What Happens If You Don T Pay Personal Property Tax In Missouri If any taxpayer shall fail or neglect to pay to the collector his taxes by December 31 the collector is mandated to apply a penalty 139 100 The only exception is if the taxpayer is serving in the

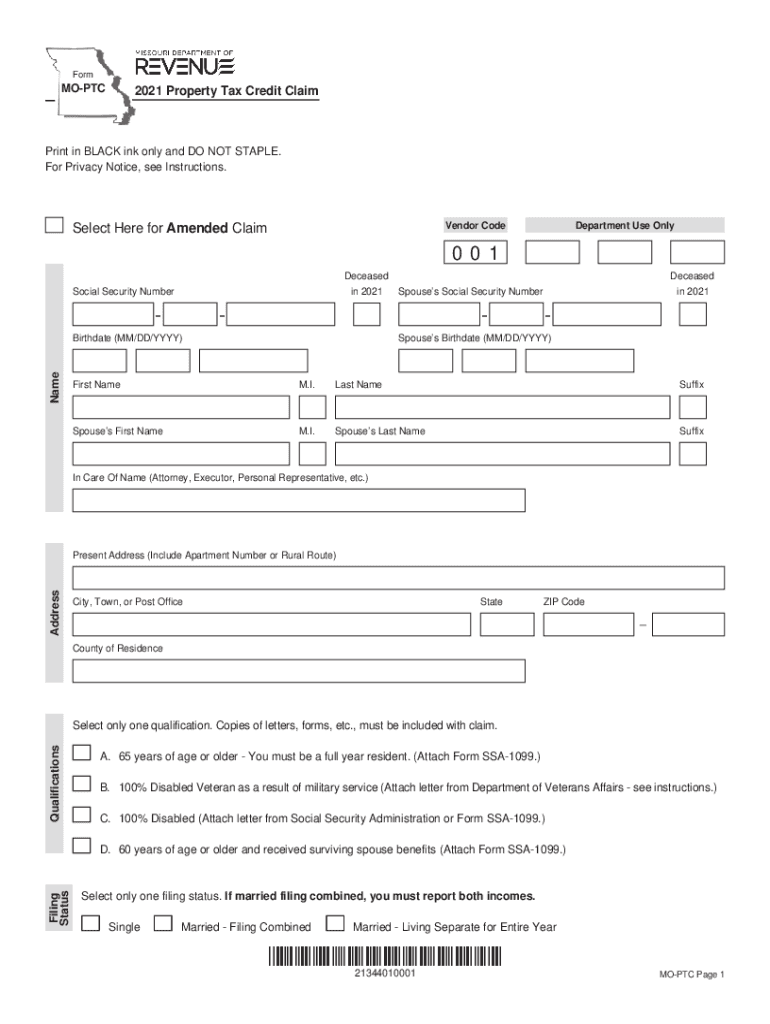

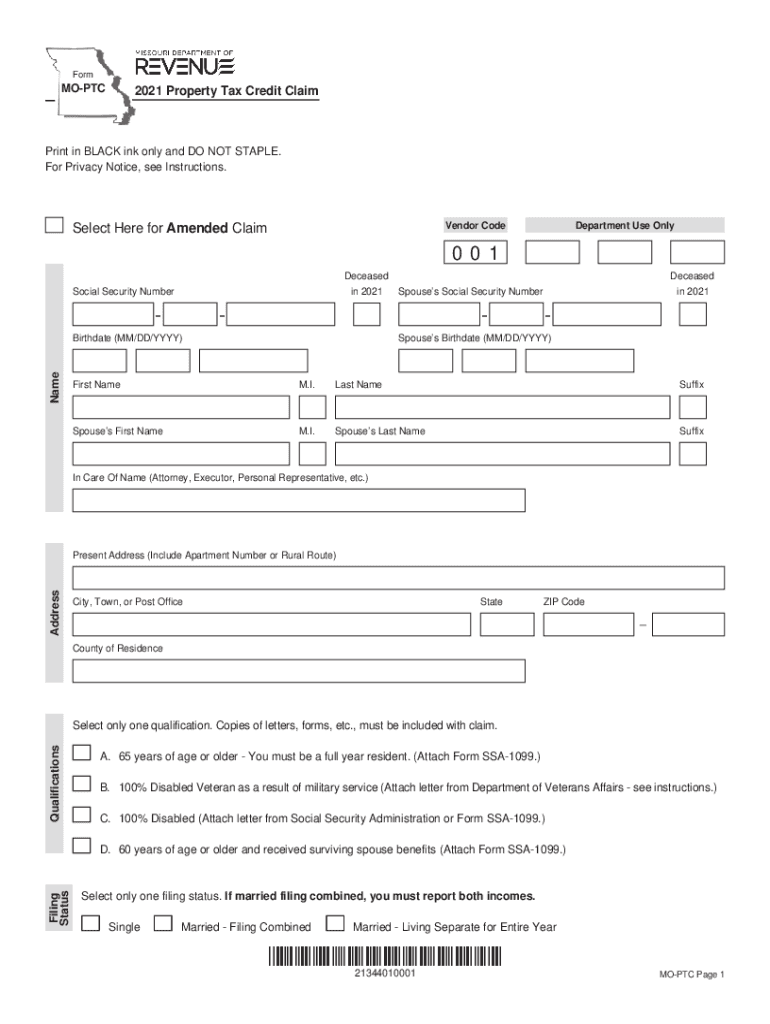

The property Personal Property Taxes due on personal property remain the responsibility of the taxpayer who owned the property on assessment date January 1 If not paid these taxes The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year

What Happens If You Don T Pay Personal Property Tax In Missouri

What Happens If You Don T Pay Personal Property Tax In Missouri

https://i.ytimg.com/vi/s4jnhbIwcpI/maxresdefault.jpg

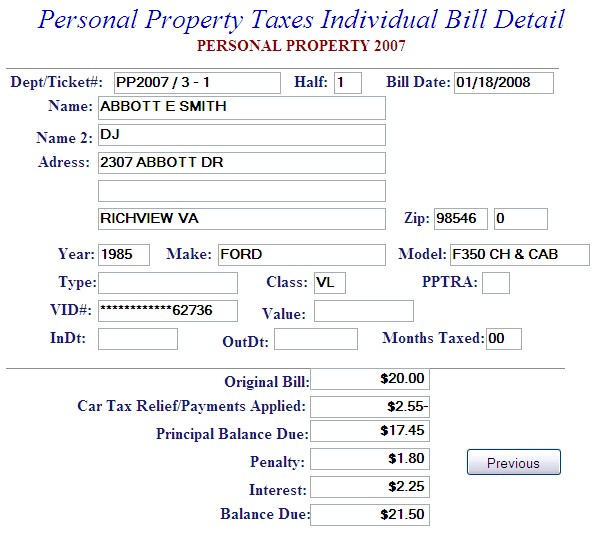

Pay Personal Property Tax Help

https://eservices.pagecounty.virginia.gov/siteimages/helpimages/ticket.gif

Film History Archives TrendRadars

https://www.thelist.com/img/gallery/what-happens-if-you-dont-eat-for-a-whole-day/l-intro-1673892115.jpg

It s entirely possible that a tax lien could be put in any personal property or property you have However as others have said you should report to the city the time you were there and then Lucy Lazarony is an experienced personal finance journalist and writer who got her start in 1998 writing about financial topics She writes accessible and easy to understand articles about credit

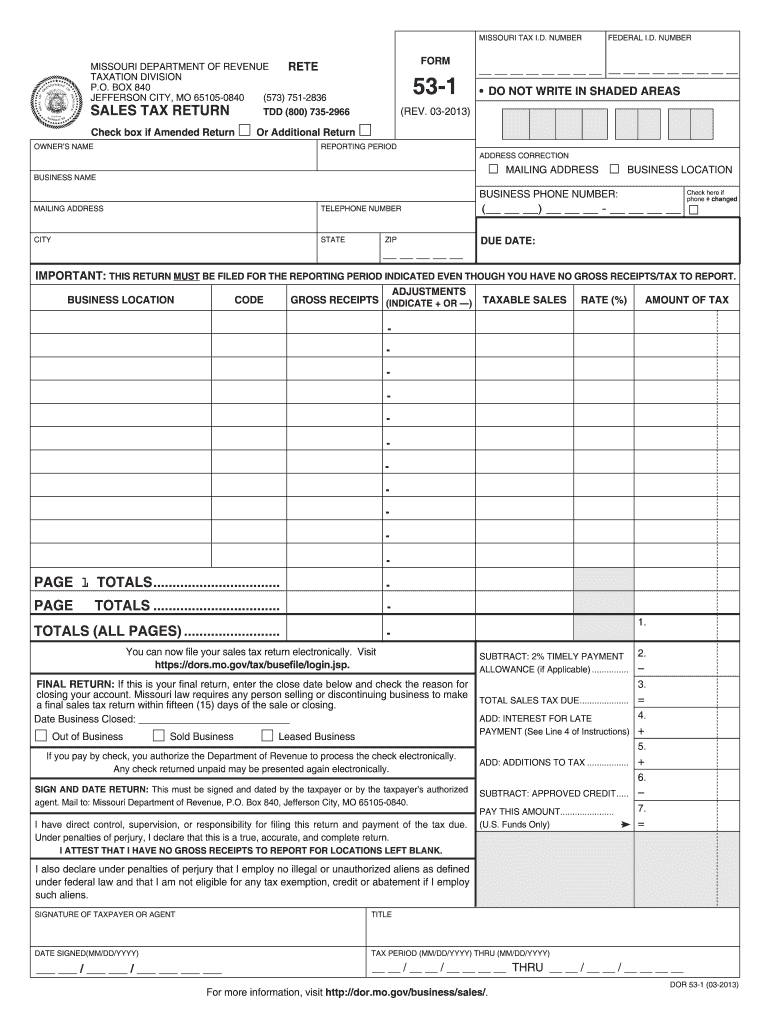

If you fail to pay personal property tax in Missouri you may face several penalties The Missouri Department of Revenue may charge interest on the unpaid taxes which can add Personal property taxes and federal heavy vehicle use tax paid when tax receipt forms failure to pay personal property tax effect of notification requirements reinstatement fee

More picture related to What Happens If You Don T Pay Personal Property Tax In Missouri

Pay Personal Property Tax

https://eservices.pagecounty.virginia.gov/applications/applications/PayPer8.gif

Pay Personal Property Tax

https://eservices.pagecounty.virginia.gov/applications/applications/PayPer2.gif

Pay Personal Property Tax

https://www.culpepercounty.gov/applications/applications/PayPer10.jpg

Even if you move to a different state or county the next day you are still taxed for the entire year You may move into Missouri January 2nd and not pay personal property taxes all year What Happens if I Don t Pay Personal Property Tax Failure to pay personal property tax can result in penalties and interest and can also lead to a tax lien on the property

Personal property taxes are due by December 31 If you don t get those paid you could face a bit of a charge Taxes paid after the deadline will face a 9 late fee and an You won t pay for the personal property taxes for your new car until till the end of December 2024 since you did not own it January 1 2023 Call your county accessor and explain your situation

Missouri Property Tax Increase 2024 Robbi Christen

https://www.pdffiller.com/preview/579/959/579959492/large.png

Missouri Fillable Form 14 Printable Forms Free Online

https://www.pdffiller.com/preview/623/237/623237583/large.png

https://stc.mo.gov › faq › what-fees-and-penalties-may-i-owe

If any taxpayer shall fail or neglect to pay to the collector his taxes by December 31 the collector is mandated to apply a penalty 139 100 The only exception is if the taxpayer is serving in the

https://stc.mo.gov › wp-content › uploads › sites

The property Personal Property Taxes due on personal property remain the responsibility of the taxpayer who owned the property on assessment date January 1 If not paid these taxes

Missouri Tax Forms 2024 Shara Delphine

Missouri Property Tax Increase 2024 Robbi Christen

You Can Now Pay Property Taxes ONLINE Orange City Council

Tarrant County 2024 Property Tax Rate Maren Sadella

Prop M St Louis County 2024 Judy Sabine

Va Tax Pay Online

Va Tax Pay Online

Queen Mediocretia Of Suburbia The Assessment Office

Sign Bill Eigel s Petition To Eliminate Personal Property Tax In

Property Tax Information Worksheets

What Happens If You Don T Pay Personal Property Tax In Missouri - Lucy Lazarony is an experienced personal finance journalist and writer who got her start in 1998 writing about financial topics She writes accessible and easy to understand articles about credit