It Service Desk Jobs Near Me Find out how to get a certificate of residence as an individual company or organisation so you do not get taxed twice on foreign income

Major changes to UK tax rules were introduced from 6 April 2025 which impact a wide range of individuals The changes abolished the historic remittance basis regime What is tax residency Your tax residency is the country where you pay tax usually where you live or work Your UK resident status affects how your income and capital gains both UK and

It Service Desk Jobs Near Me

It Service Desk Jobs Near Me

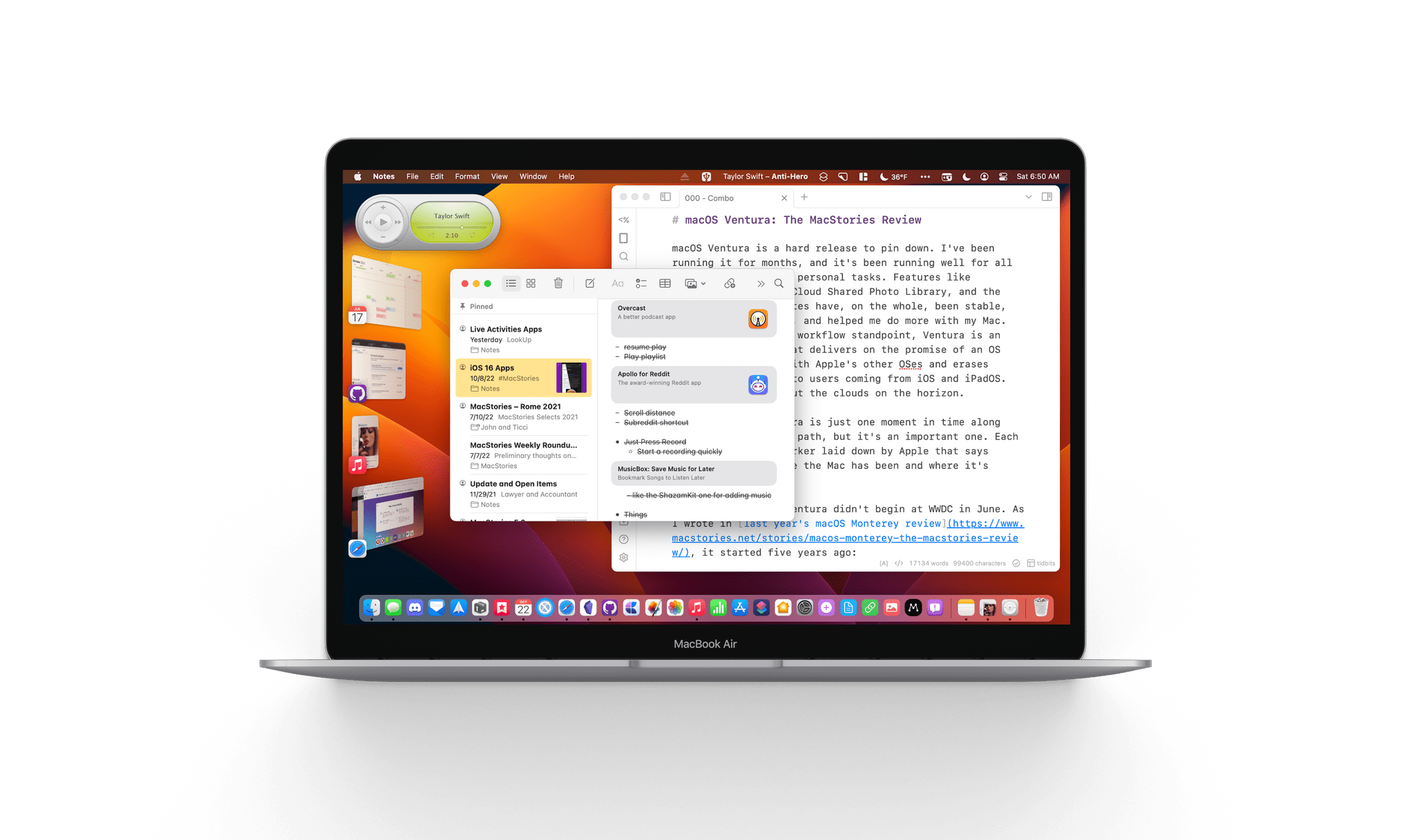

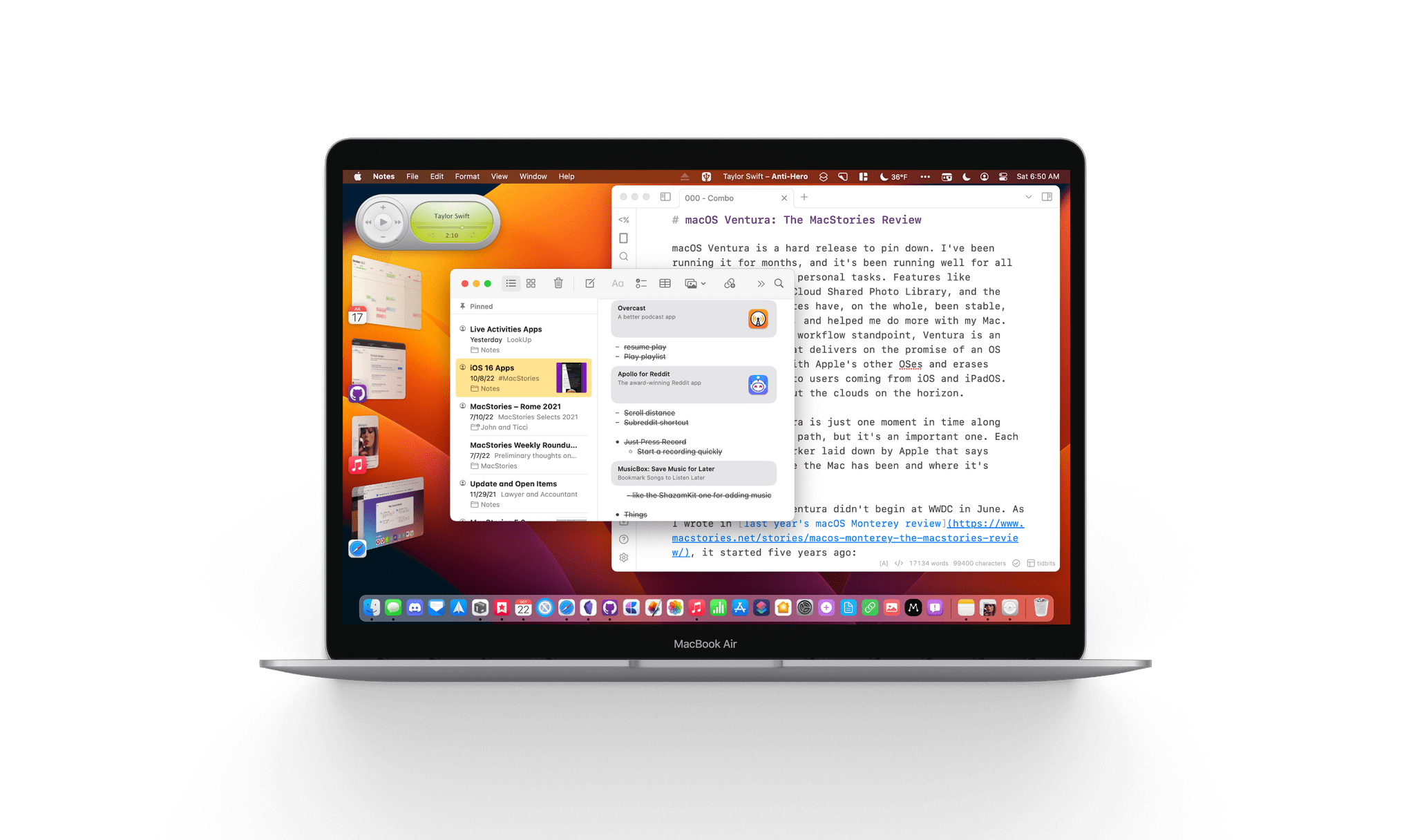

https://cdn.macstories.net/hero-1666438397317.png

Modbee Obituary

https://obits.dewittdailynews.com/assets/images/Dyer%2C_John.jpg

Modbee Obituary

https://obits.taylorvilledailynews.com/assets/images/Donaldson%2C_Sandra_Marie_Obituary.jpg

Determining your tax residency status in the UK is a crucial step in understanding your tax responsibilities Since 6th April 2013 the UK tax authorities have implemented the Residency and domicile are important concepts for people trying to navigate their way through UK taxation These are the terms that tell you how much tax you owe and to

UK expat tax advice for British expats and non residents updated for the 2025 26 tax years Provides an overview of your UK tax residence status the SRT Capital Gains Tax Back to all posts Taxation in the UK Our guide to tax residency and domiciled status We take a look at what it means to be UK tax resident or domiciled and how this may

More picture related to It Service Desk Jobs Near Me

Levels Fyi Intern

https://static.levels.fyi/team/Alina.jpg

Dcccd Brightspace

https://mir-s3-cdn-cf.behance.net/project_modules/fs/8651df90789237.5e2061c08602a.png

Contact Us

https://pumamit.com/i/puma-logo.png

Everything You Need to Know About Domicile and Residency for Income Tax Understanding domicile and residency is crucial for anyone living working or earning income Residence Status An individual s residence status and domicile status will affect the extent to which their income and capital gains are taxable in the UK In the UK an individual s

[desc-10] [desc-11]

Kys Gif

https://images.squarespace-cdn.com/content/v1/603e84259fd93d1d6b4d8a4a/d22d7e41-31a8-4efd-aa83-aef1652a526b/NicoleZohorsky-GIF.gif

Front Desk Receptionist St Clair Pediatrics

https://www.stclairpediatrics.com/wp-content/uploads/2019/06/shutterstock_125092616.jpg

https://www.gov.uk › guidance › get-a-certificate-of-residence

Find out how to get a certificate of residence as an individual company or organisation so you do not get taxed twice on foreign income

https://www.bdo.co.uk › ... › private-client › coming-to-the-uk-tax-reside…

Major changes to UK tax rules were introduced from 6 April 2025 which impact a wide range of individuals The changes abolished the historic remittance basis regime

Financial Aid Snhu

Kys Gif

Daily Messenger Obits

King Von Autopsy Photos 03

Myers Colonial Funeral Home Deridder Obituaries

Kat Dennings Nuda

Kat Dennings Nuda

Sullivan King Mortuary Obituaries

Ice Skating Gif

Happy Birthday Gif Dancing

It Service Desk Jobs Near Me - [desc-12]