What Happens If You Pay Your Property Taxes Late In Cook County The penalty for paying your property taxes late has been slashed in half in Cook County Yearly interest rate penalties have been cut from 18 to

You can lose your home or property if you don t pay your residential property taxes Failing to pay property taxes when due can mean The amount you owe may increase from interest CHICAGO WLS If you haven t paid your property tax bill you need to do it immediately so your property taxes won t be offered up for auction The Cook County tax sale

What Happens If You Pay Your Property Taxes Late In Cook County

What Happens If You Pay Your Property Taxes Late In Cook County

https://i.ytimg.com/vi/G6In3_PtRHg/maxresdefault.jpg

Should You Pay Your Property Taxes This Year Property Tax Tax

https://i.pinimg.com/originals/c4/02/08/c4020841fb42d5dedcabf145086e96b3.png

Certificate Of Title Victoria How To Obtain Original Copy

https://sbsolicitors.com.au/wp-content/uploads/2022/12/Example-of-Certificate-of-Title-Victoria.jpg

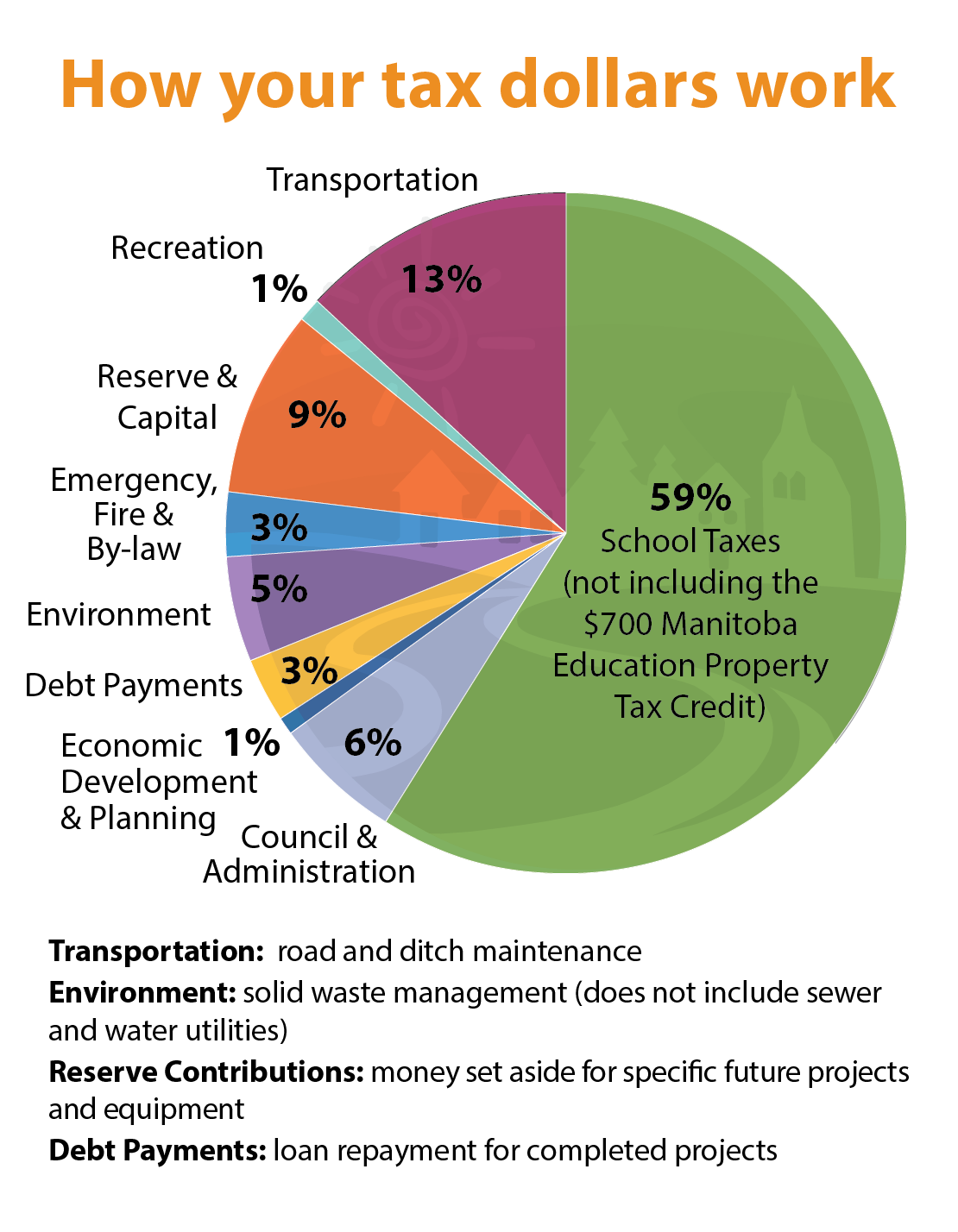

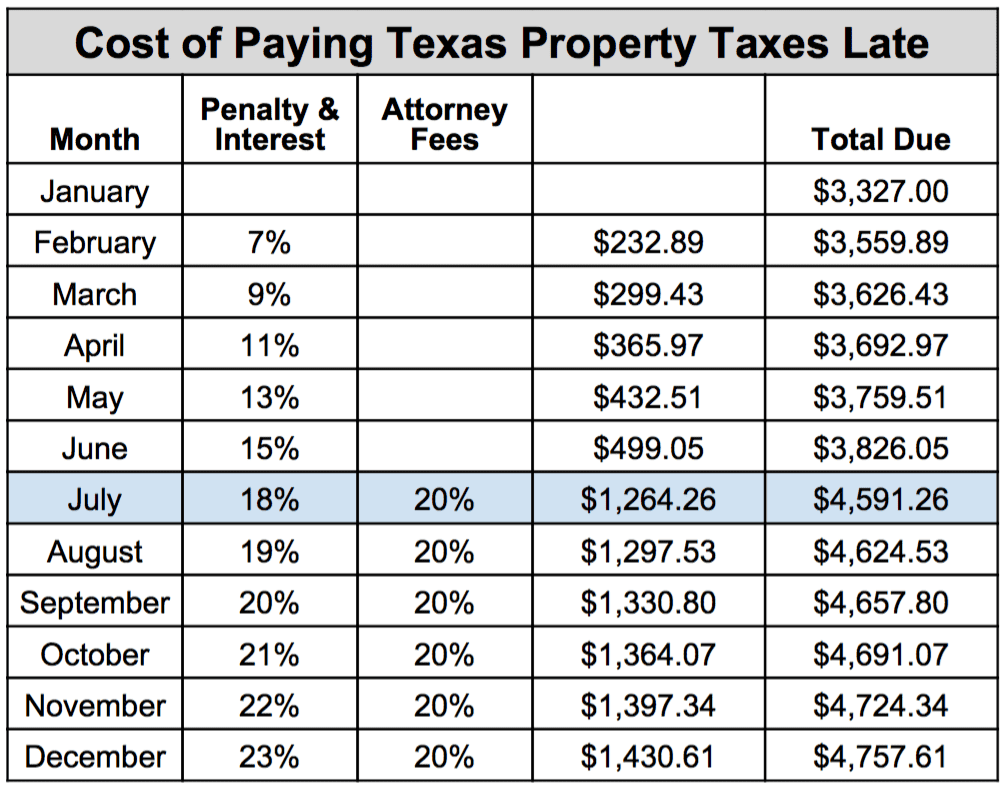

Each year thousands of Cook County property owners pay their real estate property taxes late or neglect to pay them at all Any unpaid balance due may then be subject to sale to a third party COOK COUNTY This year s first payment of Cook County property taxes was due on Monday before midnight This time around taxpayers received an extra month to pay their first

For those who are late paying their taxes due March 1 the interest rate penalty will drop from 18 a year to 9 a year The monthly rate of interest charged on late taxes will fall If you are late paying your taxes contact the County Treasurer at 312 443 5100 or cookcountytreasurer to learn the exact amount you need to pay including all penalties

More picture related to What Happens If You Pay Your Property Taxes Late In Cook County

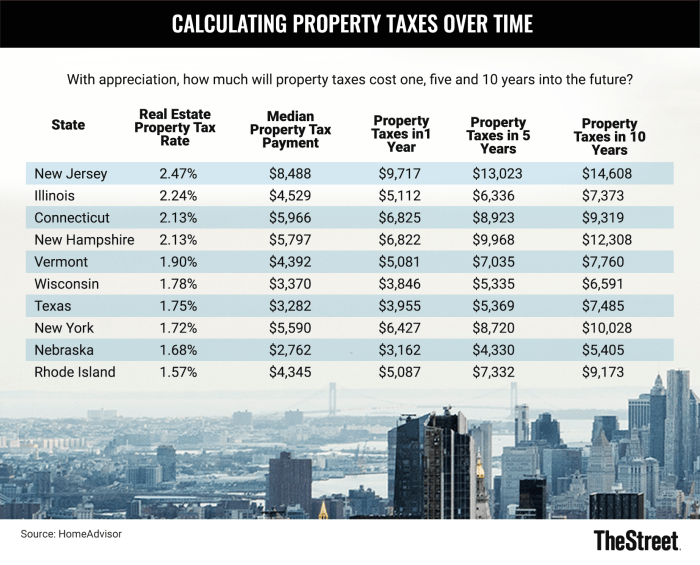

These States Have The Highest Property Tax Rates TheStreet

https://www.thestreet.com/.image/c_limit,cs_srgb,q_auto:good,w_700/MTkzMTM5Mzg2MDIyNDM4MjQ0/table-property-taxes-101922.png

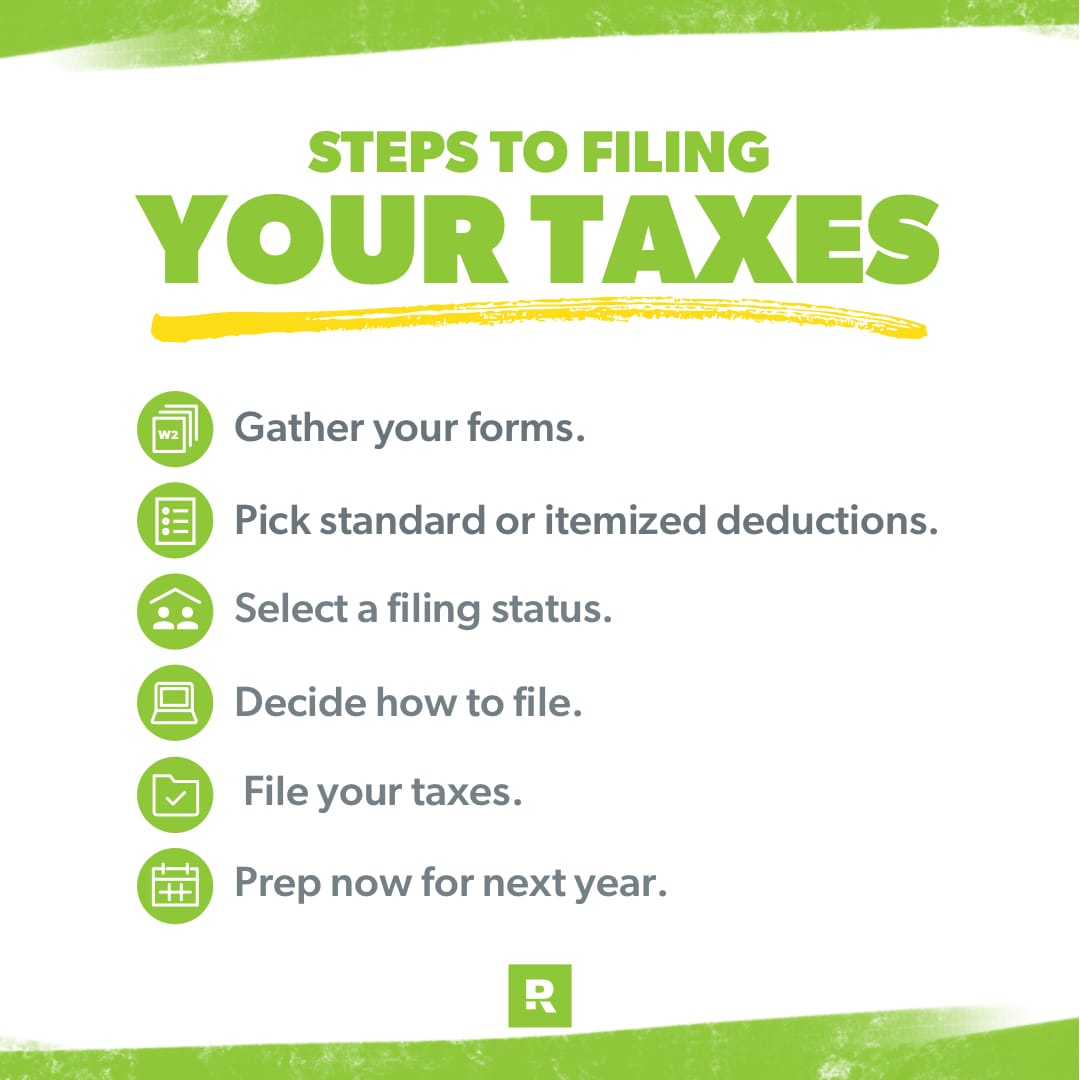

2025 Deadline To File Taxes Philippines Charles R Pruitt

https://cdn.ramseysolutions.net/media/b2c/every_dollar/blog/how_to_file_your_taxes/how_to_file_your_taxes_graphic.jpg

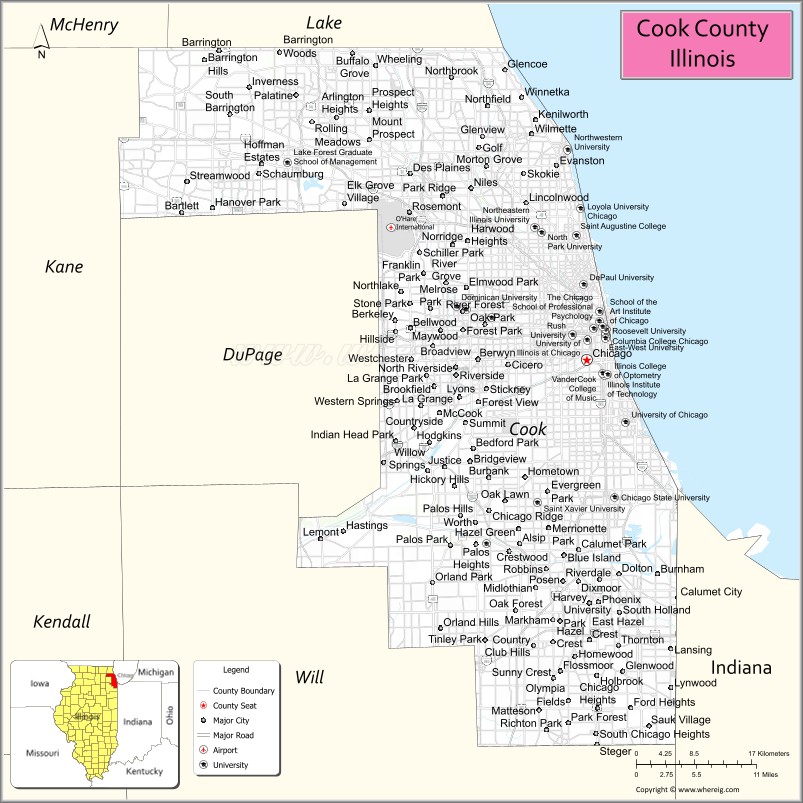

Cook County Population 2024 Rhody Mariann

https://www.whereig.com/usa/maps/counties/cook-county-map-il.jpg

Depending on where you live you ll usually have to pay property taxes once or twice a year But what happens if you pay your property taxes late There are penalties associated with paying your property taxes past their due If you re late paying your property tax you ll typically owe late fees and or penalties But in a worst case scenario the tax assessor can place a tax lien on your home

You have been responsible for payment of the property taxes If you received the Homeowner Exemption on your tax bill last year and your residency does not change you do not need to The good news there are two ways to reduce what you have to pay in property taxes Cook County property tax installments are due on March 1 and August 1 or on the first

What Happens If An Individual Can t Pay Their Income Taxes Seiler

https://www.seilersingleton.com/wp-content/uploads/2020/08/2020-08-31-Pay-Taxes-1080x675.jpg

![]()

Earliest Date To File Taxes 2025 Canada Tiff Adelina

https://www.rebelliouspixels.com/wp-content/uploads/2020/02/03abdbf0-51b0-11ea-b9f5-6690916fee10.jpg

https://chicago.suntimes.com › news › ...

The penalty for paying your property taxes late has been slashed in half in Cook County Yearly interest rate penalties have been cut from 18 to

https://www.illinoislegalaid.org › legal-information › ...

You can lose your home or property if you don t pay your residential property taxes Failing to pay property taxes when due can mean The amount you owe may increase from interest

Calcul Taxes Ontario 2024 Vanni Annalee

What Happens If An Individual Can t Pay Their Income Taxes Seiler

Understanding Property Taxes

State Of Texas Franchise Tax 2024 Starr Catherina

How To Avoid Paying Property Tax Sinkforce15

Va Tax Pay Online

Va Tax Pay Online

Tax And Interest Deduction Worksheets

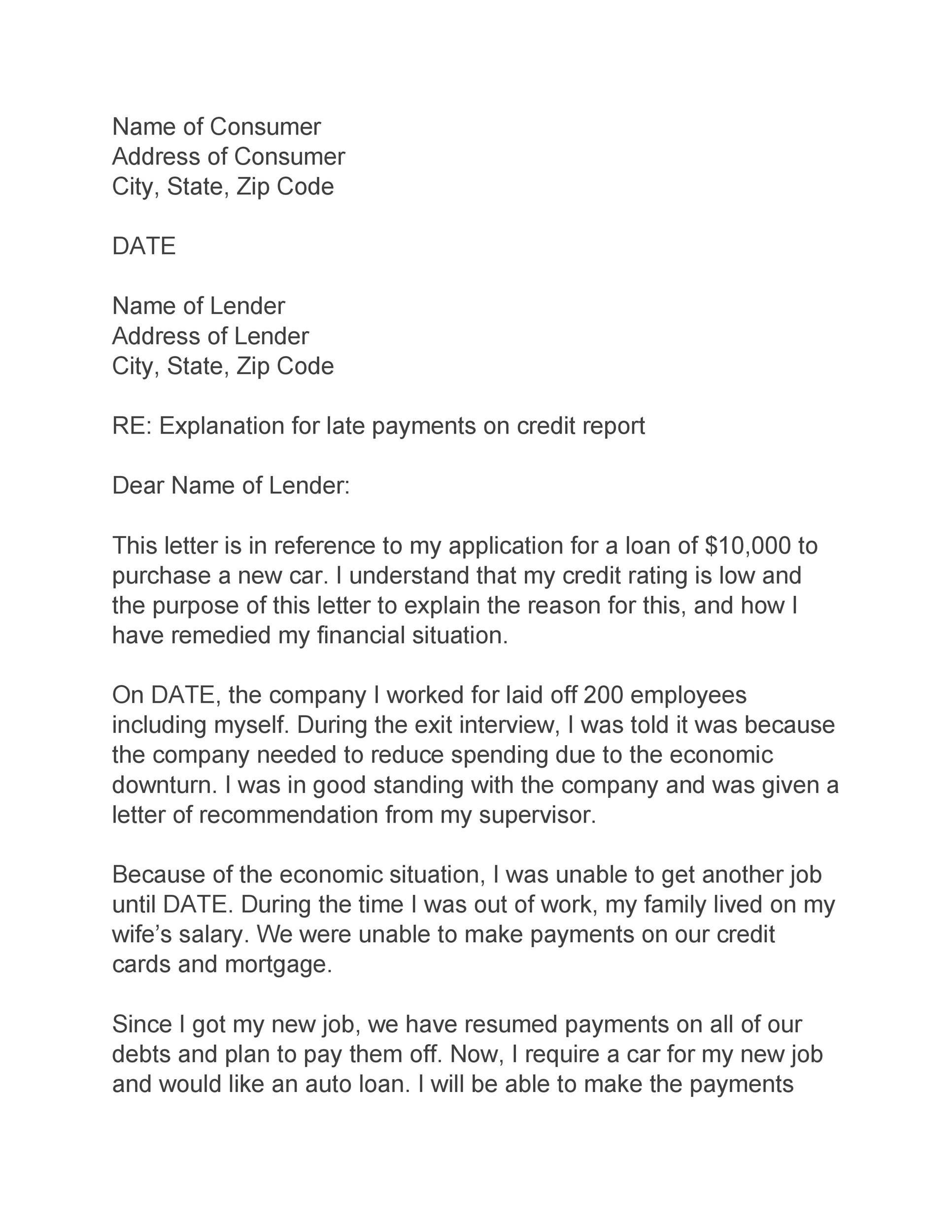

Letter Of Explanation Sample

Cook County Minnesota Highway Map By Cook County Minnesota Avenza Maps

What Happens If You Pay Your Property Taxes Late In Cook County - What happens if you pay property taxes late Failure to fulfill your property tax obligations will result in the imposition of late fees by the County Treasurer and Tax Collector