What Happens During An Energy Performance Certificate Discover how Aave is revolutionizing DeFi with its decentralized lending protocol Learn about liquidity pools yield farming and why Aave leads the future of decentralized finance

Aave is a decentralised non custodial liquidity protocol where users can participate as suppliers or borrowers Suppliers provide liquidity to the market while earning interest and borrowers can Aave is an Open Source Protocol to create Non Custodial Liquidity Markets to earn interest on supplying and borrowing assets with a variable interest rate The protocol is designed for easy

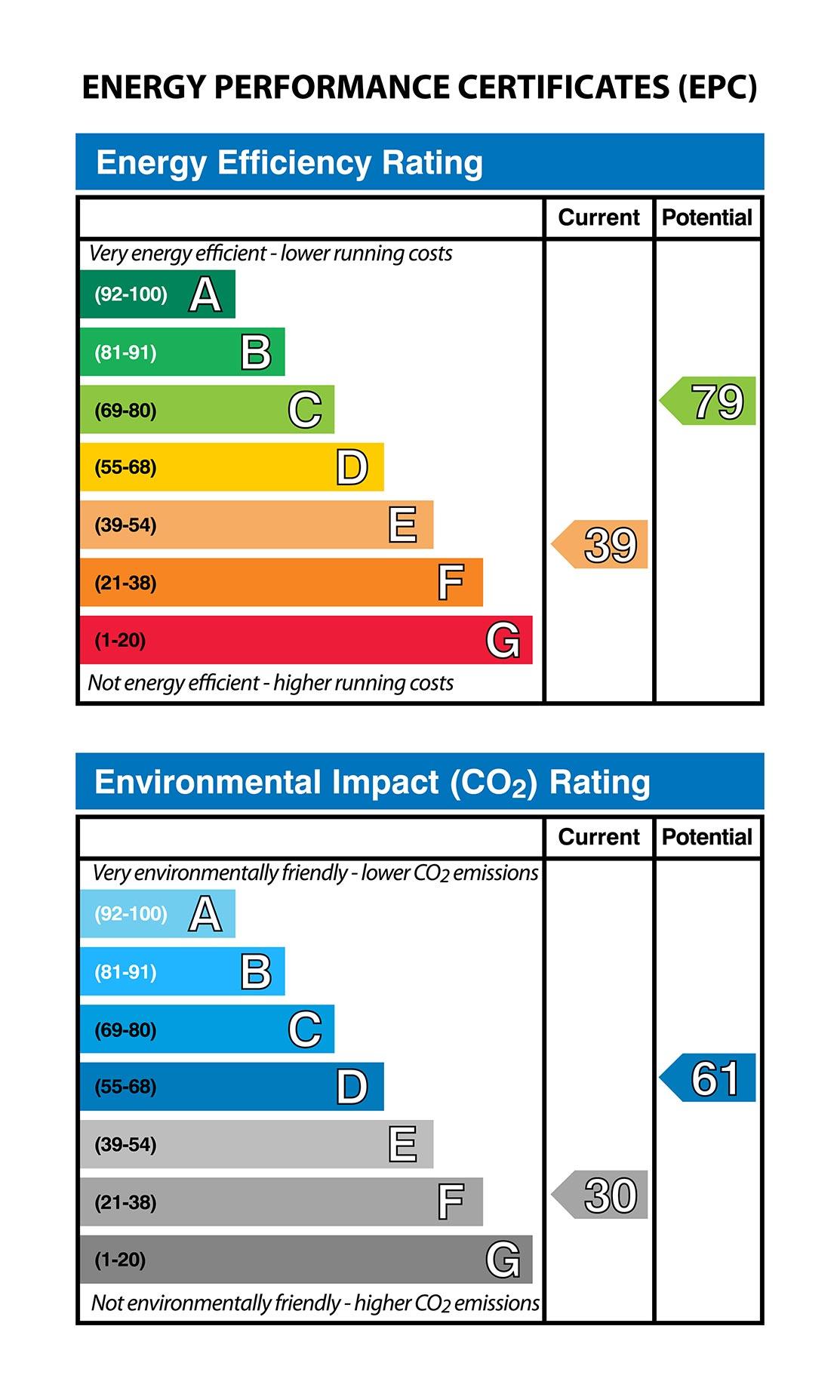

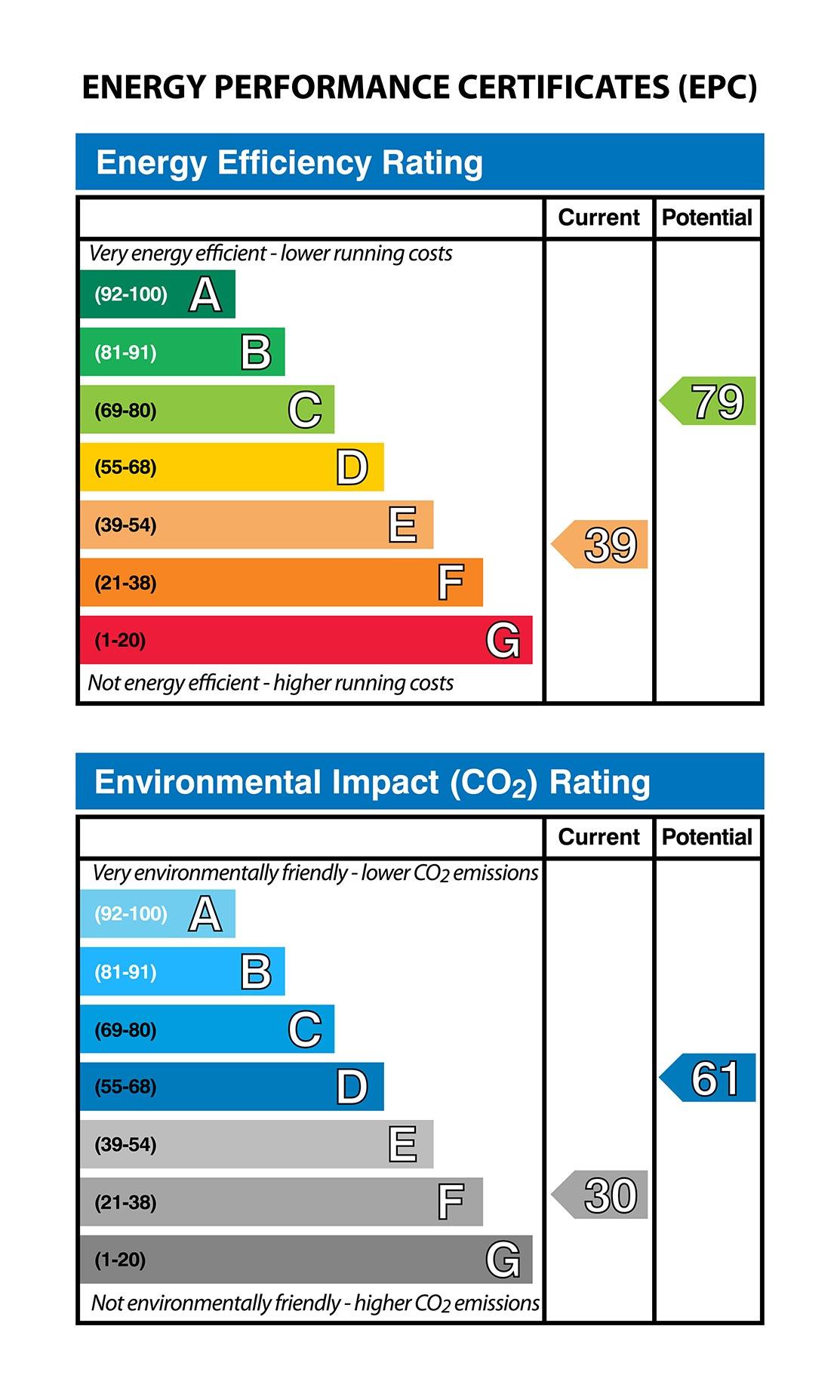

What Happens During An Energy Performance Certificate

What Happens During An Energy Performance Certificate

https://static01.nyt.com/images/2023/06/20/multimedia/20titanic-blog-industry-zmfl/20titanic-blog-industry-zmfl-mediumSquareAt3X.jpg

Energy Performance Certificate Service EPC London Fantastic Services

https://cdn.fantasticservices.com/wp-content/uploads/2018/07/Energy-Performance-Certificates-Template.jpg

EPC NRLA Portfolio

https://theconstructor.org/wp-content/uploads/2022/08/What-is-Energy-Performance-Certificate-EPC-for-Buildings.png

AAVE is a pioneering force in decentralized finance offering users a comprehensive platform for lending and borrowing cryptocurrencies With its array of features like flash loans variable Aave is an Open Source Protocol to create Non Custodial Liquidity Markets to earn interest on supplying and borrowing assets with a variable or stable interest rate The protocol is designed

AAVE is Introduction to AAVE AAVE is a decentralized finance DeFi protocol that enables users to lend and borrow cryptocurrencies in a trustless and permissionless environment Built on What is Aave In general Aave is an open source non custodial protocol that allows people to lend and borrow cryptocurrencies through decentralized finance DeFi

More picture related to What Happens During An Energy Performance Certificate

NASA

https://science.nasa.gov/wp-content/uploads/2024/02/grasshopper-eclipse-soundscapes.jpeg

How Does An Ultrasound Work Assure Pregnancy Clinic Fontana CA

https://assurepregnancy.org/wp-content/uploads/2024/09/Call-icon-1.svg

New Look Energy Performance Certificates

https://www.yourmoney.com/wp-content/uploads/sites/3/oldimg/2179537-newenergyperformancecertificate.JPG

Aave is a decentralized finance platform revolutionizing the way people interact with digital assets Built on blockchain technology the Aave protocol allows users to lend borrow and earn Aave is one of the most widely used decentralized lending and borrowing protocols You can easily lend your assets to earn interest or borrow any asset from the pools

[desc-10] [desc-11]

Energy Performance Certificate EPC Surveys HomeOwners Alliance

https://hoa.org.uk/wp-content/uploads/2016/08/energy-performance-certificate.jpg

:max_bytes(150000):strip_icc()/How-to-Take-the-Abortion-Pills-1500x1000_Illo1_V4-49f4c19bf0bc4fbb9146af8433997aec.png)

Abortion Pill Process

https://www.verywellhealth.com/thmb/TsnWY9gqPp4Y5mJ6xAB2JIt-zdo=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/How-to-Take-the-Abortion-Pills-1500x1000_Illo1_V4-49f4c19bf0bc4fbb9146af8433997aec.png

https://www.learningcrypto.com › what-is-aave-crypto

Discover how Aave is revolutionizing DeFi with its decentralized lending protocol Learn about liquidity pools yield farming and why Aave leads the future of decentralized finance

https://aave.com › docs

Aave is a decentralised non custodial liquidity protocol where users can participate as suppliers or borrowers Suppliers provide liquidity to the market while earning interest and borrowers can

ENT Exam Example Free PDF Download

Energy Performance Certificate EPC Surveys HomeOwners Alliance

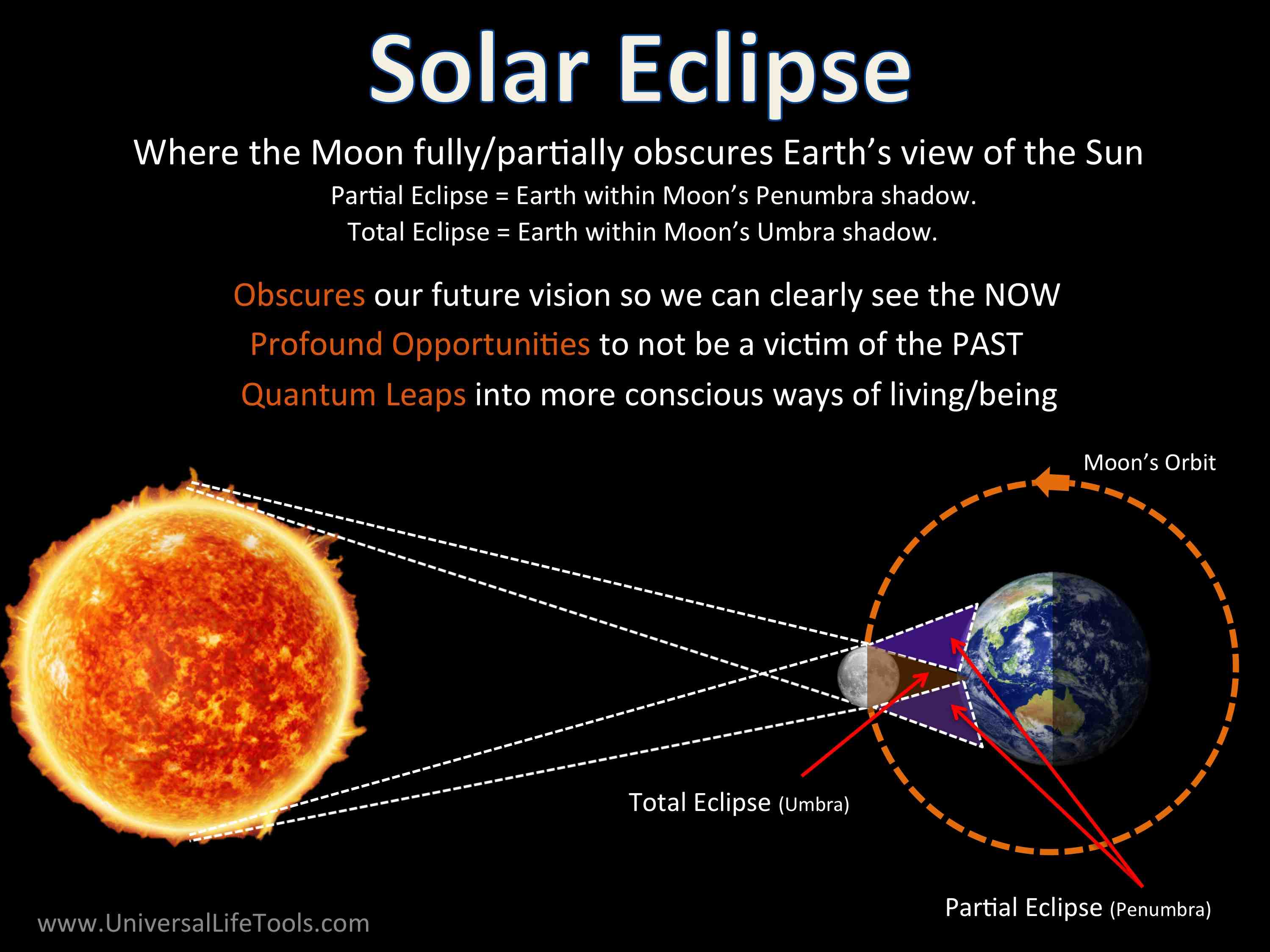

What Is A Blood Moon Eclipse And When Is The Next One

Aborted Fetus 12 Weeks

What Happens To Aborted Babies

Commercial Energy Performance Certificates A Closer Look

Commercial Energy Performance Certificates A Closer Look

Certificate Of Performance Template

2025 Eclipse Calendar Astrology Sadie Quinnt

What Happens To A Body When A Submarine Implodes

What Happens During An Energy Performance Certificate - Aave is an Open Source Protocol to create Non Custodial Liquidity Markets to earn interest on supplying and borrowing assets with a variable or stable interest rate The protocol is designed