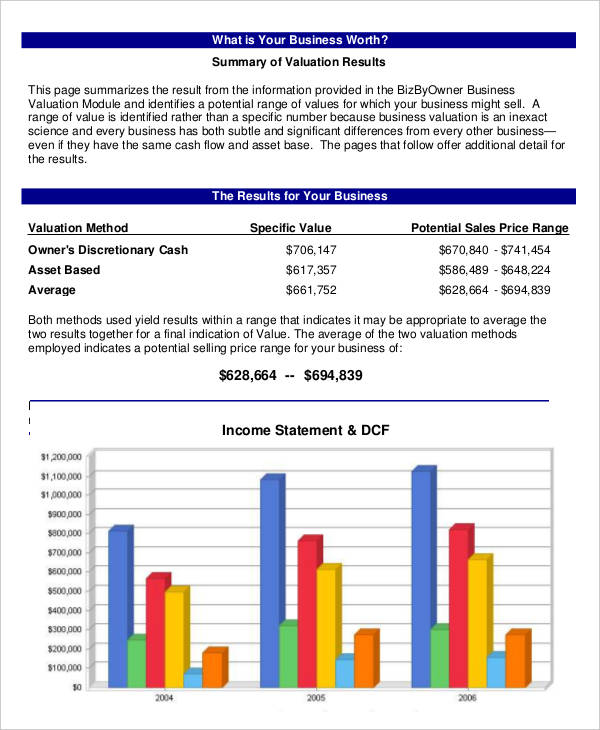

Valuation Report Example The comparable multiples valuation modeling approach in Excel is very different from that of a DCF model With this method instead of determining a company s intrinsic value as above an analyst will look at the valuation multiples of other publicly traded companies and compare them to that of the business es they wish to value

The market approach is a valuation method used to determine the appraisal value of a business intangible asset business ownership interest or security by FMVA Program Overview CFI s Financial Modeling Valuation Analyst FMVA Certification imparts vital financial analysis skills emphasizing constructing effective financial models for confident business decisions This comprehensive program ensures mastery in modeling budgeting forecasting and overall competency in accounting and finance

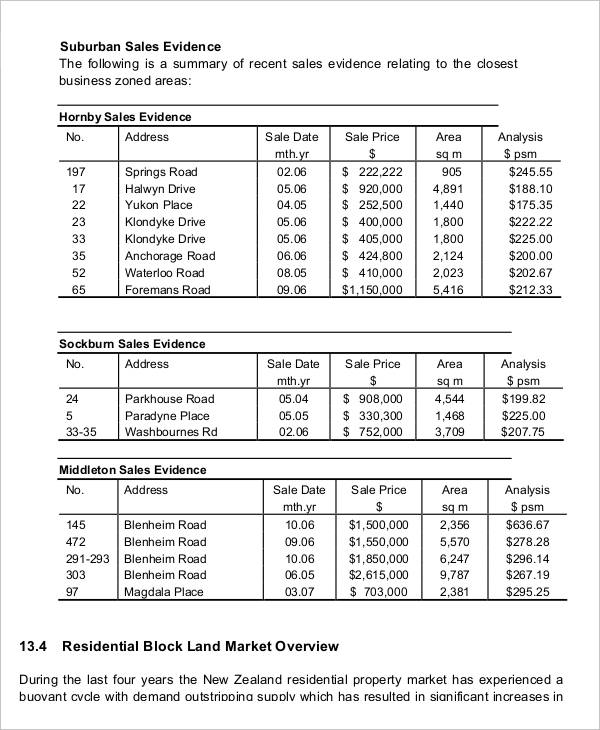

Valuation Report Example

Valuation Report Example

https://i.pinimg.com/736x/f2/b3/0e/f2b30ef09b608fef5d2dc8308dd9c99a.jpg

Valuation Report

https://images.sampletemplates.com/wp-content/uploads/2017/03/Independent-Property-Valuation-Report1.jpg

Valuation Report Template

https://i2.wp.com/images.sampletemplates.com/wp-content/uploads/2017/03/Commercial-Property-Valuation-Report1.jpg

Free cash flow is one of the most important ways to measure a company s financial performance It demonstrates the cash flow a company can potentially distribute after making reinvestments in the business via CapEx and working capital FCF is used for valuation and to determine whether a company can meet its debt obligations This guide shows you step by step how to build comparable company analysis Comps and includes a free template and many examples

There are many types of valuation multiples used in financial analysis They can be categorized as equity multiples and enterprise value multiples Net Working Capital NWC is the difference between a company s current assets net of cash and current liabilities net of debt on its balance sheet

More picture related to Valuation Report Example

Beautiful Work How To Read Property Valuation Report Engineering

https://img.yumpu.com/25532079/1/500x640/valuation-report-property-cube.jpg

Valuation Reports 17 PDF Google Docs Apple Pages MS Word Format

https://images.template.net/wp-content/uploads/2017/04/18105925/Land-Assets-Valuation-Report.jpg

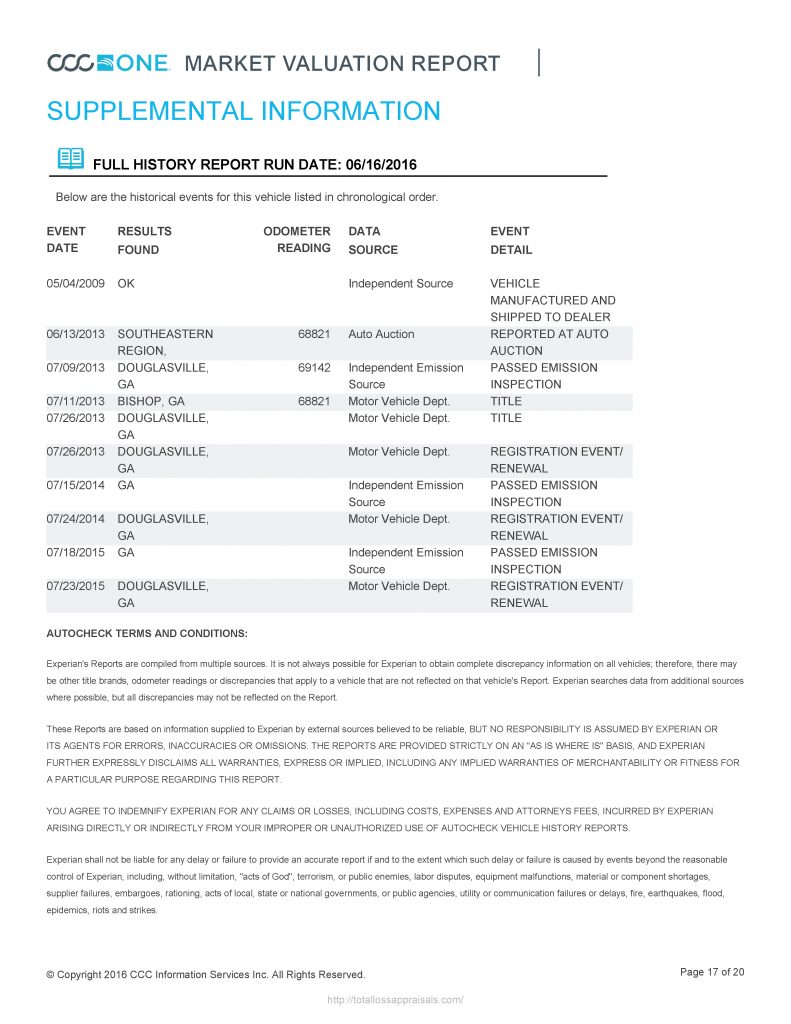

Sample Vehicle Valuation Report CCC Total Loss Appraisals

https://totallossappraisals.com/wp-content/uploads/SAMPLE-TOTAL-LOSS-CCC-REPORT_Page_17-791x1024.jpg

Understand the key differences between EBITDA Cash Flow FCF FCFE and FCFF to master valuation modeling and financial analysis techniques What is EBITDA EBITDA stands for E arnings B efore I nterest T axes D epreciation and A mortization and is a metric used to evaluate a company s operating performance It can be seen as a loose proxy for cash flow from the entire company s operations The EBITDA metric is a variation of operating income EBIT that excludes certain non cash expenses The purpose of

[desc-10] [desc-11]

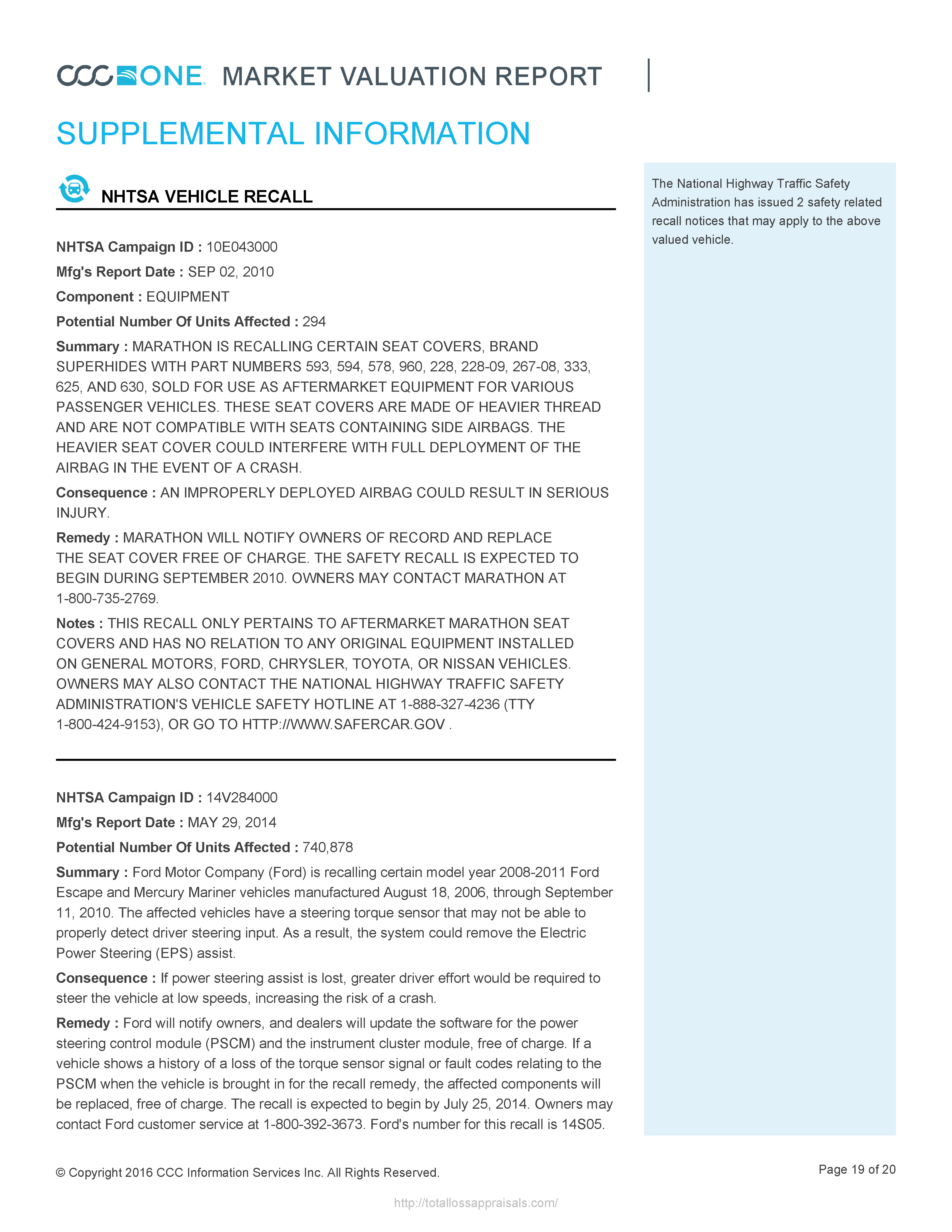

Sample total loss ccc report page 19 Total Loss Appraisals

https://totallossappraisals.com/wp-content/uploads/SAMPLE-TOTAL-LOSS-CCC-REPORT_Page_19.jpg

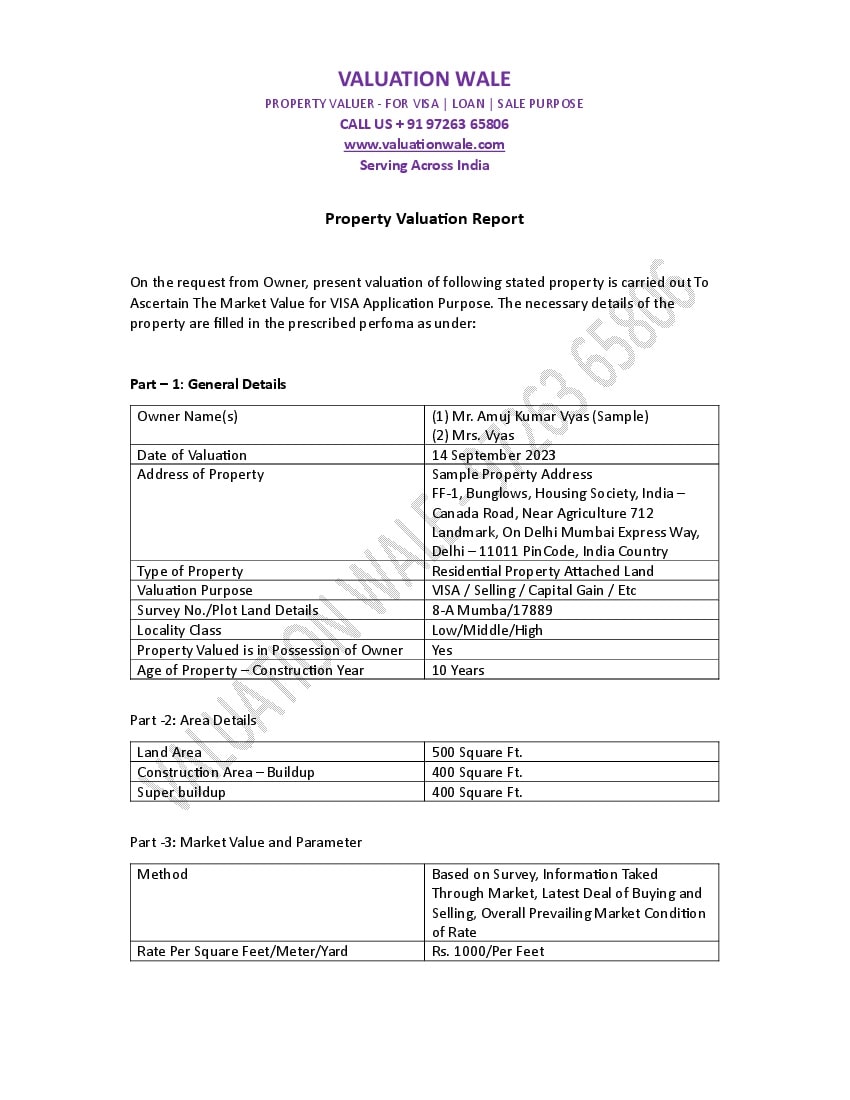

Property Valuation Report Format Sample Copy Of Certificate

https://valuationadda.com/wp-content/uploads/2023/03/Property-Valuation-for-VISA-Sample-Certificate.jpg

https://corporatefinanceinstitute.com › resources › financial-modeling › v…

The comparable multiples valuation modeling approach in Excel is very different from that of a DCF model With this method instead of determining a company s intrinsic value as above an analyst will look at the valuation multiples of other publicly traded companies and compare them to that of the business es they wish to value

https://corporatefinanceinstitute.com › resources › valuation › market-ap…

The market approach is a valuation method used to determine the appraisal value of a business intangible asset business ownership interest or security by

Net Worth Certificate For VISA Net Worth Certificate By CA

Sample total loss ccc report page 19 Total Loss Appraisals

Business Valuation Report Template Worksheet Professional Business

Valuation Reports 17 PDF Google Docs Apple Pages MS Word Format

Property Valuation Report Template Visme

Interim Valuation Summary Download Scientific Diagram

Interim Valuation Summary Download Scientific Diagram

Property Valuation Report Format Property Valuer Report Sample

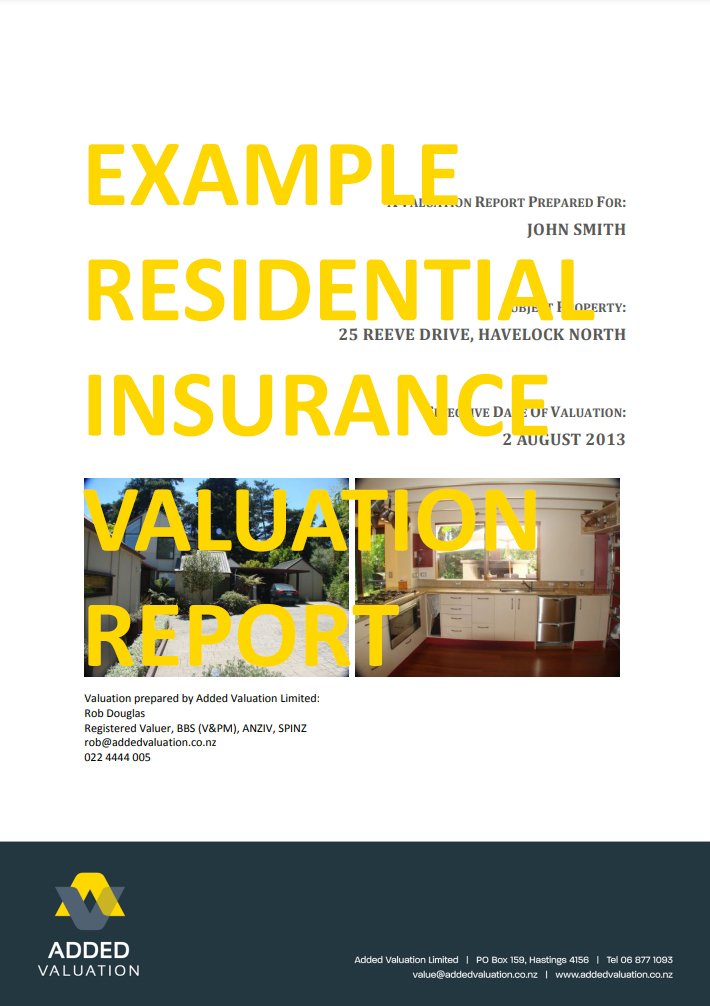

Residential Insurance Valuation Added Valuation

The Unique HDB Valuation Process

Valuation Report Example - [desc-13]