What Expenses Can I Claim For Working From Home Canada Expenses on which you did not pay GST or HST such as goods and services acquired from non registrants for example small suppliers most expenses you incurred outside Canada for

The expenses you can deduct include any GST HST you incur on these expenses minus the amount of any input tax credit claimed However since you cannot deduct personal expenses Variable B is the taxpayer s ratio of permissible expenses for the year multiplied by the taxpayer s ATI unless the taxpayer made an election under subsection 18 21 2 The ratio of

What Expenses Can I Claim For Working From Home Canada

What Expenses Can I Claim For Working From Home Canada

https://i.ytimg.com/vi/M40gOD616bY/maxresdefault.jpg

A Blue Poster With The Words Common Deductible Business Expenies On It

https://i.pinimg.com/originals/2f/7a/6f/2f7a6f27d7ae9dd9548a247bc7ee26d7.png

Self Employed Allowable Expenses Accounting Basics Best Accounting

https://i.pinimg.com/originals/de/81/c7/de81c7177a75fa53363d95cb5e077283.png

December 30 2024 Ottawa Ontario Department of Finance Canada Today the Department of Finance Canada announced the automobile income tax deduction limits and expense benefit The work space in the home expenses you can claim are limited when you work only a part of the year from your home You can only claim the expenses you paid in the part

T2SCH130 Excessive Interest and Financing Expenses Limitation 2023 and later tax years Download instructions for fillable PDFs These include small items such as pens pencils paper clips stationery and stamps For office expenses related to your workspace see Line 8811 Office stationery and supplies below

More picture related to What Expenses Can I Claim For Working From Home Canada

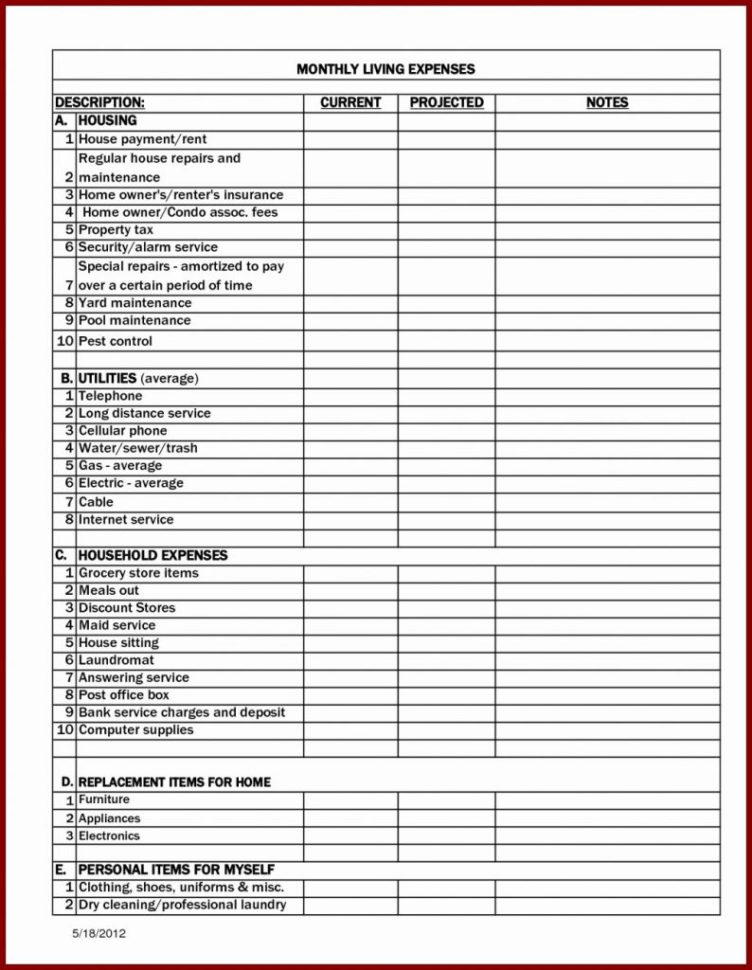

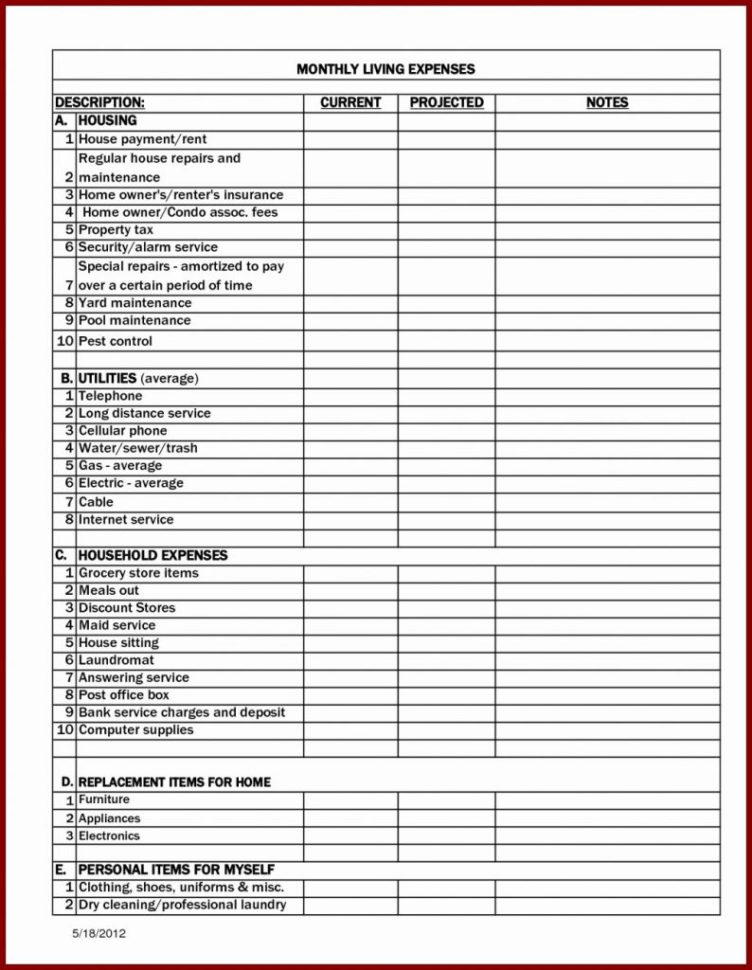

List Of Daily Expenses JsOlfe

https://db-excel.com/wp-content/uploads/2018/11/daily-expenses-sheet-in-excel-format-free-download-awesome-new-for-business-expense-categories-spreadsheet-1255x970.jpg

EXCEL Of Daily Expenses Report xls WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20190830/cfb8a944d48f426c8ee793f48130f526.jpg

Contractor Expenses List Sakiimaging

https://images.ctfassets.net/ifu905unnj2g/4YZTnk6Kv20hdUNgkt60lc/e4148669b50768645e2773364dc98891/Bench_Income_statement_template.png

Moving expenses reasonable moving expenses that have not been claimed as moving expenses on anyone s tax return to move a person who has a severe and prolonged mobility Volume II Details of Expenses and Revenues Volume III Additional Information and Analyses Detailed information relating to Sections 3 4 and 6 of Volume III Section 3 Professional and

[desc-10] [desc-11]

Nc Income Tax Standard Deduction 2025 Cherin Kara Lynn

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

:max_bytes(150000):strip_icc()/20-ways-use-your-flexible-spending-account_final_rev-d861e123d8b64ced89a51a3b178f7fc4.png)

What Is Fsa Max For 2025 Nicholas Churchill

https://www.investopedia.com/thmb/J29RmGir8gXXEsiB7UqB1Uy3nZk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/20-ways-use-your-flexible-spending-account_final_rev-d861e123d8b64ced89a51a3b178f7fc4.png

https://www.canada.ca › ... › forms-publications › publications › employm…

Expenses on which you did not pay GST or HST such as goods and services acquired from non registrants for example small suppliers most expenses you incurred outside Canada for

https://www.canada.ca › ...

The expenses you can deduct include any GST HST you incur on these expenses minus the amount of any input tax credit claimed However since you cannot deduct personal expenses

Can I Claim Medical Expenses On My Taxes TMD Accounting

Nc Income Tax Standard Deduction 2025 Cherin Kara Lynn

Claim Sole Trader Deductible Expenses NZ

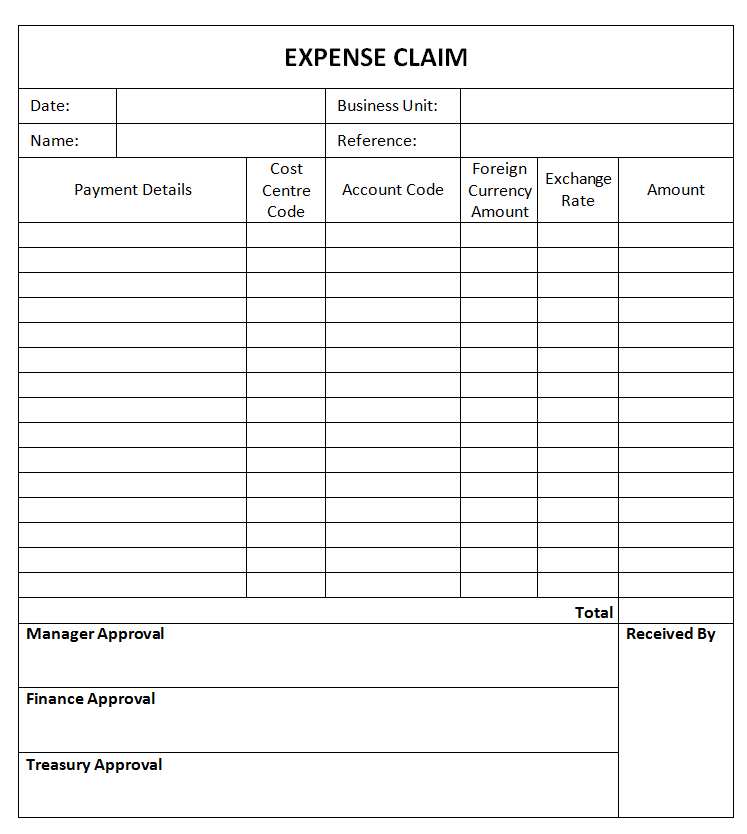

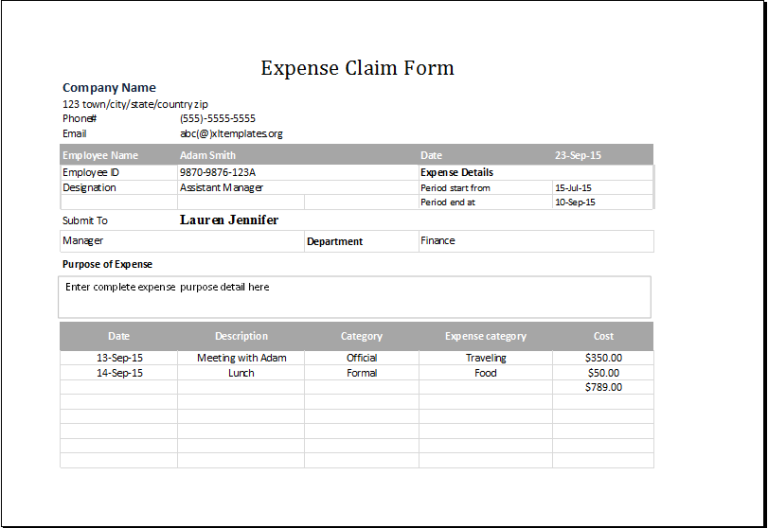

Expenses Claim Form Template

What Expenses Can I Claim FREE Printable Checklist Of 100 Tax

Investment Projection Spreadsheet Spreadsheet Downloa Investment

Investment Projection Spreadsheet Spreadsheet Downloa Investment

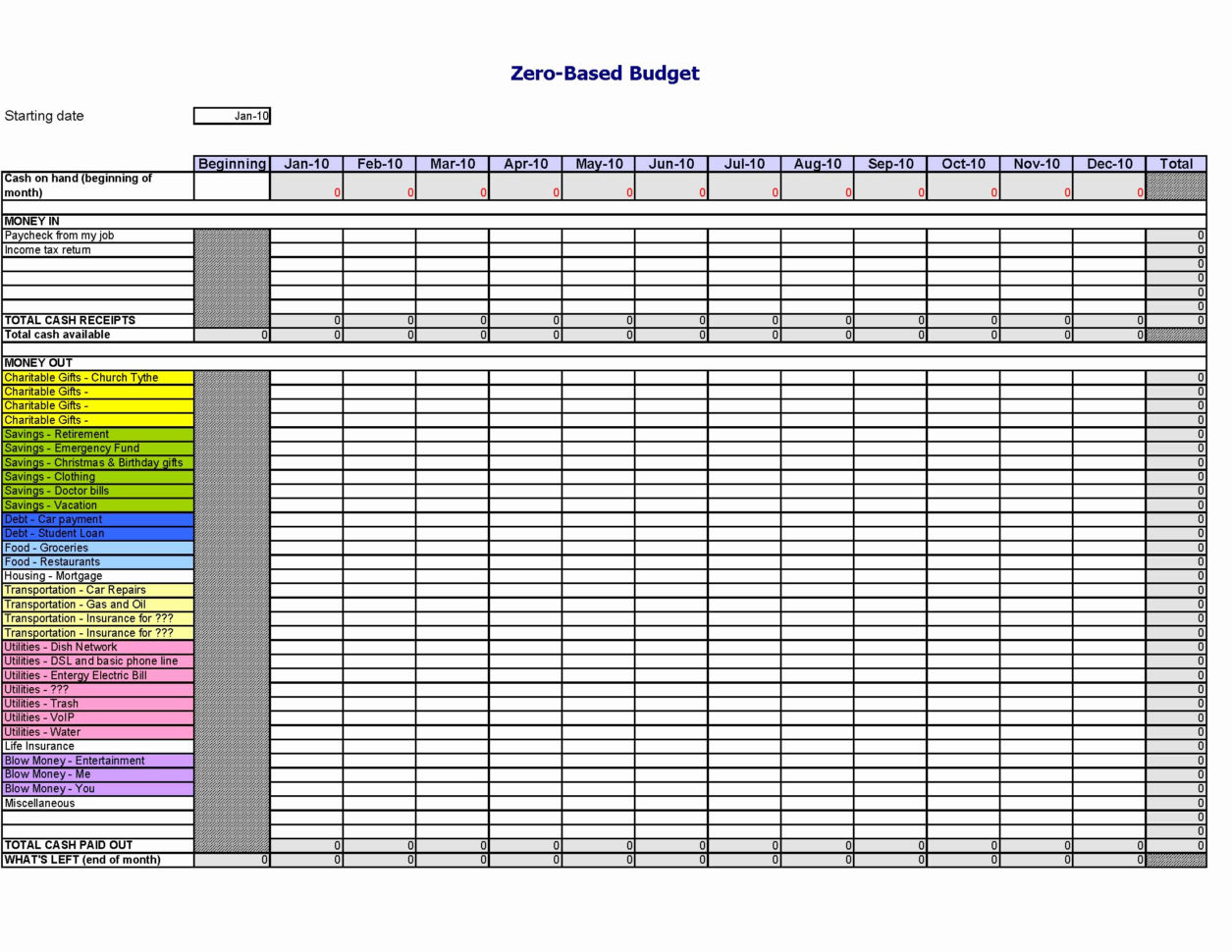

Expense Claim Form Template For EXCEL Excel Templates

Claim Evidence Reasoning Science Examples

1500 Health Insurance Claim Form Instructions ClaimForms

What Expenses Can I Claim For Working From Home Canada - [desc-14]