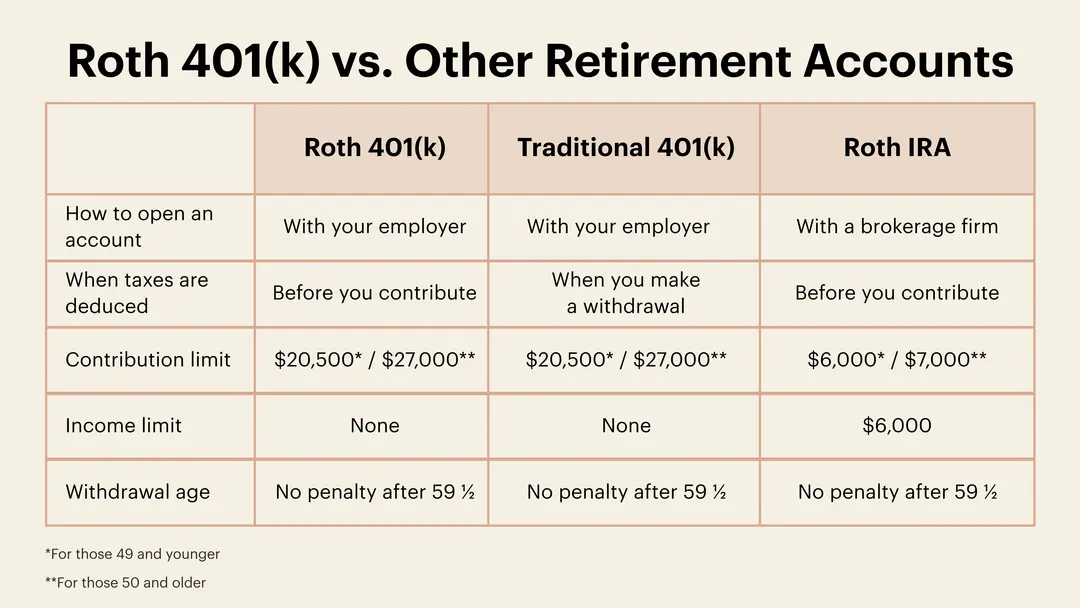

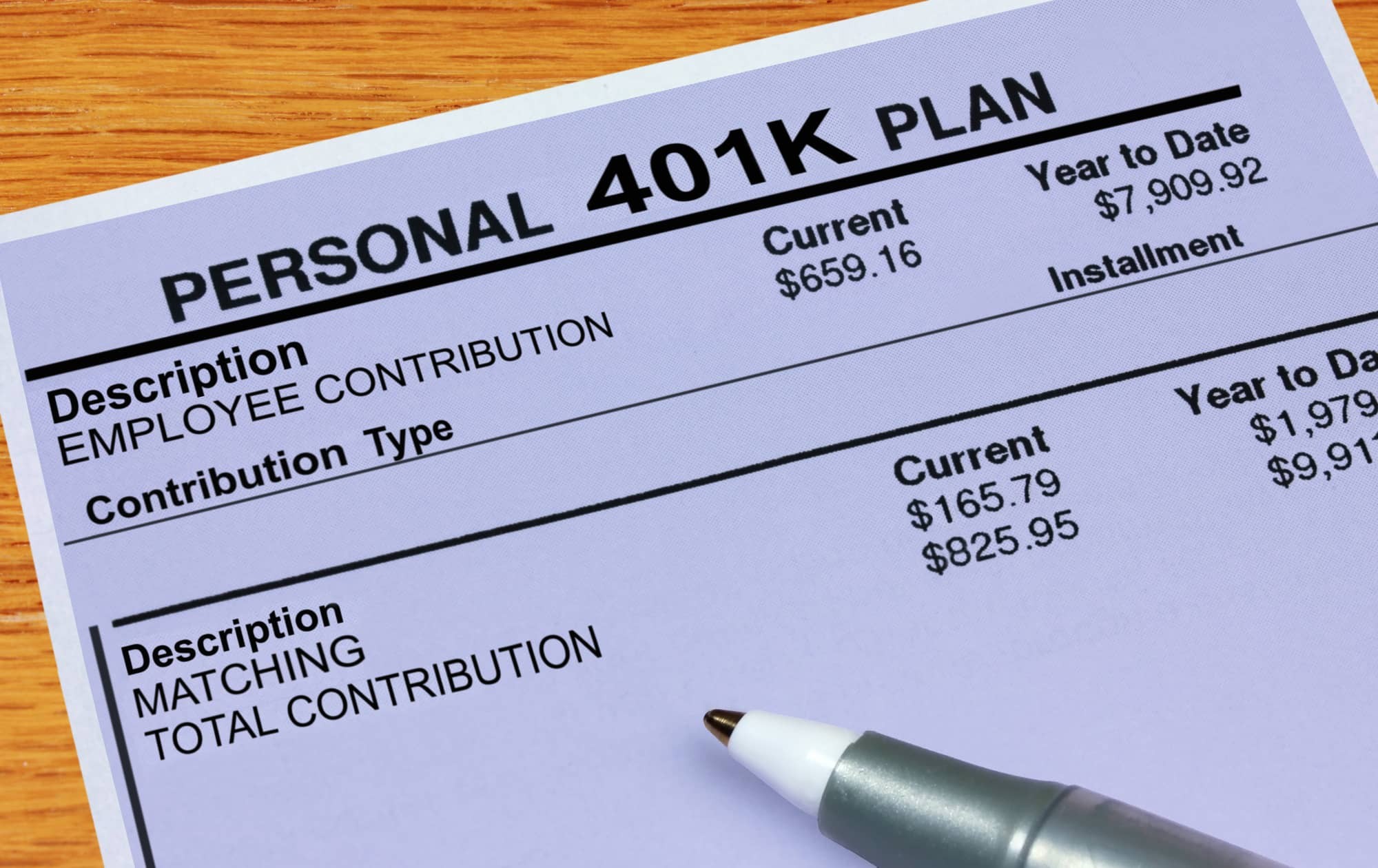

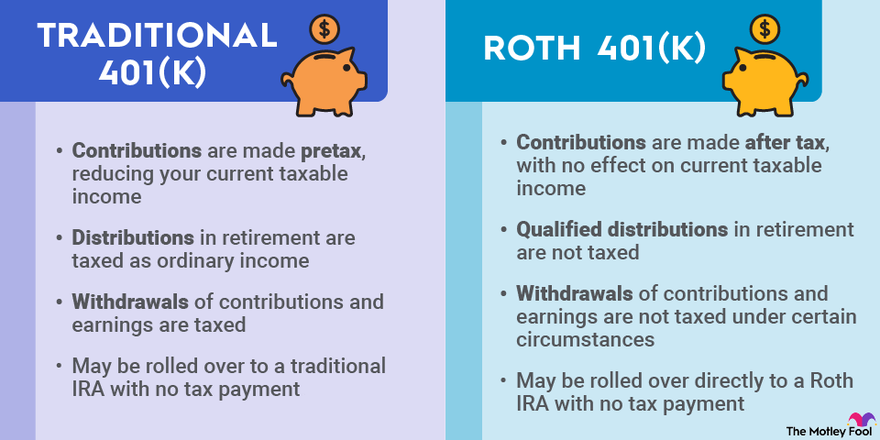

Is 401k Tax Free After Retirement Your 401 k contributions are put in before taxes have been paid and they grow tax free until you take them out When you take distributions the money you take each year will be taxed as ordinary income

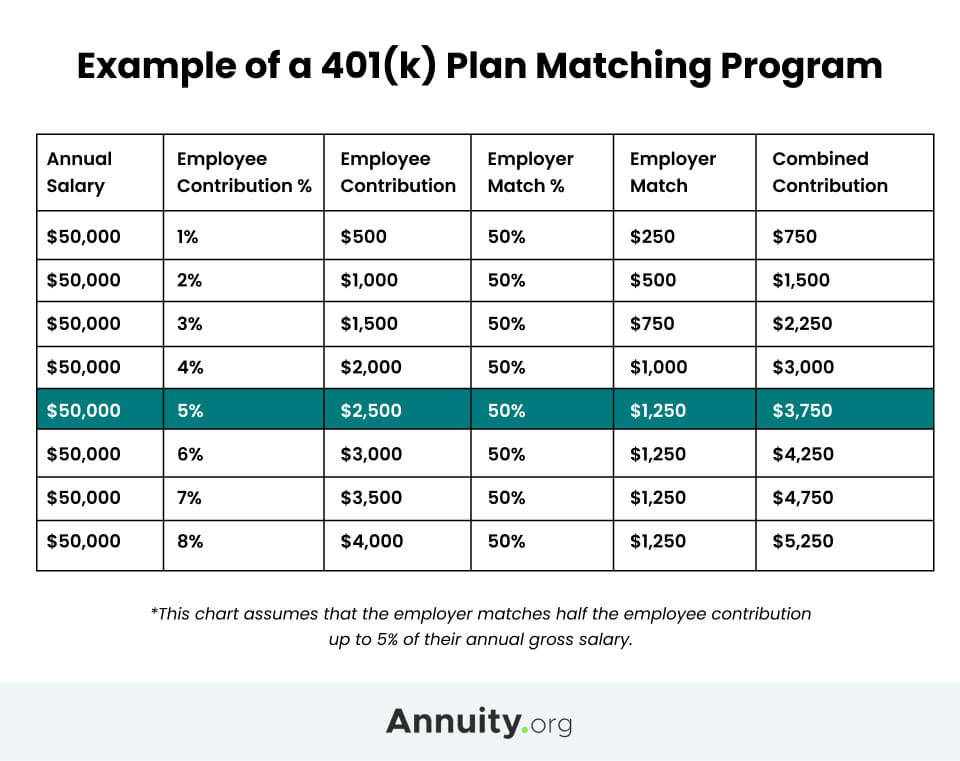

Your 401 k withdrawals are never tax free and there s no way to get out of paying the taxes But there are some situations when you might be able to access your 401 k money with minimal tax implications even if temporarily The good news is that Roth 401 k withdrawals can be tax free after 59 provided you ve satisfied the 5 year rule The IRS sets age 59 as the threshold after which

Is 401k Tax Free After Retirement

Is 401k Tax Free After Retirement

https://www.theskimm.com/_next/image?url=https://images.ctfassets.net/6g4gfm8wk7b6/6C2dwsIzDhqx0ZlHlJbPdm/8bfbea89445676b07e35a62db8c3c548/Roth_401k.png&w=3840&q=75

What Is A Roth 401 k Here s What You Need To Know TheSkimm

https://www.theskimm.com/_next/image?url=https:%2F%2Fimages.ctfassets.net%2F6g4gfm8wk7b6%2F6C2dwsIzDhqx0ZlHlJbPdm%2F8bfbea89445676b07e35a62db8c3c548%2FRoth_401k.png&w=1080&q=75

Retirement Comparison Chart

https://www.moneylend.net/wp-content/uploads/retirement_compare.jpg

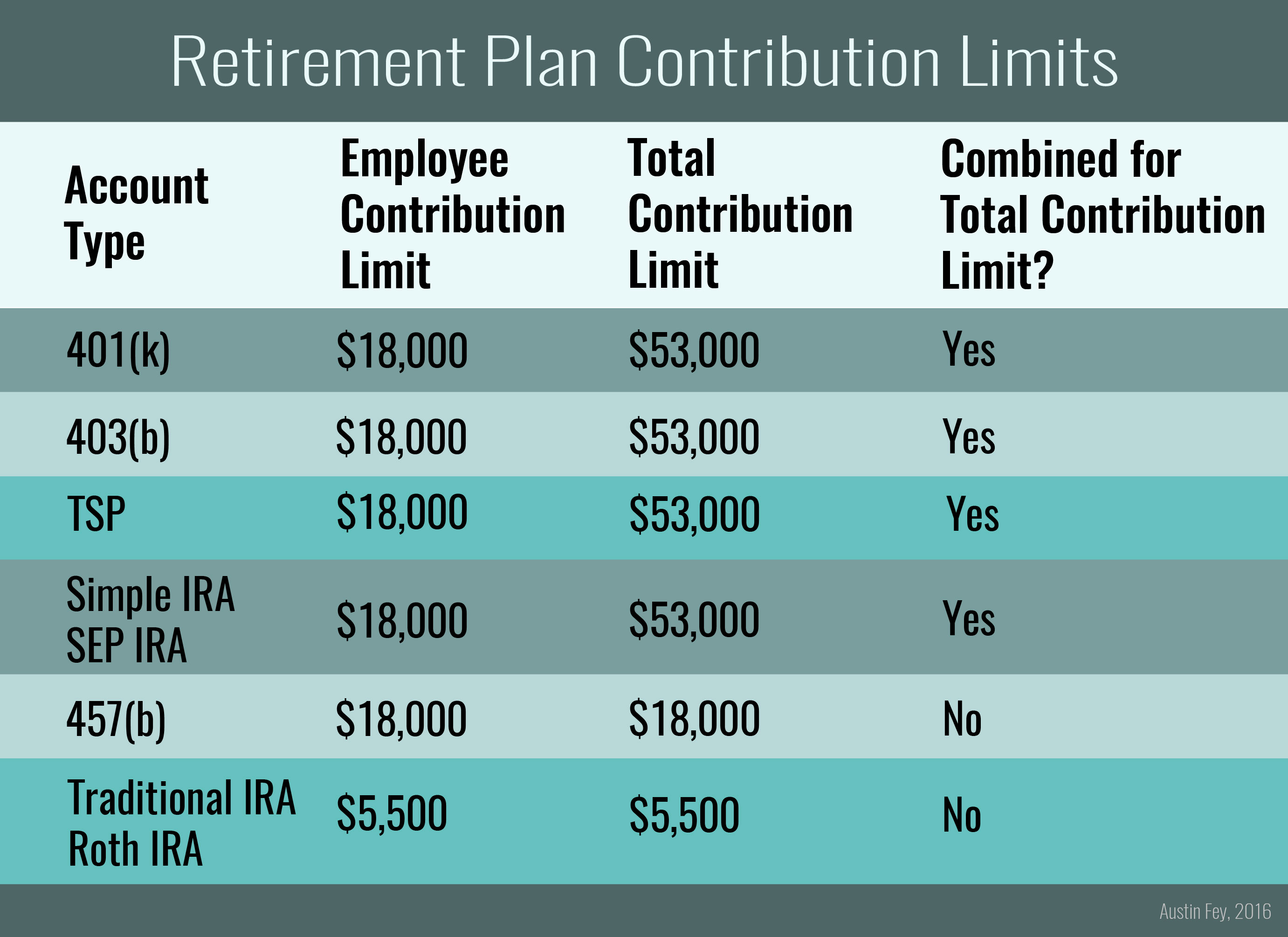

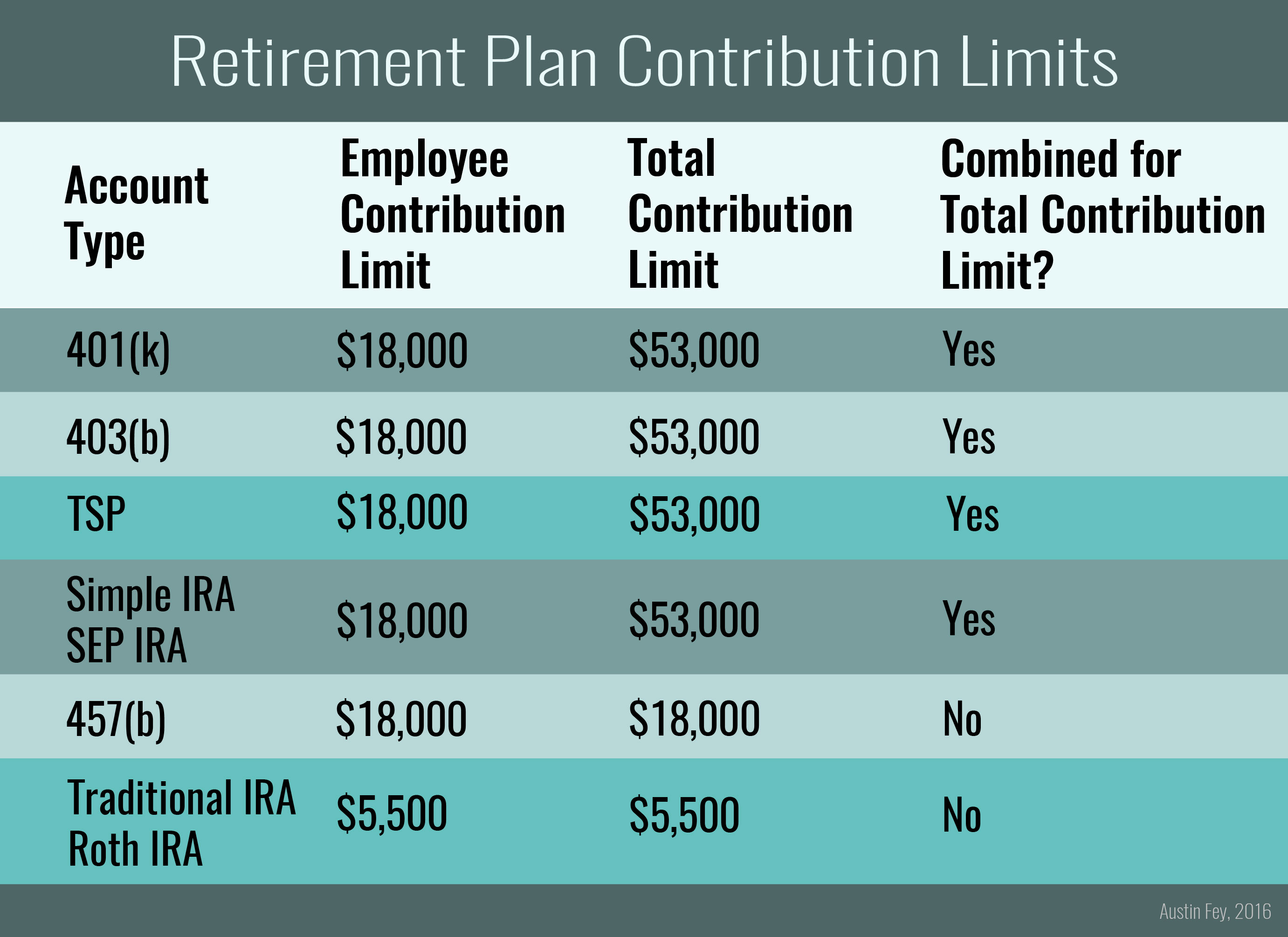

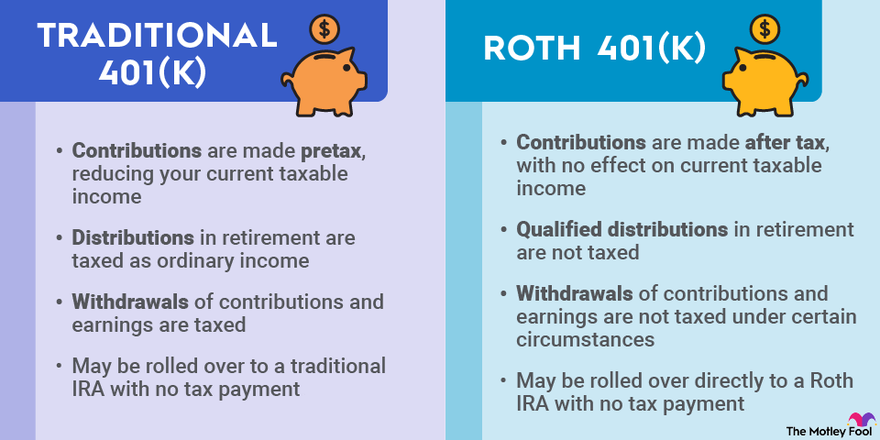

While you can increase your 401 k savings by adding after tax contributions there is a caveat While contributions can come out in retirement tax free any earnings you make on those All 401 k plans offer specific tax advantages making them a great way to save for retirement Contributions to a traditional 401 k plan as well as any employer matches and earnings in the

The good news is that if this method is used correctly once the funds are in your 401 k you ll never pay taxes on them again Your investments offer tax free growth potential while they re in the account and you can make Understand how tax deferred 401 k plans work when you re taxed on withdrawals from your 401 k and how to avoid a tax penalty with your retirement savings

More picture related to Is 401k Tax Free After Retirement

401k Limits 2025 Brandon J Soriano

https://www.annuity.org/wp-content/uploads/401k-employer-matching-768x609.jpg

2025 401k Limits Catch Up Sofia L Newman

https://insights.wjohnsonassociates.com/hubfs/Contribution Limits_BP_Blog_2023_11_1600x900_Over 50.png#keepProtocol

Irs 401k Contribution Limits 2025 Mario Roy

https://www.annuity.org/wp-content/uploads/401k-employer-matching-768x609.jpg

Traditional 401 k s are tax deferred accounts which means the account is funded with pre tax dollars and you pay taxes on your distributions in retirement Alternately Roth 401 k s are funded with post tax money so you After tax contributions to your workplace plan can be withdrawn without taxes or penalties Any earnings on those after tax contributions are considered pre tax balances so taxes would have to be paid on withdrawals

However an exception applies to qualified distributions from Roth 401 k accounts where withdrawals can be tax free due to post tax contributions Understanding the rules that regulate 401 k withdrawals is crucial for efficient Contributions made to 401 k accounts are tax free until withdrawn after retirement However when you begin to take distributions from the account the IRS Internal

2025 401k Limits Contributions Over 50 John E Anderson

http://www.marottaonmoney.com/wp-content/uploads/2016/08/retirement-plan-contribution-limits-2016.jpg

Current 401k Contribution Limits 2024 Employer Match Bell Marika

https://www.annuity.org/wp-content/uploads/401k-employer-matching.jpg

https://retirable.com › advice › retirement-a…

Your 401 k contributions are put in before taxes have been paid and they grow tax free until you take them out When you take distributions the money you take each year will be taxed as ordinary income

https://www.northwesternmutual.com › ...

Your 401 k withdrawals are never tax free and there s no way to get out of paying the taxes But there are some situations when you might be able to access your 401 k money with minimal tax implications even if temporarily

2025 401k Limits Contribution Over 50 Rina Dewal

2025 401k Limits Contributions Over 50 John E Anderson

401k Rollover Options How To Roll Over Your 401 k To An IRA

Roth 401k And Roth Ira Contributions

401k Vs Roth Ira Calculator Choosing Your Gold Ira Free Download Nude

401 K Vs Roth 401 K Which Is Best For You The Motley Fool Free

401 K Vs Roth 401 K Which Is Best For You The Motley Fool Free

What Is 401k Max For 2025 Mio Vanlange

401k Vs IRA Traditional Vs Roth The Basics Retirement Savings 101

The Differences Between A Roth 401 k And A Traditional 401 k

Is 401k Tax Free After Retirement - If your 401 k contributions were traditional personal deferrals the answer is yes you will pay income tax on your withdrawals If you take withdrawals before reaching the age of 59 the