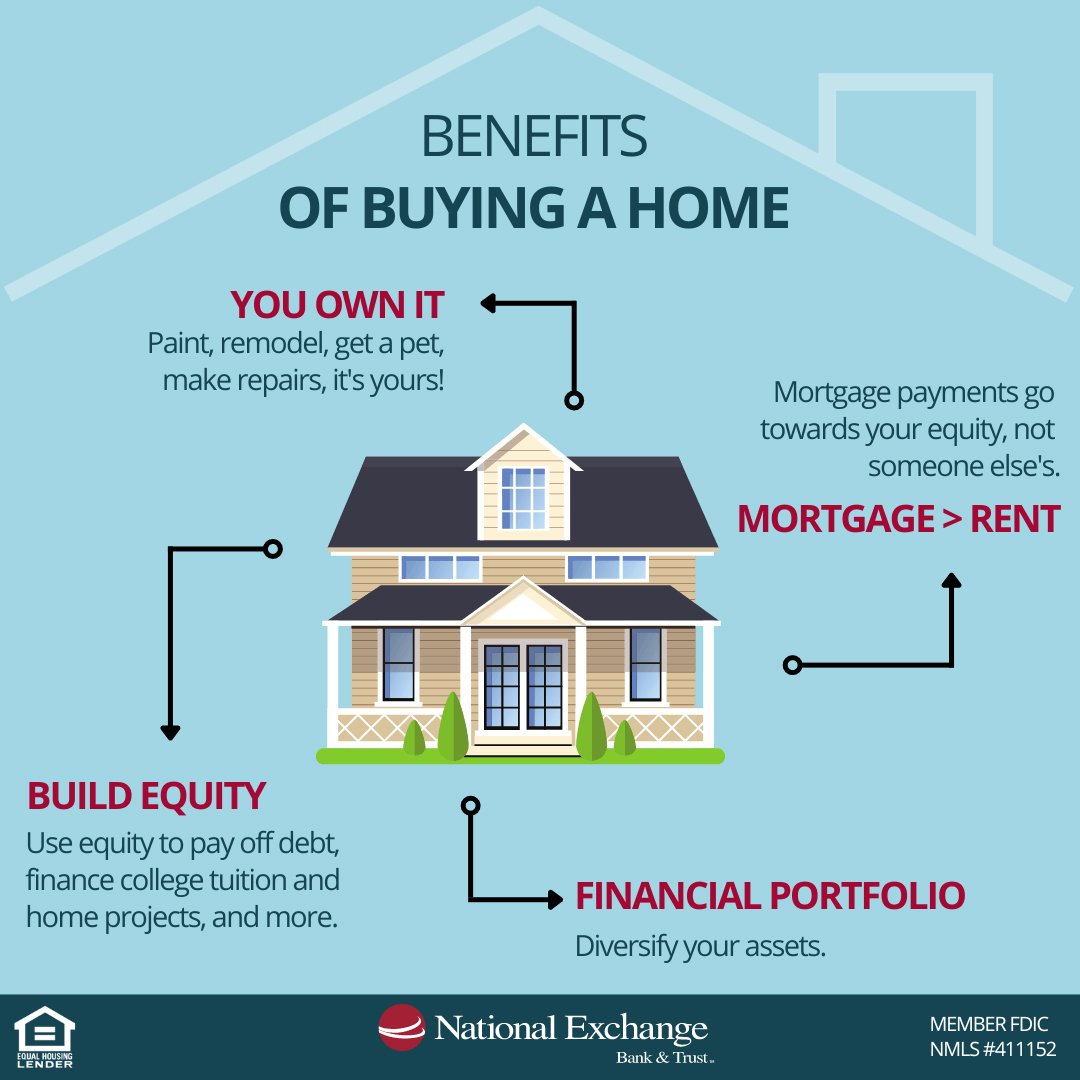

Benefits Of Owning A Home Conrad Real Estate

https://www.conradrealestate.com/wp-content/uploads/2020/01/Homeownership-Benefits-hi-res.jpg

https://ttlc.intuit.com › community › tax-credits...

Yes the IRS says A home includes a house condominium cooperative mobile home house trailer boat or similar property that has sleeping cooking and toilet facilities

https://www.weekand.com › home-garden › article

Some states require mobile homes that are affixed to the ground to acquire a real property decal and have it attached to the mobile home The county appraiser assesses mobile homes with the sticker and the owner receives an annual property tax bill as the home is considered real property

Should I Buy A House Rent Vs Buy Real Estate Buying Vs Renting

Renting A House Vs Owning A Home Find What Works For You

I m Jealous Of The Big Threads Redux 2 Page 36 Bev Vincent s

Realtor Tax Deduction Spreadsheet

Benefits Of Being A Homeowner Riverfront Estates

Buying A Home Versus Renting NEBAT Blog

Buying A Home Versus Renting NEBAT Blog

Realtor Tax Deduction List

Tax Deduction Worksheet 2023

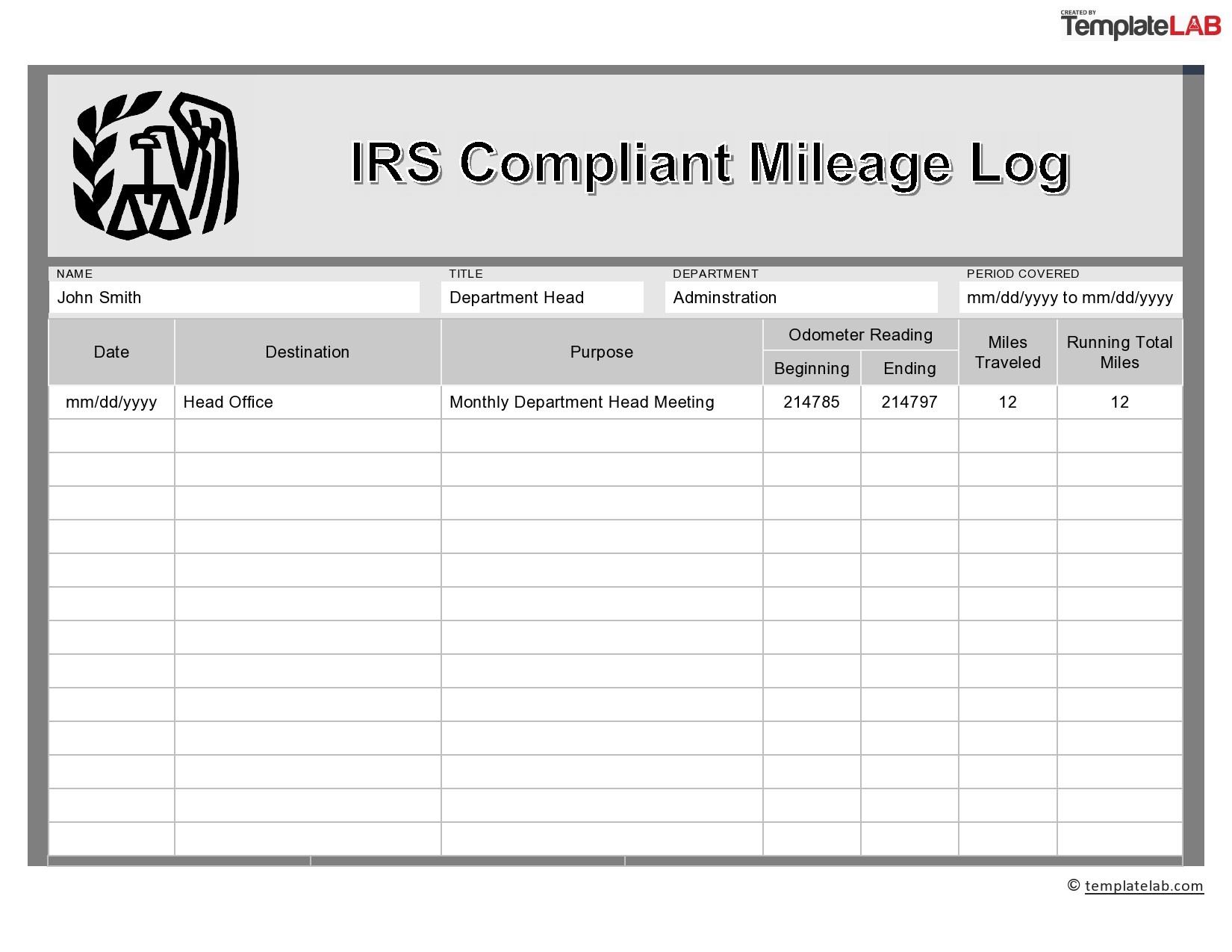

Irs Mileage Rate 2025 For Medical Travel Ashtons B Bailey

Does A Mobile Home Count As Owning A Home On Taxes - This guide covers everything you need to know about how mobile and manufactured homes are taxed how to make payments exemptions that may apply and what happens if you don t pay your taxes on time