Self Directed 401k Vs Solo 401k Both Self directed IRAs and Solo 401 k s also referred to as self directed 401 k s offer the freedom to invest in alternative assets like real estate or crypto However one may be better than the other depending on your circumstances

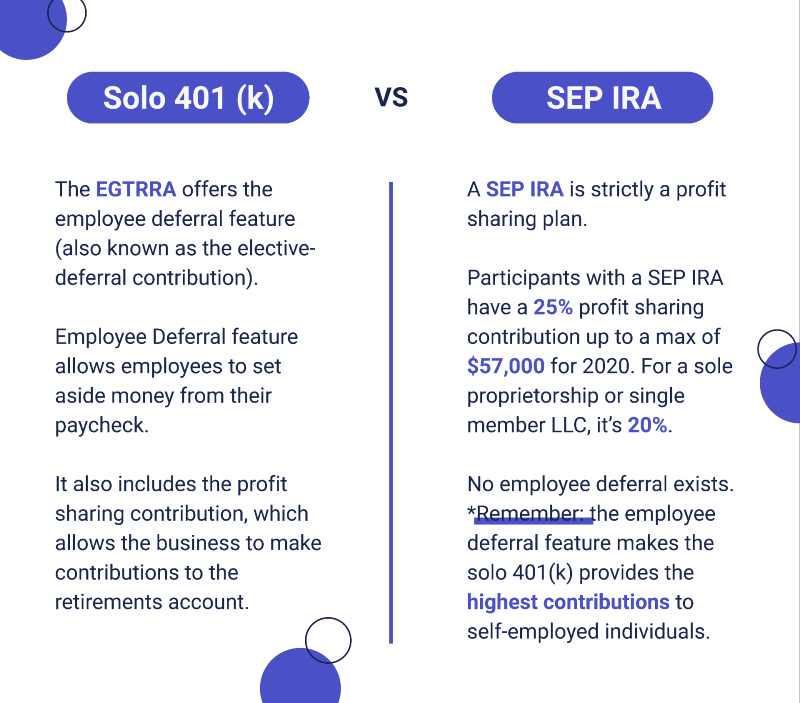

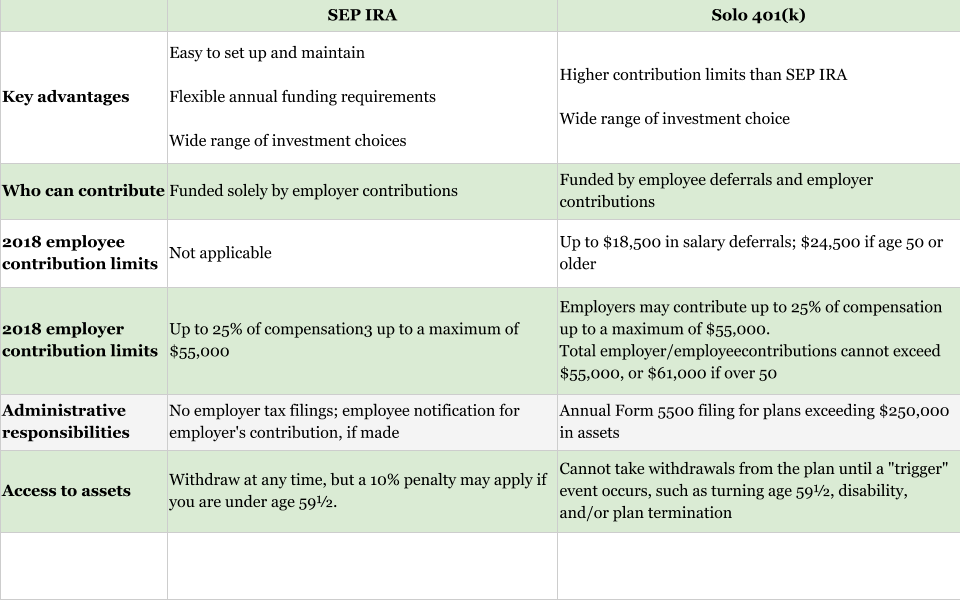

The difference between a Solo 401 k and a SEP IRA is the level of control over investments With a Solo 401 k you have more flexibility and decision making power as you can choose your own investments With a SEP IRA you must defer to the custodian and their investment options Opening either a Solo 401 k or a Self Directed IRA can be a smart choice but which one is right for you Compare your options and find the best investment option with Broad Financial

Self Directed 401k Vs Solo 401k

Self Directed 401k Vs Solo 401k

https://i.ytimg.com/vi/zoSVJZ4FRoc/maxresdefault.jpg

Solo 401k Vs SEP IRA SELF EMPLOYED WATCH NOW YouTube

https://i.ytimg.com/vi/wB7F90yM_Bk/maxresdefault.jpg

Solo 401k Vs Self Directed IRA For Real Estate YouTube

https://i.ytimg.com/vi/-zNUnCkPprA/maxresdefault.jpg

Solo 401k Vs Self Directed IRA Which is Better for You The choice between a solo 401k and a self directed IRA LLC really depends on you there is no one size fits all solution However as we will see a solo 401k is usually the best option for self employed people If you want hands on control and faster access to alternative investments a self directed solo 401k offers more autonomy and fewer obstacles than a self directed IRA Why a solo 401k might be the better choice

A self directed IRA is disallowed from investing in life insurance The solo 401k allows for high contribution amounts for 2020 the solo 401k contribution limit is 57 000 or 63 000 if age 50 or over whereas the self directed IRA contribution limit is 6 000 or 7 000 if you re age 50 or older Self directed retirement plans for self employed are considered to be the best option when it comes to saving for retirement but there is no doubt that between the self directed ira vs solo 401k the latter is a more competitive choice

More picture related to Self Directed 401k Vs Solo 401k

Fidelity Solo 401k Compare Free Fidelity Self Employed 401k VS Solo

https://i.ytimg.com/vi/UiqNPftsalA/maxresdefault.jpg

Self Directed 401k FAQ How To Wire Funds From My Fidelity Solo 401k

https://i.ytimg.com/vi/Fm3o4rx7EK4/maxresdefault.jpg

Self directed Solo 401k Investment Options YouTube

https://i.ytimg.com/vi/tR6dYXgXYb0/maxresdefault.jpg

Differences between Self Directed IRA and Solo 401k One needs to be in a self employment either part time or full time to be able to open a Solo 401k Self Directed IRA does not require self employment income A solo 401k can allow for immediate checkbook control When comparing a Solo 401k vs self directed IRA the Solo 401k is the clear winner Here s why Solo 401k loan feature The Solo 401k offers a participant loan feature that allows you to borrow from your 401k A self directed IRA does not allow you to borrow from the IRA Any money taken from the IRA would be deemed as a taxable distribution

[desc-10] [desc-11]

2023 Solo 401k Contribution Limits Self Employed 401k Self directed

https://i.ytimg.com/vi/UkaVYLieE-8/maxresdefault.jpg

Self directed 401k Can I Claim Deductions For My Solo 401k Real

https://i.ytimg.com/vi/ZAsz-9ACve0/maxresdefault.jpg

https://www.horizontrust.com

Both Self directed IRAs and Solo 401 k s also referred to as self directed 401 k s offer the freedom to invest in alternative assets like real estate or crypto However one may be better than the other depending on your circumstances

https://www.financestrategists.com › retirement-planning › ira

The difference between a Solo 401 k and a SEP IRA is the level of control over investments With a Solo 401 k you have more flexibility and decision making power as you can choose your own investments With a SEP IRA you must defer to the custodian and their investment options

Solo Vs Telegraph

2023 Solo 401k Contribution Limits Self Employed 401k Self directed

Sep Vs Simple Vs Solo 401k Hot Sale Cdlguaiba br

BLOG Discount Solo 401k Discount Solo 401k

Self directed Solo 401k Process Flowchart Illustration

Open Your Solo 401k Solo401k

Open Your Solo 401k Solo401k

How To Choose Self directed Retirement Plans For Your Future

Doing The Solo 401k Or SEP IRA Dance Insight Financial Strategists

What Is A Self Directed 401k My Solo 401k Financial

Self Directed 401k Vs Solo 401k - If you want hands on control and faster access to alternative investments a self directed solo 401k offers more autonomy and fewer obstacles than a self directed IRA Why a solo 401k might be the better choice