Income In Hotel Management Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

Calculating income tax deductions Tax deductions on other types of income Labour sponsored funds tax credits Non resident employees who perform services in Canada Application for a For combined Old Age Security pension and Guaranteed Income Supplement amounts consult the Quarterly report of Canada Pension Plan and Old Age Security monthly amounts and

Income In Hotel Management

Income In Hotel Management

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=338592995423820

Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=163650112938277

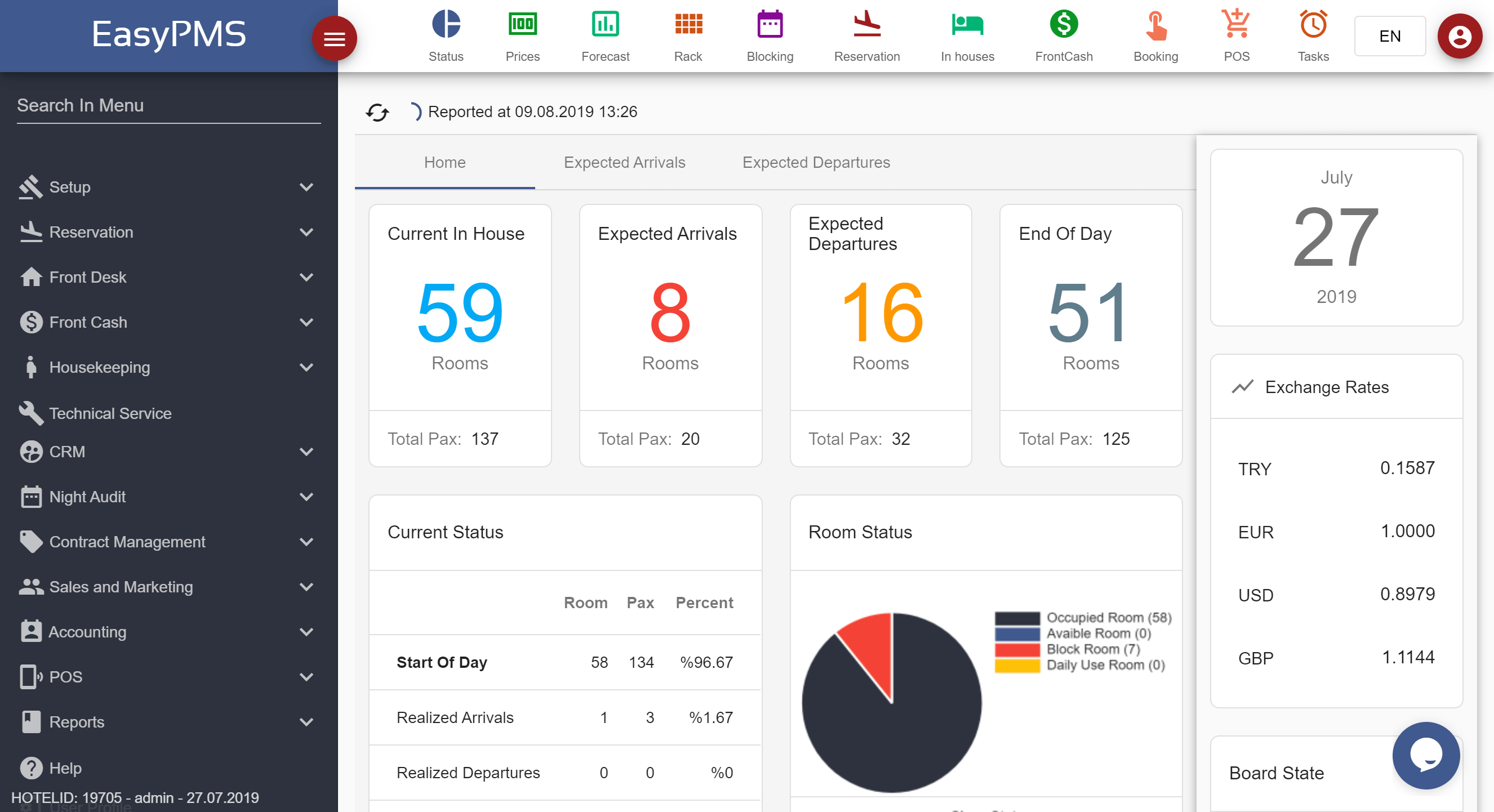

Hotel Management Software Hotel PMS With Channel Manager EasyPMS

https://www.easypms.com/wp-content/uploads/2019/08/dash.png

General information for corporations on how to complete page 3 of the T2 Corporation Income Tax Return Just how much tax can you save You save tax by investing in a retirement annuity But the amount of tax you save depends on your income level This table shows how much tax you

Completing your return for newcomers Most of the information you need to complete your 2024 Income Tax and Benefit Return is included in your income tax package However on this Income tax calculator Updated for 2024 25 tax year how much tax will you pay on your salary in South Africa find out with the SARS income tax calculator updated for 2024 25 tax year

More picture related to Income In Hotel Management

Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=509498464513033

Facebook

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=422584953193057

Bara Nepal In Maps

https://nepalinmaps.com/wp-content/uploads/nepal-in-maps-high-resolution-logo-transparent-1280x876.png

Your payment If your income is higher than 90 997 2024 you will have to repay part or your entire Old Age Security pension Find out more about Old Age Security pension recovery tax Updated March 14 2025 This webpage has been updated to provide additional information on the enhanced trust reporting rules The rules governing which trusts must file

[desc-10] [desc-11]

Hotel Management App Figma

https://s3-alpha.figma.com/hub/file/5249042584/36d9b007-09fe-4712-a9ef-a915ab906e44-cover.png

Master Of Education Kings University College

https://kingsuniversitycollege.edu.my/wp-content/uploads/2023/09/Diploma-in-Psychology-1-1.png

https://www.canada.ca › en › department-finance › news › delivering-a-…

Income is reported and tax is calculated on an annual basis To reflect a one percentage point cut in the lowest tax rate coming into effect halfway through the year the full

https://www.canada.ca › en › revenue-agency › services › forms-publicat…

Calculating income tax deductions Tax deductions on other types of income Labour sponsored funds tax credits Non resident employees who perform services in Canada Application for a

Christmas Light Final 3 Converge ICT

Hotel Management App Figma

Business Wealth Income Donald Trump Recently Announced He Plans

Annabel Scholey In Hotel Lobby Stable Diffusion Online

Aisha Bar Counter Stool Academy

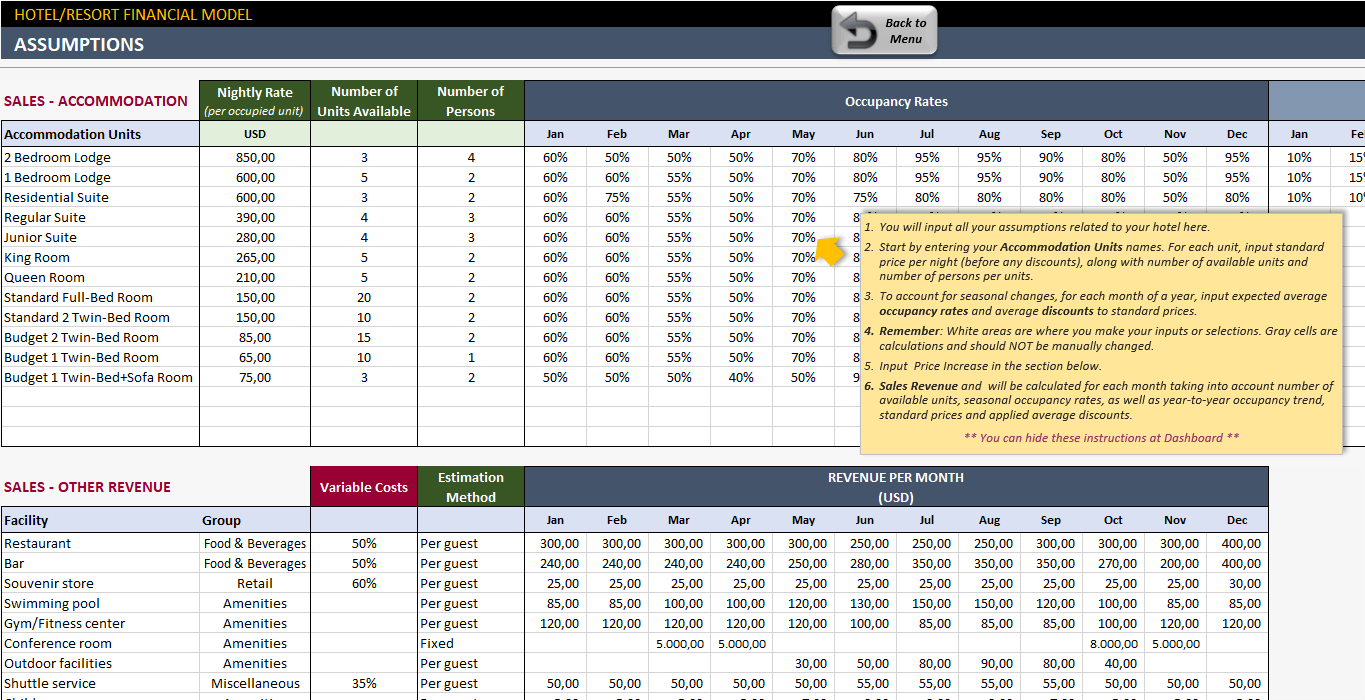

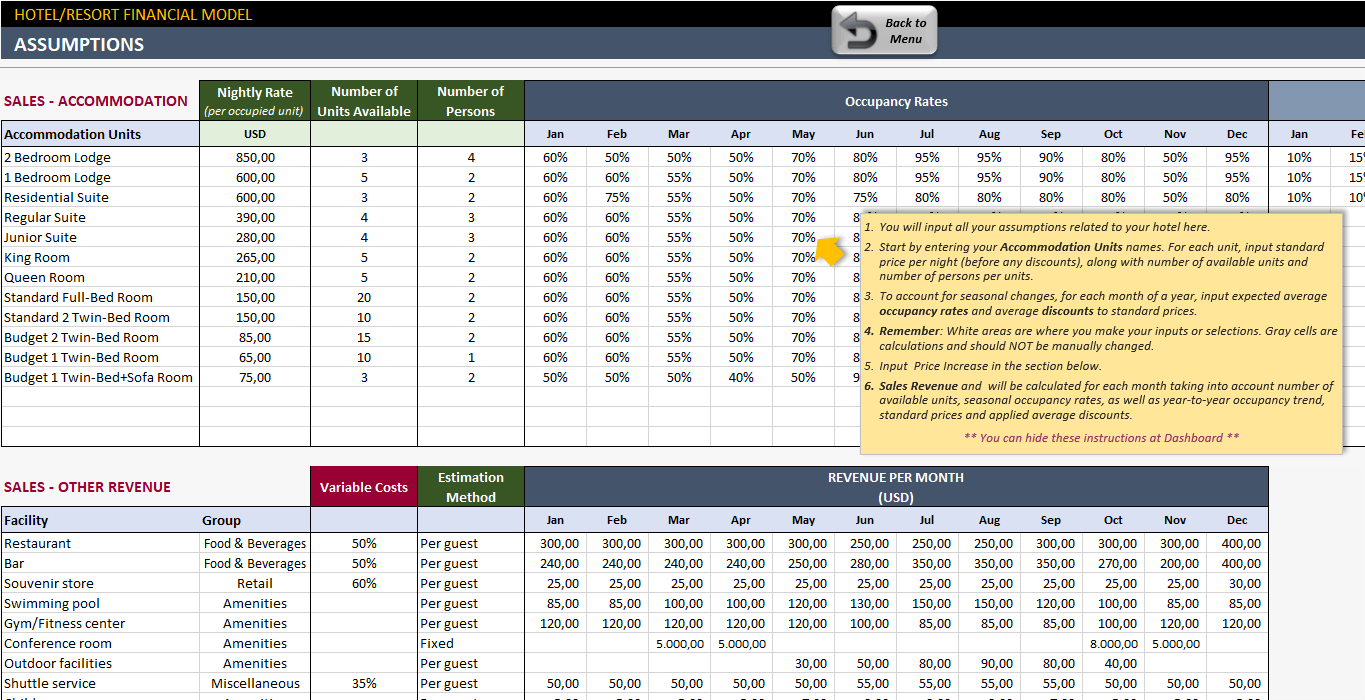

Hotel Excel Templates Bundle Special Discount

Hotel Excel Templates Bundle Special Discount

Diploma In Business Administration ODL Kings University College

Bitcoin Games Transforme Seu Dia Com O Poder Do Gigante Da Colina

R35k Salary After Tax Example ZA Tax 2023

Income In Hotel Management - [desc-14]