Ira 10 Year Rule Calculator If you ve inherited an IRA and are required to take annual distributions also known as required minimum distributions RMDs use our calculator to determine how much you need to withdraw from the account each year to avoid penalties

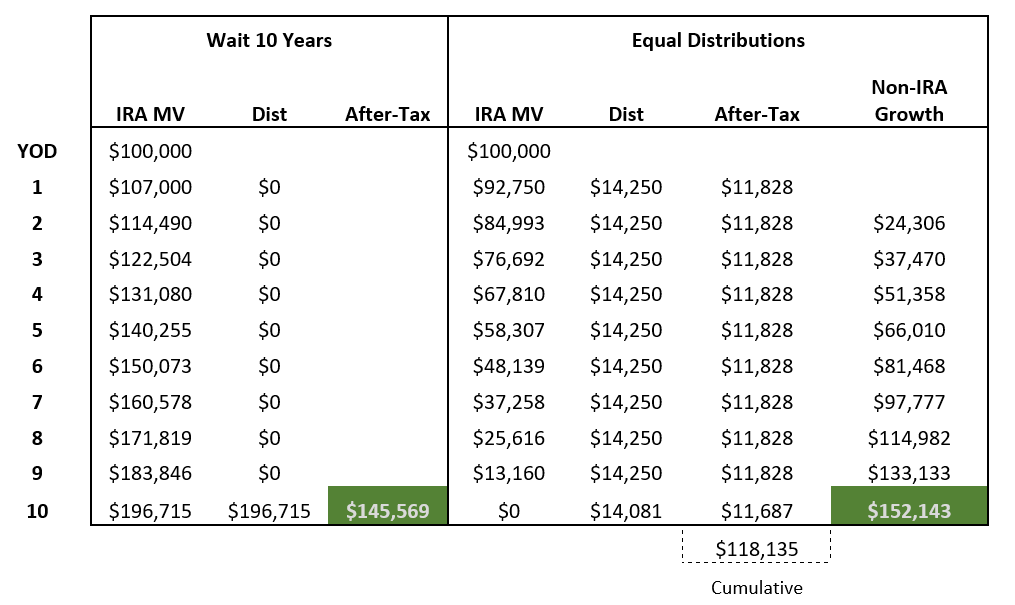

10 Annually Catch Up Take 10 of the IRA s value each year then distribute whatever is left in the final year to comply with the 10 year deadline Calculating Distributions The calculator determines how much you withdraw each year under the chosen scenario When someone bequeaths an IRA to you it s essential to adhere to the IRS Inherited IRA 10 year rule Here s what you need to know

Ira 10 Year Rule Calculator

Ira 10 Year Rule Calculator

https://i.ytimg.com/vi/v5a2OguyI3E/maxresdefault.jpg

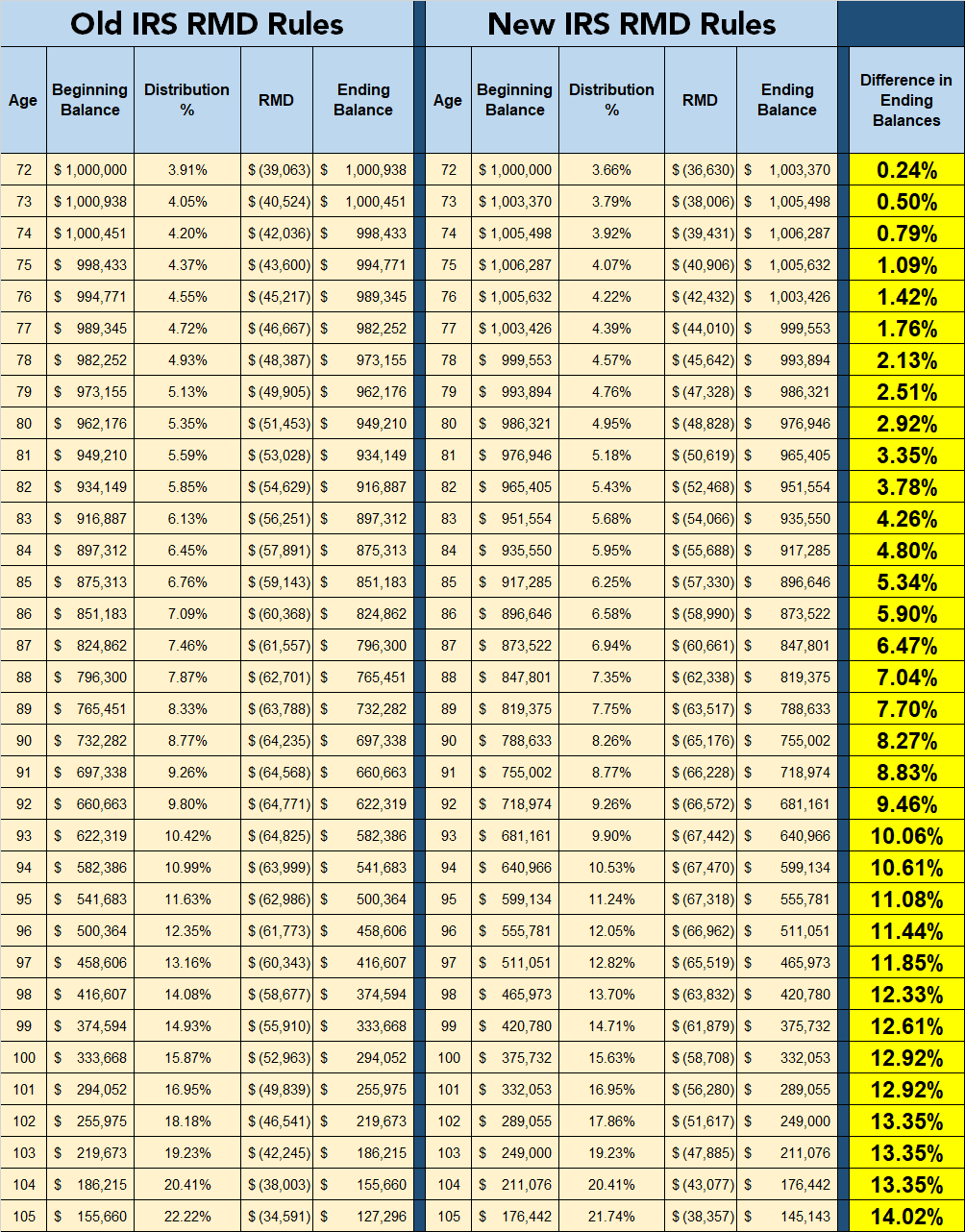

Rmd Distribution Factor Table Brokeasshome

https://levelfa.com/wp-content/uploads/2020/12/RMD-Rule-Changes.png

Mandatory Ira Distribution Table Brokeasshome

https://static.fmgsuite.com/media/images/8b424cf3-7b5e-4f69-bc28-a30349d068f6.jpg

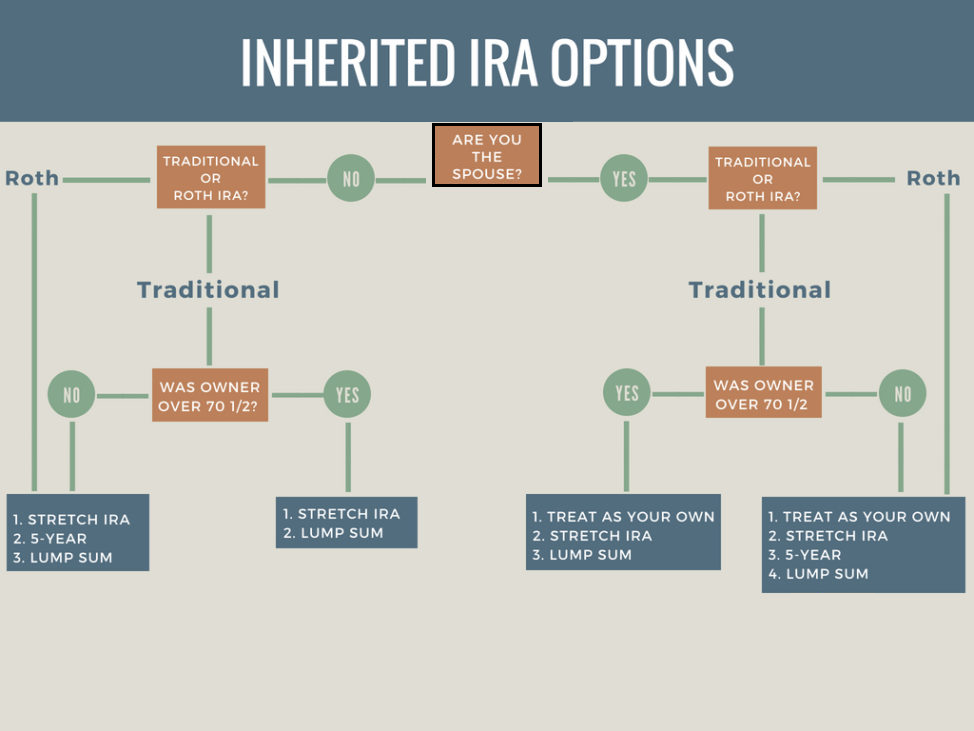

What this calculator does Helps IRA beneficiaries calculate the required minimum distribution RMD amount that must be withdrawn this calendar year from an inherited IRA if applicable This 10 year rule applies to a successor beneficiary who inherits a retirement account after 2019 from an eligible designated beneficiary taking distributions over their applicable life

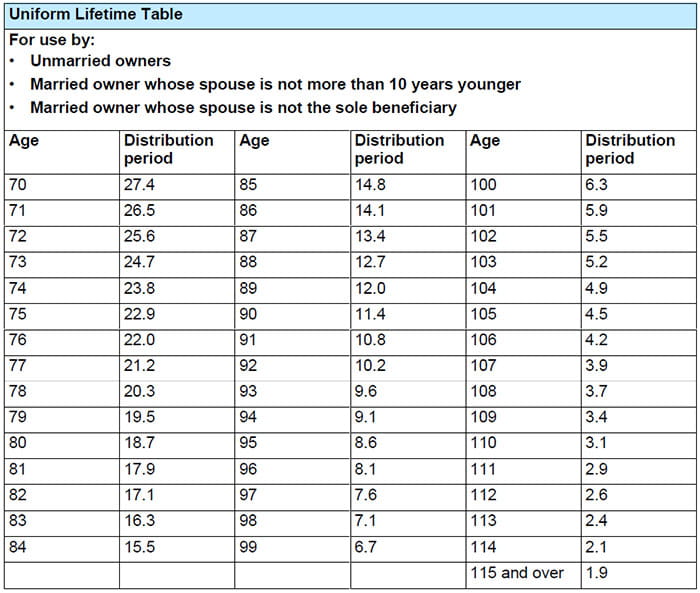

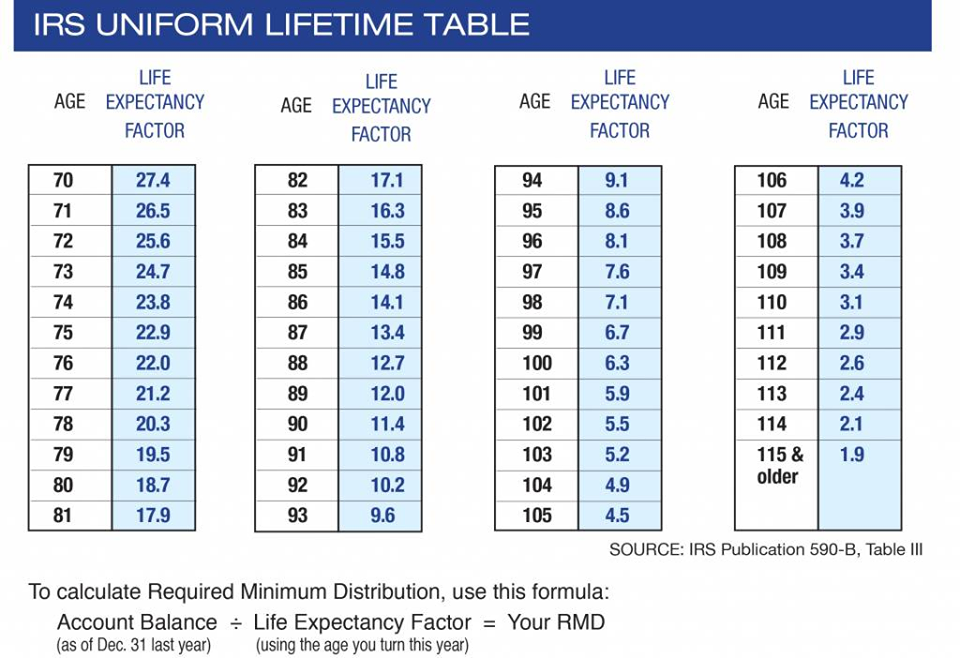

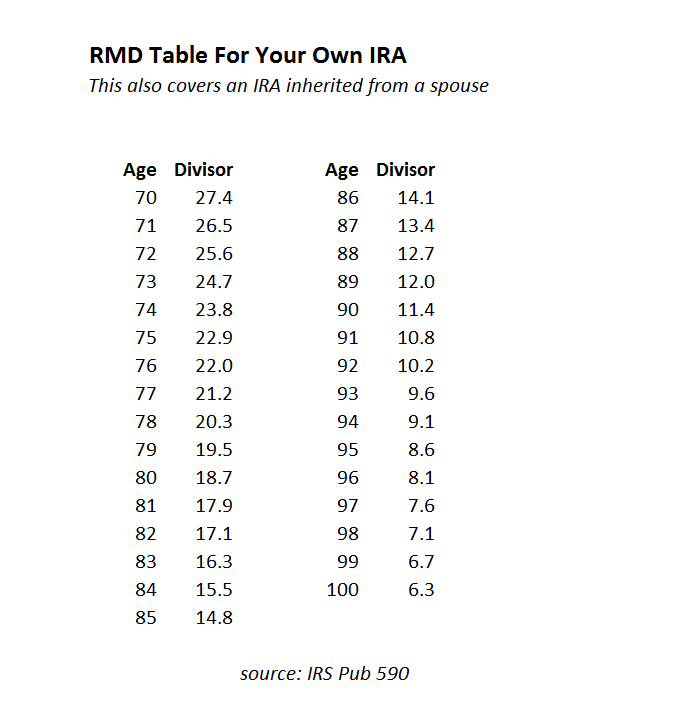

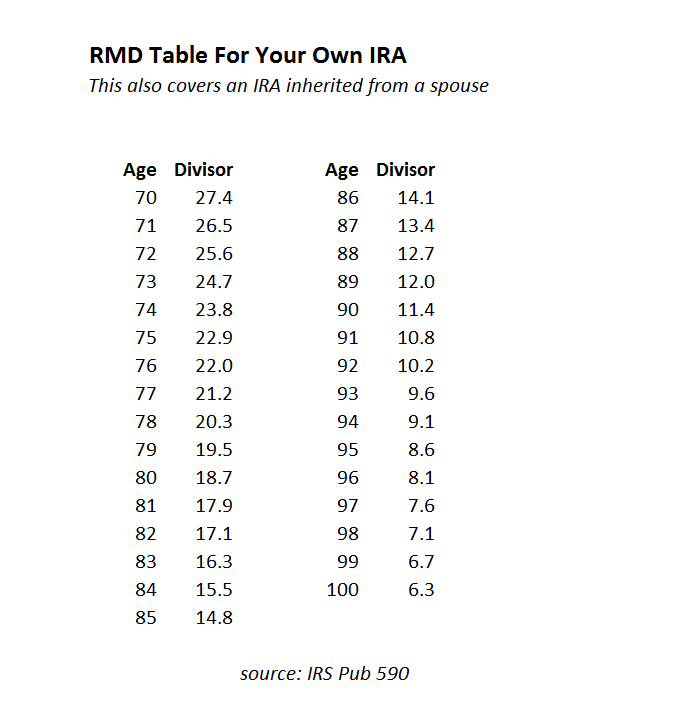

The Inherited IRA RMD table is a financial tool used to calculate the Required Minimum Distributions RMDs from an inherited IRA It provides a schedule based on the beneficiary s age and life expectancy Use this calculator to provide a hypothetical projection of the required minimum distributions for you and your beneficiary Keep in mind that distributions will be subject to any applicable federal and state income taxes

More picture related to Ira 10 Year Rule Calculator

Aarp Rmd Calculator 2025 Fawne Christal

https://www.raymondjames.com/-/media/rj/advisor-sites/sites/n/e/nevadafamilywealth/images/rmd-chart.jpg

Aarp Rmd Calculator 2025 Fawne Christal

https://alquilercastilloshinchables.info/wp-content/uploads/2020/05/RMD-Table-Required-Minimum-Distribution.jpg

Rmd Calculator 2025 Aarp Medicare Otis G Hawkins

https://www.mrbaccounting.com/uploads/7/1/9/8/7198582/rmd-table_orig.png

To calculate a required minimum distribution RMD for a Qualified See Through Trust beneficiary select either Spouse Nonspouse or Nonperson based on the applicable beneficiary status of the trust as prescribed under Proposed Treasury Regulation 1 401 a 9 4 f for IRA owner deaths in 2020 or later and Treasury Regulation 1 401 Rather for IRA owner deaths that occur after December 31 2019 a designated beneficiary must deplete the account within 10 years unless the person is an eligible designated beneficiary Use this calculator to provide a hypothetical projection of the required minimum distributions for you and your beneficiary

How much are you required to withdraw from your inherited retirement account s If you ve inherited an IRA and or other types of retirement accounts the IRS may require you to withdraw a minimum amount of money each year also known as a Required Minimum Distribution RMD Due to a series of IRS notices that waived beneficiary RMDs from 2021 to 2024 the 10 year rule does not take effect until 2025 But as noted if the original account holder had already started RMDs all money must be out of the account within the 10 year window regardless of the specifics

Rmd Table 2025 Pdf Free Windy Lilian

http://www.jhwfs.com/wp-content/uploads/2018/06/Inherited-IRA-Flowchart.jpg

Rmd Table 2025 Pdf 2025 Nani Michaela

https://michaelryanmoney.com/wp-content/uploads/2022/07/RMD-New-Uniform-Lifetime-Tables-2022.jpg

https://www.schwab.com › ira › ira-calculators › ...

If you ve inherited an IRA and are required to take annual distributions also known as required minimum distributions RMDs use our calculator to determine how much you need to withdraw from the account each year to avoid penalties

https://advisorfinder.com › resources-for-clients › inheritance › ira

10 Annually Catch Up Take 10 of the IRA s value each year then distribute whatever is left in the final year to comply with the 10 year deadline Calculating Distributions The calculator determines how much you withdraw each year under the chosen scenario

Rmd Tax Factors For 2025 Carey Maurita

Rmd Table 2025 Pdf Free Windy Lilian

Aarp Rmd Calculator 2025 Table Reta Rosemarie

Schwab Inherited Ira Rmd Calculator 2024 Dyna Philippa

Ira Distribution Tax Calculator CardeanEvann

Irs Rmd Factor Tables 2023

Irs Rmd Factor Tables 2023

Rmd Age Factor Table 2023

Rmd Age Factor Table 2023

Max Ira Contribution 2024 Roth Ira Growth Livvy Quentin

Ira 10 Year Rule Calculator - Use our RMD calculator to find out the required minimum distribution for your IRA Plus review your projected RMDs over 10 years and over your lifetime