Tax Deductor And Collector Meaning The Canada Revenue Agency CRA administers tax laws for the government providing contacts services and information related to payments taxes and benefits for individuals and businesses

This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a Client portals with a single sign in Filing through a tax preparer If you don t do your taxes on your own an EFILE certified tax preparer like an accountant can file your income tax and benefit return for you Tax preparers use EFILE certified software to file your taxes online To find an EFILE certified tax preparer in your area try our postal code search Filing a paper

Tax Deductor And Collector Meaning

Tax Deductor And Collector Meaning

https://i.ytimg.com/vi/D9ZEc4NwFqc/maxresdefault.jpg

What Is TDS Who Is TDS Deductor And Deductee TDS Entry Kaise Kare

https://i.ytimg.com/vi/cvVUjivG8ek/maxresdefault.jpg

CA FINAL GST REVISION CH 12 PAYMENT OF TAX TDS DEDUCTOR TCS DEDUCTOR

https://i.ytimg.com/vi/_iBWzFvcTzc/maxresdefault.jpg

The middle class tax cut would reduce the tax rate that is applied to the first 57 375 in 2025 of an individual s taxable income regardless of their income level As shown below the bulk of total tax relief will go to those with incomes in the two lowest tax brackets including nearly half to those in the first bracket NETFILE service in tax software that allows most people to submit a personal income tax return electronically to the Canada Revenue Agency

Today the Minister of Finance and National Revenue the Honourable Fran ois Philippe Champagne released for consultation draft legislative proposals that would implement a range of previously announced and other tax measures including measures that would Today the Minister of Finance and Tax assessment or reassessment This section provides a summary of the key line numbers and amounts used to assess or reassess your tax return If changes were made to your return an explanation of the changes is provided Summary Shows the line numbers and amounts used to calculate your refund or balance owing on your assessed tax return

More picture related to Tax Deductor And Collector Meaning

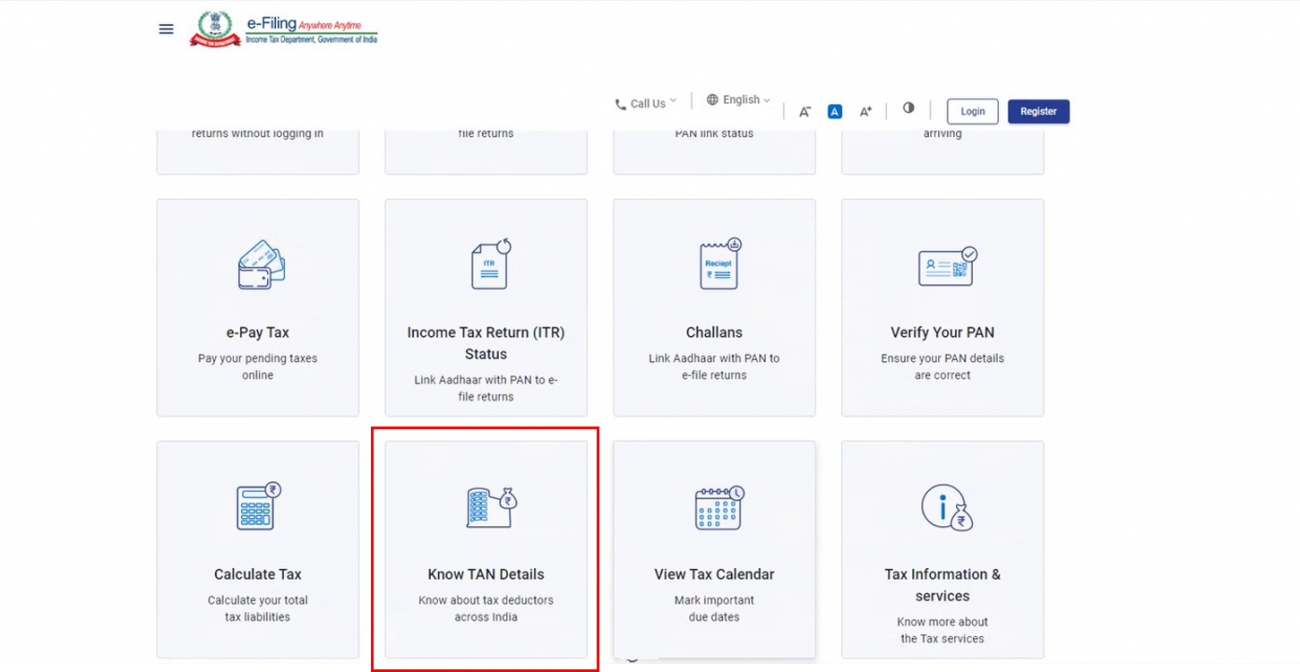

How To Register On E Filing Portal For A Tax Collector Tax Deductor

https://i.ytimg.com/vi/TBsT5AlylKk/maxresdefault.jpg

How To Register Tan No Deductor Account On Efiling Income Tax Portal

https://i.ytimg.com/vi/0-V7GhUKw2g/maxresdefault.jpg

How To Pay TDS Challan Without Eifling Income Tax Portal Login With

https://i.ytimg.com/vi/Io2ZIJtXiOQ/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGkgaShpMA8=&rs=AOn4CLByTIVrA8Wdp_HYa4sEFgtPMRJ13g

How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund or Preservation Fund as a cash lump sum The first R550 000 of your retirement lump sum is tax free as of 1 March 2024 Any previous withdrawals or retirement lump sums you ve taken will For tax purposes estates and trusts are treated similarly In calculating the income of an estate references in this guide to a trust or trust property include estate or estate property The Act refers to the Income Tax Act

[desc-10] [desc-11]

GOODS SERVICES TAX TAX DEDUCTED AT SOURCE Ppt Download

https://slideplayer.com/slide/14653753/90/images/8/How+can+the+deductee+claim+benefit+of+TDS.jpg

Know Your TAN Details Learn By Quicko

https://learn.quicko.com/wp-content/uploads/2021/07/Know-TAN-Details-Option.png

https://www.canada.ca › en › revenue-agency

The Canada Revenue Agency CRA administers tax laws for the government providing contacts services and information related to payments taxes and benefits for individuals and businesses

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-ti…

This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a Client portals with a single sign in

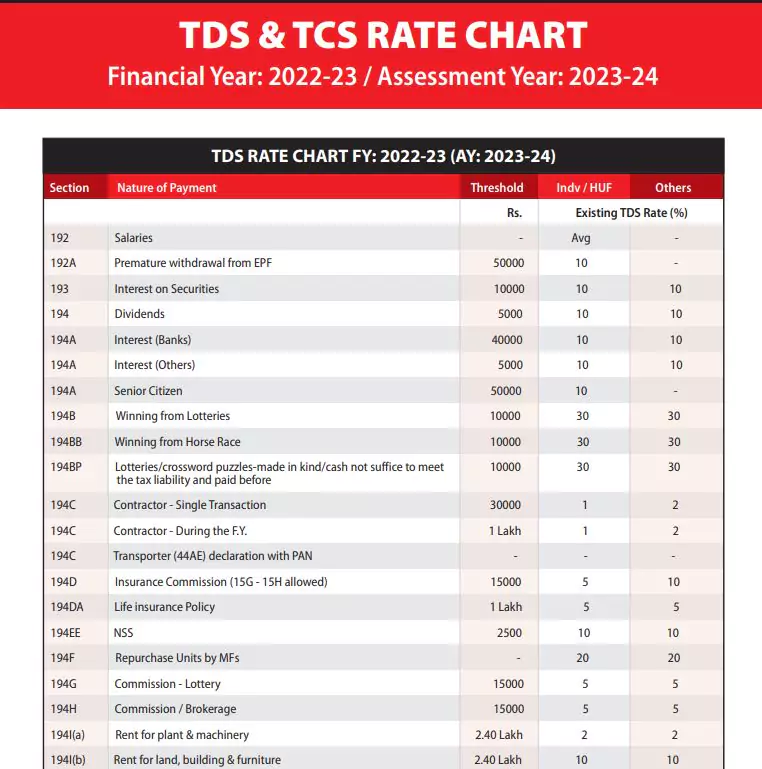

New Tds Rate For Fy 2023 24 Image To U

GOODS SERVICES TAX TAX DEDUCTED AT SOURCE Ppt Download

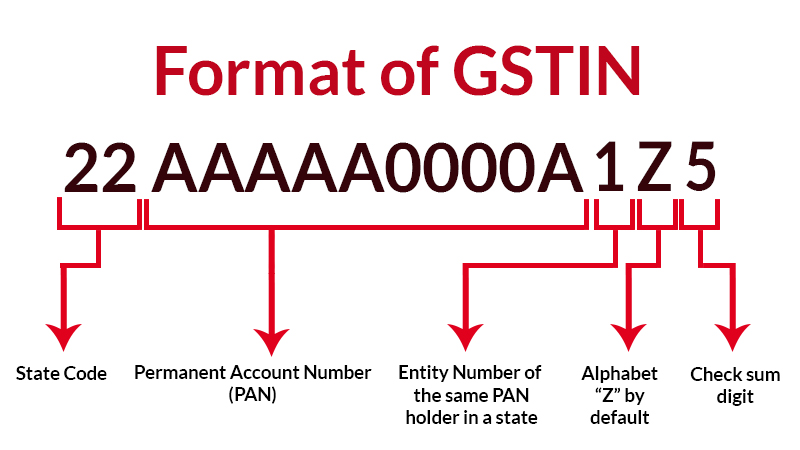

GST REG 30 Form For Physical Verification Report By Officer

:max_bytes(150000):strip_icc():focal(749x0:751x2)/liam-payne-chest-tattoo-2-071023-422c2dc555954fcf86217b721cb4f30a.jpg)

Liam s Arrow Tattoo Deciphering The Symbolism

Tax Deductor Registration On The Income Tax Portal

SOP Penyusunan Laporan Keuangan Perusahaan

SOP Penyusunan Laporan Keuangan Perusahaan

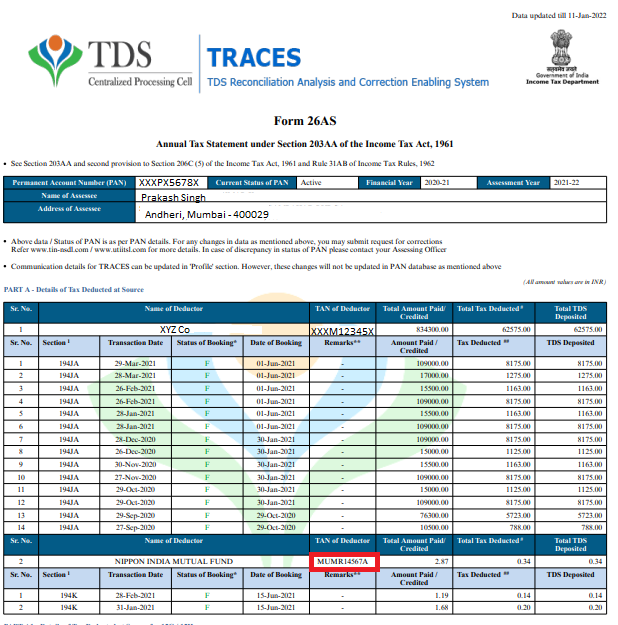

TAN Tax Deduction Account Number Of Deductor MyITreturn Help Center

A Deep Dive Into The World Of Stusy Unraveling The Enigma

Know Your TAN Details 2024

Tax Deductor And Collector Meaning - Today the Minister of Finance and National Revenue the Honourable Fran ois Philippe Champagne released for consultation draft legislative proposals that would implement a range of previously announced and other tax measures including measures that would Today the Minister of Finance and