Simple Ira Rules For Business Owners SIMPLE Savings Incentive Match Plan for Employees of Small Employers IRA plan offers great advantages for businesses that meet two basic criteria Your business must have no more

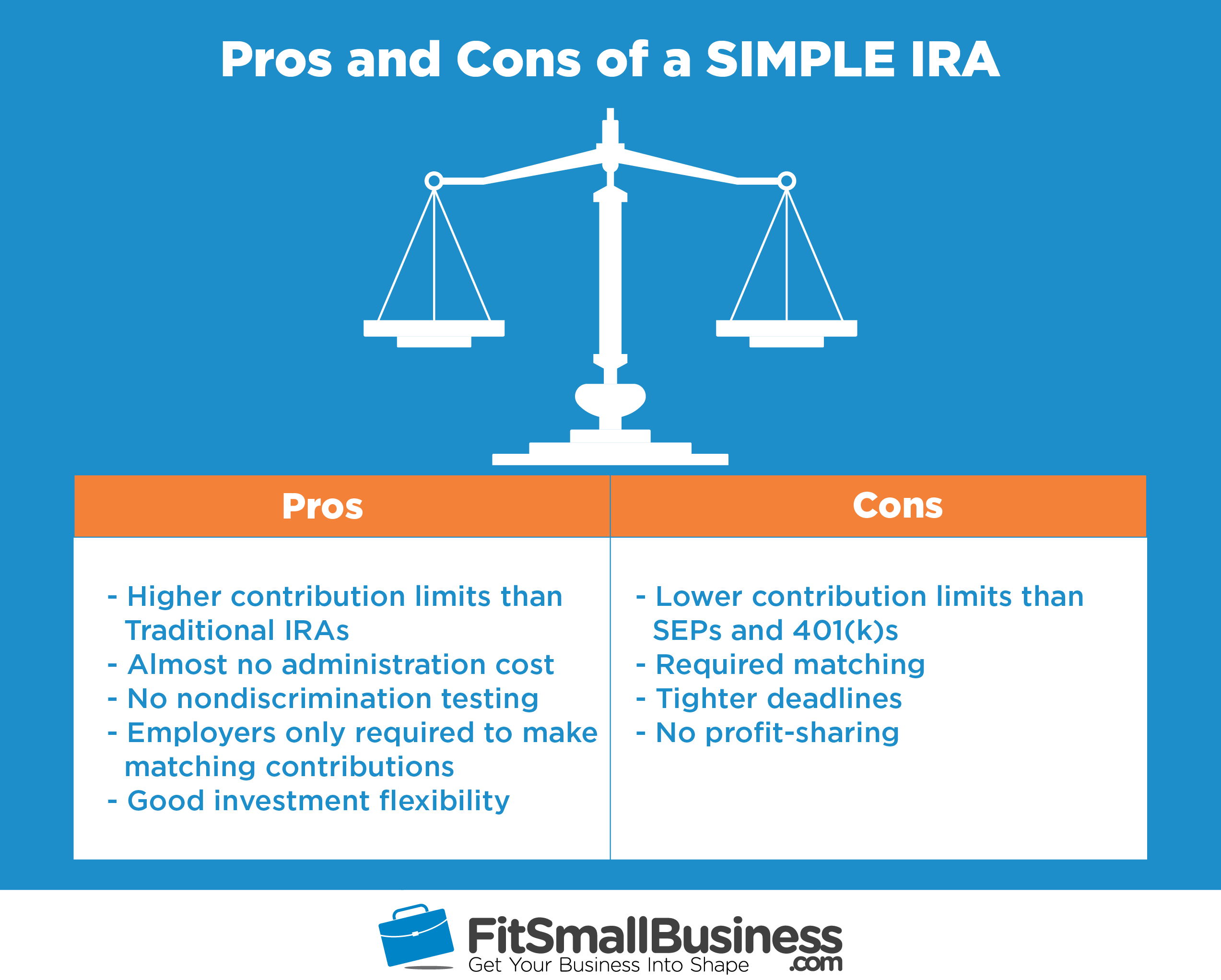

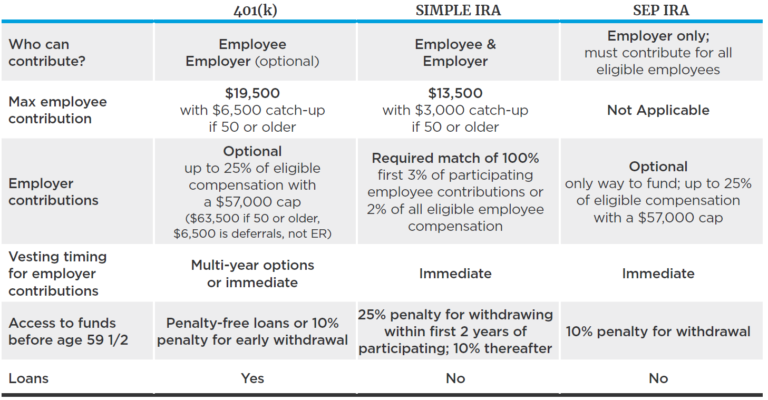

A SIMPLE IRA is easier to set up and administer than a 401 k has fewer rules and allows greater contributions than a regular IRA So is it good for your business Read below to find out A SIMPLE IRA plan establishes an IRA for each employee that they and their employers can both contribute to and get tax benefits from SIMPLE IRAs are for small businesses with no more than 100 employees and

Simple Ira Rules For Business Owners

Simple Ira Rules For Business Owners

https://smallbizgrowth.net/wp-content/uploads/2018/06/20180607031326-46.png

2025 Ira Contribution Limits Estimates Alan B Gibson

https://meldfinancial.com/wp-content/uploads/2023-11-23-2024-IRA-limits-768x637.png

2025 Roth Ira Contribution Limits Ian I McDonald

https://meldfinancial.com/wp-content/uploads/2023-11-23-2024-IRA-limits-759x630.png

You may be ineligible to sponsor a SIMPLE IRA plan if the combined number of employees who earned 5 000 or more during the preceding calendar year in your related A Simplified Employee Pension SEP IRA is a tax deductible retirement plan ideally available to freelance workers the self employed and small business owners with few employees like REALTORS for example

Opening a SIMPLE IRA can be a smart move for small business owners seeking to offer retirement benefits to their employees But what are the specific rules and considerations that could influence your decision to set one A SIMPLE IRA plan is a retirement plan for small businesses with fewer than 100 employees Here s how SIMPLE plans work how to establish one and rules to know

More picture related to Simple Ira Rules For Business Owners

2025 Ira Contribution Limits Estimate 2025 Images References Abdul

https://www.marinerwealthadvisors.com/wp-content/uploads/2019/11/401k-Advantages-Over-SEP-and-Simple-IRAs-1024x533.png

Irs 401k Limits For 2025 Silvia Faith

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-07-2022-401k-IRA-Limits.png

Sep Ira Contribution Limit 2025 Jena Robbin

https://www.carboncollective.co/hs-fs/hubfs/A_Side_by_Side_Comparison_of_SEP_and_Simple_IRA.png?width=3588&name=A_Side_by_Side_Comparison_of_SEP_and_Simple_IRA.png

As a small business owner offering a Simple IRA retirement plan can help attract and retain valuable employees But it s critical you understand the contribution rules to remain compliant and avoid potential penalties SIMPLE IRAs are designed for small businesses with 100 or fewer employees who earned at least 5 000 in compensation in the preceding calendar year Businesses that

Here s a breakdown of some key SIMPLE IRA rules that every small business owner should be aware of Eligibility Requirements To establish a SIMPLE IRA your business must have 100 or fewer employees who earned SIMPLE IRA stands for Savings Incentive Match Plan for Employees Congress wanted a less complicated retirement plan for small businesses that would be easy to set up

2025 Ira Contributions Chart Pdf Valeria Skye

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-12-2022-Roth-IRA-Income-Limits-1536x1536.png

2025 Irs 401k Limit Chart John J Albers

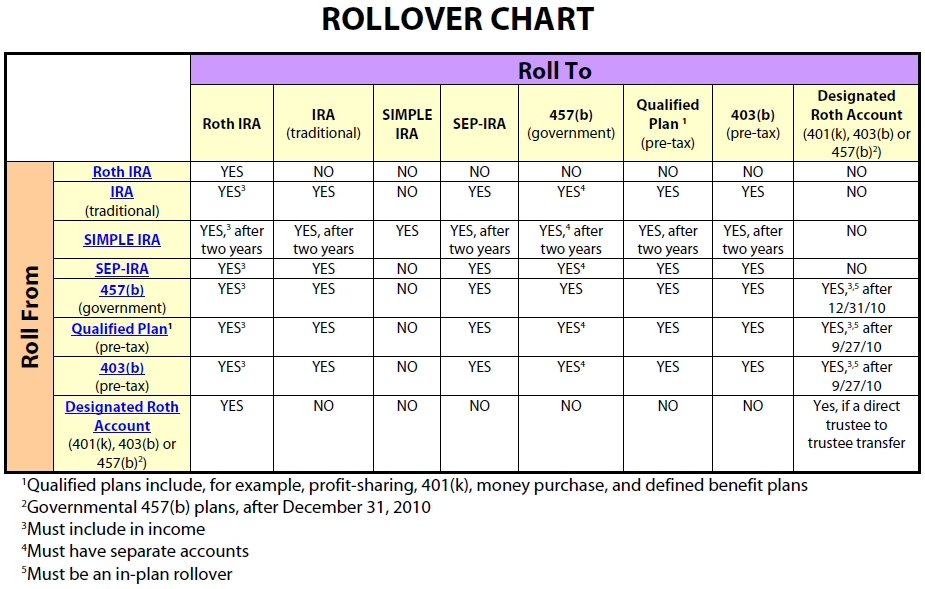

https://www.irafinancialgroup.com/wp-content/uploads/2018/05/ira-rollover-chart.jpg

https://www.dol.gov › sites › dolgov › files › ebsa › about...

SIMPLE Savings Incentive Match Plan for Employees of Small Employers IRA plan offers great advantages for businesses that meet two basic criteria Your business must have no more

https://windgatewealth.com › not-so-simpl…

A SIMPLE IRA is easier to set up and administer than a 401 k has fewer rules and allows greater contributions than a regular IRA So is it good for your business Read below to find out

Maximum Ira Contribution 2025 Deadline James Henry

2025 Ira Contributions Chart Pdf Valeria Skye

Ira Limits 2024 Catch Up Mei Dorette

Sep Ira Contribution Limits 2025 Shahab Sadie

Navigating SIMPLE IRA Rules For Small Business Owners DKK Accounting

2025 Roth Ira Income Limits Phase Out Zaydah Sage

2025 Roth Ira Income Limits Phase Out Zaydah Sage

401k Contribution Limits 2024 Including Match Limit Tonye Shandeigh

Understanding A SIMPLE IRA For Retirement Planning

Discover The Benefits Of Establishing A 401 k Over A SEP Or Simple IRA

Simple Ira Rules For Business Owners - If you are among the thousands of business owners eligible for a SIMPLE IRA plan read on A SIMPLE IRA plan provides you and your employees with an easy way to contribute toward