Tax Rate On 401k Withdrawal After 65 Calculator This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a

Income tax Personal business corporation trust international and non resident income tax Canada Disability Benefit The Canada Disability Benefit provides direct financial support to people with disabilities who are between 18 and 64 years old The program is

Tax Rate On 401k Withdrawal After 65 Calculator

Tax Rate On 401k Withdrawal After 65 Calculator

https://i.ytimg.com/vi/PyOFCELOJhM/maxresdefault.jpg

What Is The Tax Rate On 401k Withdrawal After Age 60 YouTube

https://i.ytimg.com/vi/SCONqHFT1R4/maxresdefault.jpg

Rmd Life Expectancy Tables Beneficiary Ira Elcho Table

https://www.merriman.com/wp-content/uploads/ULT.jpg

Quotes The deferral of the increase to the capital gains inclusion rate will provide certainty to Canadians whether they be individuals or business owners as we quickly It s never been easier to do your taxes online In fact online filing gets you access to the benefits credits and refunds you may be eligible for even faster Last year approximately 93 of

When you are on your Sign In Partner s website ensure it is your information that is entered and not that of somebody else If you register with someone else s banking credentials How much tax will I pay on my retirement lump sum withdrawals From age 55 you can take up to one third of your retirement fund Retirement Annuity Company Pension Fund

More picture related to Tax Rate On 401k Withdrawal After 65 Calculator

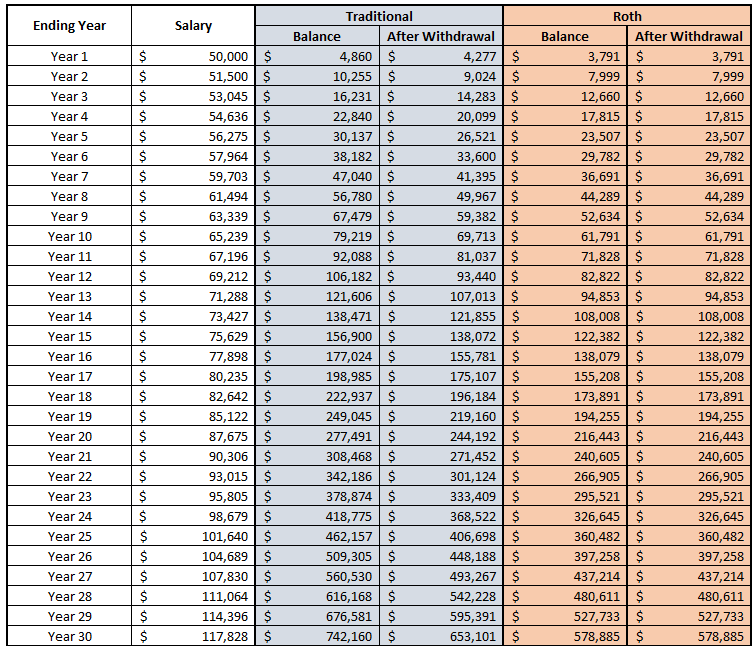

Roth 401k Calculator Choosing Your Gold IRA

https://cdn.vertex42.com/Calculators/Images/traditional-vs-roth-ira-based-on-tax-rates.png

401k Limits 2025 Brandon J Soriano

https://www.annuity.org/wp-content/uploads/401k-employer-matching-768x609.jpg

Rmd Table For 2024 Distributions 2024 Joyan Julietta

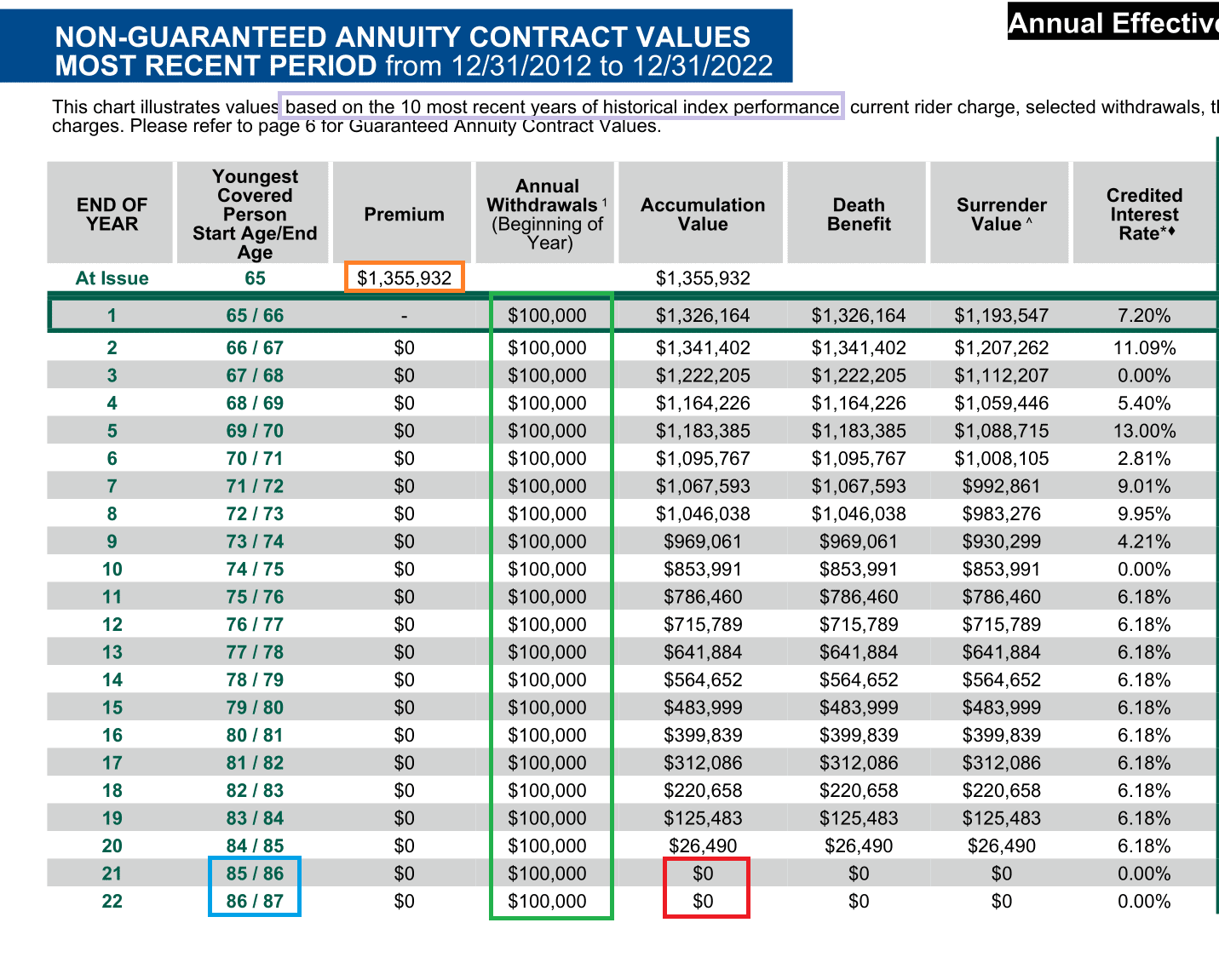

https://ssd2.s3.amazonaws.com/tmp/2018-08-02/1533216001454-image.png

Contact the CRA Call the CRA if you have any questions about electing under section 217 of the Income Tax Act TD1 2025 Personal Tax Credits Return Notice to the reader Notice for employers Instead of giving paper copies of Form TD1 to your employees give them the link to this webpage Ask them to

[desc-10] [desc-11]

401k Contribution Max 2025 Joshua M Matter

https://www.financialsamurai.com/wp-content/uploads/2018/11/401k-max-contribution-potential.png

Irs Traditional Ira Contribution Limits 2025 Misu Flint

https://www.personalfinanceclub.com/wp-content/uploads/2021/11/2021-11-07-2022-401k-IRA-Limits-1024x1024.png

https://www.canada.ca › en › revenue-agency › news › newsroom › tax-ti…

This tax season the Canada Revenue Agency CRA has simplified its sign in process making it easier to access the My Account My Business Account and Represent a

https://www.canada.ca › en › services › taxes › income-tax

Income tax Personal business corporation trust international and non resident income tax

401k Contribution Limits 2025 After Tax Georgina M Ali

401k Contribution Max 2025 Joshua M Matter

401k Catch Up 2024 Calculator Pdf Carree Melita

2025 Contribution Limits Irs John J Albers

Uniform Lifetime Table Irs 2025 Wilma Ledezma

401 K Limits 2025 Over 50 William S Bell

401 K Limits 2025 Over 50 William S Bell

401k Contribution Limits 2025 Employer Lachlan T Bindon

Retirement Withdrawal Calculator Estimate A Safe Rate To Drawdown

2025 Individual 401k Contribution Limits Hiro Dehaan

Tax Rate On 401k Withdrawal After 65 Calculator - [desc-13]