Six Year Rule Land Tax The 6 year property rule is a significant aspect of Australia s capital gains tax CGT system that can provide substantial tax relief to property owners This guide will explore the rule in detail explaining its benefits

The six year exemption rule applies to your main residence and reduces the CGT you pay upon selling it Whichever category your property The six year CGT exemption rule is a provision that allows property owners to treat their former main residence as their principal place of residence for CGT purposes for up to six years after they have moved out

Six Year Rule Land Tax

Six Year Rule Land Tax

https://i.ytimg.com/vi/8ycClERvACI/maxresdefault.jpg

Mario Party 2 Music N64 Rule Land YouTube

https://i.ytimg.com/vi/eIaVWGhDyXQ/maxresdefault.jpg

LAND REVENUE SETTLEMENTS IN INDIA DURING BRITISH TIME YouTube

https://i.ytimg.com/vi/lNJBKSR6_I4/maxresdefault.jpg

The capital gains tax six year rule allows eligible property investors to treat their investment property as if it were their main residence for a period of up to six years and still What is the CGT Six Year Rule The six year capital gains tax property rule allows you to use your property investment as if it were your principal residence in Australia for up to six years whilst you rent it out

I would like to understand how CGT will be calculated in my specific scenario and how I can utilise 6 years rule I bought a land in 2021 Jan and build a duplex 2 identical In a nutshell the six year rule allows you to move out of your residence live somewhere else provided you don t own the property and rent out your former home then sell it before the six year period is up without

More picture related to Six Year Rule Land Tax

Who Owned The Land During British Rule 18th Century By Owned We

https://pbs.twimg.com/media/Fbphe-9aUAUsITx.jpg

Inheritance Tax Calculator JT AccountS

https://jt-accounts.co.uk/wp-content/uploads/2023/01/Screenshot-2023-01-29-at-12.11.28.png

Is It Bad Luck Or Poor Leadership The Unfortunate Events During D az

https://cdn0.celebritax.com/sites/default/files/styles/watermark_100/public/1731399096-salacion-diaz-canel-cadena-eventos-tragicos-llego-presidencia-cuba.jpg

The 6 Year CGT Rule is a tax regulation that allows you to continue to treat a property as your main residence for up to 6 years after you have moved out of it This month Angelo Panagopoulos answers some reader questions about claiming deductions the six year rule CGT calculation

What is the Capital Gains Tax CGT six year rule The Australian Taxation Office ATO states that when you sell a property used to produce income such as earning rental The six year exemption rule applies to your main residence and serves to reduce the CGT you must pay when selling it If the property has appreciated in value you may still be

Land Tax Price From Mtg Wilds Of Eldraine Enchanting Tales

https://image.echomtg.com/JErvmPv20i2_zTv-Q6uGaaLTRaFfYO_mpAY3cr7gsw8/w:1536/h:1741/g:no/el:1/f:jpeg/q:30/aHR0cHM6Ly9hc3NldHMuZWNob210Zy5jb20vbWFnaWMvY2FyZHMvb3JpZ2luYWwvMTUyOTYyLmpwZw

Certificate Of Land Tax Clearance From Municipal Treasurer Lepiten

https://i0.wp.com/lepitenbojos.org/wp-content/uploads/2023/07/Certificate-of-Land-Tax-Clearance-from-Municipal-Treasurer-18072023-scaled.jpg?w=1804&ssl=1

https://taxstuff.com.au

The 6 year property rule is a significant aspect of Australia s capital gains tax CGT system that can provide substantial tax relief to property owners This guide will explore the rule in detail explaining its benefits

https://investguiding.com › article

The six year exemption rule applies to your main residence and reduces the CGT you pay upon selling it Whichever category your property

Land Revenue System Introduction Features Types Impact

Land Tax Price From Mtg Wilds Of Eldraine Enchanting Tales

Rmd Table 2025 Pdf Free Windy Lilian

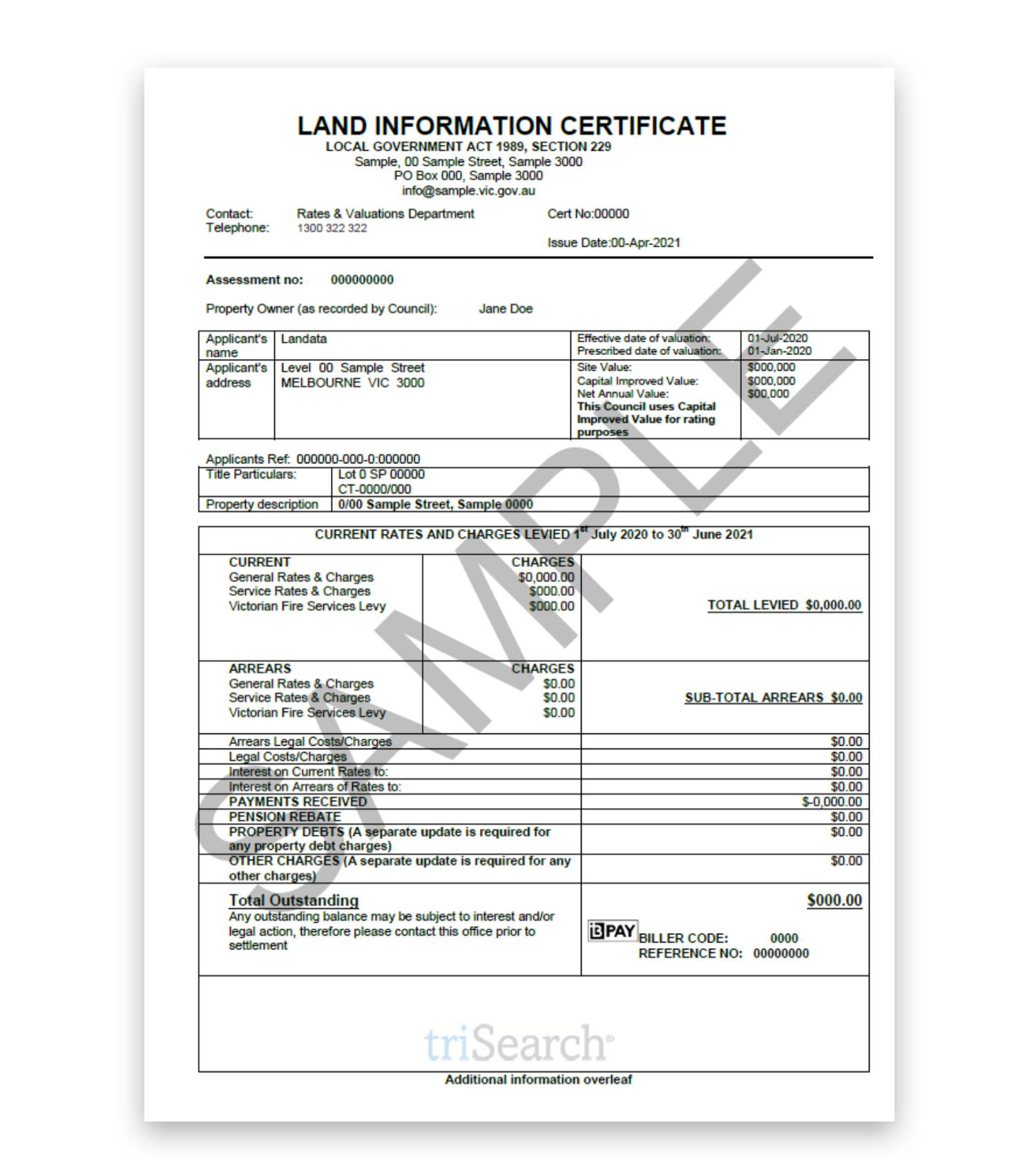

Revenue NSW TriSearch

Land Information Certificate TriSearch

Land Tax Anime Borderless Wilds Of Eldraine Enchanting Tales

Land Tax Anime Borderless Wilds Of Eldraine Enchanting Tales

Tax Free Threshold 2024 Australia Sara Wilone

Turning Your Home Into An Investment Property Can Be Advantageous For

Property Tax Information Sheet

Six Year Rule Land Tax - I would like to understand how CGT will be calculated in my specific scenario and how I can utilise 6 years rule I bought a land in 2021 Jan and build a duplex 2 identical