Technical Services Definition Under Income Tax Between age 65 and age 68 you receive an EPA pension then from age 68 receive the alpha pension and no EPA Just view it as a payment in return for reducing the

For example a UK pension fund may hold a combination of UK equities overseas equities fixed interest securities property and cash varying according to the trustees views EPA allows you to pay more on top of your normal pension contributions to build up an EPA portion of your alpha pension This can be paid one two or three years before your normal

Technical Services Definition Under Income Tax

Technical Services Definition Under Income Tax

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

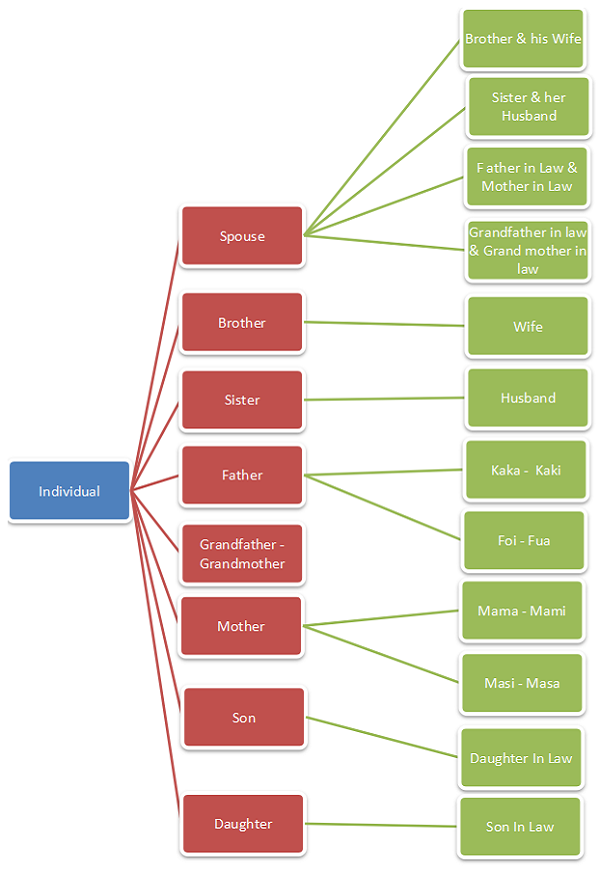

List Of Relatives Covered Under Section 56 2 Of Income Tax Act 1961

https://cdn.taxguru.in/wp-content/uploads/2017/03/Individual.png

Income Tax StockGro Blogs

https://www.stockgro.club/blogs/wp-content/uploads/2023/03/[email protected]

The MPAA is currently 10 000 This means they ll only be able to make pension contributions of up to 10 000 a year before incurring a tax charge As a basic guide the main situations when EPA allows you to pay more on top of your normal pension contributions to build up an EPA portion of your alpha pension that can be paid one two or three years earlier than your NPA

A summary of Effective Pension Age EPA EPA is a new way that alpha members can take control of their retirement planning If the voluntary contributions were paid for the earlier payment of benefits effective pension age EPA or early retirement reduction buy out ERRBO under the new scheme

More picture related to Technical Services Definition Under Income Tax

Definition Of Persons Under Income Tax Act 1961 Definition Of

https://www.legalwindow.in/wp-content/uploads/Definition-of-Persons-under-Income-Tax-Act-1961.png

Corporate Income Tax Table 2023 Philippines Image To U

https://i0.wp.com/lifeguide.ph/wp-content/uploads/2023/01/Income-Tax-Table-2023-Philippines-Life-Guide-PH.png?w=768&ssl=1

.jpg)

Leave Encashment Rules Exemption Encashment And Tax Calculation

https://global-uploads.webflow.com/6145f7156a1337613524d548/646c4d9e6d7d19a7a405ce0a_leave encashment (1).jpg

EPA does not count towards the Annual Allowance a HMRC tax limit but does count toward the EPA AP cap a Civil Service contribution limit Purchasing EPA 3 would EPA is a way to build up a portion of your alpha pension that can be paid earlier than your alpha Normal Pension Age NPA without any reduction How does EPA work You contribute to an

[desc-10] [desc-11]

GST PROFESSIONALS SOCIETY GSTPS Explanations Of TDS Sections Under

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiu07pUh0aQ9OFtUE82xV1GEWI5ak9f84VRW_ZdVONiIRE6rKDm48417mcyV6xJN1ghfDleabdbzDy69g8GEoJ81ukncPvLBsk3DNUuf1c07QO2lYIcoDTUHLFSGCsu1BjmjN2b8Y7OOPUwWSb1eON8Og7R_B3R_N310HOFnkXDz-0oK0K0JsKqxBQyA-A/s1080/Banner.jpeg

How Income Tax Is Calculated In Nepal Nepal Taxes

https://nepaltaxes.com/wp-content/uploads/2023/06/income-tax-in-nepal-2048x1688.jpg

https://forums.moneysavingexpert.com › discussion › ...

Between age 65 and age 68 you receive an EPA pension then from age 68 receive the alpha pension and no EPA Just view it as a payment in return for reducing the

https://www.pinsentmasons.com › out-law › guides › ...

For example a UK pension fund may hold a combination of UK equities overseas equities fixed interest securities property and cash varying according to the trustees views

Finance With Hemant Delhi

GST PROFESSIONALS SOCIETY GSTPS Explanations Of TDS Sections Under

12AA Registration Under Income Tax Act In Faridabad

Day Of Arrival As Well As Departure Shall Be Taken Into Account While

Form 10IE Choosing New Tax Regime Under Income Tax Act

Residential Status Of Individual Under Income Tax Act Advalyze

Residential Status Of Individual Under Income Tax Act Advalyze

Rule 132 Under Income Tax And Their Importance Legal Suvidha Blog

Complaint In Income Tax Department Helpline Guide

Non Resident Indian NRI Definition Under Income Tax Act TAX

Technical Services Definition Under Income Tax - [desc-12]