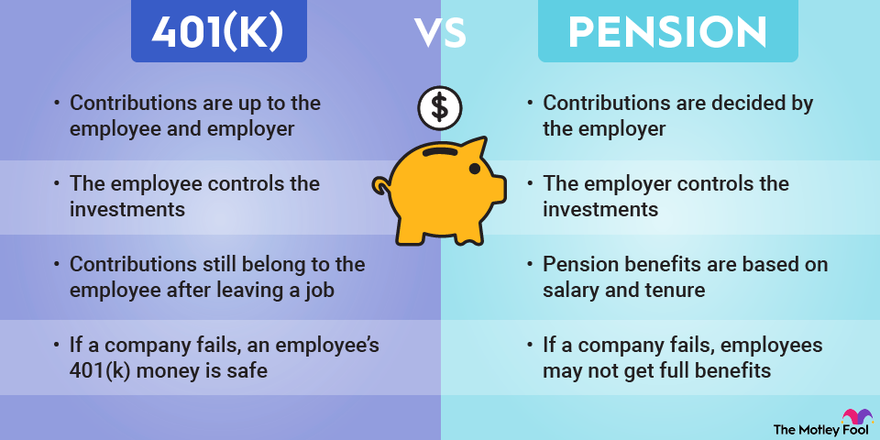

Is A 401k A Retirement Plan Employer contributions A key advantage of 401 k s is that your employer may also contribute to help you save for retirement This typically comes in the form of a 401 k

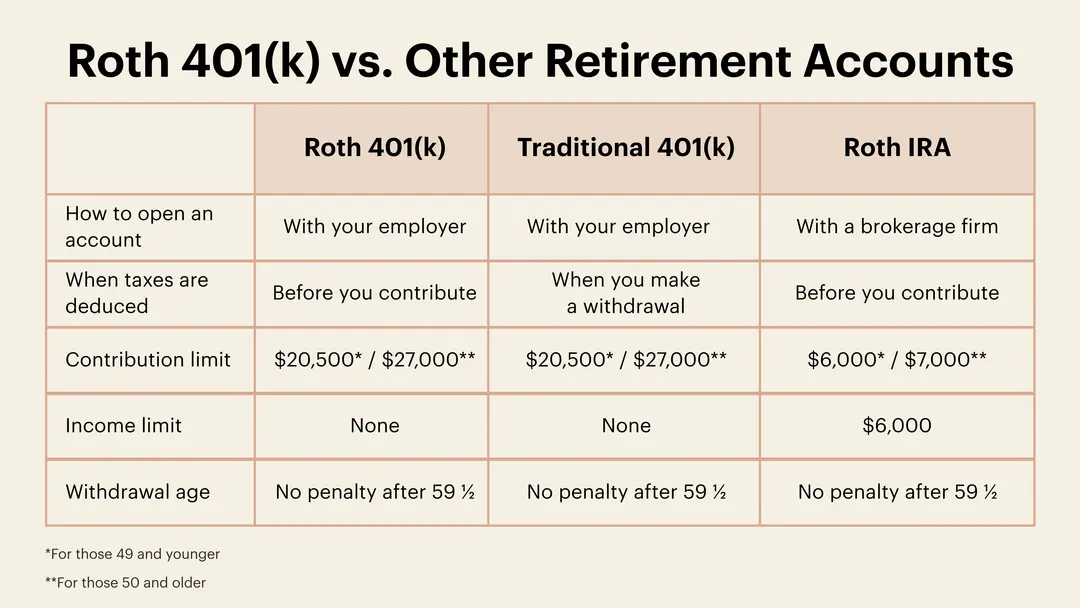

Roth 401 k s When 401 k plans were first rolled out in the 1980s companies and their employees had one choice the traditional 401 k Roth 401 k s didn t arrive until 2006 A 401 k is an employer sponsored retirement plan that comes with tax benefits Basically you put money into the 401 k where it can be invested and potentially grow tax free

Is A 401k A Retirement Plan

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

Is A 401k A Retirement Plan

https://www.investopedia.com/thmb/9Rj4BAvEf2P_WLFphJolmALSRUw=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png

What Is A Roth 401 k Here s What You Need To Know TheSkimm

https://www.theskimm.com/_next/image?url=https:%2F%2Fimages.ctfassets.net%2F6g4gfm8wk7b6%2F6C2dwsIzDhqx0ZlHlJbPdm%2F8bfbea89445676b07e35a62db8c3c548%2FRoth_401k.png&w=1080&q=75

401k Contribution Chart

https://www.loanry.com/blog/wp-content/uploads/2019/01/401k-infographic.jpg

A 401 k is a staple for many people s retirement planning so it s important to understand how they work Browse Investopedia s expert written library to learn more Contribution Type Contribution Limit 2025 Employee contributions 23 500 Catch up contribution employees 50 or older 7 500 SIMPLE 401 k contributions

A Roth 401k plan is much the same as a traditional 401 k except employee contributions are made with after tax dollars Roth contributions don t reduce your taxable Should I Move 401k to Bonds Should You Keep Investing in Your 401 k Plan Should You Put Your 401 k Into an Annuity Understanding and Maximizing Your Roth 401 k

More picture related to Is A 401k A Retirement Plan

401k

https://m.foolcdn.com/media/dubs/images/401k-vs-pension-retirement-plans-infographic.width-880.png

2025 401k Contributions Max Salary Faris Naroman

https://www.financialsamurai.com/wp-content/uploads/2019/11/historical-401k-contribution-limits.png

2025 401k Contributions Max Salary Faris Naroman

https://insights.wjohnsonassociates.com/hubfs/Contribution Limits_BP_Blog_2023_11_1600x900_Over 50.png#keepProtocol

1 U S Bureau of Labor Statistics 73 percent of civilian workers had access to retirement benefits in 2023 September 2023 2 IRS 401 k Plan Qualification A 401 k plan is an investment account offered by your employer that allows you to save for retirement If your company offers a 401 k plan it may have certain eligibility requirements

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png)

Retirement Plan 401k

https://www.thebalancemoney.com/thmb/Zk5vHtGLbBP1-iwLMiDVgM_ZAWs=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png

2025 401k Limits Contributions Over 50 Carol R Futch

http://www.marottaonmoney.com/wp-content/uploads/2016/08/retirement-plan-contribution-limits-2016.jpg

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png?w=186)

https://www.fidelity.com › learning-center › smart-money

Employer contributions A key advantage of 401 k s is that your employer may also contribute to help you save for retirement This typically comes in the form of a 401 k

https://www.investopedia.com › terms

Roth 401 k s When 401 k plans were first rolled out in the 1980s companies and their employees had one choice the traditional 401 k Roth 401 k s didn t arrive until 2006

Retirement Plan 401k

:max_bytes(150000):strip_icc()/401k-retirement-plan-beginners-357115_FINAL2-430f125e634544fe80440a1cf026eafe.png)

Retirement Plan 401k

401k Limits 2025 Chart By Age Jesse B Hernsheim

457 B Contribution Limits 2025 Tova Carter

401k 2025 Levi Jibril

matching example_ Boeing.png?width=4960&name=401(k) matching example_ Boeing.png)

Irs 2025 Contribution Limits 401k Richie Lingo

matching example_ Boeing.png?width=4960&name=401(k) matching example_ Boeing.png)

Irs 2025 Contribution Limits 401k Richie Lingo

401k Catch Up 2025 Rothpur Samuel F Watkins

401k Annual Limit 2025 Elijah Sameer

Retirement With 401k Plan Route On A USA Highway Road Sign CKS Summit

Is A 401k A Retirement Plan - A Roth 401k plan is much the same as a traditional 401 k except employee contributions are made with after tax dollars Roth contributions don t reduce your taxable